Trust Capital TC is a Forex and CFDs broker that offers its financial and trading services to the residents of the European Union. The broker first appeared in 2018 and seemingly is not popular yet, as there are not many Trust Capital TC reviews and opinions made by the customers. The broker is registered in Cyprus and is regulated by the local financial authority CySEC. The broker offers a limited number of trading instruments from several asset classes such as Forex, commodities, precious metals, and indices. The trading conditions with Trust Capital TC are not as good as most European brokers offer to their customers. The minimum deposit is high, the spreads are also high, and most importantly there are a lot of commissions applied. This review will discuss the broker’s features and see if the Trust Capital TC scam is possible or if the broker is trustworthy.

The safety and security of the Trust Capital TC

According to the website, Trust Capital TC was established in 2018 and is fully regulated and authorized by the Cyprus Securities and Investments Commission. As many brokers claim to be regulated, without having an actual license, while making a Trustcapitaltc.com review we checked the broker’s license and were glad to see that it truly is regulated.

Trading with a regulated broker protects customers from the wrongdoing of it, moreover, brokerages that are authorized by European regulators are obliged to have clients’ compensation funds. Since Trust Capital TC is regulated by CySEC it means that you are protected by the scam or fraud. However, it does not mean that you will receive high-quality service and the broker is right for you. Let’s examine the features and offerings of the broker to see if it is a good idea to open an account with it.

Fees and spreads of Trust Capital TC

The spreads for the Trust Solo account have recently been lowered to 0.9 pips, which is close to the industry average of 1 pip. However, there are no spreads as low as 0 pips, and the Trust Together account has expensive spreads starting from 1.9 pips. There are commissions for trading Forex, and other CFDs, and overnight charges. The specific amounts are 10 or 20 USD per lot for commissions. The broker also charges fees for withdrawals. As we can see the Trust Capital is not attractive with these many fees and charges.

Accounts, deposits, and withdrawals

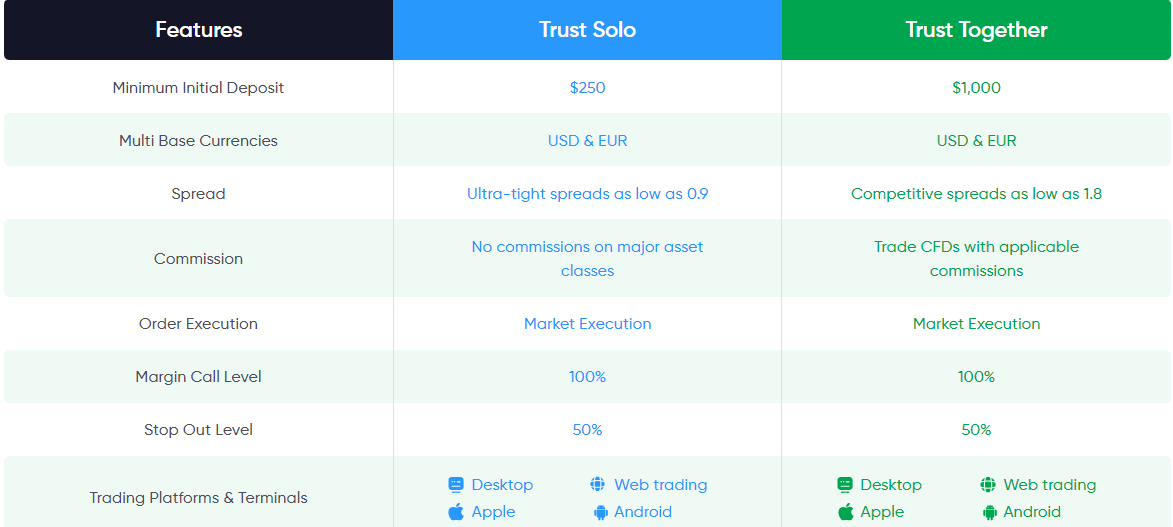

Traders have the possibility to choose between two types of trading accounts. Previously there were three different account types, but the broker recently upgraded their accounts with new spreads and requirements. The broker classifies the trading accounts as follows:

- Trust Solo

- Trust Together

There are all features and details listed for new upgraded account versions which is very convenient for traders. Both accounts have market execution and the minimum trade order is 0.01 lots. Other conditions differ based on the trading account.

The major changes have been made in the spreads department and they are now lower for the Trust Solo account from 0.9 pips. This is very close to the industry average of 1 pip and we consider these steps very positive overall. With 0.9 pips spread, it becomes possible to trade on the Solo account with competitive spreads. What’s lacking with new accounts is lower spreads from 0 pips and trading commissions to trade scalping strategies. Other than that the accounts seem normal.

Spreads for Trust Together account are very expensive from 1.9 pips and commissions apply to various trading assets which are not attractive. The minimum deposit is 250 USD or EUR for the Solo, and 1 000 for the Together account.

Other major differences include there being no share CFDs for the Together account and no CFDs on Forex Minors.

New account types are much better and the broker describes all details now on their website. Definitely steps in the right direction.

Deposits and Withdrawals at Trust Capital TC

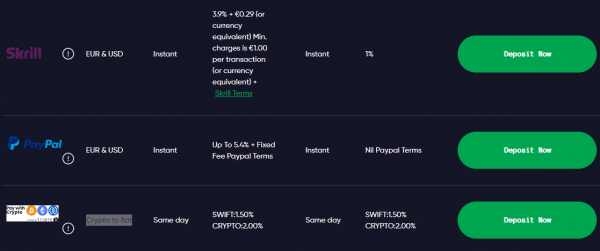

Wire transfer, Visa and MasterCard, PayPal, Skrill, and cryptos like BTC and Tether (USDT) are all accepted by the broker. Skrill, PayPal, and crypto withdrawals are instantly processed by the broker which is amazing. Generally, when a broker does not complicate the withdrawal procedure it is already a good sign and in this case, Trust Capital TC seems honest and legit. The only downside is the broker charges fees for withdrawals which may be inconvenient for traders.

Trading assets and features of Trust Capital TC

Trust Capital TC Forex broker offers customers the to trade currency pairs and CFDs on different trading assets. Unfortunately, The number of trading assets is very limited there are only 28 currency pairs available. The list of the currencies available with Trust Capital TC includes USD, GBP, EUR, AUD, CHF, CAD, NZD, and JPY only. CFDs on different trading assets are even more limited. The broker offers CFDs on gold and silver, and CFDs on commodities such as Coffee, Soybean, and Cocoa. Energy futures including Brent, NATGAS, and SL. One can also trade CFDs on five index futures – NASDAQ, DOW, DAX, AUS, and S&P.

Traders who want to open an account with the broker have to deposit a minimum of 250 USD to open a standard account. It is higher than the average, especially for the basic account that does not come with a lot of features. Another thing that reduces Trust Capital TC rating a lot is spread. According to the website, the spreads for Forex start from 1.6 pips. There are a lot of brokers that offer zero spreads for the standard account, compared to them the offerings of Trust Capital TC are simply not attractive. As for the leverage, the broker offers different leverages for different trading assets. One can get the highest leverage which is 1:30 when trading currency pairs. The leverage for the other trading assets is either up to 1:20 or up to 1:10.

Customer Support Review of Trust Capital TC

Live chat on the broker’s website is very convenient and responsive. It is free of all the unnecessary features and does what a live chat has to do: connecting you with the broker’s representatives. Both the website and live chat are multilingual which is great.

As for other support methods email addresses, Fax, and hotline are all available and easy to use.

Trust Capital TC Education

Access to educational materials and webinars is limited only to the traders who are able to fund the account with a minimum deposit of 1000 USD remains same. Almost all brokers offer educational center and webinars, which is accessible to every trader no matter what type of account they have. Last but not least, the broker charges commissions for each lot traded. Usually, when brokers offer high spreads it means that they make money via spreads and should not be charging additional commissions. However, Trust Capital TC charges commissions for trading Forex which can be 10 or 20 USD per lot, there are commissions for other CFDs which are the same amount, and there is an overnight charge of 6 USD. These commissions alongside the high spreads make trading with Trust Capital TC expensive and less profitable.

Should you consider Trust Capital TC?

Trust Capital TC has one advantage only – it is regulated by the CySEC which means that traders in Europe are protected by Trust Capital TC fraud, and in case the broker will violate the law against its customers they can seek the help from the regulator. But as you already know the regulations does not always mean that the broker is good. Especially today, when there are many regulated brokerages that offer far better trading conditions and service than Trust Capital TC. The broker does not provide a good selection of the trading assets, the number of instruments that can be traded is very low and limited. Trading with Trust Capital is also very expensive. The minimum deposit requirement is high, there are high spreads, and various commissions that are never welcomed by the traders. This Trust Capital TC review shows that while a broker might have a license, it does not always mean it offers good service. If you were thinking about opening an account with the broker, it is better to continue searching for the other regulated brokers that have better trading conditions.

Is Trust Capital TC a good and reliable broker?

What are the spreads offered by Trust Capital TC?

Does Trust Capital TC charge commissions for trading?

Are there any fees for withdrawals with Trust Capital TC?