Forex trading is one of the riskiest markets around the world, but still, many people are drawn to it. It represents the world’s largest market, according to official data of 2019, the average daily turnover of this market was as much as $5.1 trillion. Today, this market is accessible to everyone around the world. However, this has not been like this in the past.

There was a time when only large companies and banks had the ability to participate in this market, today, however, it has changed a lot. Today, thanks to the internet, people from all over the world can start trading Forex. But, there are also many challenges as well. One of the biggest problems that traders have is that they have a very hard time finding out which broker to trust.

Today, we are going to review Blue Suisse, which is a Forex broker registered in Malta. After going through the details of the broker, we found that there are some problems that people should know about. Although it is a licensed company, the things that we found can be very dangerous for investors, so read our review carefully to make sure that you and your funds can stay safe!

Blue Suisse Safety and Security

While looking for Forex brokers, regulations are something that investors should pay huge attention to, but being authorized does not mean that the broker is absolutely safe, and Blue Suisse is a great example of that. Since the broker is registered in Malta, Blue Suisse is licensed by a local regulatory agency, called Malta Financial Service Authority, simply known as MFSA.

Blue Suisse owns a Category 2 license, meaning that this company is able to provide traders with investment services, they can also hold and control the money of their clients. The company is registered in Mosta, Malta Cornerstone Business Center, Level 2, Suite 1, 16th September Square.

Since Malta is a European country, it has an obligation to follow the regulatory guidelines of the EU. MFSA is also known to do so, but still, this regulatory agency is not that reputable in the world of Forex, and there are some reasons for it. Many people believe that the regulatory framework that the regulatory agency has is simply not enough to make sure that investors stay safe on the market. Also, MFSA is not that strict when it comes to misconduct from Forex brokers. This is one of the reasons why some people decide to avoid Forex brokers that are regulated only in Malta.

Guidelines that Blue Suisse follows

While reviewing the Blue Suisse FX broker, we had a very hard time finding out if this broker could have been trusted or not. One of the main reasons for this is that the team behind the broker simply does not have many details about the regulatory framework provided on their website.

It is unclear how the broker handles the money of their investors, and how they are trying to keep traders safe from unwanted spending. One thing that we are always looking to prove the legitimacy of a broker is it is keeping the funds of their clients in segregated bank accounts. We could not find any information about this at Blue Suisse.

Keeping the funds of the clients in segregated accounts are very important for the safety of their funds. What happens with this is that even if the broker goes bankrupt, investors will be able to withdraw their money from their own segregated account, without the broker being able to touch any of the money. The fact that Blue Suisse did not provide any information regarding this means that traders here are in great danger.

Keeping the funds of the clients in segregated accounts are very important for the safety of their funds. What happens with this is that even if the broker goes bankrupt, investors will be able to withdraw their money from their own segregated account, without the broker being able to touch any of the money. The fact that Blue Suisse did not provide any information regarding this means that traders here are in great danger.

Also, it is very unclear if the broker has a Negative Balance Protection. With this, brokers are making sure that their clients do not spend more than what they intended while trading, and if there is no such a thing as Negative Balance Protection, investors can potentially end up losing everything that they had.

Generally, it was very hind to find specific information about the guidelines that Blue Suisse follows, every information that was provided on the website is very bland and general, which makes us believe that Blue Suisse simply is not enough for Forex traders.

Besides, according to the team behind the broker, their main goal is to become well-known worldwide, which is impossible by only having one license. In most countries, Forex brokers that are not authorized locally are not allowed to offer their services. It is quite strange that Blue Suisse has such huge goals while relying on one license only.

Fees and spreads of Blue Suisse

Before we go any further, let’s just talk about the way brokers are getting money. Every time you trade, there is a little amount of commission that you pay to the broker. To avoid these commissions, mostly, people are creating large trading accounts, that are mostly known for low commissions.

But, in the case of Blue Suisse, they have indicated on their website that there are little to no commissions or fees that investors have to pay. This leads us to believe that the company is trying to use this offering as a way to attract more people to its platform. Without any commissions, the broker simply can’t make money, which means that they will not be able to offer investors good enough services.

Blue Suisse makes money on above-average spreads of 1.5 pips for major pairs. While it is good that the broker seems legit and makes money on legal services, these spreads are still too expensive. What’s even worse is the average spreads are usually 2.1 pips for EURUSD and 2.2 pips for GBPUSD on the Denim Blue account type.

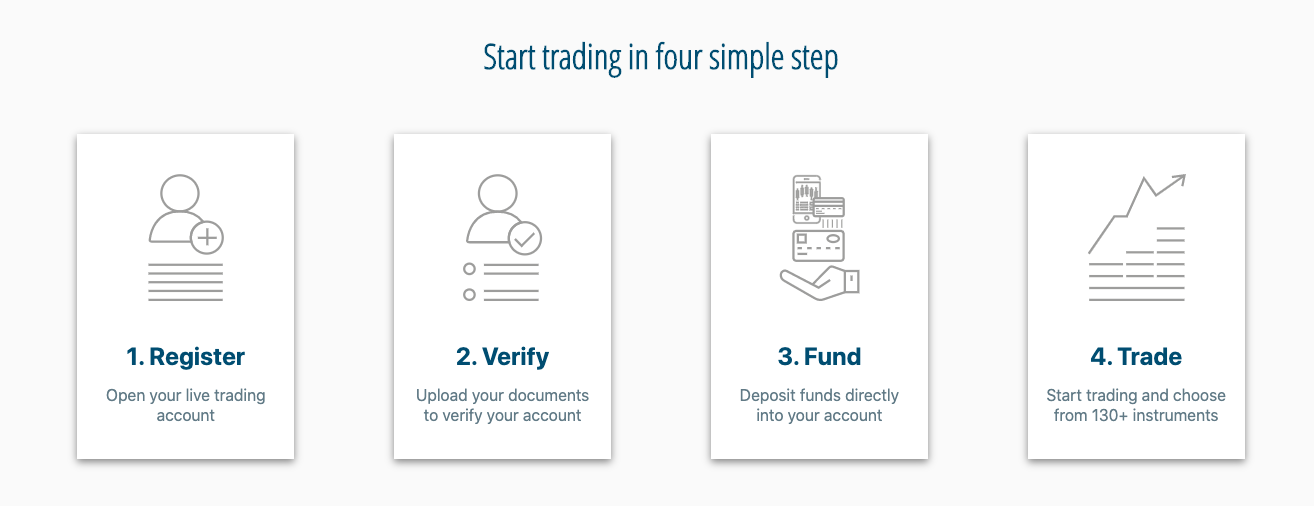

Accounts, deposits, and withdrawals at Blue Suisse

While reviewing Blue Suisse, we found that the broker has several different account types offered to its users. Sadly, the differences between these account types are not that huge so we did not really understand why the minimum deposit requirements were so drastically different. You can create three types of accounts at Blue Suisse, they are:

- Denim Blue, with a minimum deposit requirement of $500-$5000

- Sky Blue, with a minimum deposit requirement of $5,000-$50,000

- Sapphire Blue, with a minimum deposit requirement of at least $50,000

These numbers are huge and do not make any sense. In most cases, in the modern Forex trading world, brokers will give you the ability to start trading with just a few dollars, to give you the ability to understand the market well. Here, at Blue Suisse, it seems like the broker is simply trying to somehow make people deposit as much money as they can. All of these are creating even more questions, and we believe that trusting this broker can be very dangerous.

Can investors create Islamic versions of these accounts?

Islamic accounts, also known as swap-free accounts in the world of Forex, are something created for those who want to trade without adjustment to swaps. Mostly, these are the people who are restricted to receive any swaps because of their religious beliefs. In the Forex world, the swap is a commission or rollover interest charged by a broker for extending a trader’s position overnight.

According to our review of Forex broker Blue Suisse, this broker does not offer this account type which is creating a very unequal environment. Although most of the European people are not Muslim, the broker has noted that they want international exposure, which means that they are willing to offer their services to people worldwide. Not offering this type of account means that the broker is ignoring a huge part of the world.

Deposits and withdrawals

Funding methods are extremely limited to only Bank Wire, Visa, and MasterCard payment options. This is a huge downside considering most brokers offer faster online payment systems for withdrawals. While deposits through Visa and MasterCard methods are instant it takes roughly 2-3 days for withdrawals to get processed. Many brokers offer online payment systems that make withdrawals under a day procedure. Blue Suisse lacking in this department is a downside every trader should consider when dealing with them. For traders from Malta, however, the main methods used for payments are cards and this should not impose any difficulties or inconvenience, but for global traders, this is a serious downside.

Trading assets and features of Blue Suisse

The only tradable asset classes offered by the broker are currency pairs, commodities, indices, and stock CFDs. While these many diverse instruments are great the lacking in the digital currencies department is still a con for Blue Suisse. There are 45+ stock CFDs, commodities, and indices in total, while the number of Forex pairs is above 70. From this picture, we can tell that the main focus of the broker is to offer Forex pairs. and 70 is not a small number for Forex pairs and it should include all major and minor pairs, and many exotics as well. 9 indices allow traders to bet on performance indicators of various economies. The leverage for indices and commodities is capped at 1:20 which is a good leverage for indices. The highest leverage is for currencies capped at 1:30 as of MSFA regulations. The leverage for stock CFDs is the lowest at 1:1.

Trading platforms of BLue Suisse

Blue Suisse offers several advanced trading platform software for traders. These platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradeMaster, the broker’s proprietary Problue trader, and various mobile apps. True professional software from this list are MT4 and MT5 which are tested and popular worldwide. The mobile platforms are also MT4 and MT5 mobile apps for both Android and iOS which is great as these software allow to analyze markets on the go with various inbuilt indicators and also offer functionality to open and manage trading positions.

The customer support team of Blue Suisse – is it any helpful?

The thing about the customer support team is that they should be fast to reply, and helpful. There was no online chat previously, which means that the only way trader could contact the customer support team was to either call them or send them an email. Now they have a live chat with an advanced chatbot and the support team is available through all support channels Monday-Friday, 08:00-17:00 (CET).

The website of the Blue Suisse

From the first look at the website, there were some issues previously. But after revisiting the website recently the improvements are clear as a day and night. The website is now properly arranged and everything is in its place. We are always happy to see new brokers make improvements and offer better services. In the case of Blue Suisse, the improvements are positive which is a very good sign.

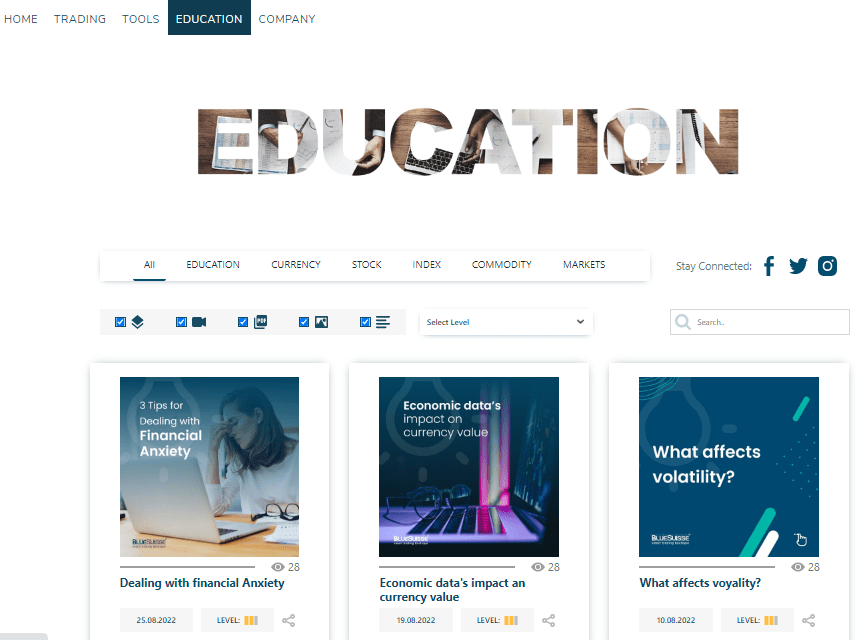

There are now educational materials on Blue Suisse’s website

The same situation is for the educational section. Previously there were no educational resources on the website which is radically different now. There are several sections added with the extended knowledge base that offer newbies a way to make sense of Forex markets without searching endlessly on the web. Around the world, top Forex brokers are trying to create many opportunities for their investors, so that they can develop and learn more about trading Forex.

Also, some of the regulatory bodies around the world require Forex brokers to do so. This broker does now offer several educational resources including articles on currency trading for beginners, how to improve trading and CFD trading. Another section of education is media.

Should you consider Blue Suisse?

After reviewing FX broker Blue Suisse, we found that we can not recommend this broker still. Despite the numerous improvements the spreads are still higher and initial deposits requirements are also expensive. With many alternatives offering better trading conditions with low spreads and initial deposit requirements, the advantages of BLue Suisse over other brokers is scarce.

The market is full of trustworthy and well-developed Forex brokers, so investing with a broker that can’t offer you low spreads and commissions does not make any sense, so, try to look for other and more trustworthy brokers.

Is Blue Suisse a safe and secure Forex broker?

What are the fees and spreads charged by Blue Suisse?

What are the account options and deposit requirements at Blue Suisse?