Getting quality service from the brokerage is as important in trading as having the necessary skills to execute successful trades. One may have the second but if their broker is a scam, their finances are under threat and no profit can save them.

Unfortunately, the internet is full of such brokerages. Yet there are also many credible ones and it’s for them that we’re careful about who we deem fraudulent.

In this MGC Logic review, we’ll determine which group this broker belongs to and whether you should trade with it. So, let’s not waste any more time and get right to it.

First impressions

MGC Logic is a cryptocurrency CFD trading brokerage based in the Commonwealth of the Dominican Republic (COTDR) and operated by a marketing company called New Olympia. For many people, the MGC Logic scam becomes less pressing when they hear that the broker has an FSA license from the COTDR, however, we will explain what this actually means further down below.

Apart from the crypto CFDs, the broker also supports seven different cryptocurrencies, including Bitcoin, Ethereum, etc. Both CFDs and real securities come with seemingly incredible features such as 1:100 leverage and spread as low as 0.1. Again, we’ll explain everything in the coming chapters.

Is the MGC Logic scam real?

MGC Logic has been considered as a scam due to some rumors online. The argument was that the company does not hold a real regulatory license and the FSA license is, in reality, a cover. We cannot help but share the same opinion and here’s why:

The COTDR is a small island in the Caribbean region, enjoying no political or economic prowess; the country doesn’t even have full-fledged independence. Therefore, when a random brokerage shows up with a license coming from the COTDR, we become a little suspicious of how this country will actually regulate MGC Logic’s financial activities.

In general, fleeing to smaller and powerless countries is a well-tested method used by the companies. This way, not only do they avoid paying taxes posed by much stronger governments, they also hide their illegal activities and scam their customers as much as they can. And that’s exactly what we think of the MGC Logic FX brokerage.

MGC Logic account types

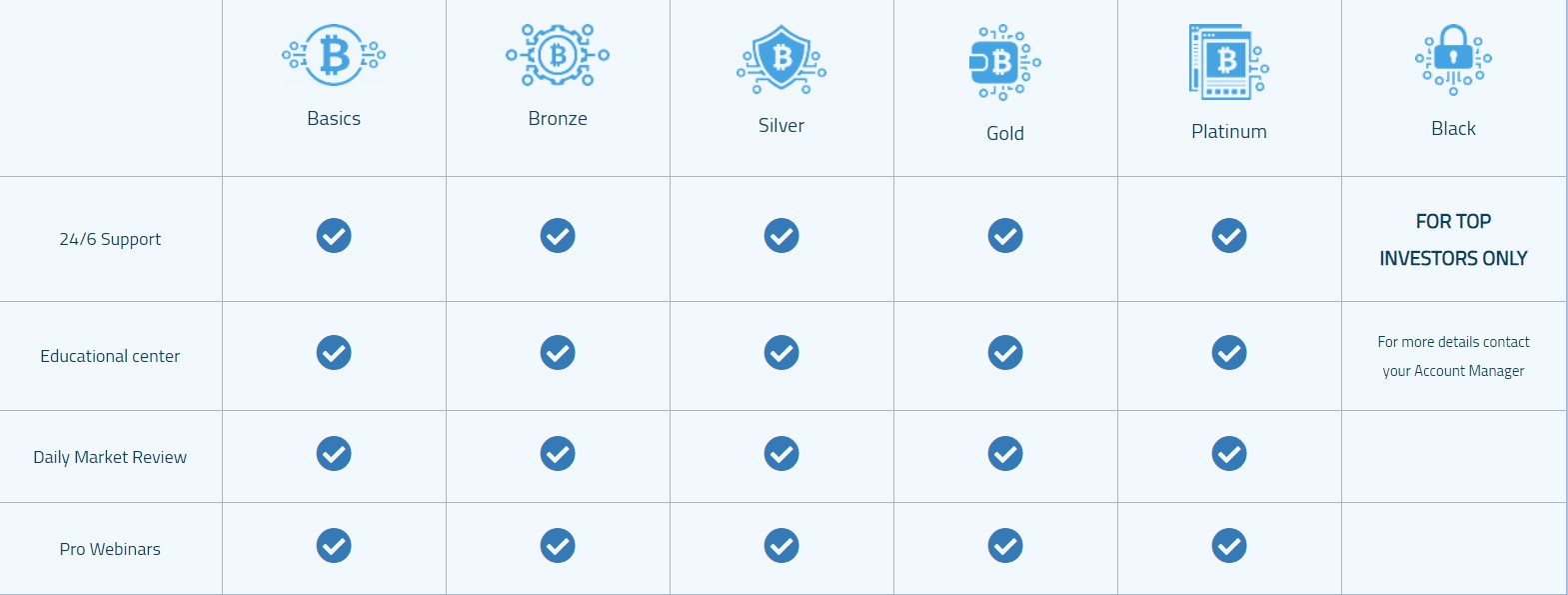

Next up, the account types. The broker offers five regular and one elite account to its customers: Basics, Bronze, Silver, Gold, Platinum, and Black. Right off the bat, it’s good that MGC Logic offers such a level of diverse account base, however, diving deep into their characteristics and differences, we don’t think that the distinction is sufficient.

In fact, these accounts are more common in their offerings than different. All the leverage ratios, spreads, educational center, daily market review, and other features are supported in each of these accounts, and the differences in notification types and the account manager definitely isn’t enough for enticing people to pay tens of thousands of extra dollars.

Speaking of paying, the minimum deposit requirement for entering the MGC Logic Forex broker’s platform is $250. Now, it may not seem as high for those who have experience in trading, but for the beginners, who want to minimize risks as much as possible, this is still a heavy financial commitment. And the broker doesn’t even offer a demo account to them.

So, our overall opinion of the account separation is this: impressive on the outside but underwhelming on the inside.

Deposits & Withdrawal options

Deposits

There are not too many deposit options with MGC Logic. In fact, it can be considered that it’s quite restricting. The only options people have are Credit Card, Wire Transfer, and some E-wallets such as Skrill and Neteller. This certainly is a restriction for those traders that use different payment platforms, including cryptocurrencies.

And yes, that is strange that a crypto trading brokerage doesn’t support crypto payments. If it doesn’t trust the blockchain technology to get paid for its services, why does it offer the digital tokens for trading then? An interesting question!

Withdrawals

There’s not much of a difference in a withdrawal policy either. The supported Credit Card, Bank Wire, and E-wallet solutions certainly do not lift our MGC Logic opinion, which has already descended to an unfavorable level.

The company requires that the traders provide quite a lot of personal information. For example, a trader needs to show their Personal IDs, such as their ID card, driver’s license or anything else containing their ID number. Furthermore, a Proof of Adress needs to be shown, alongside a photo of your credit card from both ways, covering everything besides the last four digits.

This know-your-customer policy, which is taken to the extremes by the broker, is certainly one of the most controversial issues here. Customers, submitting their private credentials, delegate dangerous leverage to the broker’s hands which it can use to undermine their financial stability.

Besides, the withdrawals take ages to complete: from three to seven days of completion time is unforgivable for a financial company of any scale.

MGC Logic leverage and spread

The issue with leverage and spreads is a completely different beast. Let’s start with the leverage: as you already know, the broker claims to offer a 1:100 leverage ratio to its crypto assets. Now, if you know anything about various trading markets, you’d also know that such ratio amounts are quite normal for Forex, yet the crypto market offers a max of 1:20 leverage.

With this over-the-top offering, the broker puts itself in a peculiar position where such flashy conditions seem too good to be true. And in trading, they usually aren’t true indeed.

And then there’s a 0.1 pip spread. One of two ways the brokers use to receive funding for their services is by deducting bid-ask spreads from their clients’ positions. Another method is having commissions on transactions, which MGC Logic doesn’t have, except for the bank wire transfers. Therefore, when the broker says it has almost zero spreads on the positions, we become a little suspicious of the credibility of that statement.

In short, the trading terms and conditions are suspicious for their exaggerated size and scope.

Is MGC Logic legit?

So, what is our final MGC Logic rating based on this review? Let’s round everything up:

We reviewed the FSA licensing provided by the Commonwealth of the Dominican Republic and determined that because the COTDR is a small distant island with no credible power, we can safely say that MGC Logic is an unlicensed brokerage and can do anything it wants. This, in terms of the scam suspicions, is certainly a downside.

Then we moved on to the trading assets and account offerings. The broker offers cryptocurrencies, as well as crypto CFDs to its customers and has six seemingly different accounts. However, these accounts are more similar to one another than different. As for a $250 minimum deposit requirement, we still think that it’s too much for the beginners.

After that, we looked at the deposit and withdrawal platforms – another shady part of the broker. MGC Logic only supports credit card, bank wire, and e-wallet payments that are both obsolete and prone to security breaches. Besides, the payments take three to seven days to complete.

Finally, we reviewed the actual trading offerings. A 1:100 leverage and 0.1 pip spread for crypto trading are very high numbers and certainly suspicious when considering other factors we’ve listed above.

In short, when we add everything up, we believe that the MGC Logic scam is real and traders will be better off if they stay away from this broker.