Table of content

There are some people who believe that investing in the Forex or Stock market is very risky. They believe that trading is like gambling since there is a significant risk of losing money. Consequently, they prefer to stay away from Forex and Stock trading and limit their investments to real estate, savings accounts, and bonds.

Now, it is true that trading is not for everyone. The fact of the matter is that trading might be too stressful an experience for some individuals or alternatively they might find it too difficult to control their emotions. Consequently, it makes a lot of sense for those people to stay away from trading and move on to less stressful markets like long term real estate investments.

However, this does not change the fact that besides some similarities, there are a number of differences between trading and gambling. Firstly, it is worth noting that with trading the market participants can analyze the given currency pair or stock, looking at technical and fundamental indicators. If one does this correctly, then this has the potential to improve the trader’s odds of earning some payouts in the process.

On the other hand, in gambling, the outcome of a bet is not determined by market forces or technical or fundamental indicators. Instead, it is determined by luck. Obviously, there are also a number of strategies people can use in gambling, however, their ability for analysis here is quite limited compared to the Forex and stock market.

In addition to that, it is worth noting that in gambling the odds usually are against the gambler. This is because the companies which operate casinos and gambling websites want to make sure that in the end, they will earn profits. Consequently, with gambling games, the player might have a 45% to 49% chance of winning each bet. In this way, in the majority of cases, the company ends up winning the bet.

In sharp contrast to gambling, in Forex and stock trading by conducting a proper due-diligence and analysis traders can improve odds in their favor and have the potential to earn some decent payouts in the process. This is especially true with long term stock investing. If an individual invests in a stock of a successful company with the competent management in change, then it is likely that that investment will eventually pay off a significant amount of return. Now let us go through each of these aspects in a greater detail.

Similarities Between Gambling and Day Trading

There are indeed some people who might ask a very interesting question: is Forex trading gambling? Now, in order to make an answer as accurately as possible, it is important to recognize that there are both differences and similarities between those two markets.

Firstly, it is worth noting that one similarity here is that the principle of the investment in each case is not secure. The fact of the matter is that there is a distinct possibility with both Forex trading and gambling that an individual will lose all money.

For example, in the case of savings accounts and certificates of deposit, in the United States, there is FDIC insurance for those deposits up to $250,000. This means that even if the commercial bank fails, its deposits will still get their money back up to $250,000.

In the case of real estate, it is obvious that the value of those types of investments moves alongside market prices. So in times of recession, the property prices might go down. However, one thing which is very clear is that homes will never become completely worthless. They will always retain some value since humans always need a shelter in their daily lives and it represents a basic necessity for people.

So unlike those cases, with the Forex market and with gambling, there is no guarantee that people will not lose their entire investments. Another major similarity between those two categories is the fact that controlling emotions is a very important factor to succeed in trading or gambling. Those people who make their trading or gambling decisions based on emotions, often lose money in those activities.

Here it is worth noting that there are indeed some traders who are gambling in the Forex market. Those types of people do not pay attention to any technical or fundamental analysis. So they make decisions randomly or use the same tactics here as in gambling. In fact, the MetaTrader 4 has some expert advisors, who execute trades based on a coin toss and double their investment in case of a loss. This is indeed what we can call trading in a gambling style. So obviously in those cases, similarities between gambling and trading are obvious.

Difference Between Forex Trading and Gambling

Despite some of their similarities, it is obvious that there are important differences between Forex trading and gambling. The first thing which comes to mind is that gambling games generally present gamblers with a binary choice: either one wins the bet and earns some money, or one loses the bet and all money is lost. There are no stop-loss orders in gambling to use for the purpose of risk management.

On the other hand with Forex trading traders can place stop-loss orders and close losing positions. This gives them the ability to limit their losses to a fraction of the original investment into the trade.

So for example, if a gambler puts $1,000 towards the single bet, in case of a loss an individual loses the entire $1,000. At the same time with the Forex market, if the market turns against the trader, then one can simply cut losses and close the position by $100 loss or lower and recover the rest of the amount.

Another difference between day trading and gambling is that the former one allows market participants to conduct the technical and fundamental analysis of different currency pairs. This potentially can improve the trader’s chances of earning some decent payouts.

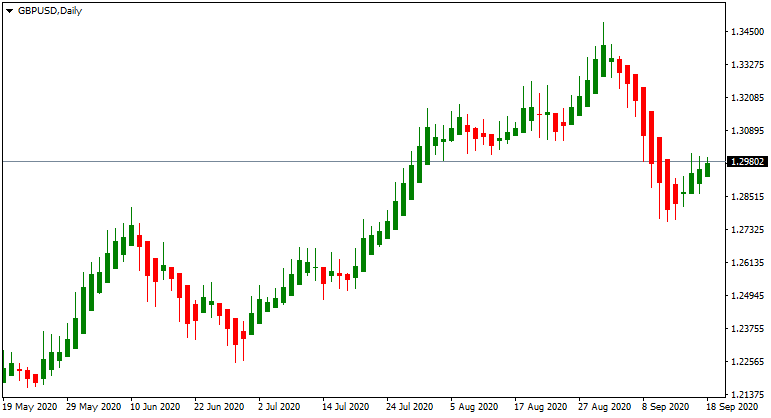

In order to illustrate this point better let us take a look at his daily Heiken Ashi GBP/USD chart:

As we can see from the above diagram, during the middle of May 2020, the GBP/USD pair was trading near $1.22 level. During the subsequent month, the pound was in a solid upward trend, rising all the way up to $1.34 level by the end of August 2020. After this impressive run, the pair has faced a notable correction, eventually stabilizing near $1.30 mark. So far we have three greek Heiken Ashi candlesticks forming up by the end of the chart, therefore, at the current moment, the pair has the potential to return to the upward trend.

Now, moving on to the fundamental analysis, the recent surge of the pound was not surprising. The reason for this is that according to the purchasing power parity indicator, also known as the PPP, the pound is still considerably undervalued. According to the ‘Economist’, as well as the PPP level for GBP/USD is above 1.60. This means that the pound still has a long way to go before reaching the fair value levels.

So everything else being equal the GBP/USD pair should continue its upward trend. On the other hand, it is also worth remembering that the pound is dragged down by uncertainty about the relationship between the UK and EU and also the very real possibility of the second Scottish independence referendum. Consequently, if things settle down in those two fronts, this going forward might be a bullish sign for the pound.

So, as we can see with technical and fundamental analysis the market participant can make plenty of conclusions and potentially can also improve the accuracy of trades. This is not possible with gambling. Mostly the entire process is based on luck. There is no real analysis method to determine exactly on which number the ball will land or which card will show up. Obviously, there are still some strategies one can employ with gambling, but the number of available options is not as numerous as in the Forex market.

Similarities Between Gambling and Stock Trading

When discussing the topic of gambling vs trading, it is worth noting that there are indeed some similarities between gambling and stock market investing. When we have previously discussed the topic of gambling vs Forex trading one thing which was mentioned was that in both cases the capital of the individual was not secure. This is also true for stock investing as well.

The fact of the matter is that the public company is under no obligation to give a guarantee to its shareholders that it would refund any losses due to a change in the stock price. This sort of guarantee is only in place if one invests in corporate bonds. In this case, the investor receives an interest, also known as a coupon for the company and once the bond matures, the firm repays the principal to that individual.

However, if one purchases a number of shares in a company, this investment is pretty much a subject of a day to day fluctuations. If the corporation succeeds, then it is likely that its shareholders will be rewarded with dividends, with capital appreciation due to rising stock price and even with some share buyback programs. On the other hand, if the company goes bankrupt, the stock price will most likely go to zero and investors will lose all of their invested capital.

Now, generally speaking, the stock market tends to be more volatile than the Forex market. However, it is also less leveraged than the latter. According to the US regulations, brokers are only allowed to lend their clients 50% of their investment account balance. This means that if an investor holds $20,000 with a broker, then the brokerage firm is only allowed to lend $10,000 for the purpose of investing. This means that the maximum effective amount of leverage stands at 1:1.5.

In comparison, the maximum amount of leverage in the Forex market in the United States is 1:50 in the Forex market. Therefore, generally speaking, investors are less likely to lose all of their money in the stock market compared to the Forex market. However, this does not imply that one can not lose all of his or her savings in the stock market. After all, such a thing has already happened in the United States on a massive scale during the Great Depression, when millions of people have lost all of their capital with stocks.

It is also true that for some people, trading stocks is gambling since they do not do any analysis of companies or their earnings. They simply buy some stocks and hope for the best. Obviously, this type of stock trading is much closer to gambling, than other trading styles. Finally, it is worth mentioning that some market participants say that trading options are gambling since in some cases it might be very risky, depending on the market price movements.

Difference Between Stock Trading and Gambling

In addition to some similarities, there are many differences between stock trading and gambling. One of the most important factors among those is the fact that with gambling, the odds are usually set against the gambler. In some games, the player might have a 45% chance of winning each bet, while in others it might be at 48%. However, generally, those chances are usually set below 50%, so that casinos and owners of gambling websites can keep earning money.

Now, the most important difference between trading and gambling is that with the stock market the odds are not against the investor. In fact, if one can do a thorough analysis of the stock and choose shares of a successful company the odds can be in favor of the market participant.

So when it comes to professional investors, most of them are not interested in trading for excitement, but for earning consistent returns. So they look for those companies which have a strong financial position, have a decent track record of returning money to shareholders, and also for those stocks which are undervalued or at least are fairly valued.

The fact of the matter is that the stocks of successful companies with a competent management tend to rise considerably in the long term. Obviously, there is no strategy in trading which can guarantee payouts 100% of the time. However, the odds can definitely be in favor of those investors who do their proper due diligence on stocks they purchase.

On the other hand, this type of analysis is impossible with gambling. The reality of the matter is that one can not evaluate which number or card is ‘undervalued’ or ‘overvalued’. The outcome for each session mostly depends on luck, rather than some technical or fundamental factors.

Another major argument for people arguing that trading is not gambling is a passive income factor. The fact of the matter is that an individual can not earn passive income by gambling. A player must keep gambling in order to earn money. If one stops this activity, then there will be no earnings.

On the other hand, this is not necessarily true with stock investing. In fact, there are millions of investors across the globe who have built an income portfolio. This investing style involves the purchase of those stocks which have a solid track record of paying dividends to their shareholders. Some of them make payments to shareholders on a quarterly basis. At the same time, there are many companies which pay dividends on a semi-annual or annual basis.

Now, the most important thing here is that investors who follow this strategy do not have to keep buying and selling stocks on a daily basis, in order to earn money. In fact, there are many investors who have already retired on dividends and have enough income to cover all of their living expenses.

Trading vs Gambling – Key Takeaways

- There are some similarities between trading and gambling, but there are several important differences as well. They are similar in the sense that in both of those cases, the invested amount is not secured or guaranteed. Therefore, in both cases, people can win some payouts or alternatively lose all of their investments in the process.

- One of the main differences between trading and gambling is that in the first case traders have the ability to conduct the technical and fundamental analysis of different currency pairs and stocks. In this way, they can improve the odds of their success considerably. On the other hand, with gambling, the odds of winning are generally fixed and are not set in the player’s advantage.

- One of the most important differences between gambling and stock market investing is the fact that in the latter case one can create a passive income stream. In the former case, the player has to keep gambling in order to earn some money. If he or she stops gambling there will be no new earnings to speak of. However, with the stock market, one can build an income portfolio and can earn dividends on a regular basis even without making any new trades in the process.