Table of content

To be precise about this term, there are two types of safe havens. Firstly, we have the US dollar, the most liquid currency in the world. Because it is the world’s reserve currency, it is a universally accepted medium of exchange across the globe. Therefore, in times of economic downturn, investors flee to the US dollar in order to preserve their liquidity. The reasoning behind this is the fact that USD is backed by the most powerful country and economy in the world.

Therefore, if something goes seriously wrong, the US dollar is more likely to be still an accepted medium of exchange, compared to other currencies. This is why the USD tends to rise in economically challenging times. In addition to this, US government bonds also have a safe-haven status. The reason for this is that those securities pay coupons in US dollars and are backed by the largest and most developed economy in the world.

The second category of safe-haven currencies includes assets which help traders to preserve their purchasing power. In the modern world, nearly all currencies are subject to inflation. This means that in the long term, those assets are losing their buying power. It goes without saying that in times of near-zero interest rates, investors are looking for those investments that can help them to hedge against inflation. Examples of Safe Havens include the Japanese Yen and Swiss franc.

Over the last two decades, the average inflation rate of those currencies has been lower than that of other major currencies. Therefore some investors and traders might consider JPY and CHF to be reliable tools for preserving the purchasing power.

Whatever the preferences of individual investors, it is worth mentioning that safe-haven currencies in Forex behave differently than other major currencies. They tend to appreciate it in times of economic downturn and uncertainty.

On the other hand, those assets tend to fall, when the economy strengthens and other central banks start raising rates. Finally, those currencies tend to benefit from improving the Purchasing Power Parity indicator against their peers. This helps them to achieve a long term appreciation against some emerging market currencies.

Finally, it must be noted that this term applies only to individual currencies or assets. There is no such thing as safe-haven Forex pairs. This is logical since when investors and traders face major economic crisis, they usually prefer to park their savings in safe assets, rather than in one particular currency pair.

Understanding Safe Havens

Financial commentators as well as some experts in the field and experienced Forex traders very often mention the term Safe-haven currencies. This term is frequently used not only when it comes to trading, but also with long term investing as well. Therefore, some people might wonder what is a safe haven and which currencies and assets have such a distinction.

The general understanding of the term is that in times of uncertainty or economic downturn investors and traders tend to flee to safe-haven assets, in order to preserve the value of their investment. Now, under normal circumstances, market participants always try to maximize their returns. Some of them might prefer to grow their capital by value investing, while others prefer to create a steady income stream.

However, in times of crisis and uncertainty, those goals take backstage and as a result, investors are becoming more concerned about preserving the value of their current holdings. So that is why they turn to those assets, which can help them to achieve this goal.

This is when the US dollar comes into play. It has several characteristics, which makes it one of the top safe-haven currencies to trade. Firstly, it has the full backing of the largest economy and military power in the world. This is an important factor since it means that in times of economic crisis, war, pandemic, or natural disasters, the US dollar is still most likely to retain its status as a universal medium of exchange.

In fact, by the end of 2019, according to the International Monetary Fund’s (IMF) currency composition of official foreign exchange reserves, the USD makes up more than 60% of the world’s currency reserves.

One of the most important reasons for this type of widespread use of this currency lies in the instability of many emerging market currencies. Some of them did suffer from a collapse in the past, like Venezuelan Bolivar and Zimbabwe dollar. However, the majority of them did not face those extremes, but they have three key problems.

Firstly, their average inflation rates are much higher than in developed economies, ranging from 5% to 15%, depending on the individual country. The second major issue with those currencies is that their exchange rates are subject to wild swings, sometimes depreciating by 10% or 20% in a matter of days. Sometimes they do regain some of the lost ground, but their movements are highly unpredictable. Finally, the majority of emerging market currencies suffer from long term depreciation against major currencies.

By comparison, the long term average US inflation rate stands near 3%. The currency does not depreciate against its pairs on a long term basis. Instead, the US dollar is typically engaged in multi-year cycles, ranging from 6 to 9 years. For example, from 1995 until 2001, USD made some dramatic gains against other major currencies. From 2002 until 2011 it was engaged in a downtrend. While from 2011 until so far in 2020, the US currency made some notable gains against its peers.

Therefore, for many people, living in developing countries, the prospect of having savings and investments in a stable currency, which in the long term preserves 97% of its purchasing power per year, seems very appealing. This is why in many countries banks do accept deposits in US dollars and even make currency available to its clients through ATM machines.

Safe Haven Forex trading with US dollar

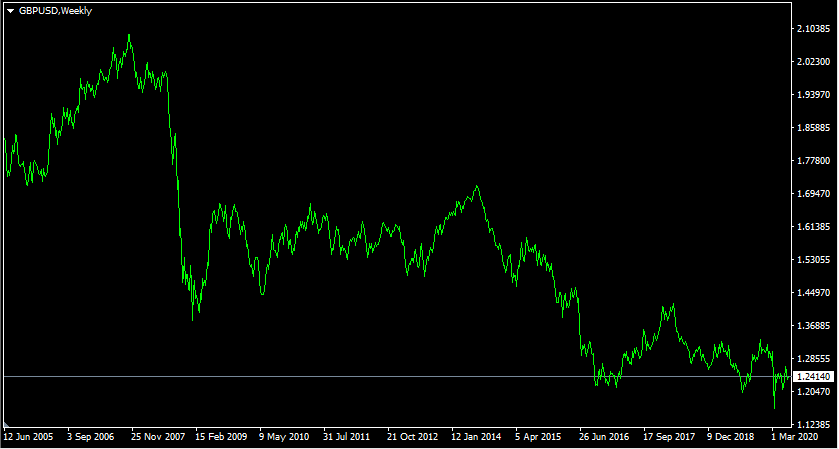

So how does the US dollar behave in the Forex market? Well, if we analyze the price action over the long term, we can notice that the currency is heavily influenced by the relative interest rates of the world’s major central banks. To illustrate this better, let us take a look at this weekly GBP/USD chart:

As we can see from the diagram above, the pair has essentially gone through three stages:

- From 2005 until summer 2008, the British pound has appreciated steadily against the US dollar, rising from $1.80 to $2.00 level. This long term uptrend of GBP started back in 2002, when the US Federal Reserve started massively cutting rates, eventually reducing them to just 1% and then from 2004 slowly raising it with 0.25% rate hikes. In contrast, the Bank of England only reduced rates to 3.50% and by 2006 already raised them to 5.00%. As a result, the British pound became more attractive to investors and traders, leading to its significant appreciation.

- The second stage began with the beginning of the great recession. As a result, the US dollar benefited from the safe-haven status, with GBP/USD dropping from the $2.00 mark and eventually stabilizing around the $1.60 level. Since both the Federal Reserve and the Bank of England have adopted near-zero rate policies in response to the crisis, the pair moved sideways and was mostly confined within a range of trading from 2009 until 2014.

- The final period began in 2014, as the US Federal Reserve started to trim its Quantitative Easing (QE) program. In December, the US central bank authorized the first rate hike in a decade. By 2018 the Federal Funds Rate has reached 2.50%.In contrast, the UK economy has suffered from the economic fallout of Brexit. Therefore the Bank of England only settled for one rate hike in 2018, increasing the rates to 0.75%. Those differentials, as well as Brexit uncertainty, led to the further decline of the pound with GBP falling from $1.71 in July 2014 to $1.24 in June 2020.

So as we can see from the above example when it comes to trading Forex safe haven, the US dollar against other major currencies, the underlying principles are the same: relative economic growth and inflation rates, as well as interest rate differentials, do play a key role in determining the exchange rates. There is also one notable difference: in times of crisis and uncertainty, as it happened in 2008 and 2020, the US dollar tends to appreciate against its peers.

Therefore, trading rules for USD are very similar to those of others. Traders can compare relative interest rates, Gross Domestic Product figures, inflation differentials, and other major indicators between two given economies. After some thorough research, one trader gets some idea, which central bank is more likely to raise rates, he or she can open positions accordingly.

The only notable addition to those tactics with US dollar trading would be to open long USD positions in times of global economic downturn.

Trading US dollar with Exotic Currencies

The principles of trading USD with other major currencies seems quite understandable. However, here it is helpful to point out that the rules of trading the US dollar with emerging market currencies are quite different.

Firstly, it has to be mentioned that the exchange rates with those kinds of currency pairs are much more volatile than with FX majors. The rate with those pairs might stagnate for several weeks or even months, but then very frequently some major move comes with dramatic gains and losses. As a result, in general, trading exotic currencies does bring more lucrative opportunities. The flip side of the coins is the fact that they also tend to be much more risky trading instruments than Forex majors.

Secondly, the trends with those exotic currency pairs tend to be much shorter than with other ones. To illustrate this let us take a look at this daily USD/RUB chart:

As we can see from the image above, instead of being engaged in some multi-year trends, the pair already managed to have 5 trends. Firstly, the Russian ruble has steadily appreciated against the US dollar during the second half of 2017, with USD/RUB falling from 59 to 55. Then there came a sharp move upward, pushing the pair up to 71 level by September 2018. This was followed by another correction, eventually reducing the exchange rate back to 61.

Another major move upward came after the outbreak of COVID-19 pandemic, at one point in March 2020, even pushing USD/RUB above 80. Yet, this spike turned out to be very short-lived. The pair faced a sharp correction, as a result of which, USD/RUB dropped to 69 level by June 2020.

So as we can observe from this example, when it comes to exotic currency pairs, there tend to be very frequent extreme overvaluation and undervaluation of currencies. On the downside, It does create more risks for traders, so they prefer to trade with low or no leverage, when it comes to those pairs, in order to protect themselves from large losses.

However, this tendency has some serious upsides as well. The frequent undervaluations create some major trading opportunities, one which traders can easily capitalize on and earn some decent payouts in the process. It goes without saying that identifying those possibilities does require some insight and thorough analysis.

Yet, traders can achieve this by analyzing the charts, showing the developments of past price actions, as well as using valuation models such as Purchasing Power Parity (PPP). So when it comes to trading exotic currencies, traders certainly do have a variety of options.

Japanese Yen as Safe Haven Currency

As mentioned earlier, we do not have a safe haven Forex pairs, however, instead, we have other individual currencies with this status. For years, many traders and investors have considered the Japanese yen as a safe haven. This might be surprising for some people. After all, since the second half of the 90s, the Bank of Japan has kept near-zero interest rate policies, a decade before other major central banks did so in response to the 2008 great recession. In fact, eventually, the Bank of Japan has even resorted to negative interest rates, setting its benchmark at -0.1%.

Therefore, many people might wonder how any currency can be attractive as safe heaven with such ultra-low interest rates. The reason for this is that for decades the long term price levels in Japan remained flat. There were some years where inflation exceeded 1%, but those price gains were subsequently offset by periods of deflation.

This meant that despite all of the failings of the Japanese economy, the yen did manage to maintain most of its purchasing power. The result of this was that JPY now makes up 5.7% of the world’s currency reserves, putting it in 3rd place behind the US dollar and Euro.

Despite all of those gains, there were some developments, which in the long term can seriously threaten the safe-haven status of the Japanese yen. Since 2012, the Bank of Japan abandoned its previous 1% inflation target and instead started aiming at a 2% Consumer Price Index (CPI). This move was followed by massive quantitative easing and fiscal stimulus.

After this massive effort, the Japanese central bank, with support of the government did manage to achieve 2% inflation and keep CPI at that level for subsequent years. It only dropped to zero after the outbreak of the COVID-19 pandemic. However, the effort is still underway to return inflation to 2%.

This essentially creates two major problems for the Japanese yen. Firstly, if the long term inflation rate stays at 2%, the JPY losses attractiveness as a store of value. During previous decades, when general price levels in Japan stayed relatively flat, the Japanese yen retained more of its purchasing power compared to other major currencies.

However, now if 2% of inflation becomes entrenched in Japan, then its currency will lose this distinction. After all, why would someone invest in JPY, which have a negative interest rate, when there are plenty of currencies, which have at least 0.25% yield.

The second long term problem has to do with Japan’s public finances. The overall government debt has already surpassed 200% of GDP back in 2009. Now it is widely expected that Japan’s debt to GDP ratio might reach 250% before the end of 2020. It goes without saying that this type of fiscal policy is not sustainable.

Every single year, the portion of the Japanese budget spent on interest payments rises. Now with 2% inflation at some point in the future investors are more likely to demand higher returns on Japanese government bonds. As a result, the likelihood of a sovereign debt crisis increases with each passing year. It goes without saying that such a crisis can have a devastating impact on the exchange rates of the Japanese yen.

Swiss Franc’s Status as Safe Haven Currency

For many years, the Swiss Franc was considered to be one of the safe-haven currencies. This line of reasoning for this perception is that for more than 200 years, Switzerland has maintained neutrality, even during the two world wars. Another positive factor for the currency is that it maintains very low inflation rates, averaging just below 0.5% during the last two decades. In fact, since 2008 the general price levels in the country stayed mostly flat.

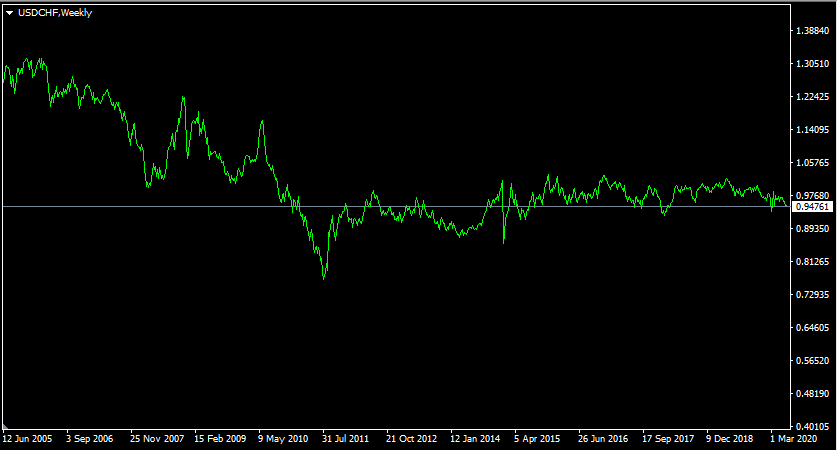

So as we can see the Swiss currency’s attractiveness as a safe haven currency comes from its ability to hold on to most of its purchasing power. In order to see how this has affected the exchange rates, let us take a look at this weekly USD/CHF chart:

As we can see from the above chart, after the Swiss franc made some early gains from 2005 to 2010, the exchange rate of USD/CHF has stayed relatively flat during the entire decade. The pair is mostly confined to 0.90 to 1.05 range.

All those advantages mentioned above can be useful, but it does not make the Swiss franc a perfect safe-haven currency. One possible reason behind this type of stagnation with the USD/CHF exchange rate is the fact that the Swiss National Bank is becoming increasingly desperate to stop strengthening its currency. In 2015, SNB went as far as to set interest rates at -0.75%. This is something many other major central banks shied away from.

As a result, thousands of savers in Swiss banks with large balances are charged interest rates for holding money in CHF in those financial institutions. As Keith Weiner, the CEO of Monetary Metals and an American economist has mentioned, this creates incentives for people to withdraw their money in Swiss francs and convert those amounts to another currency. He further clarifies that this process, at some point in the future can lead to the collapse of the currency.

Trading Safe Haven Currencies – Key Takeaways

- There are essentially three safe-haven currencies in the Forex market in 2020. The first most popular one is the US dollar. It is the most liquid currency in the world and has been the global reserve currency for more than 70 years. The exchange rate movements of USD does depend on the interest rate differentials, relative economic growth, and inflation rates. The US dollar also tends to rise in times of uncertainty and economic crisis.

- The Japanese yen is considered to be another major haven currency for many traders and investors. However, this status of the currency has been in danger since 2012, since the Bank of Japan started aggressively pursuing the 2% inflation target. This coupled with the high debt to GDP ratio of the country made the yen less attractive for safe-haven status.

- The Swiss franc traditionally is considered one of the safe-haven currencies, due to the low inflation rates of CHF and historical neutrality of the country. Despite all of those upsides, this tendency might change in the future, as the Swiss National Bank (SNB) adopted a policy of negative interest rates, leading to thousands of savers and depositors being charged interest for holding on to their francs. In the long term, this can certainly undermine the safe-haven status of the currency.