A brief history and overview of Nextmarkets

With the number of Forex brokers increasing around the world, it is becoming harder for beginner Forex traders to decide which companies to trust and why. The number of Forex brokers has skyrocketed over the past few years, and while this has created very high competition in the market, there are some drawbacks to this process as well.

Many of the newly-established Forex brokers lack the standards that could guarantee the fund safety of Forex traders. While not all of these brokers are scams, their services are simply not good enough to offer traders a high level of security and safety.

One of such Forex brokers in Nextmarkets. At first sight, the broker seems to be a regular company. Regulated in the EU, offering competitive and innovative services, and so much more. The main focus of Nextmarkets is on stock trading and the broker offers very competitive terms for stock traders. The fees and spreads are almost zero and ensure traders can have maximum profitability when trading these peculiar financial markets.

The services of the broker for other asset classes are also very competitive with low spreads on Forex pairs. But, what exactly does Nexmarkets offer? That is exactly what we tried to find out with this Nextmarkets review. So, follow our detailed review and see what this brokerage is all about.

The safety and security of the Nextmarkets

While reviewing Nextmarkets, we made sure to focus on the most important factor for traders – the security and safety standards that the broker offers. One of the most important things for ensuring clients’ safety is being regulated by a reputable regulatory agency.

The broker is authorised and regulated by the Malta Financial Services Authority (MFSA) which is not a very strict regulator. Despite this, the fact that Nextmarkets is regulated still offers safety for their clients. The broker has to abide by the regulations and offers segregated bank accounts for client funds and also is a member of the investor compensation fund. Despite being regulated having only one regulator which is known to be less strict is a downside for the Nextmarkets.

Nextmarkets Fees and spreads

The spreads are really tight on Forex pairs and start from 0.6 pips on major pairs. This is very attractive, but the lack of other trading accounts with zero spreads may be considered a disadvantage for traders who love using scalping strategies. Still, this spread is low and should be sufficient for Forex day traders and swing traders.

Is it really commission-free to trade stock CFDs with Nextmarkets?

One of the biggest selling points of this brokerage is that it claims to be totally commission-free, offering traders the opportunity to get the most out of their trading and initial deposits. But, this is not necessarily correct. The broker still charges spreads, which are in-trade commissions, commonly viewed as the main income source for brokers.

As we were able to find out, the spreads on this broker are above-average and while the broker has been claiming to be commission-free, this offer only applies to orders that are above 250 euros. Other than that, the broker still charges commissions. This is a sign that this brokerage is not really a commission-free brokerage, it is just the way it attracts more traders. This is a huge drawback of this broker.

While the commissions are still very low, it is not totally commission-free and traders should understand this before opening an account with this broker.

Accounts, deposits, and withdrawals

While working on this broker review, we found on the website of the broker that it claims that getting started with them is very easy, and opening an account should not take a long time. But, we were met with a number of issues while trying to register on this brokerage.

But, the time needed to register was not as much of an issue. The worse thing is that the broker only offers one type of account to all different types of traders. This is a very bad thing since not all traders want the same thing in the trading market. Their needs are different it is very important for brokers to ensure that they offer traders of all different interests and backgrounds services that are tailored to their own needs.

Supported payment methods include Credit/Debit Cards, Sofort, and some other less-known options. The deposits are instant and commission-free, but we could not find the withdrawal details anywhere so we assume there may be fees for withdrawals. Generally, Nextmarkets lack information on their website and it is difficult to find some critical data.

Trading assets and features

While reviewing Nextmarkets, we focused on all the different factors that traders are considering when choosing a new brokerage. First of all, let’s start by reviewing the website of Nextmarkets. At first, the website seems to be okay. But, once you start looking for information about the services of the broker, things get a bit tricky.

First of all, the website of the broker is very laggy and it is hard to get around. Finding information about different types of things is not easy either. The broker does not really have pages created for the different types of services that it has to offer. This makes finding much-needed information a very hard venture for traders.

The list of trading assets is provided in the Information and T&Cs section which requires some effort to find. It is strange that the broker is shy of showing its low spreads and commission-free stock trading specs on their website and clients have to dig deeper to find all this information.

This is a huge disadvantage, which can lead to many traders making uninformed decisions. As for the actual trading conditions of the Forex broker, they do not seem too bad. First of all, the broker claims to have very tight spreads and no commissions for deposits and withdrawals.

As for the leverage, the broker claims that it is limited to 1:30 due to the local regulations in the EU. However, at the same time, the broker says that the leverage can go up to 1:200, but, there is no specific information provided about when such high leverage applies and how can one use it. The broker also notes that it is heavily focused on offering its clients assets such as stocks and ETFs.

Trading platforms of Nextmarkets

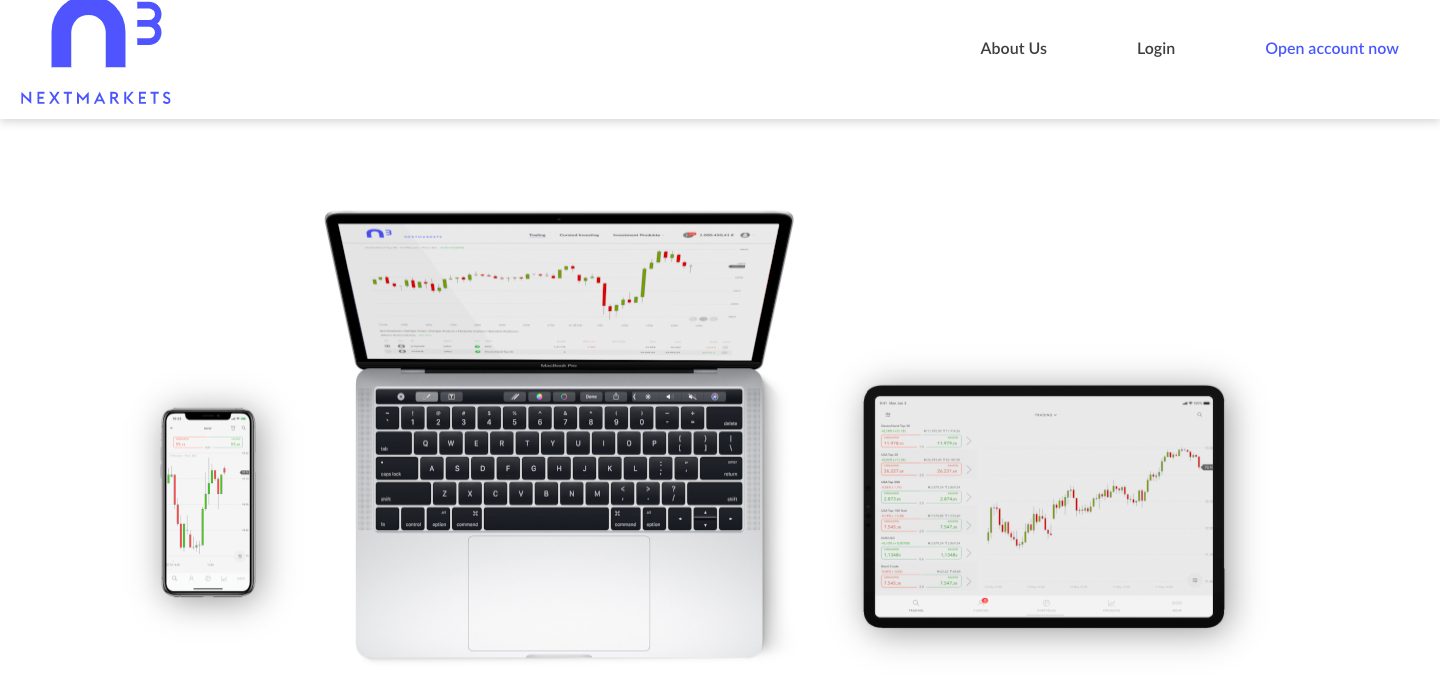

One of the biggest disadvantages that we were able to identify about this Forex broker is the fact that it does not offer traders well-known trading platforms. While there is nothing wrong with offering a custom trading platform, it would be better if traders had some type of choice.

While reviewing Nextmarkets, we found that there is only one platform that traders can use, which is a custom trading platform and not all traders are familiar with this platform. It is very common for the majority of the brokers in the market to offer traders different types of trading platforms, including those like MetaTrader 4 and MetaTrader 5 to ensure that they can use the platform that they are already familiar with.

By not offering these trading platforms, it can be a bit hard for traders who are used to using trading platforms such as MT4 and MT5 to start using the services of the broker and it can take them additional time to get used to the feeling of the new trading platform.

In addition, traders using Nextmarkets will have to miss out on the opportunities that MT4 and MT5 have to offer, specifically, the analytical tools of the trading platforms and the Expert Advisors, which are very frequently used to make trading a bit easier.

It should also be noted that there is an apparent lack of available trading assets on this brokerage. It only offers traders assets like ETFs and stocks, which are not that much and leave traders without having the opportunity to trade what they really like. If you want to trade different types of assets, this broker simply won’t be able to satisfy your needs and wants.

Customer Support of Nextmarkets

The broker has one of the best customer support with knowledgeable representatives who are responding very quickly and offer every information traders may ask. If not such good customer support is offered by this broker we would straightaway suggest traders avoid Nextmarkets, but since the broker has support that is caring and polite, Nextmarkets may have a chance to survive in this competitive field of modern brokers. With an excellent live chat, every interaction with this broker becomes a simple and good experience.

Education

Throughout our review of Nextmarkets, one of the most disappointing things that we found is the lack of educational material on this brokerage. While it claims that it helps beginners by connecting them to experienced traders to learn more and grow their skills, there is no actual trading educational material that beginners can use on their own.

This is a disadvantage, considering that the broker claims to be regulated in the EU. The European regulatory bodies require brokers to provide traders with educational material, and there is no such thing available at Nexmarkets.

The only thing that traders can use for practice and learning about the market is the demo account. This type of account is offered by almost all of the brokers available around the world and is not a huge advantage.

There are no educational materials as of now available on the Nextmarkets website. The website needs some major improvements if this broker wants to get noticed as it provides little to know information about the broker’s services.

When trading, one of the most important factors that traders have to keep in mind is comprehensive market analysis. While this Forex broker offers traders the opportunity to use different types of technical indicators, it lacks the offering of fundamentals. Fundamental analysis is a very important part of market analysis. It is the process of analyzing the market data, such as ongoing events around the world, statements of central banks, and many others and their possible impact on the trading markets.

It is a very common practice for brokers to offer traders different types of market updates to ensure they are up-to-date with the ongoing events in the market. There is no such offering by this broker, which can make it harder for traders to stay in touch with ongoing events around the world that could have a huge influence on the price fluctuations in the market.

Should you consider the Nextmarkets broker?

One of the biggest disadvantages that we were able to find about this Forex broker is that it simply does not provide traders with enough information about their services. There is only one page on the website of the broker and it is the About Us page, where the broker simply talks about their history.

This is a huge disadvantage. Even the information that is provided by the broker is very vague and general, which does not have any actual value for traders.

Overall, even since the broker has very competitive trading terms and excellent support it still is not a very attractive broker because of how poorly its website is made. The first thing every broker should try is to make a user-friendly and intuitive website that offers traders enough information and they do not need to dig deeper or contact support to find out details about spreads, accounts, and other important things. There is a lack of analytical opportunities, and no educational material also.

While we do not think that Nextmarkets is a scam, the broker is simply not good enough to meet the needs that modern traders.

Is Nextmarkets a trustworthy Forex broker?

What trading platforms does Nextmarkets offer?