Capex is a CFD brokerage operating in the European Union. It boasts licenses from several large financial regulators in the region such as the FSA (Seychelles), FSCA (South Africa), CySEC (Cyprus), and ADGM (Abu Dhabi).

The company is a rebranded version of CFDGlobal.com, which more or less gives us a reason to disregard the Capex scams in all shapes or forms. Capex is headquartered in Cyprus, but most likely has offices in all the licensed countries as well, but that much isn’t certain.

Due to the strict restrictions on CFD products by these many regulators, Capex doesn’t have too many unique features, but some stick out here and there. Let’s find out what they are and how the company operates.

Capex review – company features

Much like every other CFD brokerage operating in the European Union, Capex has to comply with multiple restrictions on CFD products. This includes limits on the leverage it can offer to its customers as well as any trader benefits such as bonuses and additional promotions.

On the surface, Capex does indeed seem to be a competent CFD brokerage but comparing it to offshore companies, it immediately falls short because of the restrictions.

Nevertheless, this Capex review is important to showcase where the company still manages to stand out even though its full potential is limited by the authorities.

The safety and security of the Capex broker

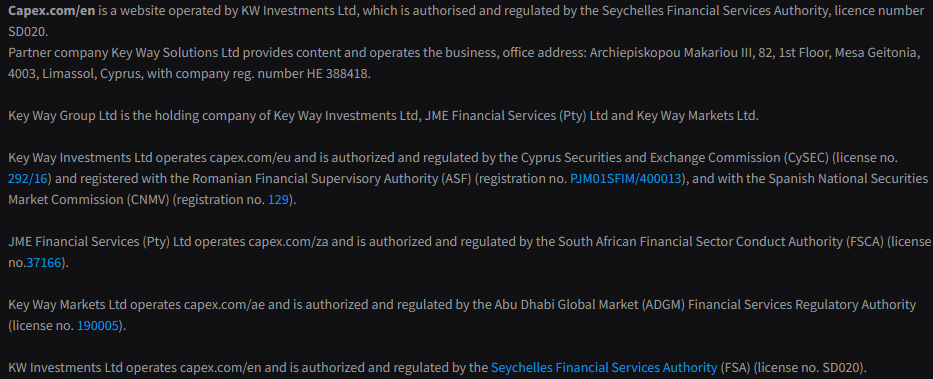

Capex is regulated by several reputable authorities. The broker is authorized and regulated by

- The Seychelles Financial Services Authority (FSA) (license no. SD020)

- The Cyprus Securities and Exchange Commission (CySEC) (license no. 292/16)

- The South African Financial Sector Conduct Authority (FSCA) (license no.37166)

- The Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (license no. 190005)

As we can see four independent regulators are overseeing the broker’s fair activities across many jurisdictions. This adds to Capex’s legitimacy and reputation. With these many regulations, there is no chance of the company being a scam or fraud. This also means the client fund segregation and maximum safety.

Capex Fees and Spreads

One of the most important aspects where CFD brokers can hope to shine is the spread. If they’re able to offer industry-standard spreads, meaning as low ones as possible, they have at least some method of standing out.

For Capex, spreads on the most popular Forex pairs such as the EUR/USD start from as low as 2, allowing traders to maximize their profits as much as possible. Even though it’s not necessarily the lowest spread being offered by a CFD broker in Europe, it’s still an above-average feature.

Capex Accounts, deposits, and withdrawals

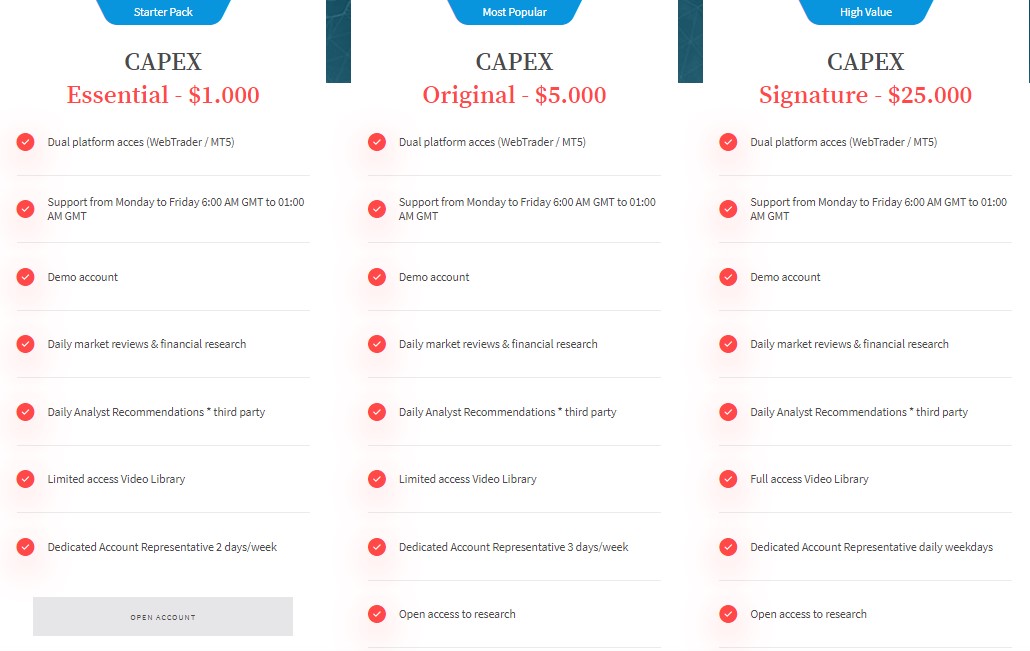

There are three Capex Account types and they all come with their advantages and small perks. When it comes to the deposits though, the amount kind of surprised us in the beginning, but considering that Capex is a rebranded CFDGlobal it immediately became understandable.

The minimum deposits are $1000, $5000, and $10,000 respectively for the three accounts, all coming with a DEMO version, access to a library of video content as well as occasional trading signals.

Naturally, beginners are recommended to start with the $1000 deposit account due to the lower entry barrier, but in all honesty, the minimum deposit is quite steep for rookies.

Withdrawals and deposits

The Capex withdrawals system was a bit confusing from the start as the company displays various third-party payment providers according to specific regulators. But in the end, it became apparent that nearly every country can use things like Visa, MasterCard, Neteller, Skrill, Trustly, and Maestro cards.

According to the information on the webpage itself, both deposits and withdrawals have no fees attached to them whatsoever.

Capex trading assets and features

The trading assets are very diverse and abundant on the Capex platform. Forex, indices, bonds, ETFs, commodities, shares, ThematiX, and cryptos can all be traded at your heart’s content. The most intriguing asset class that caught our attention is called ThematiX. Let’s explain it in detail. ThematiX offers the possibility and a unique way to trade with the world’s most powerful companies in a simple pre-built portfolio. These portfolios are based on trends and specific industries. These portfolios are also thematic for example social media and electric vehicles. It gives you the ability to trade the basket of stocks that includes stocks from certain sectors. They seem similar to indices and ETFs, but are slightly different and add the flavor to diversity of trading asset types.

Trading platforms

Thankfully, Capex CFD broker managed to stand out with at least more than one software available for trading the assets. The broker fields a custom WebTrader application with a mobile version as well, alongside the notorious MetaTrader 5 platform. It may not be the favorite of most, but it’s still the type of diversity we always like to see.

Capex Customer Support review

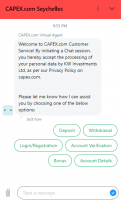

Depending on your residence and jurisdiction the live chat redirects users to respective support representative teams. The live chat is multilingual as well as the website and we can say it is also multijurisdictional. This is great

As for other forms of support email addresses, and hotlines are all provided on the broker’s contact us page. These all make it convenient and time-efficient to contact the broker and get all the answers if somehow it was not mentioned on the website.

Capex Education explored – So many resources!

What are the educational resources of Capex? Learn to trade, CAPEX Academy, Market Analysis, IPO,

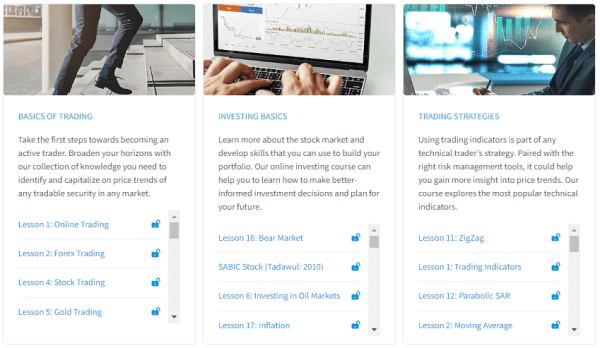

Webinars, Financial dictionaries, and Online Trading guides are available on the website and it makes it simple for beginners to make sense of financial markets and trading. The Capex Academy is the most intriguing one from the above list of resources. The academy consists of various lessons divided into specific sections that include tutorials for basics in trading, investing, and trading strategies. There are also beginner guides on crypto and blockchain basics. With these many resources, learning should become much easier for newbies and will help them not to get lost in the complex world of financial trading.

Should you consider Capex?

With this small glance over the benefits offered by Capex, we conclude that the brokerage is indeed worthy of your attention as long as you consider yourself a slightly experienced trader. The minimum deposit entry level is a bit higher than the industry standards but the benefits such as access to educational material, DEMO accounts, etc, make it worth it nonetheless.

But is Capex legit? Of course, it is! Having several licenses under one’s belt, especially ones from the FCA and BaFin immediately ramp up the trustworthiness. There is no such thing as the Capex scam, it’s most likely a fabrication of several skeptic traders that didn’t know Capex was the rebranded version of CFDGlobal.

In conclusion, Capex managed to pull through in the greenish area, earning itself an above-average CFD broker’s title, but since it’s headquartered in Cyprus, it could get the opportunity to increase the max leverage to 30:1, which would put it in a completely different league compared to other EU entities.

Is Capex a legitimate CFD brokerage?

What are Capex's fees and spreads?

What trading assets and platforms does Capex provide?