We do not often have an opportunity to present a broker company coming from Africa. The growing popularity of forex trading in the entire world means that Africa is also active when it comes to financial transactions. However, brokers from Africa are still relatively young, and they lack the integrity or experience to make a significant impact on the global market. Our Rally trade review will explore the essential features of this broker company coming from Nigeria.

Rally Trade – A Quick Glance

Traders who are willing to invest their funds in Forex trading should always perform extensive research about their new broker. That is why we provide our readers with an in-depth study of the company in question. We put a lot of effort into discovering a potential Rally trade scam.

For example, we learned that this broker was established in November 2016, and it is under the ownership of “FRNG Nigeria.” Rally Trade has offices in London as well, and allegedly – they are licensed and regulated under the number RC 1288748. However, their website does not mention which regulatory body performed the inspection, and this is a definite cause for concern for anyone who considers investing their hard-earned funds with this unreliable broker.

Other important features of the Rally trade Forex broker

Even though some Rally trade reviews refer to this broker as the “best newcomer in the region,” we do not share their enthusiasm in this regard. First of all, the lack of a license is a serious issue, and a license from some Financial Commission in Hong Kong is not a strong guarantee. Also, the African financial market still lacks a coherent legal framework when it comes to financial activities and operations. That is why we urge our readers to pick a broker that complies with the regulations stated by MiFID, or some other similar legal authority.

The Safety and Security of Rally Trade

The broker is a member of the Financial Commission since 2016. Financial Commission provides brokers and their customers with 3rd party mediation and that’s it. There are no strict regulations and oversight. This is still better than not having any license at all but provides very little defense against fraud.

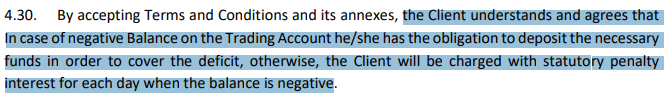

There is no negative balance protection and clients will be into debt if they go into minuses. Not only will they be eligible to fund all the negative balances, but the company will charge extra penalty fees for every day if the deficit is not covered. This is a huge red flag. The broker can use its membership in the Financial Commission to force clients to cover both deficits and penalties. Stay away from this broker!

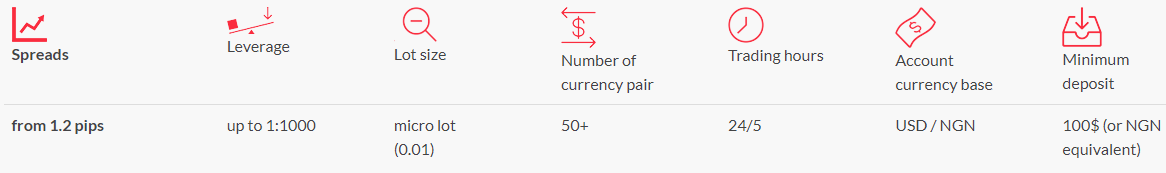

Rally Trade Fees and Spreads

The broker charges inactivity fees of 10 USD per month after 6 months of dormancy.

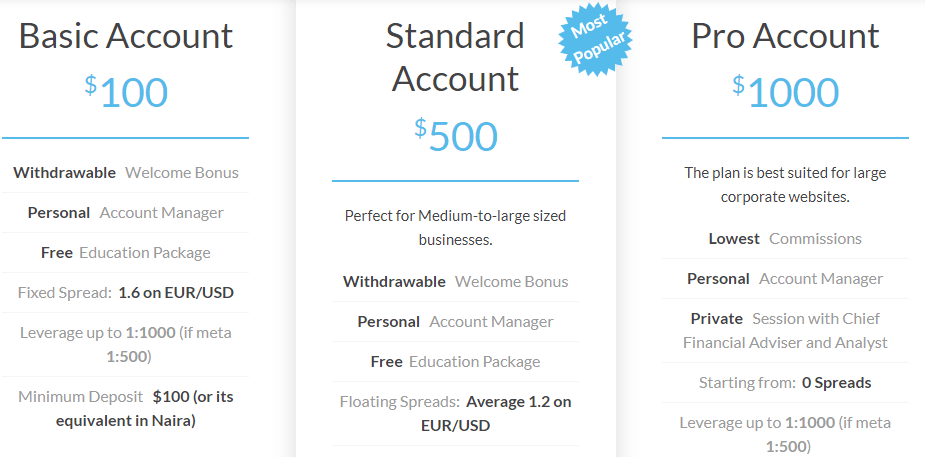

Spreads are 1.6 pips for basic and 1.2 pips for standard accounts. The commissions for the 0 spreads pro account are not clear and the broker is shy to provide any information. Another red flag here.

Rally Trade Trading Accounts, Deposits, and Withdrawals

As we already said, we attempted to base our Rally Trade opinion on relevant facts, and that is why we explored every little detail of this company. For instance, we noticed that they offer three types of accounts and that these accounts are differentiated by the minimum deposit that you are required to make before opening one of them. The Basic account starts at $100, the Standard at $500, and you will need to deposit $1.000 for opening the top-level Pro account.

The spreads are also diverse and depending on your account choice may vary between 0 pips and 1.6 pips. The standard account with 500 USD deposit requirements, and 1.2 pips average spreads is the middle ground between three accounts. For scalpers, the Pro account would be more sufficient, but the initial deposit of 1000 USD is a bit high. For general trading, the standard account offers the best set of conditions with 1.2 pips and up to 1:1000 leverage. Another downside is the broker is not clear about its trading commissions for the 0 spreads Pro account which may indicate higher-than-average fees.

Payment options

As we already said, Rally trade Forex broker is sometimes “too good to be true,” and this can also be a potential red flag in the world of financial trading. For example, they charge no fee for deposits and withdrawals, and this is a pretty unusual practice in the forex market. Clients can use various banking methods to transfer their funds, and this includes VISA, MasterCard, Neteller, and so on.

Trading Assets and Features of Rally Trade

The broker has only Forex pairs, commodities, and indices on their trading platforms. Rally Trade is mainly an FX broker that offers not very attractive trading conditions and has several red flags.

The number of instruments is capped at 20 indices, 15 commodities, and 50 currencies. The terms for trading are industry average and acceptable if not horrible negative balance policies.

How to start trading with Rally Trade broker

Another “warning sign” when it comes to trading with Rally Trade brokers is evident from the fact that they offer extremely high leverage, up to 1:1000. However, unrealistic promises are the most common signal for scams and fraudulent activities in the trading world. That is why we recommend to our readers that they look for a more reliable broker elsewhere.

Rally Trade still lacks verification, and it will take some time before we can be certain about their intentions and credibility. But, you could always use the demo account on their platform. This feature will allow you to get a glimpse of what awaits you once the “real” money is deposited.

Rally Trade Trading Software

To further substantiate our Rally Trade opinions with facts, we took a look at their trading terminal as well. This broker uses a well-known MetaTrader 5 software and xTrader. Social trading is growing in popularity, but once again – prospective investors should be cautious when following other traders. The platform also incorporates the X-Options feature, which adds binary options to the overall offer. But this abundance of choices can be confusing and overwhelming for new clients and novice traders.

Rally Trade Customer Support

When it comes to customer support, customers can report their problems via phone and email, or they can fill out the contact form on the website. There was a live chat added recently which is a great improvement. But other red flags are so prominent this will not still make us recommend them to our readers.

Rally Trade Education

The educational center like other African brokers’ cases, is a very well-thought-out place. Rally Trade offers articles that encompass all levels of trading experience including beginner, intermediary, and advanced. With this trading education, it is possible to learn the basics and test new skills on the demo account. But this is where the red flag comes into place. For beginners, it is super easy to blow up a trading account and get into a minus. This will effectively lead to penalties and heavy charges. This good educational center can become a good trap for newbies. This is why we strongly advise against making business with Rally Trade broker.

Should you consider Rally Trade?

Not only will the broker require to cover all negative balances, but it also will impose penalties for every day the deficit is not covered. Potential scam alert here. The deposit requirements are super high for 0 spread accounts, and commissions are not given. Many red flags, and too few benefits to recommend this potential scammer to our readers. Stay away from this broker at all costs!

Is Rally Trade a reliable broker from Africa?

Is Rally Trade licensed and regulated?

What are the fees and spreads of Rally Trade?