Table of content

It goes without saying that there are dozens of leading economic indicators and news releases which usually have a significant impact on the currency exchange rates. One of the important announcements which very often lead to higher volatility in the market is Consumer Confidence Forex indicators.

The reasoning for this is the fact that in nearly every country the household consumption is the largest component of Gross Domestic Product. For example, in the US the ‘Consumption’ component makes up more than 2/3 of GDP. Obviously, any change in consumer confidence and have a significant impact on their spending decisions. Therefore, changing levels of consumer expenditures can have a major impact on the GDP of a given country.

There are essentially 3 key economic indicators that measure the level of consumer confidence. The Consumer Confidence Index, also known as CCI, is one of the indicators that impact the Forex market. In the United States, this indicator is measured by surveying 5,000 households, regarding the past and future employment and business conditions, as well as about their household income. This indicator is measured and published by the United States Conference Board with monthly intervals.

Another important consumer confidence measure is the retail sales report. This can be a very valuable tool for analyzing the latest consumer trends since it is based on actual spending numbers, rather than on household surveys.

Finally, we have home sales reports. Obviously, buying a house is a major purchase for any individual. The majority of people most likely will not take this step, without feeling confident about their financial future. Therefore, rising home sales numbers point to increasing consumer confidence.

Consumer Confidence Economic Indicators that Impact Forex Market

At this stage, one might wonder how CCI is defined. Well, essentially this indicator takes the opinion of thousands of households and compares them to the base year. The CCI traders should be aware that the Conference Board asks for the opinions of survey participants on 5 issues:

- Current business conditions

- Current employment conditions

- Business conditions for the next 6 months

- Employment conditions for the next 6 months

- Total family income for the next 6 months

In order to make the report easy to quantify, the households have just 3 options to respond to those questions: ‘Positive’, ‘Negative’ or ‘Neutral’. After finishing the survey of all 5,000 households, the CB employees then sum up the results, in order to calculate the relative value of positive and negative answers. After making this calculation, the resulting ratio is compared to that of the benchmark year.

Here it is worth noting that the benchmark year which the US Conference Board has chosen is 1985. The rationale behind this was the fact that in terms of the economic performance of the country as well as in terms of levels of consumer confidence, this year was quite close to the long term average.

If the CB has chosen the year when the economy was booming, then the heavy majority of subsequent CCI publications would be much lower and therefore would be understanding the consumer confidence levels.

On the other hand, if the Conference Board has chosen the year when the country was in a recession, then the majority of future CCI reports would be considerably higher and by extension would be overstating consumer confidence.

Therefore, the CB has deliberately chosen the year of average economic performance, in order to avoid coming up with misleading results. The value of CCI for 1985 is fixed at 100. This means that if for example, the latest CCI reading shows 105, this means that the current consumer confidence levels are 5% higher than back in 1985.

How Economic Indicators Affect Forex?

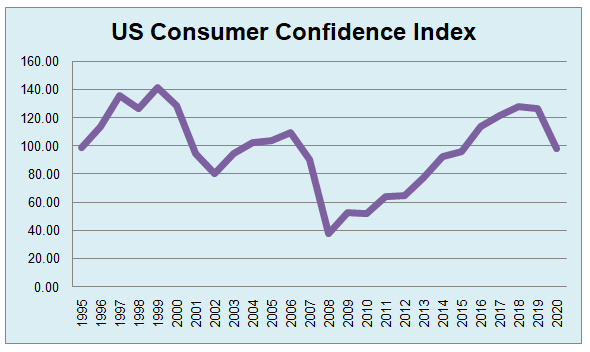

Due to the fact that the level of consumer confidence has a very strong influence on the Gross Domestic Product, this leading CCI indicator can often predict the upcoming economic trends in the nation. To illustrate this better let us take a look at this chart, which shows the changes in the US Consumer Confidence Index from 1995 until 2020:

As we can see from the above diagram, back in 1995, the US CCI stood very close to 100 mark. This means that the level of consumer confidence in the United States in 1995 was nearly the same as back in 1985. During the subsequent years, the US CCI has risen steadily and by 1999 has reached an all-time high of 140. This period was also accompanied by the persistent strength of the US dollar, with the American currency making massive gains against the British pound, the Euro, the Australian dollar, and some other major currencies.

The US CCI did face some pullback during 2000, yet the largest drop came during the next 2 years, as a result of which the index fell down to 80 level. One the recession was over, the US consumer confidence started to recover, eventually returning to 110 level by 2006. However, this recovery did not persist for long. As the credit crunch problem has entered the picture in 2007, the US CCI has simply resumed its downward trend.

The decline accelerated by the 2008 global financial crisis. At the end of this year, the index even fell below 40. This period of declining consumer confidence was accompanied by the weakening of the US dollar. From 2002 until summer 2008, the USD experienced a long term downtrend against other major currencies, including the Euro, the Pound, and the Australian dollar.

From 2009, the US consumer confidence started its lengthy recovery. As we can see from this chart, the gains were incremental and gradual, without any dramatic increases. As a result of this uptrend, by 2018, the index has already got above 120 level, reaching 130 in 2019.

During the same period, the US dollar started to make some steady gains against its rivals. The American currency got several times close to parity levels with the Euro, while at the same time reaching the multi-decade highs with the British pound.

At this stage, the CCI was very close to taking out 1999 all-time highs. However, it was not to be. The outbreak of the COVID-19 pandemic led to a significant decline in consumer confidence during 2020. From 131.6 in January 2020, the CCI dropped all the way down to 86.6 by May 2020. Yet, as we can see from this example, the scale of the collapse in consumer confidence was much smaller here than back in 2008.

Despite this decline, the US consumer confidence has started to rise again, reaching 98.1 by June 2020. This sharp recovery suggests that the 2020 economic downtrend might eventually prove to be short-lived. However, at this stage, it might be still early to come up with exact predictions.

During the last two decades, the US experienced periods of recession, each starting from 2001 and 2008. As we can observe from the diagram, in each case those developments were preceded by the massive decline in the major CCI Forex indicator. Therefore, as we can see from this example, the Consumer Confidence Index can have a significant predictive value, when it comes to forecasting the economic performance of the country.

This is exactly why the latest releases of CCI Forex announcements are typically accompanied by the elevated degree of volatility in the currency exchange rates. The reasoning for this is the fact that nowadays nearly all major developed economies are heavily dependent upon the level of household consumption.

In the case of the US economy, during the last several years, the consumption component has accounted for more than 67% of GDP. Therefore, when the Forex Consumer Confidence Index falls dramatically, it is likely to be followed by the declining GDP growth rates as well.

Market Reaction to Consumer Confidence Index Announcements

In order to illustrate how those types of economic indicators are affecting the Forex market let us take a look at this 1-minute EUR/USD chart:

As we can see from the graph, the pair was trading around $1.1227 level at the time of the release of the latest US CB consumer confidence index. The previous release showed CCI at 85.9 level, a significant decline compared to January 2020. The Analyst consensus for this announcement stood at 91.8. This suggests that the market analysts were already expecting a significant improvement in the index. When the actual number came out it showed CCI to be at 98.1. Therefore, the results have considerably exceeded market expectations.

The initial results after the publication of this report were quite predictable. The EUR/USD pair started to decline and fell all the way down to 1.1190 level, after losing 37 pips. However, as we can see from this chart, later in the day, the Euro has started to recover and eventually stabilized around $1.1249 level.

Now the fact that the US dollar made some gains after the release of the report is not surprising. This showed that the process of collapse in the US consumer confidence has been halted and now CCI started to recover considerably. However, how can one explain the subsequent appreciation of the Euro?

Well, in fact, we can come up with at least 3 possible explanations. Firstly, it is important to keep in mind that there are also other economic indicators Forex traders should be aware of besides CCI. Things like interest rate decisions, unemployment rate, GDP numbers all have their impact on the currency exchange rates.

Here it is also important to remember that just like with any other economic indicators when it comes to analyzing a given currency pair, we should take into account the latest developments with both of those currencies. Therefore, basing our analysis of EUR/USD solely on US consumer confidence figures can be misleading. Here it is worth noting that the Eurozone CCI has also improved considerably, rising from a multi-year low of -22.00 to -14.7, which does represent a substantial improvement.

Finally, many Purchasing Power Parity measures, including one published by the Organization for Economic Cooperation and Development (OECD) and the British financial journal ‘Economist’ have pointed at substantial undervaluation of the Euro against the US dollar.

The PPP essentially shows the exchange rate at which the average price of goods and services will be equalized among the two given nations. The Purchasing Power Parity theory suggests that despite some periods of divergence, the exchange rates will mostly gravitate towards the PPP level. Considering the current Euro undervaluation, it is not surprising that the single currency recovered and made some notable gains in the process.

Impact of Retail Sales on Forex Market

Another item on our leading economic indicators list is the retail sales report. This is also published on a monthly basis. This indicator calculates the total volume of sales at the retail level. On the Forex economic calendars, this news release is usually expressed as a percentage change compared to the previous month.

Actually this is where the retail sales differ from other important Forex economic indicators. For example, in the case of the consumer price index (CPI), the headline number shows the percentage of change compared to the same month of the previous year.

For example, the US CPI for June 2020 stood at 0.6%. This means that the average price levels for the basket of consumer goods and services in June 2020 were 0.6% higher than back in June 2019.

Now the principle of calculation of the headline retail sales report is quite different. The latest report has shown a 7.5% increase in June 2020. This means that the volume of retail sales during June 2020 was 7.5% higher than in May 2020, instead of June 2019.

The reasoning behind this is the fact that the retail sales report is some of the more volatile Forex trading economic indicators. The main point of analyzing the retail sales indicator is that it can provide traders with early signs of consumer spending trends.

Since the household consumption accounts for around 2/3 of US GDP, even relatively small changes in the consumer spending levels can have a significant impact on the rate of the economic growth of the country. Therefore, traders and financial analysts need to analyze the latest trends in retail sales, instead of focusing on how the situation has changed during the last 12 months.

The second reason why retail sales are one of the most important economic indicators for Forex traders is the fact that it is based on actual consumer spending numbers, rather than relying on surveys. Obviously, the consumer confidence index can provide some valuable insights into the latest economic trends. However, it is entirely based on opinions, something which can change dramatically in relatively short periods of time.

On the other hand, the retail sales indicator can provide traders with more reliable information. This gives traders and analysts some actual figures to work with, before the GDP and other economic announcements come out.

Influence of Home Sales Reports on Forex Market

The home sales report is yet another major economic indicator Forex traders should take into account when making the trading decisions. Actually, there are two sets of reports, when it comes to this indicator. There are new home sales, which takes account of all newly built homes which were sold. Also, we have the existing home sales report, which covers the rest of the homes in the market. Obviously, the latter report is more important than the former, since it covers a large number of sold homes.

In order to illustrate the impact of this indicator on the market, let us take a look at this 1-minute GBP/USD chart, which covers the price action of the pair before and after the release of US existing home sales report:

As we can see from the above diagram, just before the release of this announcement, the pair was trading at $1.2727. The initial reaction of the market was the significant decline of the GBP/USD pair, as a result of which the pound dropped all the way down to $1.2644. However, once this initial selloff was over, the British currency gathered some strength and eventually returned to $1.2727 level.

As for the report itself, the previous release showed that the number of existing home sales during the month in the US has reached 3.91 million. For this latest report, the analyst consensus expected the figure to be around 4.78 million. When the actual announcement came out, it showed the number of existing home sales at 4.72 million. This was obviously much higher than during the previous months.

This outcome has clearly demonstrated the rise in the US consumer confidence and underlined the possibility of a relatively speedy recovery of the American economy from the damages of the outbreak of the COVID-19 pandemic. This is why the initial reaction of the market was the strengthening of the US dollar.

However, the obvious question here is: how one can explain the subsequent recovery of the pound exchange rate? Well, actually there can be several possible reasons for this.

Firstly, it is worth noting that despite all the progress, the latest existing home sales report did miss the analyst consensus figures. The difference was quite small in percentage terms, however, for many traders missing the forecasts is still a significant sign of the weakness in the economy.

The second possible reason for this move is the fact that after the 2016 European Union membership referendum in the United Kingdom, the pound fell dramatically and remained at the oversold territory for an extended period of time.

In fact, as the latest reports from both OECD and the ‘Economist’ suggest, at the moment the pound is even more undervalued against the US dollar than in the case of the Euro. For example, according to the latest report, published by the ‘Economist’, using the raw price data, the pound is 25% undervalued against the US dollar. As the same source suggests, if we adjust PPP levels according to the GDP per capita, then the GBP will still be 11% undervalued against the USD.

Therefore, it is not surprising that some traders and investors decided to take advantage of this discount and purchased the British currency, hoping to profit from the potential appreciation of the pound.

Finally, it is worth noting that in terms of interest rate differentials, the British pound and the US dollar are at very similar levels. This is indeed one of the most important economic indicators Forex traders should keep in mind. In fact, those differentials were arguably behind many significant moves in the market.

However, the difference is very small. The Bank of England keeps its key interest rate at 0.1%. At the same time, the US Federal Reserve keeps its rates within 0% to 0.25% range. Now if we take the midpoint of this range, the difference between US and UK nominal interest rates is just 2.5 basis points in favor of USD, which is obviously very small. Therefore, the current state of affairs promotes a stalemate, rather than a serious move.

Consumer Confidence Economic Indicators and Monetary Policy

Before moving on to the concluding remarks, it is important to discuss the impact of those consumer confidence indicators on monetary policy. Firstly, it is important to mention that so far no central bank has adopted any target for the Consumer Confidence Index, retail sales, or existing home sales. It goes without saying that this is highly unlikely in the foreseeable future as well.

After all, nearly all central banks have some target for the inflation rate. If any of their governments decide to expand their mandates, it is more likely that they will focus on the rate of unemployment or GDP growth, rather than turning to relatively less important indicators as CCI.

However, this does not necessarily mean that the policymakers at the US Federal Reserve and other central banks simply ignore the latest consumer confidence indicators. In fact, they take note of the latest developments in this area of the economy and it even can have some influence on the decision-making process.

The reasoning for this is the fact that for the central bank’s monetary policy to be successful, policymakers have to make the interest rate and other policy decisions in a timely manner. Deciding on a 0.25% rate cut, when the economy is already deep into the recession is not a very effective way to manage monetary policy.

The fact of the matter is that some of the most important economic indicators in trading, such as GDP and unemployment figures are usually released several weeks or even months after the relevant period has ended. Therefore, central banks can not simply rely on those publications in order to make informed decisions. Consequently, they take a look at those indicators, which provide early signs of the latest trends in the economic activity, such as CCI, retail sales, and home sales announcements.

So, for example, if the latest consumer confidence index drops dramatically, with the retail and home sales also declining, the central bank might decide to already start cutting rates gradually, before this latest economic downturn will be confirmed by falling consumer price index, unemployment, and GDP figures.

On the other hand, if the consumer confidence index is rising, with strong retail and home sales, this can give the policymakers enough confidence to raise the key interest rates. So this is why the latest consumer confidence numbers not only have a significant influence on the market sentiment but also can have a notable impact on the decision making the process of some central banks.

Consumer Confidence Indicators That Impact the Forex Market – Key Takeaways

- Consumer confidence announcements are one of the economic indicators traders can use in the decision making process. One of the most famous of such indicators is the consumer confidence index (CCI). In the United States, this report is published on a monthly basis by the US Conference Board. CCI is compiled by surveying 5,000 US households about the past and future business and employment conditions, as well as regarding the household income. The benchmark year for CCI is 1985.

- Retail sales is yet another economic indicator, which by its definition is an important measure of the consumer confidence in a given country. Instead of focusing on the opinions of the households, just like CCI, this indicator shows the actual volume of retail sales during the specific period. On the other hand, similarly to the consumer confidence index, the retail sales report is published on a monthly basis. Instead of expressing the change during the last 12 months like CPI, the retail sales report displays a percentage of difference compared to the previous month.

- Forex rates are also influenced by another set of consumer confidence economic indicators as well. The new home sales and existing home sales reports show the latest developments in the real estate market. Obviously, purchasing a home is a major financial decision for households. Therefore, the rising number of home sales can be a major sign of rising consumer confidence. On the other hand, the collapsing number of home sales can be an early indicator of the upcoming recession.