Table of content

In the world of Forex trading, pip stands for Percentage in Point. It is a very important part of Forex trading, and it measures the minimum price change of the currency pair that you are trading. While trading currency pairs, the amount of unit that one currency costs, in most cases, is shown in five digits. The pip is the change in the last digit that you see in the currency price.

The Forex pip size can be calculated in two different ways. One is calculating it in the currency pairs that you are using, and the other one is using the formula. Most of the traders prefer to use the second one because it is more flexible and easy to calculate.

Understanding pips is very important while trading Forex because they show you how much the price of the currency pair has changed. However, we know that it still might sound a little confusing to calculate the amount of pip. So, if you want to learn more about it, follow our in-depth guide as we discover everything about it.

Forex pip meaning – What does it stand for?

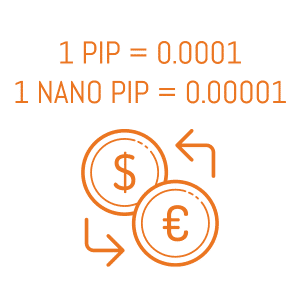

Pip in Forex trading is an incremental price change of a currency pair in the market. For the majority of currency pairs, a pip represents a price change at a 0.0001 level.

Depending on the number of pips you generate/lose in your trading session, it’s either going to be very profitable or very destructive to your portfolio. And the reason why it’s so detailed is that the price change is usually quite incremental. Therefore, the pip calculation needs to be more detailed so that traders generate higher payouts.

Depending on the number of pips you generate/lose in your trading session, it’s either going to be very profitable or very destructive to your portfolio. And the reason why it’s so detailed is that the price change is usually quite incremental. Therefore, the pip calculation needs to be more detailed so that traders generate higher payouts.

So, if you understand the Forex pips definition, now we can talk about more details. In order to make it easier for you to understand, let’s talk about specific examples:

Say that you are trading the GBP/USD, and the price of the currency pair is at 1.3155. This means that for every 1 GBP, you can buy 1.3155 USD. If the price of the currency pair increased by 1 pip, it would be at 1.3156, and if it went down by 1 pip, the price would be 1.3154.

Even if it seems that this is a tiny price change, keep in mind that it still can have a huge effect on the trading, mainly because the usual position size goes up to hundreds of thousands of currency units. It’s also worth noting that many Forex traders use leverage, which does increase profits, but it does the same thing for losses.

For the pairs that include JPY, the pips are 0.01. There also are nano pips for most of the pairs in the market. The nano pip for the majority of pairs is 0.00001, and for pairs including JPY – 0.001.

Ways to calculate pip for Forex

Being able to actually calculate the value of a pip is very important because you will be able to better understand the meaning behind it. In most cases, Forex brokers are the ones who automatically calculate the value of the pip, however, if you know how exactly it should be done, you will be able to better understand it.

The thing about the value of a pip is that it is different for every single currency pair, and that is one of the main reasons why it is so important to understand the calculating process.

The Forex pip formula is actually quite simple. To calculate it, you will have to divide the number of pips, which can be either 0.0001 or 0.01, by the exchange rate that the currency pair has at the moment. Then, after you have done it, you will have to multiply it by the lot size, depending on whether you are using a standard, mini, or micro lot.

The number that you will receive is the price of the pip on the quote currency, which is the second currency that you see in the currency pair. A very interesting thing about the pip is that in the case of the USD, the pip always equals 10 dollars.

Easier ways

There are also easier ways to calculate the amount of pip. Some of the best Forex brokers around the world are calculating them on their own, which means that traders will not have to think about it at all. Some of them also offer a Forex pip value table, which is a very good way of telling how much the pip is.

Remember that pip calculates the movement in the exchange rate, and although you could use the Forex pip indicator, understanding how it works is a very important thing. Even if you are trading with a broker that calculates it on its own, understanding it is still very important. If you understand how they are calculated, you know that you are not getting lied to, which will make your confidence in the trading much higher.

Not many people know, but as we have already said, there are several different types of pips available in the market. Let’s discuss different versions of pips and the way they work below.

Pip Forex trading – Different types of them

While trading Forex, the value of a pip depends on the currency pair that you are using for trading. For the huge majority of the currency pairs, pip stands for the fourth number after the decimal point, which is 0.0001. So, if you are trading a currency pair GBP/USD and the price of it is 1.6764, and it changes to 1.6765, (5-4=1) the price is up by 1 pip. If the price changes to 1.6760, the price is down by 4 pips (4-0=4).

Most of the currency pairs that you come across in the market will be calculated with the same method. However, it is different when the currency pair includes JPY. In this case, as we have already said, the pip is the second number after the decimal point, meaning 0.01. The process of the calculation is very much the same, and you are using the last number in this case as well.

Most of the currency pairs that you come across in the market will be calculated with the same method. However, it is different when the currency pair includes JPY. In this case, as we have already said, the pip is the second number after the decimal point, meaning 0.01. The process of the calculation is very much the same, and you are using the last number in this case as well.

As you might already know, while trading Forex, the changes are minimal, this is especially true if you are using a short-term Forex pip strategy. Because of this, many people are using high leverage. Using Forex leverage pip is very important if you want to increase your turnover, however, keep in mind that leverage also increases risks.

Nano Pips

Another type of pips that you will come across in the market is the nano pip. The nano pips are known to be much more accurate than others in the market, nano pips are also referred to as a pipette. In Forex pip trading, nano stands for the price change of the fifth number after the decimal point, in terms of the JPY currency pairs, it stands for the third number after the decimal point.

So, if the price of the GBP/USD is 1.65673 and it changes to 1.65671, it means that the price is down 2 nano pips, or 2 pipettes. Most of the traders around the world are using this method to see even the slightest movements in the market, although it is not as popular as others, it still is very useful to know.

To understand more about this concept, you should learn everything about both, Forex pips and lots. In the world of Forex, a standard lot is equivalent to 100,000 currency units. It’s basically a number of currency units traders will buy or sell.

Final Thoughts on pip Forex trading

Pip is an integral part of Forex trading. It stands for the Percentage in Point and is calculated in several different ways. There are few versions of pips available in Forex. For most of the currency pairs, the pip is the fourth number after the decimal point; for the currency pairs that include JPY, the pip is the second number after the decimal point.

There also are nano pips available in the market. For the majority of the currency pairs, nano pip, also known as a pipette, is the fifth number after the decimal point, while in JPY currency pairs, it is the third number after the decimal point.

As you might already know, one pip is a very small fraction of the change in the currency pair price, but it can play a huge role. It is especially true if you are using high leverage while trading. Because Forex pip point is such a little change, most of the Forex traders, especially those using scalping and day trading strategy, are using high leverage for the maximum payout.

Frequently Asked Questions

How many pips does Forex move in a day?

Where exactly is the “one pip”?

How much is a Forex pip worth?

What are the examples of 1 pip movement?