IFS Markets has changed a lot after our last visit this January. The broker is no longer regulated by any authority which is a huge downgrade. The company is now registered in Saint Vincent and Grenadines as an international business company. The leverage remains the same up to 1:500, with undefined spreads, and commissions. Deposits were increased to a minimum of 100 USD. IFS Markets offers only 2 account types. Both the Deposit and Withdrawal have fees. The available instruments are a little more than 50 including Forex, indices, and Commodities. Let’s now dive deeper and define if IFS Markets can be trusted or not.

First Impressions

The website gives a very positive impression when you visit it for the first time. The broker took its time to design and optimize it. The transfer between pages is quite fast and the layout of the information is commendable. The broker doesn’t shy away from disclosing legal information, such as their regulations, registration name, and address. It is safe to say that the broker does indeed pack some experience over 12 years of existence. However, there are some disadvantages, that rack up and turn the IFS Markets rating downwards. Let us discuss them.

The Safety and Security of IFS Markets

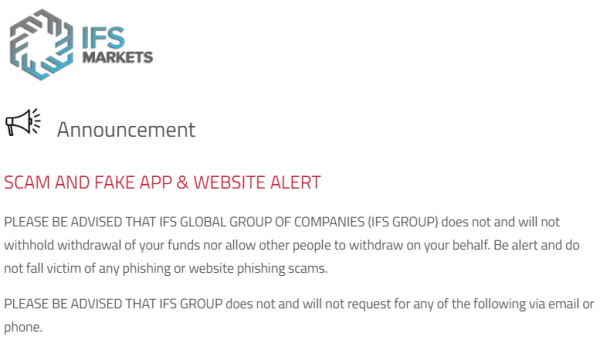

The broker has implemented an alert system to safeguard their clients against scams falsely claiming to be IFS Markets. This proactive measure ensures the security of their clients. It reinforces the company’s commitment to maintaining a trustworthy reputation right from the clients first visiting their platform. Upon further investigation by our experienced reviewers, we discovered that the company lacks regulation from any recognized regulatory authority. This raises concerns that the aforementioned alert might be strategically utilized to bolster the company’s perceived reputation without genuine justifications.

All in all, IFS Markets is only registered in Saint Vincent and Grenadines and does not hold any license from any regulator. In the financial world you can not trust anyone by word, you need strong evidence. IFS Markets does not provide this evidence by strong regulations.

IFS Markets Fees and Spreads

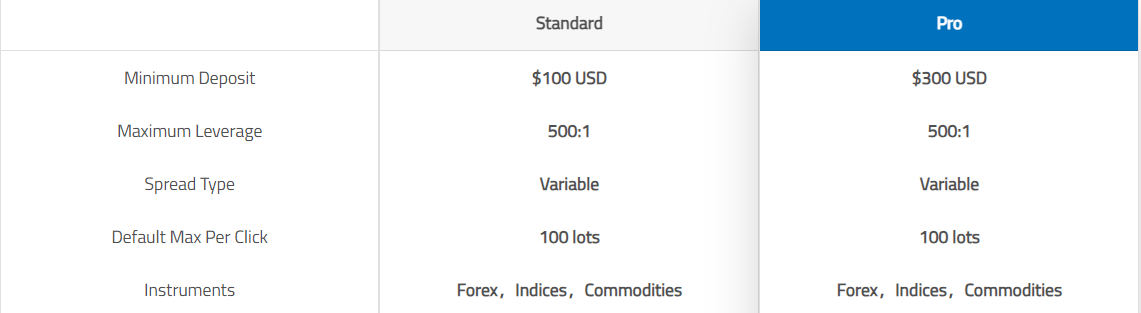

The first sign of an IFS Markets scam comes from their lack of transparency about spreads in general. However, the company has been operating for 13 years now, so the possibility can be completely disregarded. There was no clear indication about the spreads, only a small mention that they are “competitive” which can mean a plethora of things. Our attention during the IFS Markets review was solely directed at the commission-based Pro Account. Commissions are never a good alternative to spreads. Based on the lack of transparency, the broker may be pushing their traders more towards the Pro Account, by surprising them with huge spreads on the Standard one.

The Leverage

The maximum leverage available with the brokerage is quite high, 1:500 to be exact. This is obviously for currency pairs as commodities and Indices are bound to have different amounts. You can adjust the leverage to choose the comfortable number for you. Remember, leverage is both a blessing and a curse.

IFS Markets accounts, deposits, and withdrawals

The account types of brokerage seem quite redundant and contradictory. There are only 2 of them available, and they both come with the same features, with only 1 minor difference. The Standard account does not have commissions, while the Pro account has. This is an indication about spreads, which the broker does not have in clear view on its website. This is most likely a way to sweep high spreads under the rug. We’ve seen such strategies implemented on other brokers’ platforms. The company offers large spreads on standard accounts without commission, forcing the users to switch to Pro accounts that do indeed have commissions. In the large scheme of things, commissions rack up more costs for the trader, rather than the broker. Therefore IFS Markets Account Types gets a “meh” from us, for the lack of diversity and transparency.

IFS Markets Withdrawal & Deposit

IFS Markets Withdrawal & Deposit system is quite good. They offer a plethora of options, ranging from Credit/Debit Cards, WIRE transfer, Skrill, and various other options.

However, this richness in diversity comes with a price. The price is 2% of your withdrawal and deposit to be exact. Although, this doesn’t apply to Bank transfers. But let’s look at it this way. You are about to withdraw $1,000 from your account. Which one do you prefer? To withdraw it without the $20 fee and wait a whole week, or withdraw it right now for a price? In most cases, the trader would choose the latter. This was quite disturbing during the review. If it weren’t for the 13 years of experience, we’d be screaming about the IFS Markets scam right now. The variety does indeed come with a price.

The minimum deposit for the broker is exactly $100, which is a great way for beginner traders to access the market.

IFS Markets Review – Trading assets and features

IFS Markets’ features are relatively good, especially their leverage and minimum deposit. Let’s get into more detail, shall we?

IFS Markets offers three types of assets Forex, indices, and commodities. All three account for about 80 tradable instruments. For Forex traders this is not an issue. However, if you are an experienced trader and want more asset types then you will have to search for other brokers.

Trading Platforms

The broker offers a MetaTrader 4 advanced platform and its web trader. The IFS Markets MT4 platform is nothing special compared to others it can’t be special now, can it? However, IFS Markets offers ZuluTrade which is a unique feature for the broker.

IFS Markets Customer Support Review

When it comes to customer support, IFS Markets does not offer live chat. Live chat is the best way to contact the broker. This is a huge downside as it will take more time to solve any issue without the live chat. However, the broker offers email support and a hotline. You can leave a message for the broker through an online form.

Education at IFS Markets

The broker does not provide educational resources only a few tools. The research tools such as the economic calendar will help traders monitor important news and developments. IFS Markets’ other tools are trading tools and trading central.

Should you consider IFS Markets?

IFS Markets is not a scam, a 13-year log is a testimony to that. But the broker lacks proper regulations which is a huge downside. A more relevant question would be, “Should you trade with IFS Markets?” The answer to that is no, unfortunately. The flaws we found in this IFS Markets review show that the features are lackluster at best. Their best feature of a $0 minimum deposit is no longer there. When it comes to leverage, withdrawal, trading instruments, and platforms, many other brokers outclasses them significantly. Should you trade with this broker? Well, it’s up to you. Will IFS Markets scam you? No, definitely not.

Is IFS Markets regulated?

What are the fees and spreads?

What are the account types?