Table of content

The leverage essentially represents a loan from a broker to the client and can only be used for investing in trades. There is no standardized level of leverage. In fact, the leverage ratio can range from 1:1 to 1:1000 in the Forex market, depending on the broker. In the case of the stock market, the leverage levels there are much more limited. For example, according to the US regulations, the client can only borrow up to 50% of invested funds.

The use of leverage can allow traders to increase their potential earnings considerably. However, there are indeed certain risks of high leverage market participants should be aware of. In fact, with risky leverage levels, traders can lose their entire investment if the market makes sizable adverse movements in the process. In fact, this type of failure of risk management has led not only to losses for many individuals but corporate bankruptcies as well.

There are indeed no standard rules of leverage for all traders. Instead, the exact strategy here would depend on several factors. Firstly, it is important for the market participants to be aware of the regulations which limit the maximum amount of leverage one can use. In addition to that one of the most decisive factors is whether the trader wants to just earn some decent return on his or her savings, or looks at trading as a full time job.

Obviously, if an individual simply wants to just trade part time and earn higher returns than on near-zero savings accounts, then he might use less amount of leverage in order to reduce the risk for the principal of the investment.

On the other hand, if a trader wants to earn a living from those activities then one might go for a higher leverage ratio to achieve that. However, this also should have some limits, because the loss of risk management can easily lead to some serious losses.

Finally, it is worth noting that some market participants do not use any leverage at all. This is especially the case with the stock market investors. There are also some Forex traders who might abstain from using leverage due to various reasons. Now let us go through each of these themes in a greater detail.

Regulations Regarding the Maximum Leverage Levels

When looking for an adequate leverage level one of the first steps to take, is to get to know the official regulations regarding this subject. Now, it is worth noting that every country has its own policies regarding Forex trading. For example, in the United States, the maximum amount of leverage one can use is 1:50. This means that for every $1 a market participant invests, he or she can invest 50 times of that amount.

For example, if an individual opens a $100,000 position by investing only $2,000 into the trade, then this will be an example of 1:50 leverage. Here it is also worth mentioning that this regulation only applies to the major currencies.

The US regulators consider the following currencies as ‘major currencies’: the US dollar (USD), the British pound (GBP), the Euro (EUR), the Australian dollar (AUD), the New Zealand dollar (NZD), the Canadian dollar (CAD), the Swiss Franc (CHF), the Swedish krona (SEK), the Norwegian krone (NOK) and the Danish krone (DKK).

The fact of the matter is that for trades involving other currencies the limit for maximum leverage is even lower than 1:50. This means that trading with 1:100 or 1:400 leverage is illegal in the United States.

Interestingly enough, in the European Union, the maximum amount of leverage is limited to 1:30 for major currencies. Just like in the case of the United States, the limits are even lower for minor and exotic currencies.

Here it is worth noting that those regulations came into the effect after the 2008 Financial Crisis. In the US they represented a part of a general regulatory reform, which was implemented in response to the reasons behind the 2008 Great Recession.

The main stated purpose of those regulations is to protect traders from using high degrees of leverage and as a result, from suffering heavy losses in trading. Therefore, this is something to keep in mind for traders who reside in those countries which are affected by those regulations.

Trader’s Goals

When one has to choose Forex leverage levels, it is important to consider the trader’s goals. The reality of the matter is that there are some people who are simply unhappy with the near-zero interest rate policies of the world’s major central banks.

They understand that if they place all of their savings on a 0.1% interest rate savings account or certificate of deposit (CD), the returns will be very poor. In fact, the long term average rate of inflation in the United States stands near 3%. This means that if people invest their capital at lower returns, they will be losing purchasing power. Therefore, it is not surprising that many market participants are looking for higher returns.

Consequently, some people turn to trade to achieve these goals. So essentially what they are aiming to do here is to create something similar to high yielding savings accounts for themselves, by successful trading. Therefore, most of those types of traders are not aiming to earn a living from Forex trading. Instead, most of them will be quite happy if they could earn a 10% to 15% return annually from their trading activities. This can certainly help them to retain and grow the purchasing power of their savings.

Now, when it comes to those types of traders, they do not have to take some extremely risky trades in order to achieve their goals. Instead, they can use a lower level of leverage in their trading activities. This is because they are worried about the preservation of the principal of their investment. Consequently, it is very important to choose a realistic leverage amount.

Risks of Leveraged Forex Trading

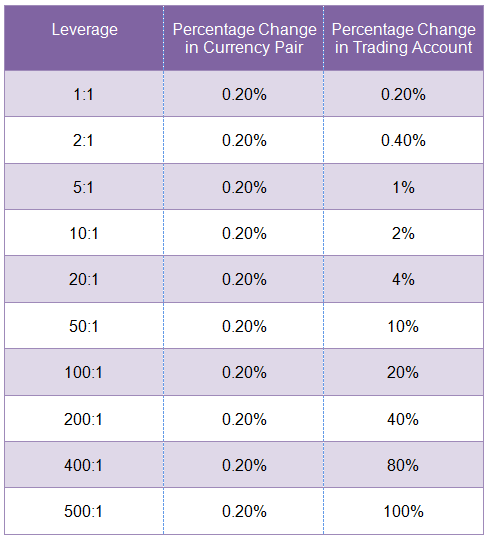

To understand those dynamics better, it can be helpful to take a look at this chart, which shows the changes in the balance of the trading account, in response to exchange rate variations:

As we can see from the above diagram, the example given here is the case of a 0.2% exchange rate movement. Now, 1:1 leverage means that traders are only using their own money, consequently, this amount of market movement will only have a trade balance by 0.2%. For example, let us suppose that an individual invests $10,000 with 1:1 leverage in a long EUR/USD position and the pair declines by 0.2%.

In this case, the value of the investment will fall by $20. So If at this point in time, the trader decided to close the trade, the overall size of loss will be $20, with the market participant retaining the rest $9,980. So it is always helpful for losses to be limited in such a way. However, one thing to keep in mind is that the size of potential gains will also be quite small, the equivalent of $20.

Here it is worth noting that, when it comes to 1:50 leverage, the situation is quite different. In this case, the 0.2% market movement can lead to a 10% change in the account balance. So, let us return to our previous example of investing $10,000 into the EUR/USD long position.

In this case, because of the use of 1:50 leverage, the market participant will be able to open a $500,000 position. From this $500,000 position, $10,000 will represent the trader’s own money, and the remaining $490,000 would be the loan provided by a brokerage company.

Consequently, if the Euro rises by 0.2%, then the balance of the trade will rise to $501,000. The brokerage company will take its $490,000 loan back and the trader will end up with $11,000. Since the $10,000 represents the original investment, the payout, in this case, will be $1,000, which is obviously a considerably better result than a $20 payout.

However, on the flip side of the coin, if the EUR/USD pair declines by 0.2%, then the balance of the trade will drop down to $499,000. So after the broker takes its money back, the market participant will be left with $9,000. Therefore, in this case, the size of loss will be $1,000, much more damaging for the trader’s trading account, than $20 setback.

So as we can see here when choosing leverage for Forex traders, traders should consider that the higher levels of leverage increase potential gains, but can also magnify losses.

This becomes even more apparent with the example of 1:500 leverage. As mentioned before, traders in the US are using the maximum leverage of 1:50, so it is not permitted in the US as well as EU countries. However, some brokerage companies which are not operating from those regions might offer such a large amount of leverage.

So in this case, with $10,000, the market participant will be able to open a $5,000,000 long EUR/USD position. If the pair rises by 0.2%, then the value of this position will rise to $5,010,000. This means that once the position is closed and the broker receives its share, the trader will be left with $20,000. As a result, the market participant will be able to earn a $10,000 payout and double the initial investment in the process.

This would be quite a notable achievement. However, one the other hand, if the EUR/USD pair drops down by 0.2%, then the balance of the trade will drop down to $4,990,000. Once the brokerage company takes its original loan back, the trader will be left with nothing. In other words, the individual will lose the entire $10,000 investment.

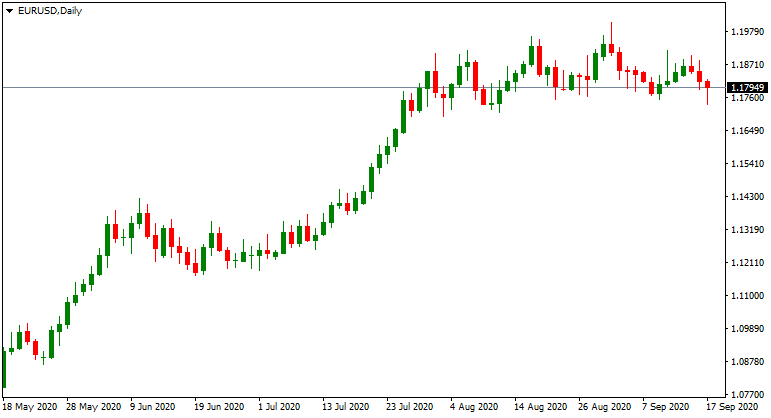

Now, the 0.2% change discussed in all of those examples, is a very small amount of movement in the Forex market. In fact, with the majority of currency pairs, the average amount of daily changes can be considerably higher than 0.2%. Here, we can take a look at the daily EUR/USD chart:

As we can see from the above diagram, since May 2020, the Euro is in a solid upward trend, rising from $1.07 level all the way up to the $1.19 mark. However, at this point, the pair has run into the resistance and by September stabilized around $1.18 level. We can also observe here that the daily movements in many cases are much higher than 0.2%.

Right Amount of Leverage for Part Time Traders

Due to the risks mentioned above, those market participants who are only looking to earn 10% to 15% annually, should not take too many risks. In fact, if one wants to achieve a 15% annual return, all the trader needs to do is to earn a 1.25% return per month, something which can be achieved even by using less leverage than in the examples described above. One of the examples of this would be to use 1:5 leverage.

In the case of 1:5 leverage, it takes a 20% adverse market movement for the entire position to be wiped out. Obviously, there is no guarantee that the market will never move by 20% in a single day, but movements with such magnitude are quite rare.

One example of a very large movement in the Forex market would be the GBP/USD exchange rate during the EU membership referendum in the UK. The chart below shows the market movements of this pair during and after this period:

As we can see from the above diagram, on the EU referendum day the GBP/USD pair has opened near $1.49 level. Due to initial optimism, at one point the pair has risen to above $1.50 mark. However, those gains eventually turned out to be short lived. As it became apparent for traders and investors that the UK was voting to leave the EU, the GBP/USD pair started to collapse, going all the way down to $1.32.

This means that during one of the most volatile days in the history of the Forex market, the UK pound fell by approximately 12% against the US dollar. It goes without saying that those who had opened long GBP positions against other major currencies have lost a considerable amount of money. However, one thing to note here is that despite the magnitude of this large move, those traders who used 1:5 leverage, would not have seen their positions closed due to a margin call. This is because, as mentioned earlier, with 1:5 leverage, it takes at least 20% adverse market movement for the entire position to be wiped out. So if the position can withstand such a serious headwind, then using a 1:5 leverage in Forex trading might be a relatively safer bet.

It goes without saying that there is no such thing as the best leverage to choose. The optimal level of leverage depends on the trading style of a trader, as well as on one’s risk tolerance.

Choosing the Right Forex Leverage for Full Time Trading

When discussing which leverage to choose it is worth noting that not all traders are content with earning 10% to 15% annual returns. The fact of the matter is that some people look at Forex trading as a full time job. Consequently, the main goal for those market participants is to earn enough money from their trading activities to cover all of their living expenses.

Obviously the exact amount of expenses a trader needs to cover all of his or her expenses depends on many factors. This includes the place of residence, the size of the family, the age, and other variables. However, one thing which will always be true is that full time traders need to earn more money than the part time traders.

The reason behind this is that in many cases those who trade part time, also have an additional source of income from their regular job. Consequently, they do not need to earn as much money from their trading activities as the full time traders. On the other hand, one has to earn thousands of dollars in trading if it is his or her main source of income.

Now, in order to illustrate those dynamics better, let us suppose that a group of traders want to become professionals and make this activity as their main source of income. Let us further suppose that each of them would need $3,000 per month to pay all of their living expenses. So what should they do if they want to pick the right leverage level?

Well, actually this would depend on the trading balance of those traders. It is clear that it is much easier to earn the above mentioned amount with a $300,000 deposit, compared to a $15,000 deposit. Let us consider each of those scenarios. In the case of the $15,000 deposit, one had to earn a 20% return on a monthly basis in order to achieve this goal. It goes without saying that achieving this target would be very unrealistic with 1:1 or with 1:2 leverage. Most of the time the currencies simply do not move that fast. Even if they did it would be impossible to always guess the correct direction of the exchange rate.

Consequently, when considering what leverage to choose those traders might prefer to take on more risk in order to achieve higher returns. Those market participants might decide to choose 1:20 leverage or higher. For example, in the case of 1:20 leverage and $15,000 deposit, one has to make a cumulative return of 1% in order to hit the target.

In order to simplify the matters, let us suppose that a trader invests $15,000 for a long GBP/USD position with 1:20 leverage. This means that the overall size of the position will be $300,000. So if the pound rises by 1%, then the value of the trade will increase to $303,000, leaving the trader with $3,000 profit.

On the other hand, for those traders who already have $300,000 in their trading account to begin with, they do not necessarily have to resort to high leverage amounts. They can even just stick with 1:1 leverage. One benefit of this approach is that this tends to reduce the risk exposure of traders considerably by limiting the downside risks.

However, it is also true that if an individual has such a large amount of capital under disposal then he or she might prefer to diversify into other investments as well, like investing in the real estate, stock or bond markets, instead of putting all those funds in the Forex market.

Using Leverage in Stock Market

Before moving on to the concluding remarks, let us take a look at the leverage options when it comes to stock investing. One thing which comes to mind here is that the leverage amounts allowed here are much more limited than in the Forex market. For example, according to US regulations, brokers are only allowed to lend up to 50% of the funds, investors have invested in the market.

For example, if the total value of the investment account of an investor is $10,000, the brokerage firm is only allowed to lend him or her $5,000. This means that the maximum effective amount of leverage here is 1:1.5.

It might be surprising to see the degree of limitation in the stock market. After all, one can get a higher amount of leverage in the real estate market. So if an investor comes up with a 20% down payment, the bank will lend the rest 80%. Therefore, here we are dealing with 1:5 leverage.

The reason for such significant limitations in the stock markets is historical. In fact, there was a time when there were no limitations on the amount of leverage used in stock trading.

Before the Great Depression, it was very common for the market participants to buy stocks with just a 10% deposit and borrow the remaining 90% from the brokerage company. The main idea here was that if the price of a stock in question fell by 10%, then the broker would call its client and ask him or her to add more money to the trading account. If the client was unable or unwilling to do so, then the brokerage company would sell those shares and recover its money.

Now, this system worked for a while quite well. However, the problem was that it became one of the main reasons behind the Great Depression. The collapse in the stock market led to many people losing all of their money in the stock market. This would have never happened if they purchased stocks without leverage since the heavy majority of stocks retain at least some value in times of economic downturn. Stocks usually go to zero, if the company in question goes bankrupt.

However, since the majority of market participants had used 1:10 leverage with stocks, as the price of securities fell, they got their margin calls. As many people were unable to keep adding money to their trading accounts, their shares were sold and they have lost all of their investments.

It goes without saying that the US government did not want for the same scenario of the 1929 Great Depression to be ever repeated again. Therefore, they put up the significant restrictions on leverage trading in the stock market.

In addition to the lessons of the great depression, one of the additional reasons for limiting the leverage in this market is the fact that generally speaking the Forex currency pairs tend to be less volatile than stocks.

Consequently, it might be a better idea for traders to invest in stock without using leverage. After all, since stocks are more volatile than the currency pairs, there are more opportunities to earn some decent returns without resorting to using leverage.

Choosing the Amount of Leverage in Trading – Key Takeaways

- The leverage essentially represents a loan, which a brokerage company gives to its clients for the purpose of opening trading positions. There is no standard amount of leverage. Instead, the exact amount of leverage can vary from 1:1 to 1:1000, depending on the brokerage company as well as on local laws and regulations. For example, in the United States, the maximum level of leverage is limited to 1:50 for major currencies, while in the European Union this limit is set at 1.30. It is also worth pointing out that leverage limits for minor and exotic currencies are even lower than those figures.

- The recommended amount of leverage Forex traders can use depends on their trading goals as well as the size of their account. For part time traders, who are just looking for earning higher returns than on savings accounts might prefer to use lower amounts of leverage. On the other hand, for full time professional Forex traders, it might be more acceptable to use higher amounts of leverage, in order for them to earn enough money to cover all of their living expenses.

- The amount of leverage permitted in the stock market investing is much lower than in the Forex market. In fact in the United States, the brokerage companies are only allowed to lend 50% of invested funds to the client. This means that the maximum effective amount of leverage, in this case, is 1:1.5. One of the main reasons for this limitation is the experience of the Great Depression, which was mostly caused by the highly leveraged trades in the stock market. In addition to that, it is also worth noting that in general, the stock market tends to be more volatile than the Forex market.