Choosing the right broker is a crucial part of Forex trading. Do not make the decision to open an account with Investous before reading detailed Investous review that discuss the regulation, policies and features of the broker.

About the company

Investous Forex broker is relatively new brokerage on Forex market. It was established in 2018 and claims to be an international broker. The company behind the broker is IOS INTERNATIONAL Limited, registered and licensed in Belize, by the International Financial Services Commission of Belize. The fact that it is regulated by the offshore regulator and does not have a license from reputable regulators already raises the red flag. Almost all fraud brokerages that offer their services to the international audience are either not regulated or have found haven in offshore countries. Hence, the traders who have an account with the broker are not covered by any compensation funds and have no protection whatsoever. Therefore, for them, it is easy and more devastating to fall under the Investous scam.

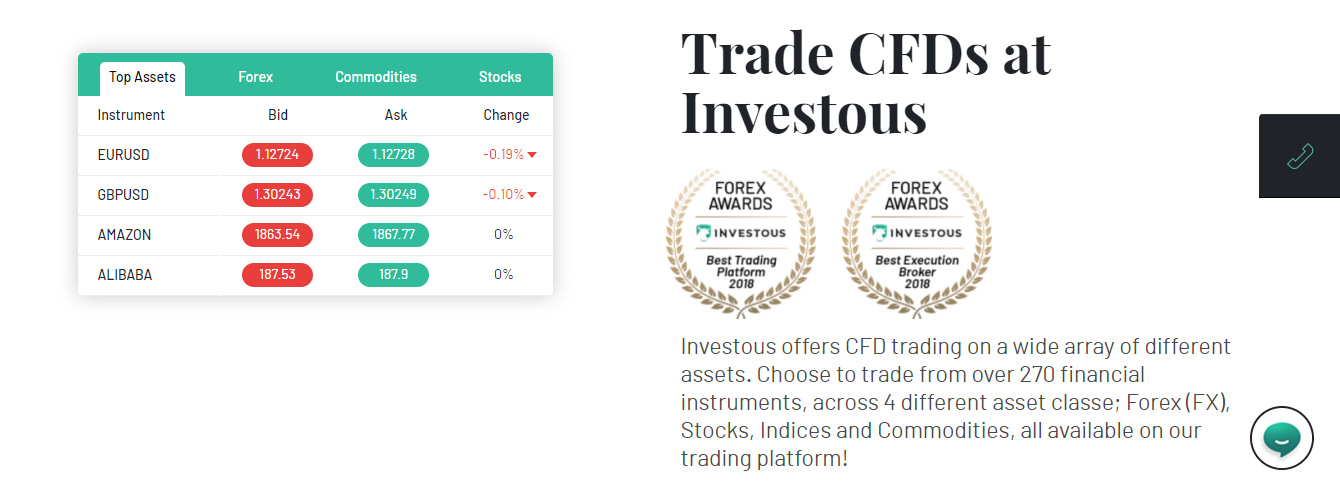

The opinion that Investous might not be a trustworthy broker is also supported by the fact that there are no reviews and opinions about the broker from their customers. It means that the broker does not really have a customer base that is satisfied by the service or it only targets new traders to scam them. Despite being opened only in 2018 and not having any customer reviews, the broker claims to have awards of the best trading platform and the best execution broker in 2018. Needless to say that Investous does not show any information about the awards that would make its claim more realistic. Hence, the chance that it is another Investous fraud is very high. The background of the company and overall information about it does not speak well about the broker, now let us take a look at the features of it.

Intvestous.com review

From the very first minute of entering the broker website it an experienced person might feel that the website is created to look as valid and trustworthy as possible. Everything looks clean, the design is relatively modern and overall looks nice. One can find the major information on the first page of the website. The broker showcases the educational centre, trading page, account and legal information. You can find the daily videos and information about awards as well. While the first impression might be good, investigating the website further is disappointing. The clean design of the website is simply a facade. None of the pages provides full information about the brokerage or its services. Even in the educational centre that should serve as the source of education to the traders do not carry any value. The information there is very short and does not really explain anything. It leaves the impression that the purpose of the educational centre is not to really educate visitors, but to seem more valid. It raises the question – is Investous legit or is it just another scam broker?

Account types

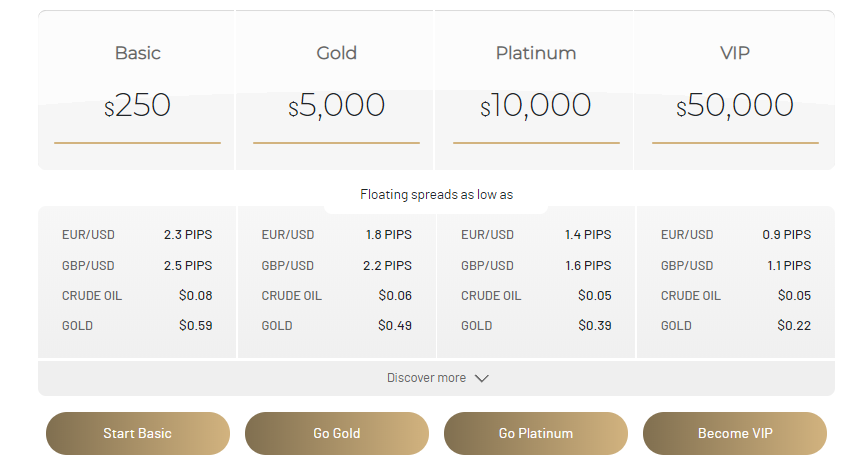

Investous has four types of accounts available for its customers: basic, gold, platinum and VIP. These accounts come with different advantages and features.

Basic account: The minimum deposit for the basic account is USD 250, the pips start from 2.3

Gold account: The minimum deposit is USD 500, the pips start from 1.8

Platinum account: The minimum deposit is USD 10,000, the pips start from 1.4

VIP account: The minimum deposit is as high as USD 50,000 and the pips start from 0.9

As you can see the difference between the basic and gold account is bigger than the difference between other accounts. It seems the broker tries to encourage traders to open a gold account to get better features. Based on this, is Invesous a scam? For us, it points toward the fact that Investous fraud is even more possible, as the FX brokerage tries to lead the traders to invest more rather than to provide equally good service to all customers.

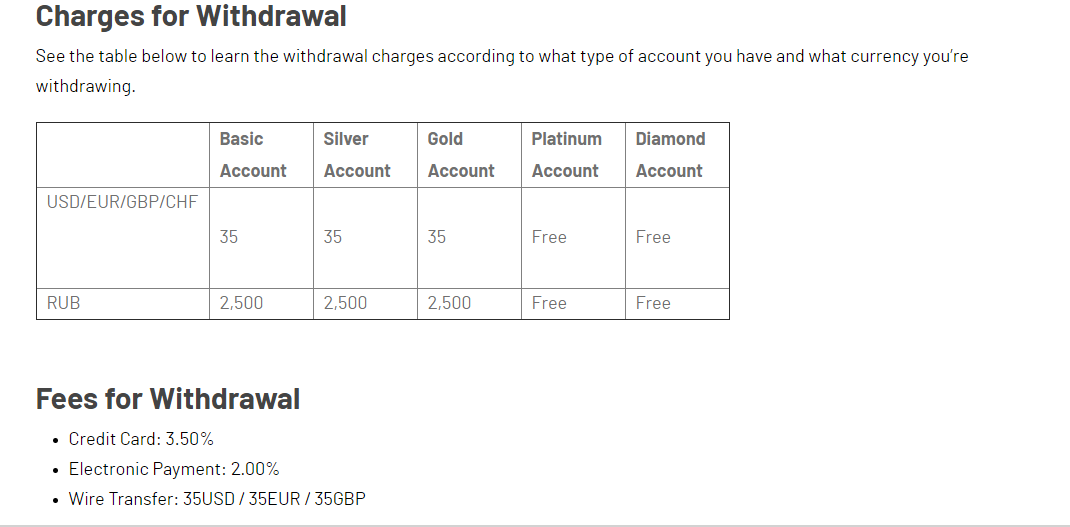

Investous withdrawal policy and fees

The withdrawal policy is one of the most important things you need to learn about the broker before opening an account. The broker does not provide clear information about the withdrawal policy. It is not stated anywhere how the traders can request the withdrawal if there is any need for providing additional information when making the request and how long does it take for the broker to process it. However, there is information about Investous withdrawal fees. The broker charges commissions on withdrawal depending on the payment methods you are using. Those who are funding their trading account via Credit or Debit card will be charged 3.5%of the money when withdrawing it. The E-wallet users will be charged a commission between 0.9 and 3.5%. The fee for Wire transfer is fixed – it is 20 GBP, 30 USD, 24 EUR, 1800 RUB, 183 CNY, 20 CHF, and 3000 JPY. However, there can be a little misunderstanding, the above-mentioned charges are indicated in the broker’s general fees on the website, but the withdrawal fee information on another page suggests that the fee is 35 EUR/GBP/USD.

In any way, while some of the brokers have commissions too it is never welcomed by the customers. Moreover, with Investous you might face some other charges and complicated withdrawal process. The broker has a right to charge an additional 50 EUR for withdrawing your profits. This money will be charged in the following cases:

- If the customer has one single position placed or there is no trading activity on the customers account prior to submitting the request for withdrawal. However, it is not stated what is the period of time that the broker considers as the “prior.” It formes a very bad Investous opinion as the broker can take this money based on its own will.

- If the customer fails to provide accurate, necessary, and adequate information or documentation to verify its identity or address. The information might be requested from time to time by the date of withdrawal request submission.

The charges do not stop on that. Investous FX brokerage also charges clients for inactivity. It is normal, you might say. Yes, almost all the brokerages charge the inactivity fee, however, they charge it for inactivity in minimum 90 days or maximum 180 days. Investous applies inactivity fee after one month of not trading only and the fees are far greater than with the other brokers. If you open an account with the broker and do not trade for one month, you will be charged with 10 EUR, from 2 to 3 months period the fee is 80 EUR, from 3 to 6 months – 120 EUR and for more than 6 months – 200 EUR. This kind of commissions and fees never talk positively about the brokers and in many cases, it is a good indicator that it is not trustworthy.

Investous customer support

If you still decide to open an account with such brokerage you might need the customer support a lot. It is good to know that you can always reach the broker and get a professional and prompt reply from them. Unfortunately, this cannot be said about Investous customer support. The most convenient way to reach the broker is a live chat where you can get in touch with the broker’s representative. While preparing Investous.com review we found out that Investous also has a chat option but instead of a real person behind it is a simple chatbot that does not understand the vast majority of your enquiries. You can still reach the real person via chat, but the waiting time is too long. The fact that the broker makes it hard for you to contact it makes us think about Investous scam. The brokerage also has the number of the customer support indicated, one is a Russian number and another one is South African. Usually, the brokers that claim to be international have a customer support team for every major country.

Can Investous be trusted?

Now let us sum up and answer the question – is Investous scam or not. While the broker tries it hard to look like a legit brokerage an experienced trader can see that it looks good only on the surface. The broker lies about the awards it lists on its own website and does not provide actual education to its customers. The account types are created in a way to push the customers open a gold account, on all of the accounts the broker charges fees that are too high. It also does not have a well-defined withdrawal policy and customers might find out that it is almost impossible to withdraw any profits when they make a request. There are no positive Investous opinions made by the customers of the broker. Last but definitely not least, Investous fail to provide proper customer support and makes it hard for the clients to reach the broker. Hence, our verdict is that the broker can actually be a scam and traders who want to open an account with it, should think twice before doing so.