Trading.com is a new Forex and CFDs brokerage that is operating in the UK. The company seems ambitious and dedicated to delivering products in the UK to younger generations. As we all know, the UK FCA is a very strict regulator and the broker will have to adhere to its regulations and guidelines. To understand how well Trading.com is navigating into the complex UK market let’s conduct a full review.

Trading.com was a big surprise for everybody involved in the financial markets. Both the traders and competitor companies did not expect the new brokerage to appear so quickly. During our last review, trading.com was still in the development phase. There was very little information about the company available on their website. There were only small hints from which we could guess what the final product would look like. For now, the website is full of necessary information and is well designed with intuitive and simple design and features. Everything seems in its place and order now.

Trading.com – For a new generation of traders

After contacting the broker and asking a few questions, it turned out that Trading.com is an XM subsidiary. The main focus of the company is to make trading simple by providing all important services and information to their traders. The company tries to adapt to new world developments with simplicity and focus on the key points only. But this does not mean to offer poor services, not at all, what trading.com offers is very refined and attractive trading conditions.

Once we found out about this very important detail, making a Trading.com review became much smoother and easier.

Let’s look into the teaser video that covers the whole webpage when we visited it, and try to piece together a comprehensive business plan as much as possible.

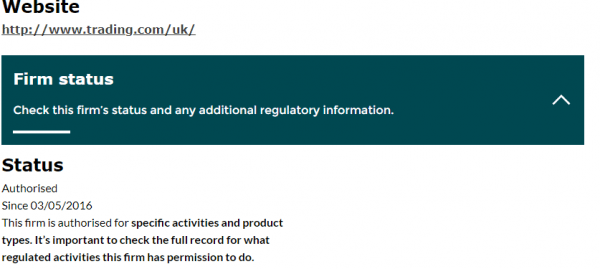

The safety and security of the Trading.com

The broker holds the UK’s Financial Conduct Authority or FCA license. The FCA is one of the most reputable and reliable regulators in the world. Having its license skyrockets any broker’s legitimacy right away.

The broker adheres to FCA guidelines in fair client treatment policies including negative balance protection, segregated accounts, and investor compensation fund. With these policies, the clients are guaranteed to be treated fair and their funds are safe.

Trading.com Fees and spreads

Last time we checked the broker there was not much information about exact spreads, commissions, and other fees. But now every little detail is presented on the broker’s website and is easy to find.

The spreads on major pairs of EURUSD start from 0.6 pips which is way below the industry average of 1 pip. This is for commission-free trading and enables traders to deploy even scalping strategies. The inactivity fees are monthly 15 USD plus 5 USD for each month the account has been dormant after 12 months of inactivity. After 5 years the company will disable the account and will pay the client the amount which was on the balance in case the client contacts the broker. All in all very friendly inactivity policies are in place.

There are no deposit and withdrawal fees charged by the Trading.com broker.

Trading.com Accounts, deposits, and withdrawals

There is only one trading account addressing all types of traders from scalpers to day traders called Ultra-Law Account. The account comes with ultra-low spreads as its name suggests and is great for all kinds of trading. The leverage as per FCA regulations is capped out at 1:30. Traders can select between 1:1 to 1:30 which is great. this account is also commission-free meaning it offers trading terms similar to zero spreads. While spreads are a bit higher the overall commission-free trading should account for a similar experience. Islamic account is possible with the same account type as there are no commissions and the minimum allowed lot size starts from 0.01 which is very good for beginners with small budgets. Hedging is allowed. There can be 200 trading positions opened at any time and account base currencies are EUR, USD, GBP, CHF, AUD, PLN, and HUF.

Deposits and Withdrawals

The processing times for withdrawals are under 24 hours which is fast. deposit and withdrawal methods include wire transfer, Visa and MasterCard, and online payment systems which we were unable to get the exact list of. When withdrawal is requested the initial deposited amount is made through the method which was used for the deposit and only profits can be withdrawn with the preferred payment method freely. Meaning if you deposited 50 USD via credit card and made 50 USD profit, after requesting to withdraw all 100 USD the broker will transfer 50 USD to the card and the other 50 USD to your selected method. This information is provided in the FAQs section and is not freely available on the website. As it seems the broker is still learning and growing and are adding new features regularly.

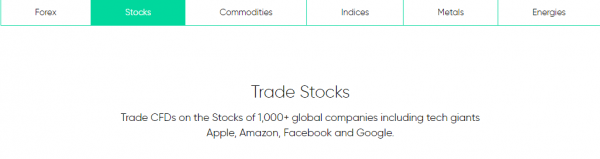

Trading assets and features of Trading.com

Forex pairs, stock CFDs, commodities, indices, metals, and energies are all included in offered asset types by trading.com. The total amount of trading assets is above 1000 CFDs similar to Xm.com. After all the broker is a subsidiary of the XM broker. To be more specific the number of only stock CFDs is above 1300 making total trading instruments around 1400-1500 which is a huge number. Everyone should be able to find their favorite asset class and instrument in this list. The only downside is the absence of cryptos and digital currencies are becoming very popular, but since the UK is about to regulate cryptos as well, this lack of cryptos is understandable.

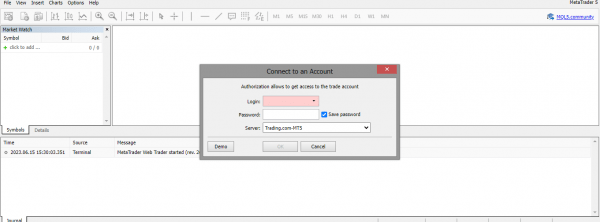

Trading Platforms

The primary trading platform offered by Trading.com is MetaTrader 5 (MT5). MT5 is an advanced trading platform with numerous advanced inbuilt features and countless indicators. MT5 is offered in all forms and favors covering all the available devices and systems on this planet. We Trader is for web browsers and offers somewhat similar features to a desktop variant, while the mobile app was recently updated and is modern in design and features. Mobile MT5 apps allow traders to analyze and trade markets on the go with inbuilt technical indicators and analysis tools.

Trading.com Customer Support Review

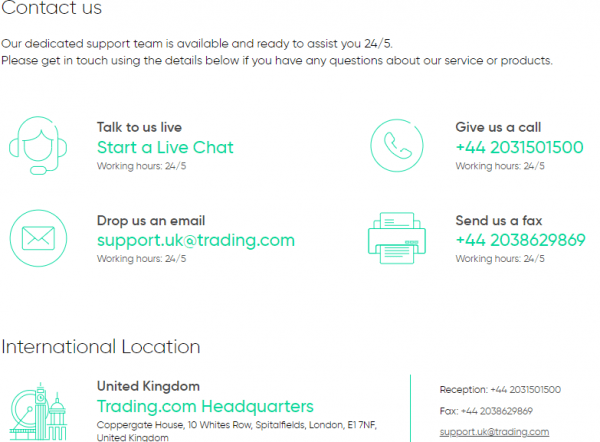

Trading.com excels in customer support by providing advanced live chat. It is worth mentioning that many UK-based brokers lack this feature. Live chat is the easiest and most comfortable way of connecting with broker support directly. It requires only a web browser and the internet. It is very surprising that the Trading.com website is available in 10 different languages, the support is also multilingual offering support in many languages.

Other support methods include hotline support, email support, and offices that can be visited. The support is online 24/5 providing assistance during active market sessions.

Trading.com Education

The broker is working to offer various educational resources including a trading glossary and trading guide. We do not have an exact release date for these materials, but it shows how the broker is working to improve their services and website which is definitely a very positive sign.

As for market research tools, there is an economic calendar to track fundamental indicators and make informed decisions. There are numerous calculators to help novices calculate important details about their potential trading positions.

Should you consider Trading.com?

Trading.com features the software for every device, desktop, tablet, and smartphone as well.

Another feature that caught our attention was the Trading.com Ultra-low account, which seems to be specifically designed for beginners as the video goes on about tapping into the new generations of traders.

Overall, Trading.com could prove to be XM’s way of incorporating the younger generation of customers on its platform. they’d train them on Trading.com, and once they’ve gained some experience, entice them to transfer over to XM’s main trading platform.

Once again, the Trading.com scam is not a reality, therefore, you can rest easy if the video got you interested. But if you’re a veteran trader, then Trading.com may not be the best alternative, according to our assumptions from the video.

However, it does seem to be the perfect place for beginners. XM was already welcoming to rookie traders, but they seemed to have created an even more comfortable platform.

The broker is trying to refresh UK’s brokerage scene and target the younger generation of traders and they seem successful in achieving this goal. We recommend Trading.com to our readers.

Is Trading.com a regulated broker?

What are the trading fees and spreads offered by Trading.com?

What trading assets are available on Trading.com?