Table of content

The Beta indicator is one of the most important indicators in the Stock market trading. It essentially measures the degree of volatility of the stock, compared to the overall market.

The mechanics behind this indicator is quite simple. If the stock has a beta of 1.00, it means that it is exactly as volatile as the broader market. If the beta of the given security is higher than 1.00, this suggests that it is more volatile than the overall market. Finally, if the beta is lower than 1.00, then this will make the stock less volatile, than the stock market.

Here it is worth noting that this indicator is mostly useful for the purpose of risk management and also for planning for investments. The fact of the matter is that there is not a single level of beta, which is optimal for investors. The preference here depends on an individual investment style.

If for example, a market participant has a conservative and income orientated trading style, then it might be preferable to build a portfolio with those stocks which have a low beta indicator. On the other hand, if the investor has a high risk tolerance and wants to build a growth oriented portfolio, then, in this case, it might be useful to find those stocks, which have high beta indicators.

It is also worth noting that the beta is not a static indicator. The reality of the matter is that over time it can change. Some high beta stocks might become less volatile over several months or years, while some low beta securities might start fluctuating more over time.

Finally, it is important to point out that there is no ideal beta level for investing. Both low and high beta stocks have their own specific advantages and drawbacks. Consequently, the choice here would depend on the overall investing strategy. Now let us go through the specifics of each type in greater detail.

Why Wound Investor Prefer Stock with Low Beta Indicator in Trading?

Firstly, let us begin by analyzing the low beta stocks. The obvious question with those is: why would an investor purchase a stock which is less volatile than the market?

Well, there can be several advantages to this type of approach. Historically speaking the stock market, on average has delivered much higher returns than bank savings accounts, certificates of deposit (CDs), and government bonds. This is especially apparent nowadays, as the world’s nearly all major central banks are holding their interest rates at 0%.

Consequently, it is not surprising that many people turn to the stock market, in order to earn potentially higher returns. Now the only problem here is that the principle of the invested amount in this market is not secure. For example, when an individual opens a certificate of deposit, the bank has to return the principle along with the agreed interest to the client at a specific date. The value of the investment does not change during this term, regardless of the performance of the bank’s stock, the size of its profits, or dividends.

On the other hand, when it comes to the stock market, the value of the investment is very much subject to day to day fluctuations. The company has no obligation to keep its share price constant for the benefit of shareholders. On the positive side, this gives the market participants an opportunity to benefit from the potential capital appreciation.

For example, let us suppose that an individual decides to purchase 1,000 shares of an individual company, with the market price of $10 per share. So the total value of this investment at the time of the purchase is $10,000. The firm also pays a $0.25 dividend per share per quarter. Let us further suppose that during the subsequent 12 months the firm performed quite well, it has increased its profits and improved its cash flow.

As a response, its share price has risen to $12. This means that the market value of the entire investment has increased to $12,000. At the same time, the investor is still receiving $1,000 in dividends per year. So as we can see the individual has gained $2,000 in capital appreciation and $1,000 in dividends. So the total return is at 30%.

However, this does not imply that investors will always be able to earn positive returns in the stock. Returning to our example, let us suppose that the firm’s management made some serious mistakes, as a result of which the company sales fell dramatically, with the organization reporting an annual loss. As a result, the share price might drop to $6 per share. So in this case the value of the investment will be at $6,000. This means that the investor has lost $4,000, which represents 40% of the initial investment.

Here it is important to remember the firm is under no obligation to refund that $4,000 loss to its shareholder. So as we can see the volatility in the stock market is simply unavoidable. However, this does not mean that the market participant should always choose stocks with high levels of volatility. This is exactly when the low beta indicator stocks come into play.

Example of Low Beta Stock

In fact, there are stocks with low beta, which are considerably less volatile, than the majority of other stocks. For example, if the stock has a 0.50 beta, it simply means that it is twice less volatile than the overall market.

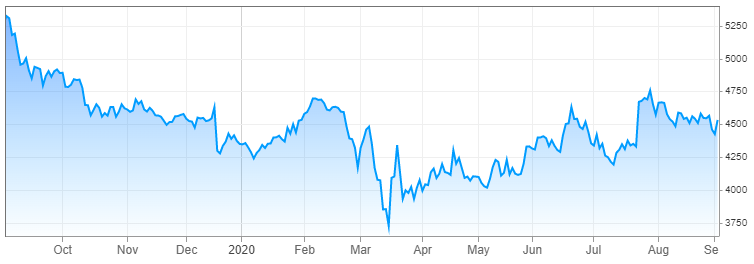

In order to illustrate this, let us take a look at those two charts. The first image shows the price movements of the FTSE 100 index. This tracks the average movements of 100 top UK stocks, listed on the London Stock Exchange.

source: cnbc.com

As we can see from the above chart, from September 2019 until the middle of February 2020, the index was mostly confined to the 7,000 to 7,500 range. However, due to the stock market crash, it faced a massive drop during late February, extending its losses well into March, falling from 7,500 all the way down to 5,000 level. This means that just in a matter of just one month, the index has lost 1/3 of its value.

This is quite rare, since this index does not track the performance of one single stock, but 100 some of the best stocks. Despite this tremendous decline, the index began to recover from the late March, eventually peaking at 6,500 level during the first half of July. However, at this point, the upward trend ended and the market moved sideways before FTSE 100 fell back to 6,000 level by early September 2020.

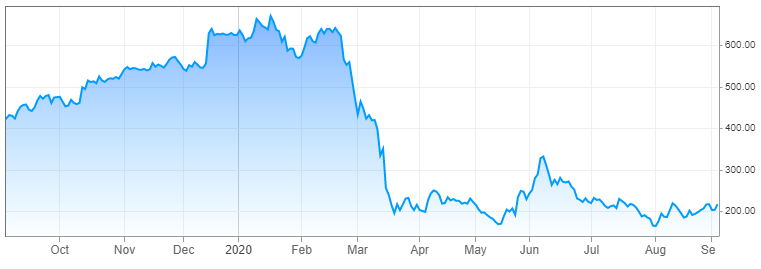

Now, let us compare this to the Unilever PLC stock chart, which covers exactly the same period:

source: cnbc.com

As we can see from the above diagram, the Unilever PLC stock was trading near 5,250p level by early September 2019. After reaching this peak, the stock price started to moderate, eventually falling down to 4,300p by the end of the year. During January and early February next year, the shares have made some notable gains, climbing up to 4,700p level.

However, due to the outbreak of the COVID-19 pandemic and the subsequent stock market crash, those gains turned out to be quite short lived. Unilever PLC stock proved to be no exception to those dynamics. The shares fell sharply during the second half of February, extending their losses well into the first half of March, eventually dropping all the way down to 3,700p. This means that in this period, the stock has lost 21% of its value.

Despite this decline, the stock began to regain its footing from the second half of March. By late August, the shares were already back to the 4,700p mark. After this impressive run, the share price has moderated around 4,500p level by September 2020.

So as we can see from this example, Unilever PLC stock is not immune from the external economic shocks and market fluctuations. However, as those charts demonstrate it is much less volatile than the overall market. According to the latest data, its beta for the last 5 years of trading currently stands at 0.33. This suggests that the stock is 67% less volatile than the overall market. During recent years the beta of the company has fluctuated between 0.20 to 0.45.

Benefits of Trading Low Beta Stocks

Securities with a low beta in the stock market can be very attractive for those investors who are mostly concerned about the preservation of their capital. The fact that some stocks are better able to hold on to their value can be very reassuring for many market participants. When they buy stocks with a low beta, they know that its value will still be subject to daily fluctuations, but the level of volatility at least will be notably lower than the overall market.

This enables the market participants to hold on to more of their net worth in the stock market in times of recession and economic downturn. In addition to that, in order to identify those types of stocks, the investors do not need to find a beta stock calculator. Instead, this measure is provided on most websites that display the stock market charts. Consequently, it is relatively easy to gather data about the beta stock market indicator.

In addition to that, it is also worth noting that some investors prefer to build income-orientated portfolios. Consequently, they are more interested in receiving a stable income, rather than only focusing on capital appreciation.

Sectors Associated with Low Beta Stocks

Here it is interesting to mention that there are some industries in the economy, which is more likely to have companies with less volatile share price, compared to the overall market. The last example we have discussed, Unilever PLC, represents the consumer goods sector. For many years, the firm in its official quarterly reports divided its sales into 4 distinct categories: Foods, Refreshments, Personal Care, and Home Care.

So what makes the stocks of the consumer goods companies more volatile? Well, it goes without saying that such daily essentials as foods, personal hygiene, and home cleaning products are something humans will always need regardless of the economic circumstances.

It is true that in times of recession, many people might start cutting back, reducing their purchases of luxury products and services. However, it is less likely that they will start cutting their spending on daily essentials. After all, it is worth remembering that the heavy majority of consumer goods products are generally quite affordable for the average consumer, the prices of which mostly fall well within the $1 to $20 range.

This means that even in times of economic downturn and recession, the majority of consumers will still purchase those products as before. This in turn keeps the sales of those companies much more stable, compared to the firms in some other sectors of the economy. On the other hand, in economically booming times consumers might buy more food and hygiene products, but they are unlikely to increase their expenditures massively since there is a natural limit on how much of those products they can consume.

Therefore, the share prices of those types of firms generally tend to be less volatile than the rest of the market. In addition to consumer goods companies, the stocks of fast food companies also tend to have a low beta indicator. This is because the food they provide is relatively cheap and consumers are unlikely to give it up in times of the economic downturn. One example of this would be McDonald’s.

During the 2008 great recession, the firm’s sales increased, because the firm was able to offer its clients a $1 menu. As a result, even despite massive job losses in the world, the company was able to expand its sales significantly, raising the dividend in the process. At the same time, many luxury restaurants suffered some serious losses, and the owners of some of them were forced to close them down.

If we take a look at beta indicator charts on the stock news website, we can notice that the Utilities sector is also full of those stocks which are considerably less volatile than the overall market. This is not very surprising since people will always need some gas and electricity, regardless of their personal financial situation. In fact, some financial commentators refer to those types of stocks as the ‘defensive stocks’.

Due to specifics of the beta stock formula, the retail stocks are also one of those categories, which have a low degree of volatility. There are obviously many people who try their best to save money on groceries, however, the sales of those firms still tend to be relatively stable. After all, most people who want to save money during the recession, are more likely to let go of expensive vacation and luxury products, rather than just focusing on reducing their grocery bills.

Finally, if an individual is looking for a low beta indicator stock, one might check out the pharmaceutical companies. People, in general, will always buy the medicine, regardless of the state of the economy. Therefore, the revenues of those firms generally tend to be relatively stable, and therefore, their stocks are not likely to be very volatile.

Specifics of High Beta Stocks

It is obvious that not all stocks are known for low volatility. In fact, there are indeed many securities, which are much more volatile than the overall market. For example, if the stock has a beta of 2.00, this means that this security is twice more volatile than the broader market.

So why would some be interested in buying those high-risk stocks? Well, the obvious risk with those securities is the fact that in times of bear market, investors can lose a significant portion of their net worth. Yet, on the flip side of the coin, those stocks typically tend to gain more in the bull market.

Therefore, high beta stocks mean that they tend to be much more volatile than the overall market, which gives the market participants an opportunity to earn considerably higher returns in the stock market, compared to low beta stocks.

Consequently, beta stocks can be a good option for those individuals who are looking for building a decent growth portfolio. Due to the fact that they are very volatile, it is in general easy to find high beta undervalued stocks. The fact of the matter is that due to high beta, their share prices tend to respond strongly and even sometimes irrationally to the latest market developments. So there is nothing stopping traders from exploiting this for their own advantage.

For example, let us suppose that the market participant has discovered a stock that recently traded at $10. However, the market has overreacted on the recent poor quarterly numbers report and the stock, due to its high volatility fell to $3. During the subsequent months, the stock has recovered from the panic selling and returned to the $6 level.

Now, obviously, the stock still trades significantly lower than the recent high of $10, however, as we can see from this example, the investor was still able to double the value of the original investment, by taking advantage of this undervalued opportunity.

However, here it is very important to mention that the fact that an individual stock drops significantly, it does not always mean that it will always represent the undervalued opportunity. There might be a very good reason why the market is selling the stock. Consequently, it is always essential to do thorough due diligence, before making investment decisions.

Example of High Beta Stock

In order to illustrate the case of a highly volatile stock, let us take a look at this chart which shows the price movements of International Consolidated Airlines Group stock, listed on the London Stock Exchange, according to the latest data, its 5-year beta currently stands at 1.66, which suggests that the stock is 66% more volatile than the broader market.

source: cnbc.com

As we can see from the above diagram, a year ago, the International Consolidated Airlines Group stock was trading near the 400p level. During the subsequent months, the shares made some steady gains, eventually reaching 650p level by January 2020. It goes without saying that gaining more than 62% in a matter of 5 months is quite an impressive achievement.

However, those gains eventually turned out to be short lived. The outbreak of the COVID-19 pandemic, coupled with travel restrictions and lockdowns had a very negative impact on the earnings of the airline companies. The results were quite predictable, the stock started dropping sharply from the second half of February 2020. By the middle of March, the shares have already fallen all the way down to the 200p level.

This means that just in a matter of one month, the stock has lost 69% of its value. It goes without saying that this was a serious blow to all investors, which had a significant portion of their net worth in this stock. Despite this collapse, the stock did rally and even reached 300p by June 2020. However, during the subsequent months, the shares fell once more and stabilized around the 220p level.

So as we can see from this particular example, without making any detailed beta calculation of stock, the International Consolidated Airlines Group shares are not only more volatile than Unilever PLC but looking at those charts it is also apparent that it fluctuates much more than the overall FTSE 100 index.

We can further observe that the high beta indicator for the stock can act as a double-edged sword. In the case of our example, it did allow investors to make up to 62% return on investment during late 2019. However, it also collapsed in response to the outbreak of the COVID-19 pandemic, with the share price falling by more than 69%.

It is also interesting to note that the airline stocks, in general, have been more volatile than the broader market even before the outbreak of the COVID-19 pandemic. The reason behind this is very simple. There are indeed some people who travel regularly as part of their regular job or a business. However, they are not in the majority. The reality of the matter is that many people travel as a part of their vocation and leisure.

Therefore, it is clear that while buying food and hygiene products are essential for human survival, traveling with the business class to the luxury destination does not represent the unavoidable necessity. Consequently, in times of the economic downturn, many people do cut back on travel. As a result, many airline companies suffer some serious losses in their revenue and their share prices fall significantly.

On the other hand, in economically booming times, people are more interested in traveling and spending their holidays abroad. Consequently, the income and profits of the firms in this industry rise, and the shares of those firms tend to make some notable gains.

Benefits of Investing in High Beta Stocks

As we have seen before, the high beta definition in the stock market is that the security tends to lose more in times of economic downturn, compared to the broader market. At the same time, such stocks tend to make much larger gains in times of bull market, compared to some of their peers.

This has several advantages. Firstly, this enables traders to make significant returns in some cases. As mentioned before, many people invest in the stock market, as some sort of alternative to investing in near-zero returns with the government bonds, savings accounts or certificates of deposit. Consequently, high beta stocks can give market participants an opportunity to earn double-digit returns.

Obviously, this does not mean that if one finds the high beta stock, that would automatically ensure success in the stock market trading. Instead, traders and investors should always check the fundamentals of the company, its earnings, price to earnings (P/E) ratios, dividend payment history, and other indicators, before making any investment decisions.

The other important benefit of investing in high beta stocks is that there are typically many undervalued opportunities available in this category. The fact of the matter is that with those securities, the market typically tends to overreact on recent economic and company news. Consequently, investors can identify and take advantage of those opportunities.

Industries Associated with High Beta Stocks

At this stage, it is important to mention that the airline industry is not the only sector, where we can find some decent high beta stocks. It might be surprising to some people, but actually banking stocks, in general, tend to be more volatile than the broader market.

There are several reasons for this. The fact of the matter is that in times of economic downturn many people are no longer able to meet their debt obligations, as a result, the number of defaults on consumer loans, credit card payments, car loans, and even on mortgages rises during those times. As a result, the banks suffer losses, and their stock price plummets.

At the same time, in economically booming times, consumers are more likely to take on more debt and also are in general better positioned to make the regular payments towards their liabilities.

In addition to that, the experience of the 2008 Financial Crisis has shown us that not only the retail banks but also the investment banks can be very vulnerable to economic downturns. In fact, one of the largest representatives of this sector, Lehman Brothers, was bankrupt during this period.

The reason for this is that those firms are usually involved in highly leveraged trades and investments. In times of economic prosperity, this can certainly increase their returns considerably. However, the problem here is that during the economic downturn, the use of leverage can magnify their losses.

In fact, as one of its former traders mentioned, at the time of the bankruptcy, the Lehman Brothers had a leverage ratio of 1:42, something which its competitors shied away from. This meant that for every $1 Lehman Brothers owned in its investments, it borrowed $42. Consequently, it is not surprising that as the real estate market dropped dramatically, this led to some serious losses, resulting in one of the largest bankruptcies in history.

Other sectors with high beta stocks include luxury upscale restaurants. After all, if there is a recession, people do not have to visit expensive restaurants in order to get some food. They always have an option to buy fast food, or even just buy some groceries and cook at home. Many financial experts state that in this way, consumers can save hundreds of dollars over the months.

Stocks that represent the Luxury car producers, five star hotel owners, and expensive accessory designers do generally have a high beta and consequently tend to be more volatile than the overall market.

Beta Meaning in Stock Market – Key Takeaways

- Beta is one of the most important indicators in the stock market analysis. It measures the degree of volatility of an individual stock compared to the overall market. Stocks with high beta indicators tend to be more volatile than most of their peers.

- If the beta of the stock is at 1.00 it suggests that the security is exactly as volatile as the broader market. Anything above this mark makes the stock more volatile, while any number below it denotes those stocks with less volatility than the overall market.

- There is not an optimal beta level, which can make the stock ideal for investing. The fact of the matter is that the more risk-averse market participants might prefer those securities which have a beta which is lower than 1.00. At the same time, investors with high risk tolerance might prefer those stocks which have a beta higher than 1.00.