Social trading platform and multi-asset brokerage firm eToro is a well-known company in the traders’ community nowadays. While the broker initially gained popularity as a Forex broker it now expanded its market coverage to other asset classes including cryptos, shares, commodities, and indices. The broker is a well-regulated entity overseen by several reputable regulators ensuring client safety and security.

To determine the legitimacy of eToro as a broker, it is crucial to delve into its trading services and conditions. If you have contemplated trading on eToro’s platform, we have compiled comprehensive data that will assist you in making an informed decision. We highly recommend reading this detailed eToro review to ensure you make the right choice.

The safety and security of eToro – Can you trust them?

eToro is one of the best-regulated brokers we have reviewed on this website so far. The exact list of regulators and licenses is as follows:

- The Cyprus Securities Exchange Commission (CySEC). License # 109/10

- The Financial Conduct Authority (FCA). License FRN 583263

- The Australian Securities and Investments Commission (ASIC). License 491139

- The Financial Services Authority Seychelles (“FSAS”). License #SD076

ASIC and FCA, two of the world’s most reputable and stringent Forex regulators, provide solid assurance against any potential scamming by eToro. The chances of encountering such malpractice are remarkably low. This high level of trustworthiness stems from the fact that these regulators uphold the strictest ethical standards and ensure fair treatment of clients by the brokers they oversee.

What does this signify for you as a trader? eToro employs segregated accounts to safeguard client funds, ensuring that they remain beyond the reach of the broker. Additionally, the broker is affiliated with an investor compensation fund, offering protection in the event of insolvency. eToro diligently enforces robust anti-money laundering policies, bolstering their commitment to maintaining a secure trading environment.

All retail clients are protected by the negative balance protection that prevents traders from going into minus balance in case of overleverage or market abnormal fluctuations.

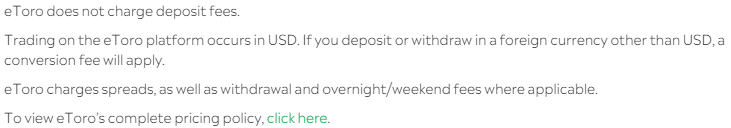

eToro Fees and spreads summarized

The spreads on currencies start from 1.1 pips on EURUSD which is close to industry average numbers. With this spread, it is possible to trade currencies market without paying commissions. GBPUSD comes with 2.2 pips which is expensive and could hurt the overall trading performance. Trading on stocks is commission-free which is very advantageous for stock traders.

The broker does not charge deposit fees, however, if the deposit were made in another currency then USD conversion fees will apply. Furthermore, the broker charges withdrawal, and overnight/weekend fees when applicable. eToro only charges spreads and does not offer 0 spread accounts for currency trading with commissions.

Accounts, deposits, and withdrawals at eToro

There are no account types offered by eToro, only two major accounts for retail and professional traders. There is also a possibility for an Islamic account. While this makes it easy to select which type of client you are, it is definitely a downside that there are no zero-spread accounts for scalpers and day traders. The spreads for minor pairs are expensive starting from 2.2 pips for GBPUSD adding to our argument.

Broker offers a free demo account with 100k virtual funds to test its services and develop trading strategies. eToro demo account can also be very useful for newbies who are interested to learn about trading financial markets.

The minimum deposit on eToro is different depending on the method used. The minimum deposit starts from 50 USD, after the first deposit there is a minimum deposit amount of 50 USD. For bank transfers the minimum amount is 500 USD. It is a bit higher than the minimum deposit you might see with other brokers. However, the other features of the broker are good compared to what other brokers might offer. The leverage for retail clients under ASIC, FCA, and CySEC jurisdictions is 1:30 as of the regulations. For Seychelles FSA there could be higher leverage of 1:100.

eToro deposits and withdrawals

The broker provides a detailed explanation of how one can submit the withdrawal request. One can use credit/debit cards, bank wire transfers, and several eWallets to cash out money. It takes up to three working days for the broker to process withdrawal requests. After confirmation, the withdrawal time depends on the payment method one can use.

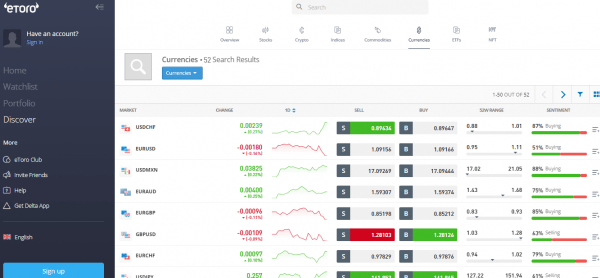

Trading assets and features of eToro

Cryptocurrencies, stocks, commodities, and Forex pairs all can be traded, copy traded, or invested on eToro’s platform. It is always a step in the right direction when brokers add and improve their trading assets. In eToro’s case,

Website Overview

While the website offers many details about the broker and its services it still feels messy. The information could be sorted out better not search everything in the FAQs section. But, still, the website of the broker also indicates that the broker is trustworthy. The website is professionally created, works without any issues, and has an SSL certificate which means that the information of the customers is safe and secure. One can find all the needed information there, after using the FAQs section as well, and most importantly the details that eToro showcases on the front page are not misleading or false.

Customer support

Sometimes one can guess if the broker is a scam or not based on customer support. If the broker does not provide a phone number or does not provide easy means of communicating with the representative it might indicate that the broker is not trustworthy. eToro has below-average customer service with available methods. There are no live chat or online forms to contact the broker. There is no phone number or email address either. There are two ways the clients can get support from the help center with a comprehensive FAQs section and by submitting a ticket. While we are more than sure that eToro is a legit broker customer support is really something they need to address in the future to make it more comfortable to get answers to questions that may arise during trading or investing. Especially when the company has copy services where beginner traders might need some help.

eToro Educational resources overviewed

One more thing that adds points to the eToro rating is that the broker also provides educational materials to the traders and website visitors. There are a lot of articles and analyses available for website visitors, and the broker has an educational center that is accessible to traders who have any kind of account with the broker. For users without an account, there is an eToro academy to browse numerous articles and beginner guides about Forex and other markets. What’s more useful is the video tutorials offered by eToro. beginners can explore by topic and easily find any necessary tutorial or article they wish to master. eToro educational resources are among the best as it is a very simple and user-friendly experience to make sense of financial markets.

eToro Plus offers market analysis about current fundamental news and global analysis that can be used to increase decision accuracy in trading which is great.

Should you consider eToro as your primary broker?

Based on the eToro review we can confidently say that the broker is trustworthy. It does not mislead customers or does not provide false information. Traders are able to find needed information on the website very easily and make sure that they know every important detail of the broker. However, these details come at a cost to checking FAQs sometimes and might not be very comfortable if you are in a hurry. the lack of traditional customer support solutions like live chat makes it even worse to get needed help in time. As for regulations broker is very well-regulated which makes us believe the broker is absolutely legit and reliable. In conclusion: you can trade with eToro without fear of getting scammed.

Is eToro trustworthy broker?

What are the fees and spreads on eToro?

What are eToro accounts?