Table of content

In the aftermath of the 2008 Financial Crisis, it became increasingly difficult to find investments with decent returns. The fact of the matter was that as the US Federal Reserve and other major central banks across the globe have adopted near-zero interest rate policies, returns on savings accounts and certificates of deposit (CDs) have become unattractive for many investors.

As a result, some market participants turned to dividend paying stocks in order to achieve returns which were at least enough to cover the cost of inflation. In fact, even nowadays there are several stocks which offer yields ranging from 3% to 6%, while some of them are even going higher than those levels.

It goes without saying that those rates of return are quite attractive to investors. However, the obvious concern here is whether or not those are sustainable in the long term. In fact during the 2008 Financial Crisis, as well as in the aftermath of the outbreak of the COVID-19 pandemic many companies have cut their dividends substantially or eliminated them entirely.

The fact of the matter is that if the stock offers a high yield it does not automatically mean that it is a very risky investment. In order to differentiate between good and poor investment choices it might be a good idea to take a look at such indicators as the past dividend history of the firm, the dividend payout ratio, as well as the average dividend growth rate.

If the company has a solid dividend history, a low payout ratio, and a good dividend growth rate, then it is well-positioned to maintain the payments to shareholders.

Examining Dividend Yield

When it comes to investing in the stock market some people are trying to build a growth portfolio in a bid to maximize their returns. On the other hand, some other investors are more focused on earning a stable income from those investments.

One of the indicators this latter group will take look at is the dividend yield. This indicator essentially measures the rate of return the investor will get in terms of dividends if one invests in this individual stock. The dividend yield is calculated by dividing the total annual amount of dividends on the current share price and is usually expressed as a percentage.

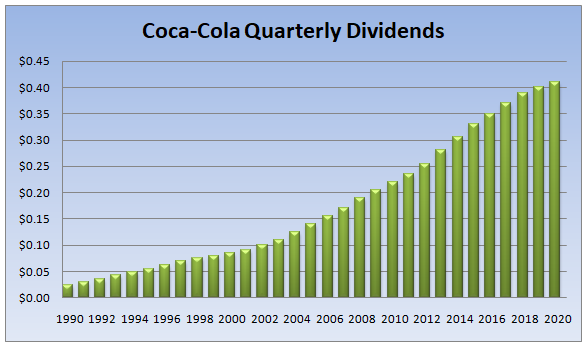

For example, by September 2020, the Coca-Cola Company (KO) stock trades near $51 level and pays a quarterly dividend which is the equivalent of 41 cents per share. This means that the total annual amount of dividends is $0.41 x 4, which is $1.64. Calculating the dividend yield of this stock is actually quite simple. We divide $1.64 to $51, the current share price, which is approximately 3.2%.

This suggests that at the current price the Coca-Cola Company stock offers a decent yield. Here it is worth noting that the average long term annual inflation rate in the United States is near 3%. Therefore, since this stock can deliver a higher returns than the average inflation rate, it can be attractive to many investors.

Here it is also worth noting that the dividend yield is not a static indicator. It changes daily depending on the market price movements of the stock. It also responds to changes in terms of the dividend amount of the company in question. There is in fact an inverse relationship between the dividend yield and the share price.

For example, if the stock price of Coca-Cola Company rises to $60 and the payout to shareholders remains the same, then the dividend yield will be 1.64 / 60, which is approximately 2.7%. On the other hand, if the stock price drops all the way down to $40, then the yield will rise to 1.64 / 40, which is 4.1%, which is considerably higher than the current rate. Therefore, the daily stock price fluctuations can significantly alter the actual dividend yield of the security.

Appeal of High dividend Yield Stocks

At this point, some people might wonder why high dividend stocks might have such an appeal. Well, the fact of the matter is that before the 2008 financial crisis, the majority of investors in developed countries had an ability to earn some decent returns on their savings accounts and certificates of deposit. In fact, in 2006 the US Federal Funds rate reached 5.25%.

Therefore, American savers and investors could easily find deposit accounts which paid around 5%. This seemed quite attractive to market participants since it allowed them to earn returns which were 2% higher than the average inflation rate in the United States.

However, the situation changed dramatically as the US Federal Reserve has decided to cut its Federal Funds Rate all the way down to 0% to 0.25% range. In response to this development, all major commercial banks in the United States have lowered their interest rates on deposits. As a result, people started losing money in real terms both on savings accounts and the certificates of deposit. Therefore, it is not surprising that they started looking for alternatives.

One of the possible alternatives here is a high dividend paying stocks. The general principle here is that many companies distribute some of their earnings to shareholders in the form of dividends. In some cases, the yields are quite high and attractive to investors. So instead of earning 0.1% or 0.25% on savings accounts, people prefer earning 3%, 6%, or higher with those stocks.

Despite this obvious upside, this type of investing is not without its own risks. In order to illustrate one example of those risks, let us take a look at this chart, showing the stock price of Pfizer:

source: cnbc.com

As we can see from this diagram, the stock has experienced a great deal of growth both in the 1980s as well as in the 1990s. During this period the shares rose from 85 cents to $48. Despite this impressive run, from 2000 the stock began its decline. This downward trend has accelerated in 2008 due to the firm’s decision to cut its dividend in half.

Before this announcement, the dividend yield of the stock was above 6%. It is not surprising that this was quite an attractive rate of return for the market participants. The reason for this high yield was the fact that the firm has consistently increased the size of its dividend, while the stock price kept sliding. What happened next was that the management has announced the large acquisition involving billions of dollars and in order to pay for it has decided to reduce payouts to shareholders by 50%.

So what happened here was that investors ended up in a stock dividend yield trap. The market reaction to this decision was immediate. During subsequent days and weeks of trading, the Pfizer stock suffered heavy losses, eventually going all the way down to $12 level. This means that compared to the 2000 peak, the shares have lost three quarters of their value.

The stock eventually started to recover and by September 2020 it was trading near the $37 mark. However, the shares have never returned back to the $48 level. One of the reasons for that is that some investors still remember an unexpected dividend cut back in 2008.

Therefore, as we can see from this example, not all high dividend shares will keep delivering results for shareholders. The reality of the matter is that some companies simply can not sustain those payments. Indeed, some firms might have financial means to do so, but the management might still decide to cut the dividend in order to pay for acquisitions, just like in the case of Pfizer, or for some other reason. Therefore, income investors should conduct proper due diligence, taking a look at several indicators in order to identify those firms which can be reliable enough to be included in the dividend portfolio.

Payout Ratio

When examining high paying dividend stocks, one very popular measure investors use is the so-called payout ratio. This indicator measures the percentage of company earnings, which the organization spends for the benefit to shareholders in form of dividends and stock repurchases. For example, if the company has made a net profit of $900 million and pays $450 to shareholders, then the payout ratio will be at 50%.

The general rule of thumb here is that if the payout ratio is at 50% or below, then the firm is well-positioned to maintain its payouts to shareholders, so dividends in those cases are generally considered to be safe. At the same time, if the payout ratio is within 50% to 80% range, it does not represent an ideal scenario for investors, but it is still considered to be sustainable.

On the other hand, if the payout ratio is above 80%, then this can be a very alarming sign for investors. This suggests that if the company faces any decrease in revenue or other financial headwinds, the management has very little margin of safety to maintain those payouts to shareholders.

In fact, sometimes there are stocks whose payout ratio is above 100%. This means that the company pays out to shareholders more money than it receives in profits. Obviously, by borrowing money or tapping into cash reserves the management might maintain this state of affairs for a year or two. However, it goes without saying that this is clearly an unsustainable strategy.

The reality of the matter is that if the firm will not be able to restore its profitability sooner or later the management will run out of funds and will be forced to cancel those dividends and share buybacks. Therefore, the payout ratio can give investors some idea of whether or not they are dealing with safe high dividend stocks.

Dividend History

During our discussion regarding the high dividend stocks we mentioned that if the firm has a low payout ratio, this generally suggests that the company in question might have financial means to maintain those payments to shareholders. However, one thing to keep in mind here is the fact that it does not guarantee that the management will always be willing to deliver decent payouts to shareholders.

After all, it is important to remember that there is no law which says that the company always has to pay a dividend to its owners. So legally speaking, there is nothing stopping the management to cut dividends or eliminate them entirely.

Now, one thing which can give some idea to investors regarding the willingness of the management to build shareholder value is to take a look at the dividend history of the stock. This is because there are some of the best high dividend stocks, which has a solid dividend history going back to decades. One example of this is the Coca-Cola Company:

As we can see from the above diagram, 25 years ago, the firm paid shareholders a quarterly dividend of 2.5 cents per share. During the subsequent years, the company has increased its payouts to shareholders steadily. In fact, this sort of progressive dividend policy has persisted even during the 2008 Financial Crisis. By 2020, the quarterly dividend of the Coca-Cola Company has reached 41 cents per share.

This sort of track record shows us that the firm’s management is more than willing to return money to shareholders. Therefore, it is highly unlikely for the company leadership to decide to spoil this solid track record going back to several decades for no good reason. Obviously, no one can guarantee dividends 100% of the time, but when the firm has defended the interest of its shareholders so well, is likely to continue doing so in the future.

On the other hand, if the company has no dividend history to speak of, or alternatively has recently cut its payout to shareholders, then it might not represent a good investment. Even if the stock currently offers a high yield, it is highly uncertain whether it will be sustainable or whether the management will be willing to keep delivering dividends to shareholders.

Since the firm does not have a solid dividend history, the company might decide to at some point change its priorities and start reinvesting profits, instead of sharing some of the profits with shareholders. Consequently, having a solid dividend history is one of the necessary requirements when looking for high dividend growth stocks.

Average Dividend Growth Rate

When looking for high dividend stocks 2020 traders can also analyze the average dividend growth rate. This can be a major indicator of whether or not the firm can be able to sustain large dividend payments. The general principle here is to find the company which on average raises its dividend by 3% or higher. This is because if the firm is not able to do so, its dividends will start losing their purchasing power and the management might also not be able to sustain those payments.

So what an investor is looking for here are companies which have increased their dividends on average by 3% or higher and have done so at least for a decade. This is because if the firm’s finances are in poor share, the board might still be able to raise the payouts once or twice, but it can not sustain those payments for a decade or longer.

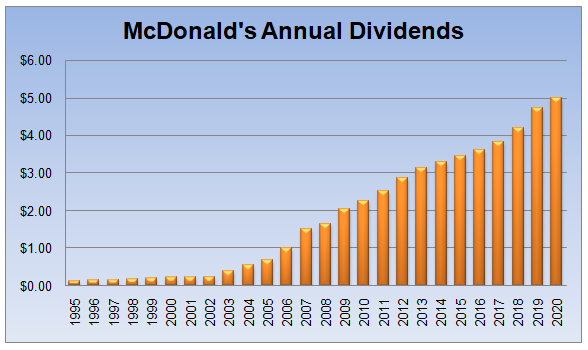

One example of a company which has quite a solid dividend growth rate over an extended period of time is McDonald’s. We can take a look at its dividend history below:

As we can observe from the above diagram, adjusting for the stock splits, back in 1995, the firm only paid 12.5 cents per share dividend to shareholders. During the subsequent years, the company has raised its payouts steadily.

In fact, during the 2008 Financial Crisis, McDonald’s managed to deliver a double digit dividend increase to shareholders. The reason for this was the fact that the company has benefited from a $1 menu during the recession. As customers were trying to save money, this seemed quite a good bargain for many people.

In the aftermath of the 2008 Great Recession, the firm kept increasing payouts, until the total annual amount of payout has reached the $5.00 mark by 2020. This means that the average annual growth rate of Mcdonald’s dividends is 15.90%. It means that one average during this 25 year period has increased its payouts more than 5 times compared to inflation, which is quite impressive.

Therefore, the logic behind this is that if the firm is able to grow its dividends at such a high rate, then it might still be worth buying if its P/E ratio is slightly higher than 20. So this is something to keep in mind when dealing with dividend paying stocks.

Frequency of Payments

One of the factors the market participants look for when hunting for decent returns is the frequency of dividend payments from individual stocks. Ideally, one might want to find the high yield monthly dividend stocks. This is because when it comes to some savings accounts, certificates of deposit, and nearly all rental properties, investors have the ability to have a monthly income.

It goes without saying that this is very convenient for market participants since this makes managing the personal finances much easier. This is especially true if the investor plans to retire and use the income from the stock portfolio to cover the daily living expenses.

Now, the problem here is that the high monthly dividend stocks do exist, but they are in a short supply. One of the misconceptions of dividend stocks for some people is that those companies pay payouts shareholders on a monthly basis. This is only true for a small minority of firms. In reality, most companies pay their dividend on a quarterly, semi-annual or annual basis.

There are indeed some market participants who try to build an income portfolio from exclusively those stocks which pay dividends at least on a quarterly basis. This is because they do not have to wait for long periods of time to receive their payouts.

However, when it comes to decent dividend paying stocks, it is worth mentioning that those are not limited to companies which pay quarterly payouts to shareholders. In fact, there are a number of firms, with a very solid track record of paying dividends on an annual basis.

Now, those investors who prefer monthly dividends might consider investing one of the income orientated mutual funds. Instead of solely focusing on growth, those funds invest in solid dividend paying stocks and after retaining some percentage of income as commission, distribute the remaining funds to shareholders on a monthly basis.

Here it is worth noting that there is a great deal of variation when it comes to the average yield of those funds. This mostly depends on their risk profile. The fact of the matter is that some of them invest in strictly blue chip stocks with a very long track record of returning money to shareholders. Consequently, the average yield on those funds might be close to 3%.

On the other hand, there are those funds whose managers are willing to take more risk and invest in higher yielding stocks. As a result, their yields can be considerably higher, in some cases being near 6%, but on the downside, they face greater risk exposure.

Obviously, those yields mentioned above are for demonstrative purposes only, because they are subject to daily changes, depending on the market movements. However, these types of funds can be helpful investment vehicles for those market participants who want to receive monthly income on a regular basis.

Investing in High Dividend Yield Stocks – Key Takeaways

- The dividend yield measures the percentage of return investors receive for buying the stock in terms of payouts to shareholders. This indicator is calculated by dividing the total annual amount of dividends on the current market share price. Due to near-zero interest rate policies in developed countries, many investors moved on to the stock market in search of higher returns for their capital.

- The fact that some stocks offer high dividend yields does not automatically mean that all of them present risky investments. This will depend on several factors. One of the most important measures for this is the so-called payout ratio. This indicator shows the percentage of earnings the company distributes to shareholders. The general rule here is that if the payout ratio is below 80%, then those payouts are considered to be sustainable.

- Investors can also take a look at the past dividend payment history of the company, in order to get some idea about the firm’s track record of returning money to shareholders. The market participants can also analyze the average dividend growth rate, to see whether those payouts can catch up with inflation.