The Safety and Security of Equiity Forex broker

The broker is registered and regulated in Mauritius by the Financial Services Commission (FSC). Despite the less stringent regulations by the FSC, Equiity still offers moderate leverage of up to 1:200 ensuring retail Forex traders can not be overleveraged.

Having a regulator means the broker is more reliable than non-regulated options and offers several security policies as required by the regulator of Mauritius.

All client funds are saved in segregated bank accounts, and the company can not touch them. Additionally, negative balance protection together with the automatic defense measures prohibits traders from losing more than their initial investment capital.

Equiity is also a member of the investor compensation fund, enabling eligible investors to get compensation in case something goes wrong with the broker, and it becomes insolvent.

Fees and Spreads of Equiity

When it comes to fees the broker has a very flexible and investor-oriented approach. The inactivity fee is applied to dormant accounts after 60 days of inactivity and is 60 EUR per month.

The deposit may be charged with 3% + 0.25 cents per deposit, and clients will also have to pay any fees charged by payment providers they are employing. Withdrawals also are charged, but the broker is not clear exactly how much these costs are. There are no other hidden fees for deposits or withdrawals.

Trading accounts are not charged fees and the broker makes income from only spreads, which is advantageous for traders as they can trade without hidden fees. Day traders and swing traders who rely on low trading commissions and care less about spreads will find the Equiity accounts especially useful.

Equiity Accounts, Deposits, and Withdrawals

The minimum initial deposit required by Equiity starts from 250 USD or Euro. EUR and USD are available as account-based currencies, meaning traders can deposit funds in these currencies. If a trader decides to deposit with other currencies, the currency conversion fees will apply.

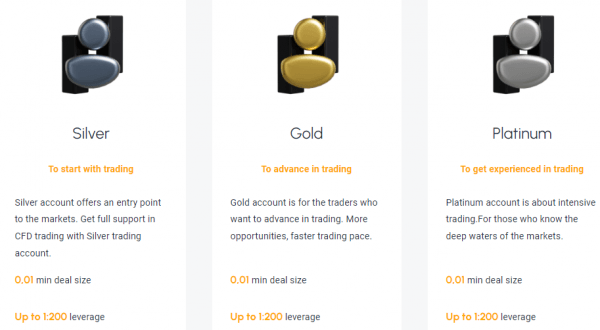

There is one trading account, and it is divided into different tiers starting from Silver to Gold, and Platinum. The trading accounts are very similar except for some minor differences in spreads and services. The higher the tier of trading account selected, the lower the spreads get, which can make a difference depending on the trading strategy used by a trader. The services accessible at the Platinum tier include News Alert, a dedicated account manager, webinars and videos, and swap discounts of up to 50%. The dedicated support and hedging are available freely for all clients with any trading account. Swap discounts are available for gold and platinum accounts at 25% and 50% compared to the silver account. Gold accounts can get all the services available for platinum except the news alert feature, making it the most popular choice among the broker’s clients.

The leverage system is the same for all trading account types. The maximum leverage for all currency pairs is capped at 1:200, for metals (Gold and Silver), indices, and commodities it is 1:50, stocks and equities can be traded with up to 1:10 leverage, and cryptos come at 1:5 max leverage.

The silver account comes with spreads starting from 2.6 pips on major currency pairs, on the gold account it starts from 2 pips, and for platinum, the spreads for EURUSD start at 1.4 pips. For the XAUUSD pair the spread for silver starts from 74 points, for the gold account it is 56, and 38 for the platinum account.

The minimum lot size starts from 0.01 lots, which makes it possible to trade with the smallest budget likely.

An Islamic account is also offered for FX traders who follow Sharia laws. All the tiers of trading accounts are available as Islamic accounts.

Equiity Deposits and Withdrawals

The payment options are diverse, and almost all methods are supported by Equiity. Starting from the bank cards, the broker accepts deposits and withdrawals by Visa and Mastercard cards. From online payment methods, Skrill and Neteller are both supported, which are faster methods when compared to bank cards.

Equiity Trading Assets and Features

Over 350 trading instruments are offered from various asset classes by Equiity. Starting from Forex pairs CFDs, the broker has all assets available including stock CFDs, crypto CFDs, commodities, and indices. With this diverse choice, it is possible to trade several asset types within one trading platform without the need to open additional accounts for different asset classes.

Top offers from indices include Nasdaq 100 Index, DAX, E-mini S&P500 Index, E-mini Dow Jones Index, FTSE 100 index, and many more. From commodities, together with precious metals there are also offered oily, natural, gas, and crude oil. All significant stocks are available in CFDs including Amazon, Apple, Facebook, Google, and Microsoft. From cryptos Bitcoin, Ethereum, Ada, Ripple, Litecoin, and BNB can be traded at any time.

Customer Support Review of Equiity

Customer support is efficient, and it is possible to contact the broker representatives at a moment’s notice using the Live chat which is readily available on the Equiity website. This support form is the most comfortable as it is both cost and time efficient.

The website and customer support including English, German, and Arabic support three languages. Live chat and all support channels are available in these three languages, which is very convenient.

Other support forms include the hotline available with a phone support network in seven different countries including the UAE, Qatar, Kuwait, Switzerland, Saudi Arabia, Oman, and Bahrain. Email support is also provided.

Equiity Education

Education is not offered without opening a trading account, and after that only gold and platinum trading account holders can get webinars and videos. Webinars are the best and fastest way to learn about trading and enable newcomers to ask questions and get a comprehensive understanding of the financial markets. The broker also has video tutorials to assist its traders.

Should you consider Equiity as your primary FX broker?

Equity is undoubtedly a strong contender as your primary FX broker. In this review, we have uncovered numerous reasons why Equiity stands out as a reliable and secure option for FX traders worldwide.

The first reason is the broker’s regulatory license, which can not be underestimated. Equity holds the license from Mauritius FSC, and despite less stringent regulations, it offers a moderate 1:200 leverage ensuring additional security for its traders. The broker also has a negative balance protection and traders will not lose more than their initial investment in trading. Client funds are secure in segregated bank accounts, ensuring the broker can’t touch traders’ funds. The broker is also a member of the investor compensation fund, providing reassurance for eligible investors that their investment is safeguarded.

With diverse trading assets and different account tiers it is possible to trade any preferable asset with the best trading conditions and all these tiers come with an Islamic account option. Payment options are also diverse, and all popular methods are supported.

In summary, Equity is a secure and attractive Forex broker that can not be underestimated. As your partner, you will be guaranteed your funds are safe, and trading costs are low without hidden fees.

Is Equiity a safe and secure broker?

Is Equiity a cheap broker?

What is Equiity's minimum deposit?