Alvexo which is owned by HSN Capital Group Ltd was established in 2014. According to the official site, Alvexo specializes in global financial markets. It continues to state that traders can trade in currency and CFDs in a safe environment.

The firm was founded by a team of market veterans and hi-tech professionals in 2014. In this Alvexo review, we take a deeper look to help us determine whether you should invest with them or not.

The Safety and Security of Alvexo

Seychelles Financial Services Authority is the sole regulator of Alvexo, which indicates a downgrade from two regulators including CySEC to just one. Seychelles is an offshore regulator, meaning it is not as strict as other highly reputable ones. Because of this, safety remains a concern. We consider this a red flag about the broker’s safety and security.

The good thing about being licensed and regulated by bodies such as CySEC and FCA is that your money is protected. Even if the firm were to go down, you can rest assured that you will not lose all your money. But as we have discovered in this Alvexo review, just because a firm is licensed doesn’t mean that everything is smooth and above board at the firm. Some clients complain that it is hard to withdraw money and some have even resulted in asking help from chargeback firms.

The broker employs segregated accounts and is part of the investor compensation fund.

Alvexo Fees and Spreads Explored

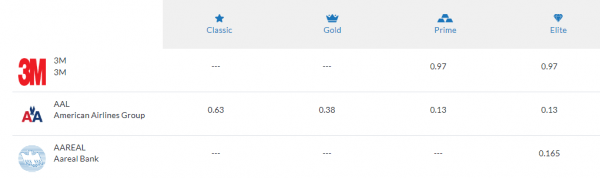

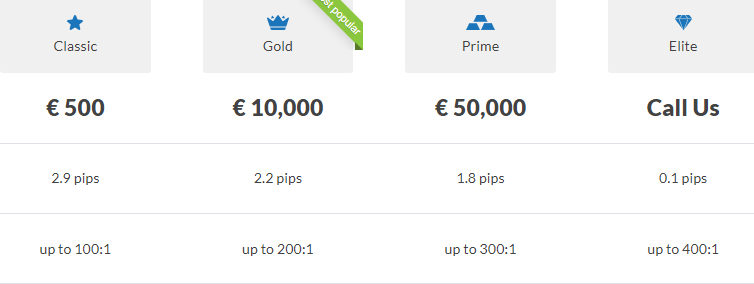

The broker fails in the spreads department as well. The spread starts from 2.9 pips on EURUSD which is way beyond the industry-accepted standard of 1 pip. To put it into perspective, when you buy 1 lot of EURUSD you pay 58 USD, which is a lot. Cryptos have relatively lower spreads compared to Forex, Alvexo offers spreads from 0.0035 for the ADAUSD pair. However, American Airlines Group’s spread starts from 0.63 on the classic account.

Alvexo does not charge commissions for stock CFDs trading, which we love to see from the broker. But since other spreads are high the broker has a lot of work to do.

Accounts, Deposits, and Withdrawals at Alvexo

The broker has four trading account types which are named Classic, Gold, Prime, and Elite. As we can see, the classic accounts come with huge spreads from 2.9 pips which is just ridiculous.

The first thing that you will notice when you visit the Alvexo website is that it is colorful but simple and well laid out. Further perusal and you will find that opening an account with them is easy. However, the minimum initial deposit that you can make is $500. According to many Alvexo reviews, both professional and from traders, this amount is just too high. Many Forex brokers ask for a much less initial deposit. Some brokers with reputable brands ask for as little as $50. Given that a good number of traders lose their entire initial capital outlay, one can see why depositing $500 with Alvexo is risky for a newbie. Moreover, a huge number of beginner traders can’t afford or don’t want to risk $500.

Deposits and Withdrawals

Alvexo mentions only two payment options Nuvei and Paynt, which is a very low number of options.

Trading assets and features of Alvexo

The broker provides a wide range of trading assets, which may vary depending on your type of trading account. For elite accounts, the available assets include Currencies, Commodities, Indices, Bonds, Europe & US stocks, as well as Cannabis stocks. On the other hand, classic accounts have access to Forex, commodities, and indices. All this information makes us question which is Alvexo’s main audience. It’s not an average trader or beginner. Considering the leverage, spreads, and initial deposits structure the broker is targeting professional traders with significant capital at their disposal.

Trading Signals

Alvexo offers trading signals for free, which is nice and good, but with the spread of 2.9 pips good luck using them to your advantage.

The trading platform

Alvexo FX broker offers its customers proprietary trading platforms. For those who are looking for functionality, Alvexo web trader will not be sufficient. For those who value accessibility, then WebTrader is the platform to pick. Smartphone users have the Mobile App to execute their trades. Alvexo trading platforms come with limited capabilities and traders will need other platforms to analyze markets.

Alvexo Customer Support Review

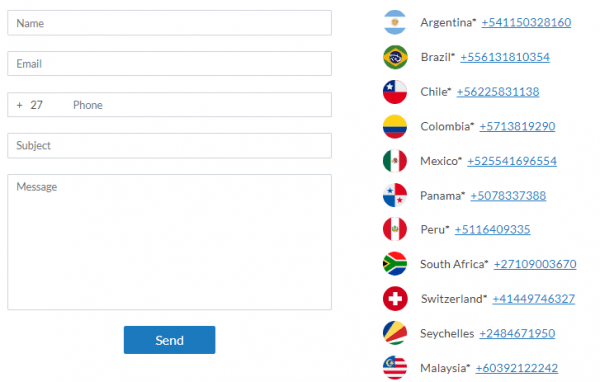

The broker does not provide a live chat, immediately raising a red flag for our team. But since the broker tries to target advanced traders, the main focus may be on phone and email support options.

Broker’s focus on the phone numbers solidifies our argument of pros being the broker’s main target audience. Alvexo provides an online form, to leave a message to the broker.

Alvexo Education

The company provides diverse educational resources consisting of a trading academy, webinars, Financial Web TV, eBooks, and a blog. Trading Academy is a starting point for beginners, webinars come with pro lecturers, and blogs provide a huge knowledge base about Forex trading.

Ebooks are a gimmick consisting of monthly analyses from the company. Traders will learn nothing from these books. The webinars are offering the most value from the list of educational resources.

Should you consider Alvexo?

In conclusion, we can say that Alvexo is a legit broker with high spreads, few withdrawal options, and high initial deposit requirements. While the broker won’t scam you, we do not recommend them to our readers.

Is Alvexo a safe and secure broker?

Is Alvexo a good broker?