FXGT.com is a global hybrid CFD broker that offers access to various asset classes, including: currency pairs, equity Indices, metals, energies, stocks, cryptos, synthetic cryptos, and GTi12 Index. FXGT.com is a well regulated broker in 4 jurisdictions. The company offers 4 different account types to meet the needs of different traders. Traders can choose between Pro, ECN, Mini, and Standard+ account types. The company has low fees, up to 1000:1 leverage and amazing 24/7 customer support.

In this review of FXGT.com, we’ll discuss all of the important details every trader should take into account before registering with the broker. We’ll uncover FXGT.com’s level of safety, available instruments and fees, trading platforms, and more.

The Safety and Security of FXGT.com broker

Finding a secure and trustworthy broker is of paramount importance for every trader or investor participating in financial trading. One of the best indications whether your broker is safe or not is its regulatory compliance. Licensed brokers are required to regularly do the reporting and undergo constant financial audits. Most regulators require brokers to have important safety features in place, such as client fund segregation, negative balance protection and more.

FXGT.com is a trustworthy broker as the company is regulated in 4 jurisdictions, which you can view below. We’ll include the license number so that you’ll be able to check it yourself.

- FXGT.com is licensed and regulated by the Seychelles Financial Services Authority (FSA) under the Securities Dealer’s License Number SD019.

- FXGT.com is regulated by the Financial Sector Conduct Authority in South Africa. (Is authorized FSP with FSP Number 48896)

- The broker is licensed and regulated by the Vanuatu Financial Services Commission (VFSC) under the Principal’s License Number 700601

- FXGT.com is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 382/20 operating in accordance with the Markets in Financial Instruments Directive (MiFID II), this license is reserved only for institutional traders.

In addition, it should be mentioned that the broker keeps client funds in segregated accounts from the company’s operating funds, which ensures that whatever happens, clients maintain access to their capital. Account segregation is very important as there have been a couple of instances where brokers have gone bankrupt and traders have lost all their money.

Furthermore, FXGT.com provides negative balance protection to all its clients. This simply means that traders can never lose more money than what they deposit. Trading CFDs is available with up to 1000:1 leverage. And the high leverage enables traders to manage up to 1000 times their initial deposit, which creates the risks of account balance going negative in highly volatile market conditions. However, as already mentioned, traders are protected, and even if the balance goes negative, you can contact the support and the balance will be reverted back to zero.

FXGT.com clients are insured with up to a total of 1 million Euros. This insurance covers for errors, omissions, negligence, or other risks that may result in financial loss.

FXGT.com account types, which account fits you best?

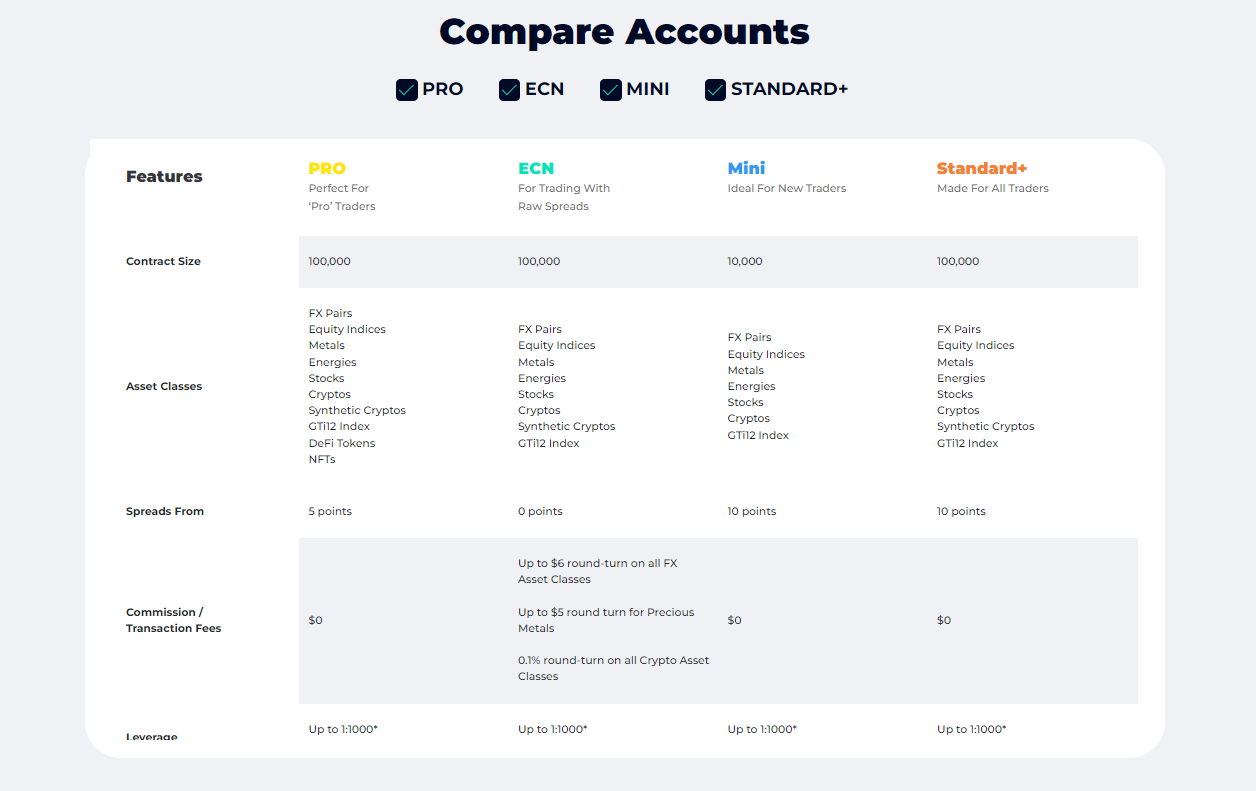

Every trader has different requirements. Traders with smaller capital or those who wish to live test their trading strategies with little capital at risk, often prefer mini/micro accounts. Algorithmic traders, active day traders and high frequency traders (HFT) generally prefer ECN accounts, due to raw pricing and minimal spreads. Regular traders that typically swing trade and prefer to plan their trades well, and trade their plans, usually take regular accounts with low commissions.

To meet the needs of all types of traders, FXGT.com offers access to 4 account types: Pro, ECN, Mini, and Standard+. All accounts offered by FXGT.com have access to MetaTrader 4 and MetaTrader 5 trading platforms. Swap free accounts are available, and negative balance protection is guaranteed for all types of accounts. However, there are some major differences. As already mentioned, the Mini account is best for low capital traders and strategy testers as contract sizes on this account are 10 times lower at 10,000 than on other accounts.

The ECN account offers spreads from 0 points, which is ideal for highly active traders, as they get to pay less fees. On the other hand, ECN account holders are charged with commissions up to $6 round-turn on all FX Asset Classes, up to $5 round-turn for Precious Metals, and 0.1% round-turn on all Crypto Asset Classes.

Pro and Standard+ accounts are charged with no commissions at all. However, trading fees are integrated into spreads on these accounts. Pro accounts have spreads from 5 points (or 0.5 pips), and Standard+ accounts have spreads from 10 points (or from 1 pips).

Keep in mind that the broker allows its clients to use cryptocurrencies to fund their accounts in addition to popular global currencies. You can fund any of the 4 accounts using these currencies:

- BTC – Bitcoin

- ETH – Ethereum

- USDT – Tether (US Dollar Tether)

- ADA – Cardano

- XRP – Ripple

- EUR – Euro

- USD – United States Dollar

Local currencies are also available depending on the country.

Deposits and Withdrawals at FXGT.com

There are various deposit and withdrawal options available at FXGT.com. Traders can use their VISA and CreditCards, instantEFT, Wire bank transfer option, or deposit funds using some of the most popular crypto currencies, such as: Bitcoin, Ethereum, Tether (US Dollar Tether), Cardano, and Ripple. Be informed that while most of these options are instant, bank wire transfers usually take a couple of more days.

Trading platforms at FXGT.com

FXGT.com provides traders with some of the most popular trading platforms: MetaTrade 4 (MT4), and MetaTrader 5 (MT5). Both platforms are incredibly popular and have very similar design as they both were built by MetaQuotes and share a lot of similar features. However, both platforms are very different. MT5 is a bit more complex, advanced, and designed to trade various asset types, including futures, bonds, stocks, and cryptocurrencies. In case you prefer to only trade currencies, and a couple of other CFDs, you can go for the MT4. The MT4 was primarily designed for trading currency pairs.

It’s worth mentioning that the broker also provides a web trading terminal and a mobile app for its clients.

25% Unlimited Loyalty Bonus

Clients of FXGT.com have access to a 25% unlimited loyalty bonus. However, this bonus is only available for Mini and Standard account holders. For instance, if you deposit 1000 USD into your account, you will receive 250 USD on top, reflected as 1,250 USD in your account.

Tradable instruments at FXGT.com

FXGT.com offers various asset classes for trading such as currency pairs, crypto currencies, Synthetic cryptos, precious metals, energies, equity indices, stocks, DeFi Tokens, and NFTs.

At this broker, you can access popular pairs such as EUR/USD, GBP/USD, AUD/USD, USD/JPY, USD/CAD, etc. As well as minor and exotic currency pairs. There are also US stocks for trading, such as AAPL, AIG, AMZN, BABA, and more. Maximum available leverage for trading stocks is 10:1. While for currencies, maximum available leverage is 1000:1.

When it comes to crypto trading, the broker offers a large pool of crypto derivatives, such as: BTC/USD, BTC/JPY, LTC/USD, XRP/USD, and more. Maximum available leverage for crypto derivatives is 1000:1.

Customer support at FXGT

Offering great customer service is essential for every customer oriented business. Especially in the field of financial services, as there are so many competitors. FXGT.com provides professional customer support available 24/7. The broker offers a resource center page where all the frequently asked questions are answered. In addition, traders can send the broker an email, or chat live. As already mentioned, the multilingual live chat option is available 24/7, which is highly convenient.

Should you consider trading Forex with FXGT.com?

Yes, FXGT.com is a regulated Forex broker that offers access to vast asset classes through some of the most popular MetaTrader platforms MetaTrader 4 and MetaTrader 5. Traders have access to up to 1000:1 leverage. There are account types tailored to different trader types, and the customer support is great. Account opening and verification is fully digital and it’s worth a try to open at least a demo account with this broker and test its services.

Frequently asked questions on FXGT.com broker:

Is FXGT.com a scam?

No, FXGT.com is not a scam, as the broker is licensed, authorized and regulated in multiple countries.

- FXGT.com is licensed and regulated by the Seychelles Financial Services Authority (FSA) under the Securities Dealer’s License Number SD019.

- FXGT.com is regulated by the Financial Sector Conduct Authority in South Africa. (Is authorized FSP with FSP Number 48896)

- The broker is licensed and regulated by the Vanuatu Financial Services Commission (VFSC) under the Principal’s License Number 700601

- FXGT.com is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 382/20 operating in accordance with the Markets in Financial Instruments Directive (MiFID II), this license is reserved only for institutional traders.

What can I trade at FXGT.com?

FXGT.com offers a wide range of asset classes for trading, such as: currency pairs, equity Indices, metals, energies, stocks, cryptocurrencies, synthetic cryptos, and GTi12 Index. Leverage is different for each instrument class and traders can get up to 1000:1 leverage.

Which account type should I choose if I want to daytrade?

Active traders typically pick account types that offer the lowest spreads, and are perfectly willing to pay commissions instead. FXGT.com offers an ECN account type for daytrading. The Pro and Standard+ are for position and swing traders, and the Mini account type is for strategy testers and traders with low capital.

*T&Cs Apply. Trading carries a risk of loss. This is not investment advice. All

information contained herein is for educational, marketing, and illustrative

purposes only. All data is subject to change at any time without notice. Please

note that different terms and conditions apply across different regions. Stay up to

date by visiting theFXGT.com website.