Table of content

The fact that approximately 90% of Forex traders lose money, might convince some market participants that achieving successful trading is a very difficult task. Some people even might believe that Forex trading is only for the select few.

However, the reality of the matter is that traders can significantly improve their chances of success by avoiding some of the most common trading mistakes associated with Forex trading.

Those types of common errors include such things as using very high levels of leverage. This can dramatically increase the risk exposure of traders and can lead to some serious losses.

Some market participants also make the mistake of not utilizing Forex demo accounts and moving straight into the real accounts. The former helps market participants to get familiar with the trading platform, eliminate some of the amateur trading mistakes, and test Forex strategies, without taking any financial risks.

There are also traders who do not take rollover charges into the account. In the short term, this might be a small sum, but over time those types of interest expenses can certainly add up and consume a significant amount of trader’s capital.

In this article, we will discuss 10 easily avoidable Forex mistakes, which are very common in Forex trading. By eliminating those, market participants can certainly increase the winning ratio of the trades and even potentially increase their payouts in the process.

Trading Mistakes to Avoid in Forex

- So here is the list of top 10 common trading mistakes traders make on a daily basis:

- Using very high levels of leverage

- Not setting a risk/reward ratio

- Trading highly correlated currency pairs

- Not having monthly trading goals

- Start trading on real accounts without practicing on a demo

- Investing a large portion of trading capital in a single trade

- Not keeping a trading journal

- Risking more money than they can afford to lose

- Not utilizing stop-loss and trailing stop orders

- Ignoring potential rollover charges

As we can see each of those mistakes is connected with different aspects of trading. However, one thing in common is that they are quite easy to understand and guard against. Therefore, let us discuss each of them one by one in more detail.

Using Very High Levels of Leverage

Many experienced Forex traders and financial commentators call leverage as a ‘double-edged sword’. The reasoning behind this is quite simple. Leverage enables traders to magnify their returns on traders. At the same time, this can also increase the amount of potential losses.

For example, if traders invest $1,000 in a long USD/CAD position with 400:1 leverage and the pair rises by 0.25%, then they would earn $1,000 in profits. However, on the other hand, if the same pair fell by 0.25%, then the entire long position will be liquidated and traders will lose their entire investment.

So as we can see using very high levels of leverage can be very risky indeed. In response to this problem, regulators in some countries started limiting the maximum amount of leverage one can use in trading.

For example, in the United States in 2009, at the height of the global financial crisis, the US Commodity Futures Trading Commission (CFTC) introduced a regulation, which limited the maximum level of leverage at 50:1 for major currencies. For currency pairs, composed of minor and exotic currencies, the limit is set at 30:1.

In the European Union, the European Securities and Markets Authority (ESMA) decided to put the limit of 30:1 leverage for major currency pairs and 20:1 cap for minor and exotic currency pairs.

The main intention of those regulations was to reduce the risk exposure for Forex traders and protect them from heavy losses due to the use of high levels of leverage.

However, here it is worth noting that even with 50:1 leverage, it only takes 2% to move against the trader’s position, for it to be closed down and the trader loses all of his or her investment.

Therefore, it might be a good idea for Forex traders, especially beginners to use lower levels of leverage in their day to day activities. This move can certainly reduce their exposure and help them to survive the adverse market conditions.

Not Setting Risk/Reward Ratio

In general, many traders believe that in order to succeed in Forex trading one has to achieve the ratio of winning trades, which is higher than 50%. However, the payout market participants receive is not only dependent on this ratio. It also has a lot to do with the actual amount of profits and losses with each trade.

This is exactly where setting a proper risk/reward ratio comes into play. For example, if traders set the stop-loss order 50 pips below the current market price and take profit at 100 pips above the price with the long currency position, their risk/reward ratio will be at 2:1. Having this sort of ratio can be very beneficial for market participants. In this case, they can still earn some payouts if they only have the percentage of winning trades at 40% or even 35%.

Therefore, by not setting risk/reward ratios, traders lose the ability to have some edge in the Forex trading. For example, if a trader completes 4 trades, earns a profit of $200, $120 and $300 and loses $1,000 on respective positions, he or she will have a ratio of winning trades at 75%. However, overall, in terms of financial profits or losses, the trader will have a net loss of $320. The reason for this is very simple: the losses in one trade was much higher than all of those 3 winning trades combined.

This is why it is important to have a proper risk/reward ratio since this can certainly help traders to avoid those types of scenarios and improve their trading performance in the process.

Trading Highly Correlated Currency Pairs

Despite all of the volatility in the market, currency pairs do not move at random. In fact, some of them are highly correlated with each other. This means that they tend to move in the same direction.

Now, many experienced professional traders and financial experts advise us to diversify, not to put all eggs into one basket. However, if traders open the same positions with highly correlated currency pairs, they would not be reducing risks, but rather doubling it.

To illustrate this, let us take a look at two charts. The first daily diagram shows the price action of the AUD/USD pair for the last 3 years:

As we can see from the above image, 3 years ago the Australian dollar was trading close to $0.76 level. During the next subsequent months, despite some pullbacks, AUD has risen steadily, eventually reaching a $0.81 mark by January 2018.

However, despite this initial surge, the pair then settled for quite a long downward trend. From February 2018 the AUD/USD pair fell consistently. There were some short-lived rallies along the way, but those eventually faded after a couple of weeks of trading. This long downtrend lasted until March 2020, by that time, the Australian dollar fell all the way down to $0.57 mark, a level not seen in many years.

Despite those developments, as the US Federal Reserve reduced rates back to 0% to 0.25% range, the USD lost the interest rate advantage of the Australian dollar. As a result of this process, the AUD has started to recover and regain some of its recent losses. After months of steady appreciation, the Australian dollar now trades just below $0.70 level by early July 2020.

Now, let us compare this to yet another daily chart, which shows the exchange rate movements of NZD/USD during the same period:

As we can observe from the above diagram, the New Zealand dollar was trading at $0.74 level. After the initial drop in December, the pair recovered and returned back to the same $0.74 level in April 2018. However, after this point, the pair has settled for a long term downward trend. Just like in the case of AUD/USD, the downtrend here lasted until the middle of March 2020, taking the NZD/USD pair all the way down to $0.56 level.

The tide has turned during the second half of the month, as the New Zealand dollar started to gain some traction. As a result of several months of appreciation, the NZD has risen to near $0.66 level by early July 2020.

So as we can see the AUD/USD and NZD/USD tend to move in the same direction. Because of their high degree of positive correlation, it is not recommended to trade those two pairs simultaneously. For example, if a trader opens two long or two short positions with AUD/USD and NZD/USD, it will not be a case of diversification. Instead, an individual will simply increase his or her risk exposure. So this is something to keep in mind when trading.

Not Having Monthly Trading Goals

One of yet another familiar trading mistakes is not to set monthly goals for payouts for trading. Having a clearly defined aim has at least 3 very important benefits.

Firstly, it allows traders to maintain their motivations. The fact of the matter is that regular trading can be hard work for many people. Therefore, it is very difficult to keep the motivation, when one has no idea how much payout they are aiming for. One the other hand with those types of goals in place, traders can be more confident that their efforts can be rewarded with some specific amount of money.

The second important benefit of this approach is that this can help traders to maintain their discipline and avoid taking unnecessary risks in pursuit of higher profits. If a market participant has no idea about his or her monthly goals, then it is very difficult to avoid overtrading or making important trading decisions based on emotions.

Finally, having a monthly goal enables traders to keep track of their progress and keep themselves accountable. So for example, if a trader is constantly missing those trading goals, then it might be advisable to change trading strategies or adjust the amount downwards.

Start Trading on Real Accounts without Practicing on Demo Account

Some beginner traders, enticed with the prospect of earning some large payouts in Forex trading decide to move straight to real accounts. Therefore, they voluntarily give up the opportunity to practice on a demo account.

This is indeed one of the mistakes to avoid in Forex trading. Demo accounts have a range of benefits, which are too important to be ignored. Firstly, here traders can learn to control their emotions. Since they are not taking any financial risks with demo accounts, this lets market participants avoid emotional decision-making.

Instead, traders can focus on market analysis and open positions accordingly. After some time of practice, traders can get used to keeping emotions under control and use those skills when they move on to real trading accounts.

Demo account also allows market participants to test several Forex strategies and choose the ones which work best for them. Here they can also find out which currency pairs they are most comfortable with. This sort of information can be very handy when a trader starts trading for real money.

Investing Large Portion of Trading Capital in Single Trade

One of the very common mistakes Forex traders make is to invest a large portion of one’s trading capital in a single trade. When it comes to Forex trading, there is no such thing as a 100% ratio of winning trades. Even some of the most experienced professional traders have some losing positions from time to time. Therefore, in order to protect one’s trading account from suffering heavy losses, it makes a lot of sense to only invest a small portion of one’s trading capital in a single trade.

When it comes to the exact percentages, every professional trader and financial expert might have his or her own opinions on the subject. However, the general consensus here seems to be that traders should not invest more than 5% of their capital in a single trade.

For example, let us suppose that an individual has $10,000 on the trading account. After conducting some thorough analysis, the trader decides to invest the entire amount in a short EUR/GBP position, with 1:50 leverage. Let us further suppose that instead of falling, the Euro has risen by 1%. In this case, the trader will lose half of the invested amount, with only $5,000 remaining on his or her trading account.

Then let us take yet another example, where another individual also has $10,000 in a trading account. The trader also decides to open a short EUR/GBP position at 1:50. However, one difference here is that instead of investing the entire capital, the market participants only invest 2% of this sum, which is just $200. In the case of 1% appreciation of the Euro, instead of ending up with a $5,000, the trader will only lose $100, with $9,900 remaining on the balance.

So as we can see from this example, by investing only a small portion of the trading capital, traders can significantly reduce their risk exposure and guard against the potential losses.

Not Keeping Trading Journal

Keeping a trading journal can be a boring task for some traders. After hours of analyzing charts, researching the latest economic data, and executing traders, some market participants might find this to be an unnecessary burden.

So why do so many professional Forex traders talk about the necessity of keeping a journal? Well, actually the reasons for this are several.

Firstly, this helps traders to keep track of their progress. It is true that market participants might get some idea about their trading performance by looking at their account balance. However, with a trading journal, traders can monitor such things as the percentage of winning trades, average profits or losses per trade, the average time for holding the position open, specific currency pairs which were involved in those traders and so much more valuable information.

Traders also mention the specific strategies which he or she used for each trade. This has additional benefits. In this case, after some time, looking back traders can analyze which techniques were most effective for them in Forex trading. Here also market participants can go through their past mistakes and learn some valuable lessons from those.

Keeping a trading journal can be beneficial in a sense that, it promotes a disciplined approach to Forex. When a trader knows that everything needs to be recorded in the journal, he or she is unlikely to engage in emotional trading, or take some reckless risks in pursuit of unrealistically high profits.

Therefore, by not keeping a trading journal, traders are depriving themselves of all those benefits, we discussed above, which can be a major mistake.

Risking More Money than They Can Afford to Lose

Yet another trading mistake to avoid in Forex is to invest more money in trading then one can afford to lose. Some traders might use their rent money, grocery funds, or their entire savings account to fund their trading activities. Unfortunately, this can lead to several problems.

Firstly, it is worth noting that when traders take such serious risks with their personal finances, they are much more likely to make decisions based on their emotions. It goes without saying that this type of situation does not really promote a successful trading experience. Without proper discipline and control of emotions, traders are highly unlikely to earn some payouts on a regular basis.

The second obvious problem with this mistake is the fact that traders can lose those sums destined for rent or mortgage payments or other essential expenses. In this case, the failures in Forex trading can spill over into other areas of one’s life and can lead to stress as well as some practical problems.

Therefore, it is always a good idea for traders to have a separate savings account or other types of liquid instruments, where they will keep their emergency fund money, as well as some amounts for regular expenses.

With this type of approach, traders are much better positioned to keep their emotions under control. After all, in this case, they can be confident that even in the worst case scenario, they will be able to meet their daily needs as well as that of their loved ones.

Not Utilizing Stop-Loss and Trailing Stop Orders

Stop-loss and trailing stop orders can be a very handy tool for the purpose of proper risk management. By ignoring those, traders are exposing themselves to unnecessary risks. The fact of the matter is that even full-time professional Forex traders can not be in front of the screen, monitoring the market movements 24 hours a day.

So there always will be time, when the market is open, but a trader will not have the platform open. Without those two types of orders mentioned above, there is a risk that the exchange rates might make some major moves. Therefore, it is easy for the one to imagine a scenario, where traders might suffer some serious losses, due to their inability to respond to market developments in a timely order. Or, alternatively, this might cause a trader to miss some very lucrative opportunities to earn some decent payouts.

Fortunately, stop-loss orders are in place to protect traders for significant losses, even in times when they are not in front of the screen. Here market participants specify the price, at which they were willing to liquidate the position if the market moves against their trade. This allows market participants to minimize their losses.

The trailing stop order differs from stop-loss order in a sense that here the level, which triggers the sale, does not stay flat. Instead as price increases, it rises as well. This allows traders to earn a considerable amount of payouts with the given trade and only close the position when the market changes the direction.

For example, traders opened a long GBP/USD position at 1.2500, with the trailing amount of 20 pips. This means that if the pair drops to 1.2480, then this will trigger the trailing loss order and the position will be closed. On the other hand, if the pair rises to 1.2550, then the trailing order level will rise to 1.2530, 20 pips below the market price. So if at this stage, the market changes direction and falls to 1.2530, the position will be closed and the trader will end up with 30 pip profit in the process. Therefore, trailing stop orders can be a very valuable tool, which can allow traders not only to guard against heavy losses but also to take advantage of profitable opportunities in the market.

Ignoring Potential Rollover Charges

One of the new Forex trader mistakes is ignoring the potential rollover charges in the decision making process. When a trader buys a lower-yielding currency and borrows a higher-yielding currency and holds it open overnight, he or she has to pay daily interest to the brokerage company. If the opposite is the case, then it is the trader which receives daily interest payments from the broker. This is also known as rollover or swap.

Actually, it not one of the avoidable mistakes Forex day traders make. This is because those types of short-term traders typically close all of their positions before the end of the trading day. However, the rollover charges only apply to those who keep positions open for more than a day. Therefore, this type of mistake is mostly associated with swing or long term traders.

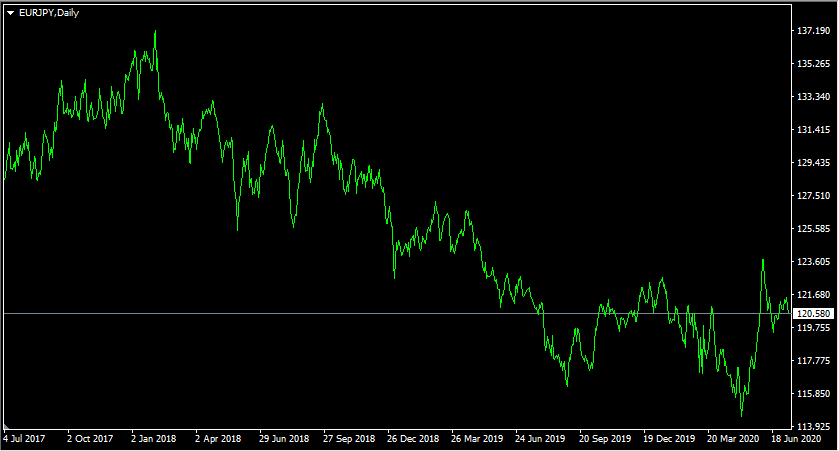

The obvious problem here is the fact that by ignoring the swaps, those types of charges can add up and consume a considerable amount of trader’s payouts. To illustrate this better, let us take a look at this daily EUR/JPY chart:

As we can observe from this diagram, by July 2017, the pair was trading near the 128 level. During the subsequent months, the Euro has risen considerably, eventually reaching a peak of 137, during February 2018. However, at this stage, this uptrend has ended, with the single currency entering into the long term downward trend. This tendency has persisted for more than 2 years, with the Euro dropping all the way down to 115 level, by May 2020. After this development, the single currency recovered, trading just above 120 mark during the middle of July 2020.

So as we can see from this example, from February 2018 until May 2020, the Euro fell by more than 16% against the Japanese yen. Therefore, theoretically, if somebody had a short EUR/JPY position during this period, should have earned some decent payouts. Consequently, some people might conclude that opening a long term short position on the pair is a very good idea.

However, there is a problem with this line of reasoning. Here it is important not to forget the fact that the Bank of Japan keeps its key interest rate at -0.1%, while the European central banks hold its main refinancing rate at 0%. It is also worth mentioning that brokers do have their commissions as well when it comes to rollover rates. This means that if the interest rate differential is 0.1%, then a brokerage company might add another 0.1%. So for each day of holding the short EUR/JPY position open, the trader might be charged with 0.2% interest on a daily basis.

Now if the downward trend continues, then the profits from this trade will more than offset all of those swap expenses, mentioned above. However, this is far from guaranteed. On the other hand, if the Euro stays flat or rises against the Japanese yen, then a trader has to cover those rollover payments from his or her own funds. Over time those types of expenses can certainly add up and can have a notable effect on trader’s earnings.

Therefore, it is always helpful to take those types of expenses into account, or alternatively, consider opening a swap-free account.

Common Forex Trading Mistakes – Key Takeaways

- There are many Forex beginner mistakes, traders make on a daily basis, which can have a major impact on their trading performance. Those mistakes include such things as using very high levels of leverage, trading highly correlated currency pairs, not setting a proper risk/reward ratio, and many others. Fortunately, it is relatively easy to identify and avoid those, which can certainly help traders to improve their trading performance and earn higher payouts in the process.

- One of the most common mistakes made In Forex trading is ignoring stop-loss and trailing stop orders. Obviously, no trader will be able to be in front of the screen, monitoring market movements for 24 hours on a daily basis. Therefore, those types of orders help market participants to protect their trading accounts at all times. Without those traders can suffer some serious losses or miss some very lucrative opportunities to close trades at profitable prices.

- Some Forex traders, especially beginners do not take rollover charges into the account when making trading decisions. Traders are charged with daily interest when they buy a lower-yielding currency and borrow in higher-yielding currency. With longer term trades, these types of expenses can easily add up to a considerable amount. Therefore, traders should take those fees into consideration, or alternatively get a swap-free account.