Mugan Markets was established in 2015 and since its creation has managed to grow customer base from all over the world. This broker has many qualities that attract clients such as: secure ECN trading, good customer service, instant deposits and withdrawals. What’s more, traders can be assured that the broker is not manipulating the markets.

In addition, Mugan Markets has a lot of partners and liquidity providers guaranteeing low trading fees and high liquidity.

Additional benefits of trading with Mugan Markets are:

- Access to MetaTrader 4 platform

- PAMM Marketplace

- ECN execution

- Fiat to Crypto Deposits & Withdrawals

- Anonymous Trading

- No Delays, No Bureaucracy

Trading Software

When it comes to trading platform, traders are offered the industry leader MetaTrader 4 (MT4). There are also Mobile and Web trading versions of the MT4 available.

MetaTrader 4 was first appeared in 2005, and it quickly became the most popular software among traders. Even today, the platform remains unchallenged and most brokers are offering it to their clients. Since the release, the platform hasn’t been upgraded much. For many the platform might seem outdated in terms of looks since it was designed so long ago, but in reality lack of complex design is also its greatest strength. MT4 is simple, doesn’t require too much space to download and is easy to run on even old or low budget computers. The simple design contributes to its high performance, reliability and functionality.

The main benefits of using the broker’s trading software are:

- 1 Single Login Access to All Platforms and Devices

- Full EA (Expert Advisor) Functionality

- Technical Analysis Tools Including Indicators and Charting Tools

- Hedging and Scalping Allowed

- Place Orders From Micro 0.01 Lots

- STP/ECN Technology and Direct Market Access (DMA) Connectivity

- Trade Forex, CFDs, Crypto, Stocks, Metals, and Commodities

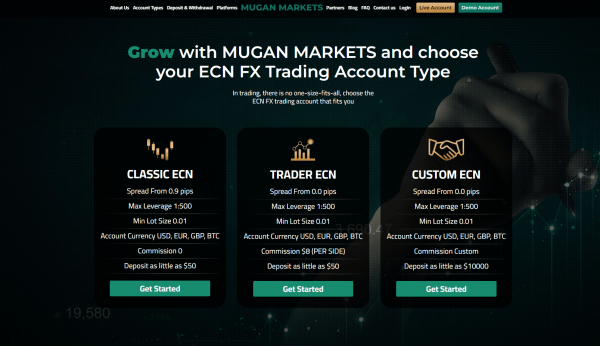

Account Types

Based on their trading style, there are traders who prefer low commissions to low spread markups and vice versa. For instance, if a trader spends more time analysing the markets, plans trades more carefully and waits for the right opportunities to come, he or she cares less about how large spreads are as long as commissions are low. For frequent traders such as intraday traders, scalpers, high frequency traders, news traders, etc. low spreads are much more important, and they are willing to pay commissions instead. What’s great about Mugan Markets is that the broker offers both spread free and commission free account types to meet the needs of different traders.

Available account currencies are: USD, EUR, GBP, and BTC. Keep in mind that it’s best to open an account in currency that you use daily. This way you will save a lot of money on conversions back and forth.

Classic ECN account

On Classic ECN account spreads start from 0.9 pips on EUR/USD. On the upside there are no commissions. This simply means that every order you open, the broker charges you with 0.9 pips. In live trading environments spreads can be higher due to low liquidity.

As already explained above the commission free Classic ECN account is very attractive for position traders and swing traders due to the fact that they place orders less frequently.

In order to open this account type at least $50 is required. Maximum available leverage is 500:1.

Trader ECN and Custom ECN account

Both account types are spread markup free. And broker charges traders with commissions instead ($8 per side on Trader ECN account). These account types are for intraday and high frequency traders. Available leverage is up to 500:1. Minimum initial deposit required to open a Trader ECN account is just $50. As for the Custom ECN account, traders need to deposit at least $10,000.

Mugan Markets 100% Deposit Bonus Explained

Mugan Market’s 100% bonus has several advantages when compared to classic deposit bonuses. The bonus is withdrawable, and it is credited to the trader’s account instantly. The bonus allows traders to enter markets with increased trading capital and turbocharge potential profits. The process for getting the bonus is also very standard and simple. Traders will need to register an account, deposit at least $250, and start trading with a bonus of 250 USD to 20,000 USD. The bonus can be used for all trading accounts, offering flexibility to traders to select an account that suits their trading style. There are no concealed charges, and the bonus is available when trading volume requirements are fulfilled. Traders are free to withdraw their initial deposit without losing the bonus.

Safety and security

Deposits and withdrawals are fast with this broker. What’s more, you can deposit funds anonymously and trade using crypto deposits.

The broker follows various policies to make sure your deposits are safe. Client money is held in segregated accounts with top-tier Global banks. Account segregation protects funds as even if the company gets liquidated, traders are guaranteed they will get their money back.

In addition, Mugan Markets provides traders with Negative Balance Protection. Leverage with this broker is up to 500:1. This means that traders can increase their purchasing power 500 times. As a result, when the market moves sharply against a trader and the position is oversized, traders can lose more money than what’s on their trading balance. To counter this, Mugan Markets guarantees that traders will never lose more than what’s on balance. The broker uses smart stop out levels. However, even if the unlikely event happens and the balance goes negative, traders can reach out to the broker and the balance with be returned to zero.

Customer Support & Extra features

Good customer support experience is the backbone of every service oriented company. Mugan Markets provides traders with an award-winning customer support available 24/7. The CS agents are very helpful and professionally trained. In 2019 Mugan Markets was awarded as the best customer service provider.

In addition, traders can find educational blogs and articles with this broker. Furthermore, the broker offers various partnership programs including PAMM accounts, affiliate and broker introduction programs.

Conclusion

We can safely say that Mugan Markets has a lot to offer. Trading fees are low, and the broker offers various account types to meet the needs of different traders. Leverage is flexible, up to 500:1. And the minimum initial deposit required to open a live account is only $50. The broker keeps funds in segregated accounts and provides traders with Negative Balance Protection. Available trading platform is MetaTrader 4 (MT4). In addition, mobile and web trading platforms are also accessible.