Table of content

The basic idea of successful Forex trading is to identify trading opportunities and capitalize on them. One of the logical ways to achieve this is to identify undervalued currencies and open long positions with those in order to profit from its potential appreciation. Undervalued currency meaning is that it involves currencies that trade below their fair value.

Here it is worth noting that there is no one universal rule for measuring fair valuation of currencies. However, many professional Forex traders and financial experts agree that there are at least some signs which can help market participants to analyze whether the given currency is trading above or below its real value. In this article, we will discuss 3 key undervalued currency identifying methods.

Obviously, when it comes to the Forex valuations there are dozens of tools and measures available to traders. However, those 3 indicators are quite simple to understand and easy to quantify, so that is why we will focus on them instead.

When it comes to searching for most undervalued currencies, it is worth noting that the trade balance can have a major impact on the long term movement in the Forex market. This measure essentially represents the balance between imports and exports of a given country. If a nation exports more than it imports, then economists call this trade surplus. If the opposite is the case then it is called a trade deficit.

An expanding trade surplus is one sign of a potential undervaluation of currency. The reason for this is the fact that when a country’s goods and services are in high demand abroad, this also tends to extend to its currency. As a result, this can have a significant influence on exchange rates.

The second important factor which can help traders identify undervalued currencies is the comparison of real interest rates. This is because investors and traders are always looking for those assets, which can help them to maintain the buying power of their capital and earn some decent returns in the process. Therefore currencies with high real interest rates typically tend to appreciate against their peers.

Finally, we have a Purchasing Power Parity (PPP) indicator. This measure identifies the exchange rate at which the average cost of goods and services will be equalized between the two countries. Currencies that trade below the PPP level are usually considered undervalued and have a potential for future appreciation.

Currencies with Trade Surplus

At this stage, many people might wonder what a trade balance has to do with the exchange rates. Well, essentially it helps the currency in two ways. As mentioned above, a given country is said to be running a budget surplus when it exports more than it imports.

When foreigners decide to import goods and services from a given country, they have to convert their currency into the local currency in order to access the products. As a result, this creates a natural demand for the currency in question. This is because those households and businesses do not buy this currency for speculative or investing purposes. Instead, they purchase those products because of their competitive price or quality.

Obviously, the Forex traders are not the only ones influencing the exchange rate market. Above mentioned individuals and corporations do have to go to Foreign exchange markets to obtain the currency they need in order to buy the desired goods and services. Those transactions also tend to be quite frequent and regular. The reasoning behind this is the fact that the majority of those products have rather short consumption timeframes, therefore they end up imported on a regular basis.

So in terms of the Forex market, when a given currency has a trade surplus, it means that on a daily basis there are a considerable number of market participants, who have nothing to do with Forex brokerage companies, but who buy the currency in question on a regular basis. This constantly creates a buying pressure for the currency and can lead to its long term appreciation.

The second major benefit of running the trade surplus is the fact that the net exports indicator is one of the four components of the Gross Domestic Product (GDP). However, unlike the rest of the three sections, consumption, investment, and government spending, this category can be represented by the negative numbers.

This means that if a given country is running a trade deficit it tends to take away some portion of the potential GDP. Therefore, this slows the rate of economic growth. This can become even worse if the trade deficit expands over the years and becomes entrenched because it can persistently reduce the GDP growth rate.

On the other hand, the amount of trade surplus is added to the GDP figures. This means that positive net exports promote higher rates of economic growth. Consequently, when a given country has a strong economy, this tends to support the strength of its currency. So as we can see, running a trade surplus can be very beneficial for the nation’s economy as well as for its currency.

How Trade Balance Affects Exchange Rates?

So the next logical question would be: Is there any undervalued currency example in the real-life Forex market? Actually, what we discussed before is not just an untested theory. Fortunately, we can test this analysis on the past exchange rates. For this purpose, let us take a look at this GBP/CHF chart:

As we can see from the image above, 3 years ago the pair was trading close to 1.24 level. During the subsequent months, the pound has risen steadily, until reaching 1.38 mark by April 2018. However, this show of strength was rather short-lived. After this development the GBP/CHF exchange rate settled into the long term downtrend, eventually dropping down to 1.18 level by July 2020.

This seems very surprising. After all, since 2014 the Swiss National Bank did nearly everything in its power to weaken its currency. SNB was the first central bank in the world to openly resort to negative interest rates, setting its key rate at -0.25% back in December 2014. However, in January 2015 the Swiss policymakers decided that this was not enough and went even further, cutting rates all the way down to -0.75%. From time to time the SNB also intervened in the Forex market to moderate the strength of CHF.

As a result of those policies, many Swiss commercial banks started charging their high net worth clients for holding deposits with them. As of 2020, most individuals who hold more than 250.000 CHF on their bank accounts are liable for a 0.75% charge.

Although, some banks did indicate that they will let some of their loyal customers store 500,000 CHF on their accounts without facing any charges. Obviously, those measures make a lot of sense. If the Swiss commercial banks went ahead and started charging all of their clients 0.75%, then most likely this would lead to an exodus of capital from those financial institutions. If this trend persisted, this process could have easily led to liquidity problems.

The result of those policies was the fact that despite all of its advantages, the Swiss franc became an unattractive currency for saving and investing for many individuals. For example, those high net worth individuals, who now have more than 500,000 CHF on the Swiss bank accounts, now have a very strong incentive to convert those sums to US dollars or some other currency. Paying at least 3,750 CHF per year for the privilege of keeping money in Swiss currency might make very little sense for many savers and investors.

During the same period, the Bank of England did raise its key interest rate to 0.75%. This policy remained unchanged for some time. However, after the outbreak of the COVID-19 pandemic, with all of its economic challenges, the British policymakers decided to reduce rates to 0.1%. It goes without saying that this is not a very impressive rate of return for market participants. However, clearly all of them would agree that 0.1% is still a better rate than -0.75%.

So logically, the British pound should have made some significant gains during those 3 years. At first, until April 2018 the GBP had risen considerably. However, for the rest of the period, the Swiss franc appreciated steadily and GBP/CHF fell consistently.

One of the logical explanations for this surprising development is the fact that Switzerland is running a massive trade surplus. Back in 2019, the Swiss net exports have reached 27.65 billion francs. In fact, the total amount of exports from Switzerland to the United States have doubled since 2011. On the other hand, the United Kingdom is running a considerably large trade deficit. So this might be one of the decisive factors, leading to the long term decline of the EUR/GBP rate.

Therefore traders can identify undervalued currencies, by checking the latest trade balance numbers of different countries. Nations that have expanded trade surpluses are more likely to benefit from the appreciation of their respective currencies.

Influence of Relative Real Interest Rates

It goes without saying that the trade balance is not the only factor that can point to undervalued currency effects. Another important indicator in this regard is the relative real interest rates. In general, it is a well-known fact that everything else being equal, high nominal interest rates tend to attract more capital.

The reasons for this are very simple. Investors and savers are always looking for a high return on their investments. Therefore, they typically tend to invest in those currencies which offer higher returns. However, for the sake of accuracy, it is worth mentioning that this might not always be the case.

One thing to note here is that market participants do want to maintain and potentially increase the purchasing power of their capital. For example, earning an 8% return seems quite impressive, especially in those days, when near-zero interest rates are quite widespread. However, even such a high return is no good for investors, if the annual inflation in the country is running at 9%.

This something which market participants do pay attention to. Otherwise, investing would not be so necessary and the majority of people simply kept most of their assets in physical cash. Besides the obvious security issues, most individuals do not do this, because they have no intention of losing the value of their savings to inflation. So the same principle applies when it comes to real interest rates as well.

Therefore, investors and savers do give preference to those currencies, which have higher real interest rates. This means that bank savings accounts, Certificates of Deposit (CDs), and other fixed-income instruments in that currency can better maintain its purchasing power and even potentially provide investors with some regular income.

This is one of the reasons why many emerging market currencies in the long term do not appreciate against the major currencies. It is true that the interest rates in those countries are much higher than the ones in developed nations. However, at the same time those major currencies also typically have much lower inflation rates, than ones from developing countries.

This means that they are much better at preserving their purchasing power. Therefore when it comes to relative real interest rates, currencies from many developed countries do not have much of the advantages over the world’s major currencies. Despite this reality, it is worth mentioning that this is not always the case. In order to tackle the problems of high inflation rates and currency depreciation some central banks in emerging markets do raise their rates considerably.

Consequently, sometimes we have cases when the key interest rates might even surpass the Consumer Price Index (CPI) in those countries and therefore its currency might become much more attractive not only for domestic but also for foreign investors as well.

Effects of Real Interest Rate Differentials on Exchange Rates

Moving on to some practical examples, to illustrate how does the real interest rates affect the Forex market we can take a look at this daily EUR/AUD chart:

As we can see from the above diagram the Euro has been in a slow upward trend since 2017 against the Australian dollar. 3 years ago, the EUR/AUD pair was trading close to 1.48 level. From the second half of 2017, the Euro has made some steady gains and as at the beginning of July 2020, it trades near 1.63 level with the Australian dollar. In fact, the pair had a short-lived spike into the 1.89 mark, however, as the market stabilized, the panic selling ceased and the pair returned to its former levels.

This means that during the last 3 year period, the Euro has gained 10% against the Australian dollar. Now, here if we take only the nominal interest rate into the account this development might be quite surprising. Here it is worth considering that by 2017 the Reserve Bank of Australia (RBA) kept rates at 1.5%. From 2019, due to weakness in the economy, the RBA started to reduce rates gradually. Finally, during early Spring 2020, due to the outbreak of the COVID-19 pandemic, the Australia policymakers finally decided to cut rates to 0.25%.

On the other hand, the policies of the European Central Bank were mostly unchanged during this period. After the reduction of the key interest rate to 0% during April 2016, ECB left it unchanged. So logically speaking this interest rate differential had to give a significant advantage to the Australian dollar in the case of the EUR/AUD rate. So then why do we see a 10% appreciation of the Euro?

Well, the answer to this question, might be in the inflation rates in the Eurozone and Australian economies. During the first quarter of 2017, the Consumer Price Index (CPI) in Australia stood at 2.1%.

In the course of the subsequent years, this indicator has experienced a notable degree of fluctuation, but as of the first quarter in 2020, it is at 2.2%. One thing here to keep in mind is the fact that in Australia, the government publishes its inflation reports on a quarterly basis, rather than with monthly intervals like the majority of other countries. Therefore the second quarterly figures will be published by the end of July 2020.

On the other hand, in comparison, the Eurozone inflation figures seem quite low. The latest flash estimate of Eurostat puts this figure at 0.3%. This means that the real interest rate of the Australian dollar currently stands at -1.95% and with the Euro, this indicator is at -0.3%. This gives the European currency a 1.65% advantage over the AUD and hence the appreciation of EUR/AUD pair.

Therefore, traders can identify currencies with the highest real interest rates and open long positions from them, in order to position themselves in a way to profit from their potential appreciation.

Currency Valuations with Purchasing Power Parity (PPP) Indicator

The Purchasing Power Parity indicator is very popular among Forex traders, as well as with some financial experts and commentators. This measure basically identifies an exchange rate at which the average prices of products in the two countries can be equalized.

The theory behind this is that when in a given country, prices of goods and services are lower than in other nations, this tends to make its products more attractive for importers. As a result, the market eventually addresses the imbalance and pushes the currency close to the PPP rate. It is obviously a long term indicator and might not be very helpful with short term trading. It is measured by the Organisation for Economic Cooperation and Development (OECD), as well as by British financial magazine the Economist.

This theory further implies that the currencies with lower inflation rates, then to appreciate against the ones with higher CPI rates. The reasoning behind this argument is that with low inflation rates the prices of goods and services in a given country become cheaper compared to other nations. This makes its exports more attractive and increases the demand for its currency.

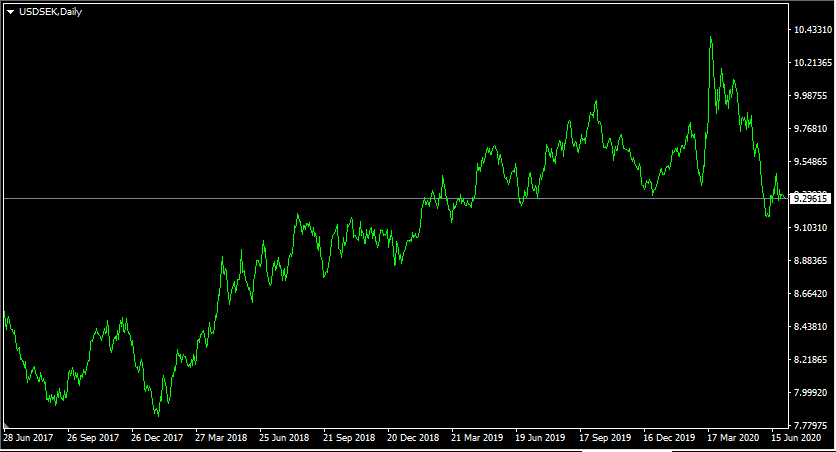

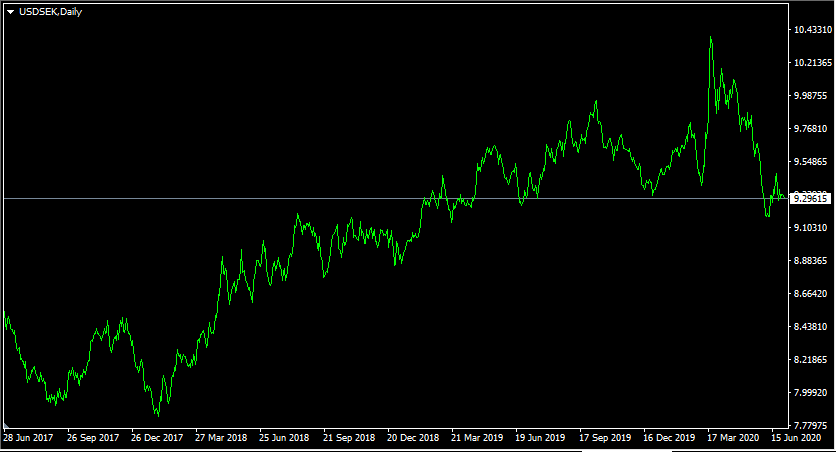

In order to illustrate how did the market react to the US dollar’s undervaluation with USD/SEK currency pair, let us take a look at this daily chart:

As we can see from this image, the Swedish Krone had a relatively strong showing during the second half of 2017, with USD/SEK eventually reaching 7.83. However, at this stage, the Economist’s latest publication about currency valuations have already shown that the Swedish Krona was already considerably overvalued and a fair value of USD/SEK was close to 9.30.

From early 2018, the US dollar has begun a steady appreciation against the Swedish currency, rising from 7.93 in January 2018 to 10.40 by the end of March 2020. This temporary overvaluation of the US dollar turned out to be very short-lived, as during the subsequent months the exchange rate of the pair moderated and returned to 9.25 by July 2020.

So as we can see from this example, sometimes predictions based on PPP valuations can be very accurate. However, this does not mean that exchange rates will always revert to PPP levels in a short period of time. Sometimes currencies might remain at overvalued levels for months or even years.

So the basic method of choosing currencies for trading here is simple. Trades can compare current market exchange rates with PPP rates and pick the ones that currently trade below those levels. This can be one practical method of composing the list of undervalued currencies.

Identifying and Trading Undervalued Currencies

- There is no one universally accepted undervalued currency definition. Instead, there are dozens of trading tools and economic indicators that can help traders with currency valuations. For example, currencies that have trade surpluses, higher real interest rates, and whose exchange rate is below PPP are likely to be undervalued.

- Currencies tend to benefit from trade surplus in two ways. When a country’s exports are higher than imports this creates a steady flow of capital into the currency and consequently increases its demand. Also, net exports are one of the components of GDP and therefore trade surplus increases the rate of economic growth.

- Relative real interest rates and purchasing power parity indicators can have a significant influence on the exchange rates. The reason for this is the fact that investors and savers are aiming to preserve the purchasing power of their capital. As a result currencies with higher real interest rates tend to appreciate against its peers.