Forex trading is one of the most popular investment options around the world. It has not been like this always, there was a time when this market was only accessible to the biggest financial companies around the world, like, for example, banks. But it has changed a lot in recent years, with the help of the development of the internet and modern technology.

Modern technology helped Forex trading to become accessible for everyone around the world, and now, more than ever before, people of all backgrounds are able to invest in the Forex market. However, with such a fast and huge development in such a short time, a lot of challenges came as well. One thing that is very hard for investors is to find a trustworthy Forex broker. The thing is, today’s market is full of scam companies that are very hard to be differentiated from the regular Forex brokers.

Today, we are going to review TigerWit, which turned out to be a well-regulated Forex and CFDs broker. With eye-catching offerings and services that can make any investor want to start trading, this company has so many opportunities that it can be considered to be a safe place for investors.

If you wish to learn more about TigerWit FX broker and if you are looking for ways to stay safe, follow our review and learn as much information about this broker as you can.

The safety and security of TigerWit

TigerWit is a Forex broker that offers many trading services to investors around the world. When you first visit the website of the broker, it looks like a regular company, with a reputable license, and general services that look very good. However, the more information you learn about this company, the easier it gets to see the real face of it.

This company is authorized by one of the most trustworthy regulatory bodies around the world, called the Financial Conduct Authority. The regulatory body is based in the UK and is known to be one of the top-tier regulatory bodies. TigerWit’s review showed that this company is based in China, and owns licenses from offshore companies. The second regulatory of the broker is the Bahamas Securities Commission. In total, there are two independent regulatory bodies overseeing the broker’s fair practices which is great news for TigerWit’s customers.

negative balance protection and leverage

As of today, TigerWit claims to be offering as high leverage as 1:400. Although it is not super high, this still is very flexible for experienced traders. The risks become even lower as TigerWit offers negative balance protection. As this review of TigerWit FX broker shows, with this protection, you are able to keep your funds safe. Imagine a situation where you are trading with high leverage, if you do not have negative balance protection, you have a huge potential of losing more money than you have deposited in your trading account in the first place.

This happens to newcomers a lot, who do not know enough about Forex trading. Keep in mind that even if you are trading with the safest Forex broker around the world, you should avoid high leverage if you are not 100 percent sure about what you are doing.

To start trading at this Forex broker, you should deposit at least $50. This number is very moderate, especially if we look at the other Forex brokers on the market.

TigerWit Fees and spreads

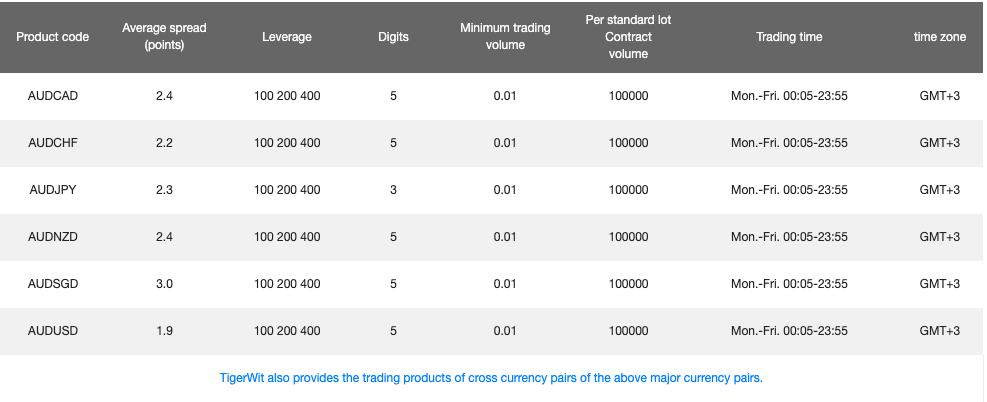

EURUSD spreads start from 1.2 pips which are 0.2 pips above the industry average of 1 pip. With these spreads, TigerWit offers near-average spreads and can be considered for traders who want to day trade major pairs. For other pairs like AUDCAD and other minors, the spreads are a bit expensive from 1.9 pips. Depending on the trading strategy deployed these spreads can be acceptable or sometimes very high. We can safely assume that this broker is not for scalpers who need spreads close to zero as they rely on many small profits during the day. TigerWit is transparent about its spreads and fees which is a very positive approach from the broker, all spreads can be found on their webpage meaning the broker is legit and does not hide anything from anyone.

Accounts, deposits, and withdrawals of TigerWit reviewed

Another very interesting thing is that this broker offers only one trading account, with a minimum deposit of $50. The top Forex brokers on the market offer several different trading accounts, to make sure that their investors are able to choose something that fits all of their needs perfectly. In the case of this company, there is only one account, that can be used by both beginner and experienced FX traders, and it is not something that can be enjoyed by anyone at all. This is especially true for scalpers who rely on low speeds to make money. Since TigerWit only offers one account with 1.2 pips spreads this broker is not for scalpers for sure. But for day traders 1.2 pips is near to average and does not bear many disadvantages.

Deposits and withdrawals

The only place to find any information on deposits and withdrawals is in the FAQs section under the education button. Their supported methods for payments are scarce and include Paysec, telegraphic transfer, and Neteller. These three methods can be used to deposits to withdraw money which is not flexible at all. Despite the lacking of payment methods the broker still offers deposits and withdrawals without charges which is a very positive sign.

TigerWit Trading assets and features

The list of tradable assets is not diverse with TigerWit brokers as they only include:

- Forex

- Commodities

- Stock CFDs

With only these three asset classes the choice for experienced traders is limited to only Forex and stock CFDs. There are no indices or digital currencies offered. We hope the company enriches its assets as its regulations and other features are so well established it is sad that traders can not trade other assets in this safe environment. One reason for this could be the broker’s focus on copy trading features.

TigerWit Copy Trading Explained

TigerWit seems very focused on offering copy trading as its one of the main trading products to its customers. This is a great feature not only for traders but for investors and master traders as well. If you have a profitable trading strategy you can amass a trader base who copy your trades and you get a commission for each trade made.

TigerWit Customer Support Review

There is no live chat unfortunately at the TigerWit website. Live chat is the best option to connect with the broker and its lack is a great disadvantage. Traders will have to use alternative methods to get in touch with TigerWit support and many of these alternatives are less efficient and require considerably more time. Email support and online form will take some time for the broker to answer while live chat could offer help within seconds.

TigerWit Education

One thing that we noticed right away is that this broker does not offer educational material. According to the regulatory frameworks around the world, every broker is required to offer its investors educational material so that they can learn and grow as Forex traders. TigerWit offers an educational section, but the only resources there are FAQs and not anything else. There are also no market research tools provided, which means traders will have to use other websites to track fundamental indicators and other important data. Also, the top Forex brokers on the market offer their investors news articles about the ongoing events on the market, to make sure that they stay up-to-date with the ongoing events on the market. Since this broker does not offer anything like that, investors are not able to make predictions like they would be able to if they had access to accurate educational material.

Should you consider this broker TigerWit?

Our review of FX broker TigerWit shows that this Forex broker is a well-regulated company. The broker because it is under strict regulations could become one of the top brokers in our list of reviewed companies, but the lacking of several important departments does not allow us to evaluate the company more and recommend it to our readers. Yes, your funds are in safe hands with TigerWit, but the lack of trading assets, education, and live chat make it difficult to find your preferred asset and get in touch with the broker in case any difficulties arise during the trading activities.

The broker has a very promising future if they continue to grow and add important services and once they do so, we will review them again and recommend them to our readers. But as of now, this broker is not recommended as there are many much better alternatives.

Is TigerWit a safe and secure broker?

Is TigerWit a good broker?