The times when the main distinctive feature that set apart good brokers from bad or scam brokerages was the regulations are long gone. Nowadays, as many new brokerages are appearing on the Forex trading market, one needs to examine more features of the broker, rather than simply checking if it is regulated or not. Mitrade Forex broker is a good example of it. The broker has several licenses from reputable regulators that are considered to be very demanding when it comes to regulations. How about Mitrade minimum deposit then? Well, Mitrade has also put nice-looking offerings on the website, such as no minimum deposit requirements, low spread, leverage up to 1:200, and various trading instruments. However, before you get excited about it and open an account with the broker, it makes sense to see what exactly it offers and how good its services are. Can Mitrade be trusted just because it has a license? This review will discuss the broker’s features in detail and let you know the answer.

The safety and security of Mitrade

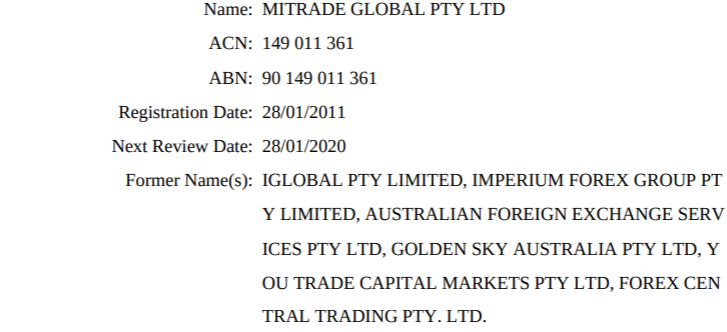

Mitrade is operated by Mitrade Global Pty Ltd. The company is registered and regulated in Australia, the number ABN (90 149 011 361) and the license number(AFSL 398528) are actual and can be checked on the website of the broker, where Mitrade provides the proof of license. It can also be checked on the ASIC’s website as well.

There are two disturbing things about the license and the company summary that is provided by the ASIC on its website. The first thing is the fact that the company behind Mitrade has changed its name several times. It is a well-used practice of scam companies. They usually run one or two brokerages and when their scam is revealed they change the name and start operating the new brokerage. Another thing is the date of registration. The company got the license in 2011 and Mitrade was established just recently. This increases our suspicions about the broker’s legitimacy. Due to these, despite being regulated we can assume that Mitrade fraud is still possible.

The broker has two more licenses, namely

- Mauritius Financial Services Commission (FSC)

- Cayman Islands Monetary Authority (CIMA)

This is why the broker can offer 1:200 leverage to some clients as ASIC prohibits brokers to offer leverage more than 1:30 on major pairs and 1:20 on minors.

The broker offers its trading services to a worldwide audience with some exceptions. Residents of the United States, Canada, and Japan cannot open an account with the broker. There are no other countries mentioned, meaning that most traders can become customers of Mitrade. Traders who want to open an account with Mitrade and at the same time are not residents of Australia should consider that the ASIC license does not protect them. Hence, if you will have any kind of problem when trading with Mitrade you cannot do anything else other than flying to Australia and complaining with the regulator.

Mitrade Fees and spreads

Upon revisiting the broker, we have observed that the spreads offered by Mitrade are highly appealing, starting from as low as 0.7 pips. This is an excellent advantage for any broker, and it appears that Mitrade has made notable improvements in various aspects since our last assessment. Such progress is always encouraging to witness, and we hope to see the broker further enhance their website with additional information, thereby reducing our initial concerns.

It is worth noting that Mitrade offers a commission-free trading account, which is advantageous for traders. However, it is unfortunate that the broker currently only provides a single trading account, lacking the diversity required to accommodate different trading methods. On a positive note, Mitrade does not impose fees for deposits and withdrawals, indicating their commitment to a client-friendly approach.

Accounts, deposits, and withdrawals at Mitrade

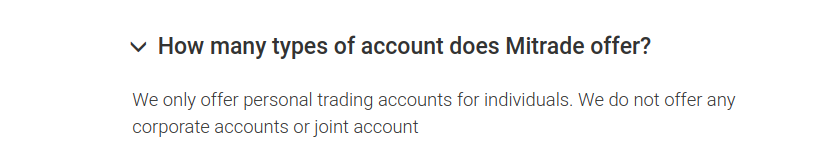

You cannot find any information about the account types on the website. The broker only mentions that there is only a personal account and Mitrade does not offer any other types of account. There are no various personal account types that one can choose from. There is only one, and the broker does not provide any details about it. The only information about the trading account is that it can be opened in two currencies USD and AUD.

Deposits and withdrawals

There are not many payment methods offered for making deposits or withdrawing money from the trading account. Traders are limited to using a debit/credit card, wire transfer, and Skrill. According to the broker, there are no commissions for deposits or withdrawals. Mitrade withdrawal takes 3-15 business days. However, this is time for the transaction, the broker does not disclose how much time it is needed to process the withdrawal request.

Trading assets and features of Mitrade

Forex, indices, commodities, and shares can be traded on Mitrade platforms. There are no cryptos supported and all assets are CFDs. CFDs are great for speculation on the prices of underlying assets without owning the assets themselves, but depending on the trader’s level of experience they may become super risky. Previously during our review, the broker offered a number of crypto CFDs as well, but it seems the broker removed them from their platform.

Overall the broker offers about 100 trading instruments that can be traded on the custom trading platform offered by Mitrade. Unfortunately, there is no additional information about the trading platform, for example, what are some in-built tools and features that can be used by the traders. Also, the broker does not offer MT4 or MT5 which are the most commonly used trading platforms. The fact that the broker does not give customers a choice when it comes to trading platforms reduces Mitrade rating a lot.

Trading conditions

One can start trading with Mitrade with as much money as he or she has. To say in other words there is no minimum deposit required. If Mitrade FX brokerage was a legit broker, it would sound good, however now it seems that the broker is trying to lure as many traders as possible with the no minimum deposit policy.

The broker offers leverage up to 1:200. However, as you might already know not all the trading assets have the same leverage. For example, one can use leverage up to 1:200 and even more for the currency pairs, but it is considerably lower for CFDs on commodities or cryptocurrencies. Unfortunately, the broker does not show the allowed leverage for each trading asset.

Mitrade Customer Support Review

The website and support are multilingual which is a great plus for the broker. Previously there were only two languages of English and Chinese, but now there are 10 different languages offered. With these many languages and three regulators, the broker seems to targeting the expanded traders’ audience worldwide.

The live chat will allow users to connect with the broker representatives directly without delays or waiting times. Live chat is a very powerful support tool and it is super positive that Mitrade has incorporated it into their website. As for other support methods, the broker offers email support and an online form to leave a message for the broker.

Mitrade Education

While in other aspects we see average services except for low spreads and multilingual websites, Mitrade excels in offering abundant educational materials to their clients. There are several types of trading lessons provided by Mitrade including

- Trading Basics

- Insights

- Academy

- TradingACE

Mitrade Academy is a robust educational platform with various trading courses that encompass all important trading concepts and basics. It has a dedicated webpage and consists of various topics and articles that can be used by newbies to learn about trading. Mitrade educational center is by far one of the best we have seen so far. It is on par with some most well-established brokers out there. Definitely a very high score in this department.

But education is not the only thing the broker made excellent on their website during the years of their existence. There are several useful tools and market research articles that can aid traders to increase their trading accuracy

- Trading Analysis

- Forecast

- Economic Calendar

- News

- Market Data

- Sentiment

- Risk Management

With these many educational, and tools, the broker may be a good place for beginner traders who have a low budget and want to hone their skills.

Should you consider Mitrade?

Mitrade offerings might look good from the beginning, but Mitrade Forex still has several red flags despite its excellent regulatory oversight. The broker is regulated, but the background of the company looks shady and it makes Mitrade less trustworthy. It does not seem that the broker gave it enough time to design its services in the best interest of traders. Traders do not have a choice with the account types or the trading platform. The information about trading conditions is strictly limited and traders are only able to learn about them after opening an account. These together reduce Mitrade rating a lot. The broker might not be scamming Aussie traders, but even in this case, Mitrade does not have a good service. Traders outside Australia should be especially careful with Mitrade.

Is Mitrade a regulated broker?

What trading instruments are available at Mitrade?

What are the account types and deposit methods?