Table of content

Any trader with even a limited experience on the Forex market knows that some currencies are referred to as commodity currencies. The main reason behind this is the fact that some currencies in the Forex market are highly correlated with the prices of one or several commodities.

One of the most obvious examples of this is the Canadian dollar. The fact of the matter is that Canada is one of the largest producers and exporters of oil in the world. Consequently, when the price of this commodity rises, it tends to increase the revenues and profits of Canadian oil producers. This is also beneficial for the Canadian government as well since the rising profitability of those firms are also likely to increase the tax revenue they receive on a regular basis.

The opposite is also true, if the oil price drops, this tends to reduce the revenues of Canadian oil firms. As a result, they are forced to cut back on the capital expenditure and in some cases even resort to layoffs. In addition to that, the net earnings of those companies also decline, leading to a reduction of the tax revenue for the Canadian government.

This means that everything else being equal, the rising oil price tends to benefit the Canadian dollar and leads to its appreciation against the US dollar, the Euro, the British pound, the Australian dollar, and other currencies. On the other hand, when the oil prices drop, this is likely to lead to the depreciation of the Canadian currency.

Obvious in practice is not always as simple as that. The fact of the matter is that the oil price is not the only factor influencing the exchange rates of the Canadian dollar. There are indeed other indicators as well, which have a significant impact on the CAD-based pairs. This includes the interest rate, set by the Bank of Canada, the consumer price index, the gross domestic product growth rate, and other economic indicators.

In addition to that, it is also interesting to note that the Canadian dollar is not the only currency that is heavily influenced by the latest developments in the oil markets. In fact, the Norwegian krone (NOK) and Russian ruble (RUB) are also affected by the price changes of this commodity, since their respective economies are also one of the largest producers and exporters of oil in the world.

Therefore, traders who wish to trade the Canadian dollar should take into account all of those variables, before making any trading decisions with regard to opening and closing trades with this currency. Now let us go through each of those details in greater detail.

Factors Influencing the Exchange Rates of the Canadian Dollar

When it comes to trading the Canadian dollar, it is important to keep in mind that there are several factors influencing the exchange rate of this currency, including:

- Oil Price Movements

- Bank of Canada Interest Rates

- Consumer Price Index

- Gross Domestic Product

- Unemployment Rate

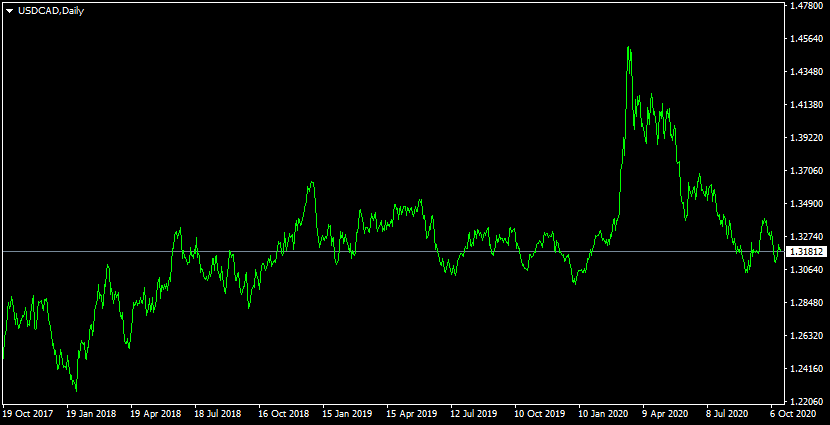

So at this point, one might wonder which of those indicators has the strongest influence on the Canadian currency. In order to answer this question, let us compare some charts. The first diagram shows the exchange rates for the USD/CAD exchange rate from October 2017 until October 2020:

As we can see from the above diagram back in October 2017, the US dollar traded close to the $1.25 level against the Canadian dollar. At first, during the following months, the Canadian dollar has managed to make some notable gains, with the USD/CAD exchange rate dropping down to the $1.23 level.

However, those losses were proven to be temporary for the US dollar. Since February 2018, the American dollar started recovering from the recent losses, regaining the $1.25 level and advancing further. This upward trend has lasted for two years and was accelerated during 2020, in response to the decline of the oil price, as well as due to the outbreak of the COVID-19 pandemic.

The result of those developments was the fact that by the middle of March 2020, the US dollar has reached the $1.45 mark with the Canadian dollar, a level not seen in several years. However, from that point on, the US dollar ceased its sharp appreciation and the Canadian dollar started regaining some of the lost ground. By October 2020, the USD/CAD pair has dropped down to the $1.31 level. This is considerably lower than the March 2020 peak, yet it is still higher than 3 years ago.

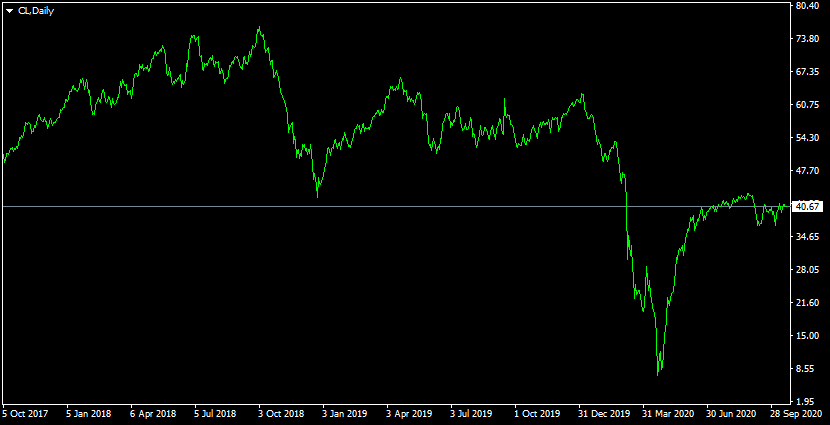

Now, let us compare this to the above chart to the diagram below, which shows the Crude oil price movements during the same time period:

As we can see from the above image, in October 2017, the oil price was trading close to the $49 level. During the subsequent months, this commodity has made some steady gains, eventually rising to the $77 level in October 2018. However, those gains proved to be short-lived.

The fact of the matter is that from the following month, the oil prices began to slide, eventually dropping all the way down to the $41 mark by the end of that year. This was followed by a period of recovery and stabilization which actually lasted until the end of 2019.

However, the reality of the matter was that the outbreak of the COVID-19 pandemic has triggered a number of flight and travel restrictions across the globe. This was followed by calls to stay at home, as well as the imposition of lockdowns in several countries. The net effect of those policies was the drastic reduction in the consumption of fuel.

Obviously, the basic economic law of supply and demand does apply to the oil price as well. Therefore, when the demand for fuel collapsed during the first four months of 2020, it led to a sharp decline in oil prices. In fact, this collapse was unprecedented, as during the middle of April it reached the negative level. This means that oil buyers were essentially paid to take the barrels from the oil companies.

It goes without saying that his state of affairs did not persist for long and by the end of April the oil price began to recover, eventually stabilizing around the $40 level from Summer 2020.

So as we can see from the two above charts, there is a case of a strong negative correlation between USD/CAD and oil prices. For example, the surge of the Canadian dollar during late 2017 and early 2018 was closely connected to the rise in oil prices. In addition to that, the decline of CAD in 2019 and 2020 was also linked to the collapse in the price of this commodity. Finally, we have seen that as the crude oil pride began to recover from record lows during late April 2020, the Canadian dollar had a relief rally and regained some of its recently lost positions.

Therefore, we can safely conclude that the exchange rate of the Canadian dollar is heavily influenced by the latest trends with oil prices. Consequently, everything else being equal, during the rising oil prices traders should consider buying CAD against other currencies. On the other hand, when the price of the above-mentioned commodity declines, then it might be a better idea to sell CAD in a bid to benefit from its depreciation.

Bank of Canada Interest Rates

Now, despite all of the similarities between the price movements of the Canadian dollar and the oil price, from the above charts, we can also notice a certain degree of divergence between those two assets. Those differences were not very significant, however, this still something to keep in mind, especially for short term traders.

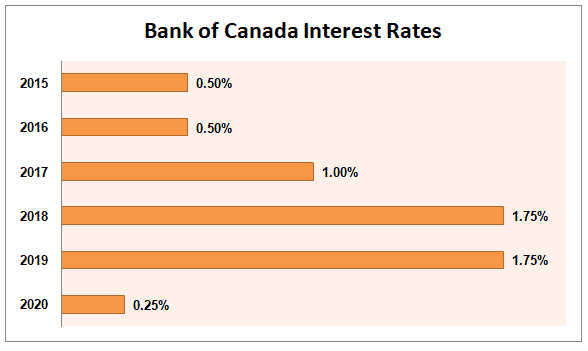

The reason for this seasonal divergence is that as mentioned earlier there are some additional factors at play here when it comes to the exchange rates of the Canadian dollar. One of the most important of such factors is the interest rates set by the Bank of Canada. To get some idea about the monetary policy of the Canadian central bank, we can take a look at this diagram:

As the above chart demonstrates, back in 2015, the Bank of Canada held its key interest rate at 0.5%. In fact, the Canadian policymakers maintain the monetary policy unchanged in 2018. However, in 2017, the Bank of Canada started raising rates. After authorizing two rate hikes during that year, the Canadian policymakers have lifted the rates to 1.00%.

However, this did not mark the end of this rate hike cycle. In fact, the Bank of Canada has authorized three additional rate increases during the next year, with the key interest rate reaching the 1.75% mark. So in total during this two-year period, Canadian policymakers have raised their policy rate by 1.25%.

Obviously, everything else being equal, the rising interest rates are beneficial for the currency and typically leads to its appreciation. However, as we can observe from the USD/CAD chart, the US dollar has kept appreciating against its Canadian counterpart until the end of 2018. Yet, during the next year in 2019, the exchange rate has stabilized before the end of this year.

So how can we explain the weakness of the Canadian dollar during 2017 and 2018? Well, here it is important not to forget that when analyzing the currency pairs it is important to take a look at both currencies, which compose the given currency pair. The fact of the matter is that during the same period the US Federal Reserve was also hiking rates.

Actually, at that time their monetary policy was even more hawkish than in the case of the Bank of Canada. The fact of the matter is that by the end of its rate hike cycle, the US Federal Reserve has lifted rates all the way up to 2.5%, which was 0.75% higher than with the Bank of Canada. Therefore, USD had a considerable advantage over the Canadian dollar. However, as the US Federal Reserve started cutting rates from the second half of 2019, that advantage was negated and the USD/CAD exchange rate stabilized.

So as we can see from this example when analyzing the given currency pair, it is not just the interest rate of one currency that matters, but the relative interest rates between two currencies. As for the 2020 situation, since now both Central Banks reduced rates to 0.25%, the relative interest rates are equal, so at the moment it does not play any major role with the exchange rate. However, if at some point in the future one of the central banks decides to make any sizable changes to the monetary policy, it can definitely have a significant effect on the USD/CAD exchange rates.

Canadian Consumer Price Index

Another major factor to keep in mind when trading CAD pairs are economic news releases rated to the Canadian economy. When it comes to this subject it is important to keep in mind that the Bank of Canada has a target range for the annual consumer price index from 1% to 3%, with 2% acting as a midpoint of this range.

Therefore, if the inflation rate falls below 1% and there is an indication that this state of affairs might persist for a while, then it is likely that the Bank of Canada policymakers might respond with a rate cut, weakening the Canadian dollar in the process. Consequently, the CPI report, which shows the inflation rate in Canada below 1% can be a very bearish sign for the Canadian currency.

On the other hand, if the annual consumer price index rises above 3%, then this suggests that the economy is overheating itself and might mandate the intervention of the central bank. This situation can lead to the rate hike by the Canadian policymakers, which in turn can strengthen the Canadian currency. Therefore, if the CPI reading is above 3% traders might consider buying the Canadian dollar against other currencies.

In addition to that, it is important to point out that the Bank of Canada’s approach with the inflation target is quite flexible. Some central banks have 2% or 3% targets and they do not tolerate large deviations from those targets. However, by setting a large range, the Canadian policymakers can focus on the long term picture and consequently they do not have to respond to the small changes in price levels all the time. As a result, variation in the Canadian interest rates is smaller than with some other countries.

Other Economic News Announcements

It goes without saying that the consumer price index reports are not the only announcements that might have an impact on the value of the Canadian dollar. One of the most important indicators for the economic strength of any country is the latest gross domestic product growth rate, also known as the GDP growth rate.

The GDP itself essentially measures the total value of goods and services produced within the economy for a given year. Economists also call this the nominal GDP. However, even more, important than nominal GDP is the real GDP, which takes the inflation rate into the account and calculates the size of the economy in constant dollars.

Therefore, the real GDP presents traders with a more accurate picture of the economic growth levels than in the case of the nominal GDP.

Another major indicator of the Canadian economy is the unemployment rate. If this indicator is high then it points at the weakness in the economy, as well as to the wasted potential. So instead of millions of people having jobs and paying taxes, the government has to pay more in unemployment benefits to its citizens. On the other hand, the low unemployment rate is one of the most obvious signs of the strength of the economy.

Obviously, the list of relevant economic indicators does not end there. Announcements as the latest manufacturing data, housing reports, consumer confidence index, or retail sales can all give traders some valuable insight into the latest trends in the Canadian economy. However, for the sake of accuracy, it is also worth mentioning that those reports typically do not lead to such elevated degrees of volatility as the interest rate decisions, consumer price index, and GDP announcements.

Conclusion

Just like all other currencies, the Canadian dollar is also influenced by economic indicators such as GDP and inflation rate. However, unlike many of its peers, the oil prices in the market have a significant impact on the strength of the Canadian economy and by extension to its currency.

Consequently, some traders are using the Canadian dollar as a proxy to have some sort of exposure to the oil markets, without taking long positions with the Crude or Brent oil themselves.

However, despite this strong degree of influence, the market participants still have to take all of the variables into the account, when making the trading decisions in the Forex market.