When you visit Finq.com, you’ll notice the website layout is quite appealing. However, before signing up, it’s important to consider additional factors. In this Finq.com review, we’ll delve into key features of the brokerage firm that can help you determine its legitimacy.

Understanding Finq.com Forex broker

Finq.com offers its website in various languages, including Urdu, Chinese, Tagalog, Thai, Vietnamese, Indonesian, Malaysian, and Arabic. Additionally, Spanish, English, Russian, and Albanian are available. According to the broker’s official website, residents of the EU, North Cyprus, Belgium, the USA, and several other jurisdictions are unable to open or operate an account on this platform. Compared to other FX brokers, Finq.com caters to a smaller section of the market.

The safety and security of the Finq.com

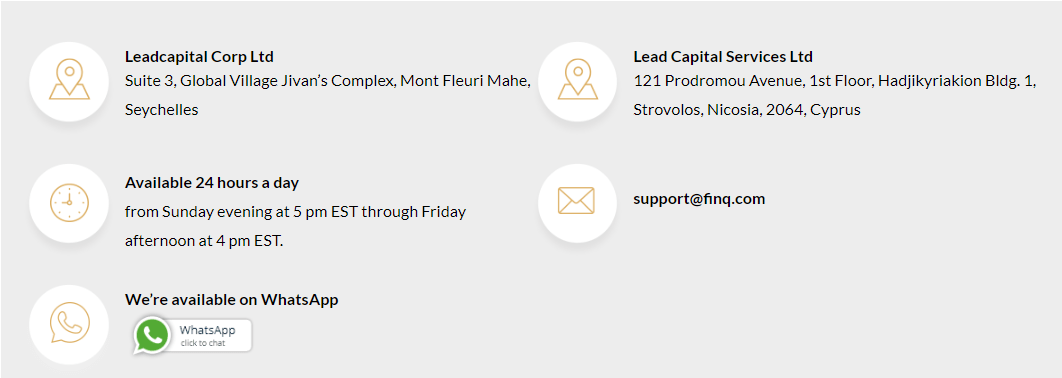

Established in 2014 by Leadcapital Corp Ltd (LCC), Finq.com Forex broker is regulated by the Seychelles Financial Services Authority (SFSA). Their license number is SD007. Leadcapital’s official offices are located in Mont Fleuri, Office Suite 3, Global Village, Jivan’s Complex, Mahe, Seychelles.

In Seychelles, it is not mandatory for a broker to have a physical presence in the country to acquire a trading license. Obtaining an SFSA license can be done online. However, the strictness regarding the segregation of customer accounts and protection of traders’ funds is not as rigorous here. It’s worth noting that the broker is part of a group of international FX companies regulated by reputable bodies.

Finq.com Fees and Spreads

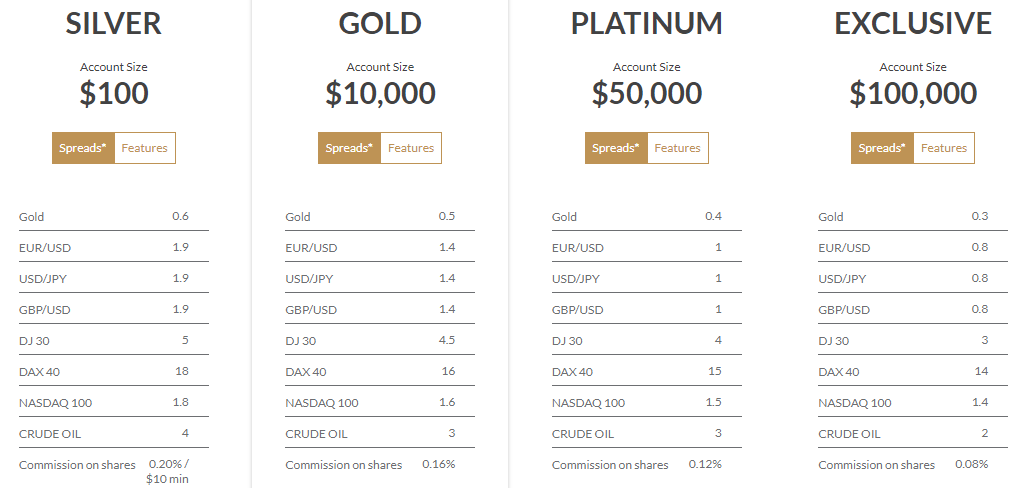

The broker offers above-the-average spreads from 1.9 pips, which is expensive. The industry average spread is 1 pip on major pairs. Some accounts offer 0.8 pips spread for the initial deposit requirement of at least 100 grand, which is a lot of money. The broker does a good job of offering its spreads though, which are listed below

- EURUSD – from 1.9 pips

- USDJPY – from 1.9 pips

- GBPUSD – from 1.9 pips

- DJ30 – from 5

- DAX40 – from 18

- NASDAQ100 – from 1.8

- CRUDE OIL – from 4

- Commission on shares – 0.20% ($10 min)

- Gold – from 0.6

You will have to open big stock CFDs volume positions to make up for the 10 USD min commission which is a downside. We will discuss trading accounts and their exact specs below.

Finq.com Accounts, Deposits, and Withdrawals

Finq.com offers a diverse range of trading accounts with comprehensive specifications. The spreads on standard accounts start at 1.9 pips, which can be considered expensive. To access a spread of 0.8 pips, the minimum capital requirement is beyond the reach of the average trader, starting from 100k USD. The transition from Silver to Gold requires an investment of almost 10k USD, which is a significant amount. Unfortunately, Finq.com does not provide trading accounts with 0 pips spreads, which is a major drawback. While swing traders might find the 1.9 pips spread acceptable, there are other brokers with lower spreads in the highly competitive Forex market. Additionally, the classic ECN and Pro ECN accounts offered by Finq.com still have relatively expensive spreads and require high minimum deposits of 1000 dollars.

Deposits and Withdrawals

Finq.com seems to lack transparency when it comes to deposits and withdrawals, as important information about exact methods and fees is not clearly and prominently disclosed. Users are required to navigate through numerous pages of terms and conditions to find any relevant details.

Supported options for depositing and withdrawing funds include Netteler, Skrill, Bank Wire, and cards.

The support team’s only suggestion was to search within the terms and conditions for further details.

For withdrawals, traders have the option of completing and signing a withdrawal form or an electronic withdrawal form. The funds will be credited back to the same bank account, credit/debit card, or other payment method used for the initial deposit.

Finq.com Trading Assets and Features

The broker provides access to stocks, indices, commodities, Forex pairs, cryptos, bonds, and ETFs. On Finq.com’s platforms, traders can find sterling, yen, euro, and dollar bonds. The web trader allows trading of a total of 39 ETFs, although this may be inconvenient for some. It would be beneficial if the broker offered all assets on desktop platforms, as they usually provide more functionality. On Finq.com’s web trader, traders can access over 2000 stock CFDs. Commodities, including soft and hard commodities and energies, are also available. Additionally, there are 7 indices, including major indices from the US, EU, and Asia.

MT4, web trader, and proprietary mobile app are provided as a trading platform. The majority of FInq.com’s assets are available only on the web trader, meaning traders won’t be able to use fully analyze the markets. In the case of MT4, everything is fine as it offers advanced chart analysis functionality.

In total, Finq.com has 2 platforms and mobile trading through their iOS and Android apps.

Finq.com Customer Support Review

Finq.com’s live chat is the easiest way to contact the support team. But they are unprofessional and have no clew about the company’s services. We were unable to find out exact details regarding deposits and withdrawals. The live chat has incorporated a bot that helps navigate and find topics or connect with support.

Other forms of support include email addresses and WhatsApp.

Finq.com Education

The broker’s educational resources include the web trader FAQ and New In trading sections. Traders can register for and start getting educated in Forex trading concepts through the New In Trading webinar. Whether you should rely on FInq.com’s education is another question. We can only hope it is a better experience than the broker’s customer support services. The FAQ section contains information about important details of the web trader.

Finq.com only offers an economic calendar as its research tool, which is not enough to help traders.

Should you consider Finq.com?

Based on our review, Finq.com is not recommended for our readers. The broker has expensive spreads, high minimum capital requirements, and a lack of transparency regarding deposits and withdrawals. Limited research tools and unprofessional support add to the red flags about the broker.

We do not recommend this broker, as there are much better alternatives reviewed on our platform.

Is Finq.com a good broker?

Is Finq.com a regulated?

What are deposit and withdrawal options?