Every new broker that you find on the Internet poses a threat to the security of your finances. It’s common wisdom that almost every trader knows. However, when it comes to well-established brokers with decades of experience in the field, things start to get a little confusing.

The MRG broker is a Forex (as well as commodities, shares, etc.) trading company with 12 years of experience. One would think that it’s enough for the broker to gain sufficient experience. Even experienced traders would be tricked by this assumption. But after finding almost no MRG reviews on the Internet, we thought we gave the broker our own assessment.

So, without further ado, let’s get to the review!

Brief overview

With the initial look at their website and other elements, we got a pretty specific idea of what the broker is all about. But let’s not jump to conclusions and follow the details step-by-step.

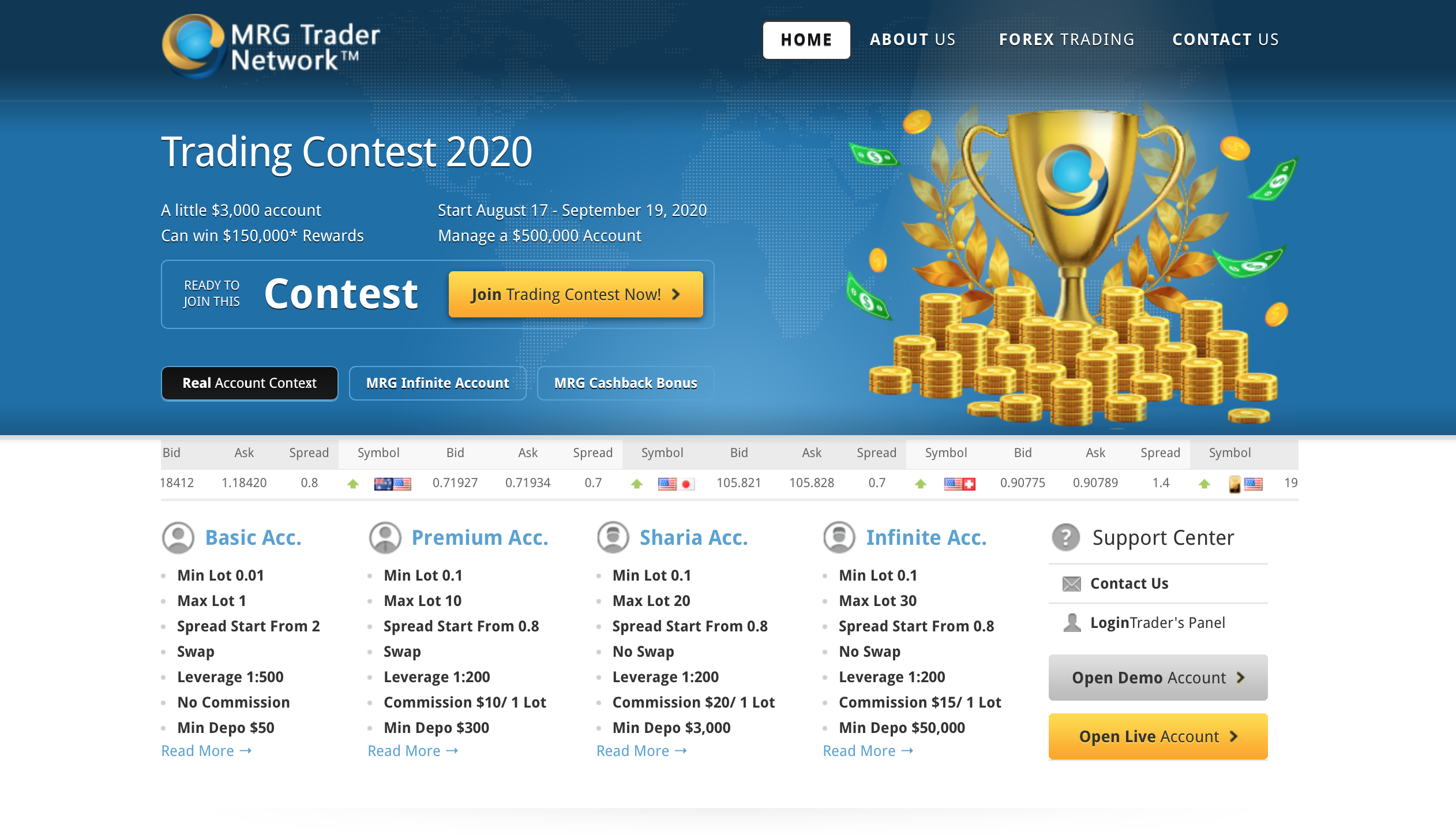

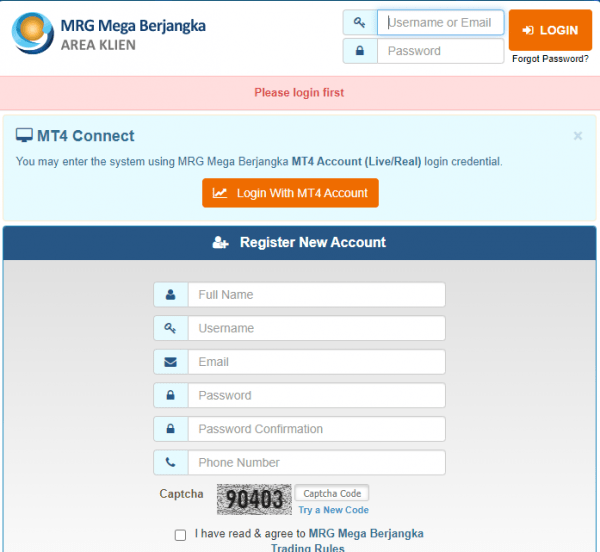

First things first, the website looks awful. The design almost looks like it was created by a ten-year-old. The tabs are counterintuitively arranged; the color palette doesn’t really correspond to the modern, more simplistic website looks; the interface is stuffed with complicated visual effects.

There’s one more problem with the website: you will have a hard time finding specific information about the broker. For example, the regulatory remarks, that are supposed to be located at the bottom of the first page, are actually hidden in the ‘Why Choose Us’ section.

Since we’re here, regulation is another aspect that we’re deeply suspicious about. The MRG Forex broker claims that it has been registered and regulated by New Zealand but as far as the actual control over their activities goes, we’re not so sure this regulation means anything.

As for the trading terms and conditions, the broker offers four types of trading accounts, which allows almost every trader across the board to use the broker’s service. In terms of which account type you choose from, the spreads, maximum leverages, and minimum deposit requirements will differ accordingly. We’ll discuss these numbers in detail down below.

The trading platform is the basic MetaTrader 4, which is common on the market. What’s a little bit new is the support for mobile devices.

Now, let’s head on to the trading conditions and see, what they really account for.

The safety and security of MRG

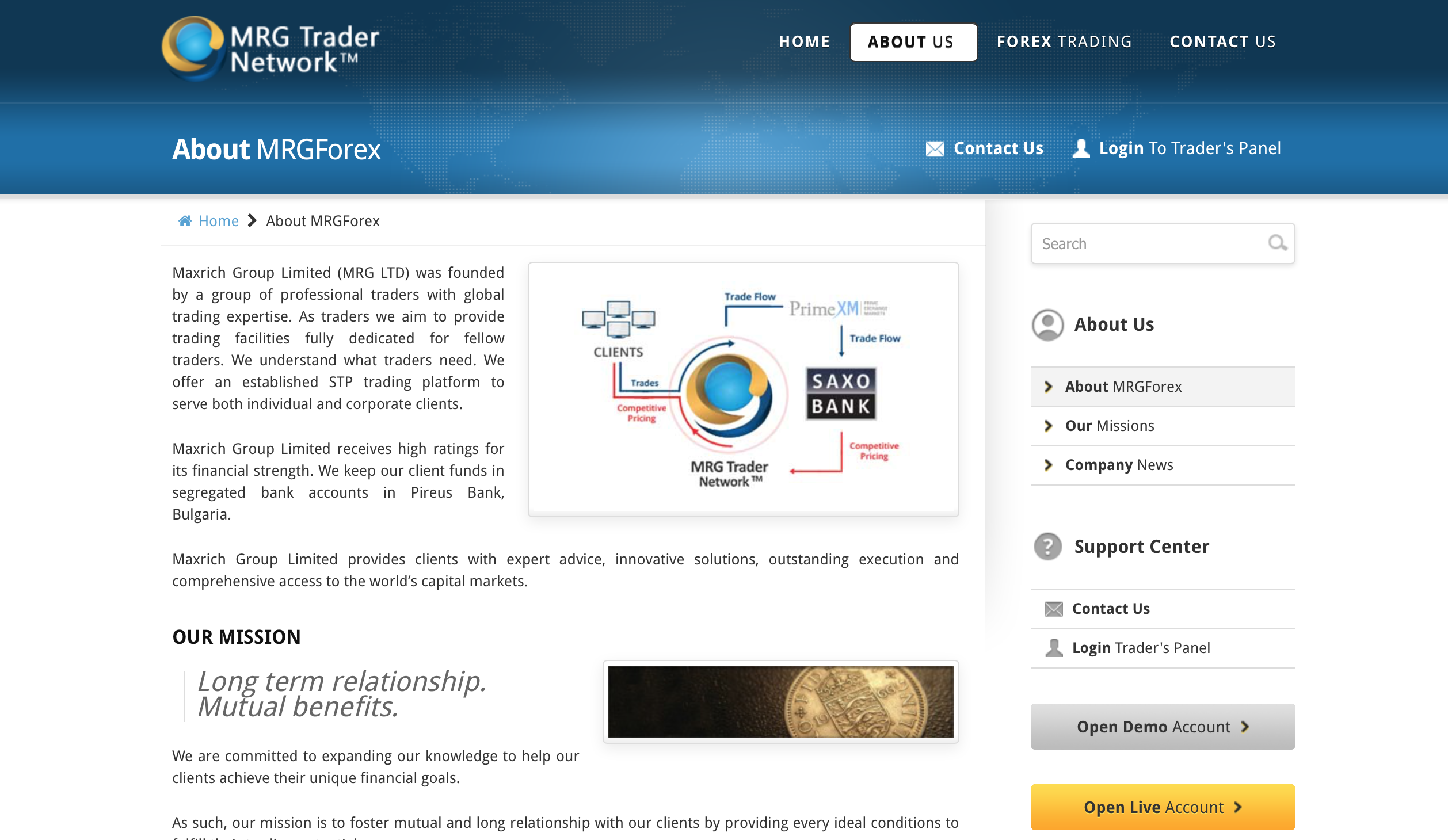

As we’ve mentioned above, MRG was registered in New Zealand in 2007. The license was acquired through the Financial Markets Authority regulation. Now, let’s talk about what this means exactly.

At first sight, New Zealand is a developed country with a somewhat strong economy. One would think that the companies registered there would adhere to strict regulations.

However, the reason why we don’t think this is the case is that New Zealand is still an island in the furthest part of the world, while the MRG broker has spread its services across the globe in many countries. It’s not really obvious to us how this small country could oversee the financial activities of the given company.

All in all the broker is still somewhat safe as it has to oversee the body which increases the likeliness of its fair practices.

MRG Fees and spreads

Spreads are relatively unattractive on MRG as the lowest spreads start from 2.5 pips which is super expensive. What does this number say? It means for every lot traded (100’000 dollars) trader will have to pay 50 USD. This is a lot. Not only is this spread high for scalpers, but it is high for other types of trading as well as spreads are considered to be normal around 1 pip level. The premium account offers 0.8 pips spread but has an expensive commission of 10 USD per lot, above the industry average 7 USD round turn commission. A minimum deposit of 50 USD is an advantage, but with such high spreads and commissions, it will be super difficult for day traders to make up for commissions and make a profit.

MRG Accounts, deposits, and withdrawals

As we mentioned above, the trading conditions vary in terms of which trading account you choose.

The Basic account requires a minimum deposit of just $10, which is probably a good thing because beginners will be able to start trading without risking too much money. The maximum leverage goes up to 1:500 and the spreads start from 2.5 pips.

The Premium account has a minimum deposit of $300, leverage up to 1:200, and spreads from 0.8 pips.

The Sharia account requires a minimum $3,000 deposit, offers leverage up to 1:200, and spreads from 0.8 pips.

And the Infinite account, the most elite one, requires a $50,000 minimum deposit. The leverage and spreads are the same as the last two.

Now that we’ve listed the numbers, what do they actually mean? Are they to be trusted and gushed over? We think not. You see when the broker wants to attract customers without too much attention to what it actually offers, it makes up such flashy numbers and tempting conditions. With our MRG fraud suspicions, there is a real possibility that these conditions will lure in many prospective traders and then undermine their financial accounts.

Now let’s move to the website review.

MRG deposits, and withdrawals

The MRG withdrawal is yet another area where the broker doesn’t shine, to say the least. It supports outdated platforms such as bank-wired transfers and debit/credit cards. There are other minor platforms like Skrill and FASAPAY, but they aren’t that popular to be even mentioned. These platforms don’t even come close to such online wallets and cryptocurrencies as PayPal and Bitcoin.

The information about deposits and withdrawals is scarce on the website of the MRG, still, we were able to find some interesting terms and conditions regarding withdrawal processing times. Withdrawals made after 00.00 to 12.00 WIB, will be processed on the same day no later than 16.00 WIB. Withdrawals made after 12.00 to 00.00 WIB, will be processed the next day no later than 12.00 WIB.

Trading assets and features of MRG

The broker has only Forex pairs, US oil, and Index as its main tradable instruments. This is probably the lowest number of asset types we have seen so far offered by the FX broker. It is not an issue as many traders gonna trade solely Forex anyways, if the terms and conditions was better we would not consider this a big downside. There is gold offered as an instrument which is very good as many FX traders love trading gold and hedging their currency risks further.

As for the trading platform, we’ve already mentioned that the broker uses MT 4 and iOS/Android systems. We’re most impressed by the latter because it’s always convenient to have a trading assistant in the pocket ready to go.

Unprofessional website

As you already know, we didn’t really get a good impression of the initial mrgtrade.com review. Let’s look at the details more closely.

The interface looks as if the broker didn’t have the money to hire decent web engineers. With the combination of rich blues and whites, we get sort of a Windows XP-era vibes – just so you know, it’s not good!

The webpage is full of unnecessary visual effects and transitions. So, the visitor tends to drift off and don’t find what they’re looking for. And about not finding what we’re looking for: some of the main details about the company, like the licensing, are hidden as though the broker doesn’t really want us to find it.

The website’s separation into the thematic sections is also very counterintuitive. Here’s the arrangement: Home, About Us, Forex Trading, and Contact Us. On a typical, well-assembled website, these tabs would have been in a different order, where the Home tab would maintain the same spot, while the Forex trading would come to second place. Next would be the Contact Us section, and finally – the About Us page.

We are not making this up; this is based on the psychology behind website visitors’ decisions on where to go first. Typically, they’re most interested in trading conditions and numbers, which they can find in the Forex trading tab. When it comes to the information about the broker, the visitor will automatically go all the way to the end to find a related section – typically, About Us.

Customer Support Review of MRG

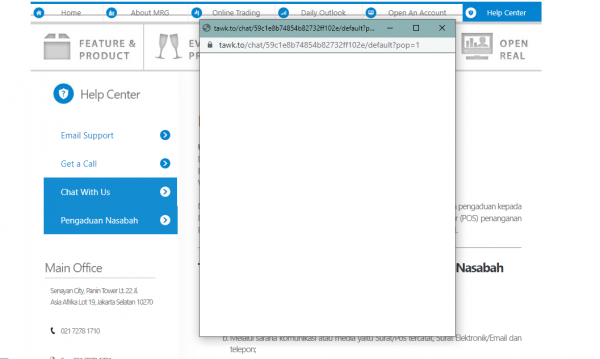

Support seemed excellent from one glance. But there few caveats here. The live chat can only be accessed from the support page and it has some kind of a bug and is not working properly. It opens in a popup separate window and that’s it. There is some kind of an issue that the broker has to address soon. For now, the live chat is horrible and unusable. As with other methods online forms, email and hotline are all accessible. The language of the website and support seems to be a blend of Indonesian and English which is a huge downside and an unprofessional approach. They need to make a separate selection for both languages to make it comfortable and useful. As of now, we can not give MRG support a high score.

MRG Education explored

There are no educational resources or research tools currently offered by the broker. The only available Daily Outlook section requires full authorization and seems to be usable only for real account holders. This is a big downside and we hope the broker if it stays on the market, improves its website, and offers educational resources.

Should you consider MRG?

In this review, we discussed the trading conditions offered by the MRG broker, as well as examine the regulatory issues, and assessed the website.

With the flashy and boastful trading conditions that are promoted by the broker, we think that the company is trying to lure in as many customers as possible while not really thinking about the implications.

As for their website, it looks unprofessional and amateurish with its unmatched color palette and unnecessary visual effects. Even finding the crucial information takes a lot of time and research.

The regulation, in our opinion, is just a piece of paper with New Zealand mentioned in it. In effect, the company can do whatever it wants and not be charged for its actions.

Is MRG a reliable broker?

What are the fees and spreads on MRG?