Maxco is an Indonesia-based futures and Forex broker with over 30 years of experience. It has three different licenses from diverse Indonesian regulators of Forex, securities, and commodities. Despite its vast experience, the broker is not primarily a Forex broker and still has a lot of work to do. We have researched Maxco and will explain its services and conclude why this broker may be a suitable option for Indonesian commodities and futures traders but not for global Forex traders.

The Safety and Security of Maxco broker

As we have mentioned the broker is very well regulated and holds three separate licenses from Indonesian regulators of the BAPPEBTI, the PT Bursa Berjangka Jakarta (JFX), and PT. Kliring Berjangka Indonesia (Persero). These licenses allow the broker to be one of the most reliable options for Indonesians as it keeps client funds in segregated bank accounts and is a member of the investor compensation fund.

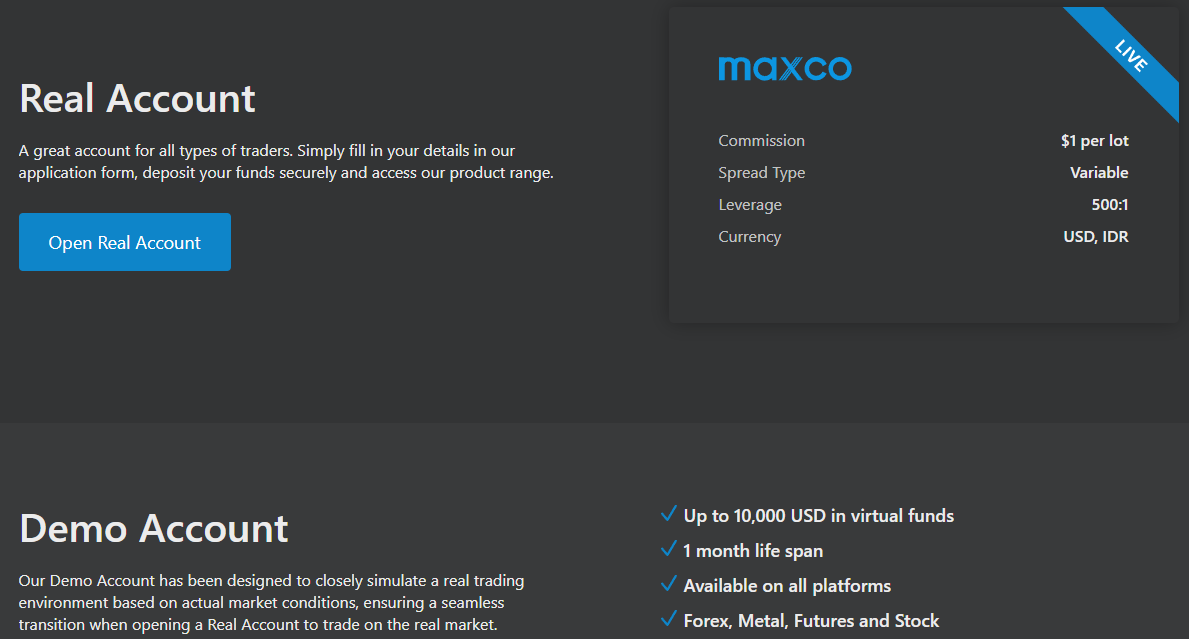

But there are some cons too. Despite being so reliable and legit the broker lacks a negative balance protection which is a huge disadvantage. As the maximum leverage is up to 1:500, the lack of negative balance protection can easily lead beginners to lose more than their initial investment. A minor red flag here for beginner FX traders to consider.

The broker is also shy to offer information about minimum spreads on its website which we eventually found out by opening a demo trading account.

Maxco Accounts, Deposits, and Withdrawals

There is only one live trading account offered with attractive terms of maximum leverage of 1:500 and a minimum deposit requirement of 100 USD. There is a trading commission for Forex trading from 1 USD per lot which makes Maxco a very expensive broker for Forex trading. Add to this the 2.0 pips minimum spreads on major pairs and there is no chance scalpers and traders with short-term trading strategies make money with Maxco platforms. However, for commodities trading the broker has acceptable spreads from 0.4 USD. Indices got higher spreads from 1 USD, and we wonder if the broker is suitable for trading any other asset classes except futures.

A free demo account with 10,000 USD can be opened for practicing but has a limited expiration time of one month.

The account opening process is also moderately complicated by requiring an SMS code and email code before a trader can open an account.

Deposits and withdrawals

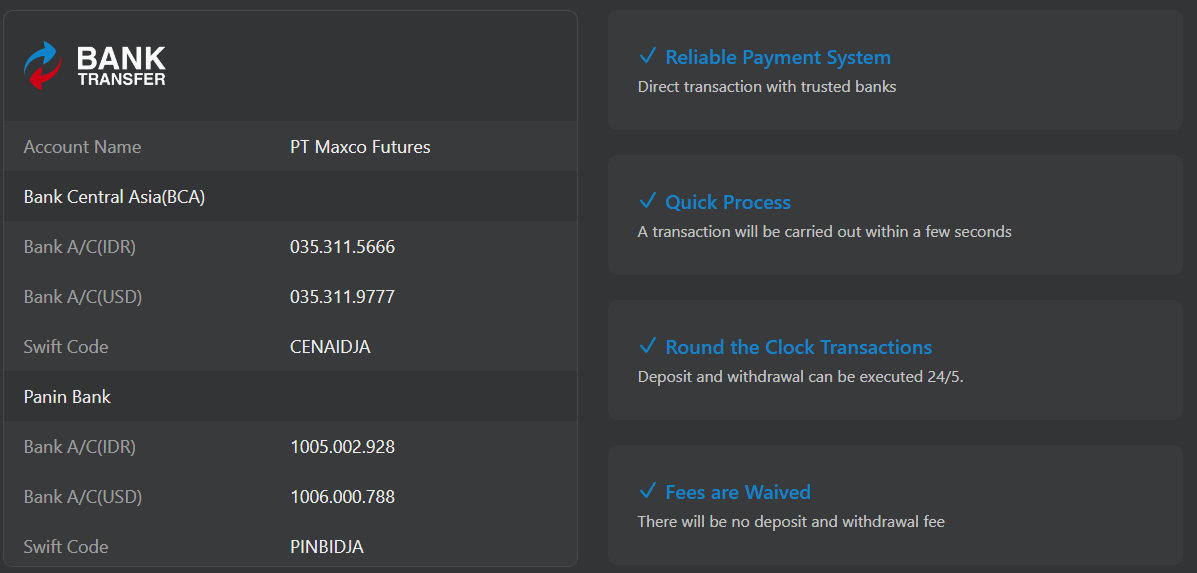

As for deposits and withdrawals, there is only one option to deposit funds. Bank Central Asia (BCA) wire transfer is only one option for local traders. The only positive side of this limited payment method is that Maxco enables traders to deposit funds free of charge. Unfortunately, there are no other methods and the broker did not disclose the fee charged for withdrawals.

Trading Assets and Features of Maxco

What does Maxco have to offer for trading? We researched and found the exact number of tradable instruments from the broker. Maxco offers 33 stocks including Tesla, Amazon, Google, etc., 8 futures, 2 metals gold and silver, and 26 Forex pairs.

Trading Platforms

MetaTrader 4 is available for all traders at Maxco and offers advanced functionality including full auto-trading capabilities. It can be downloaded freely. For mobile trading, there are apps for Android and iOS. Additionally, the broker offers a basic web trading terminal that has few functions to open and close trades.

Maxco Educational material

There are no educational materials available on the Maxco website and no trading or market research tools either. This makes Maxco no suitable for beginner traders who want to start learning and practicing on a demo account.

Customer Support Team of Maxco

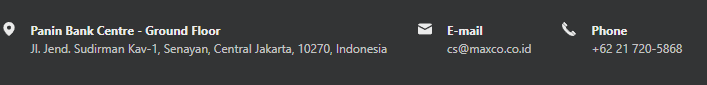

From customer support options there are three options provided: phone support, email support, and office for local traders. The broker is fully focused on Indonesian futures traders. There is no live chat which makes a support lengthy process unless a phone call is made. However, using phone support is much less convenient than a live chat can be used directly from the website, and is usually the fastest way to get help from brokers.

Should you consider trading Forex with Maxco?

If you live in Indonesia and consider trading futures and commodities then Maxco really offers a value. But if you are a Forex trader then the broker is not recommended. There is no live chat support, only local banks can be used for deposits and withdrawals, spreads are super high on Forex pairs together with trading commissions, and there is no negative balance protection.

We do not recommend this broker to Forex traders.

Is Maxco a regulated broker?

What is the minimum deposit and maximum leverage at Maxco?

Is Maxco a cheap broker?