As our review of Enclave FX broker shows, it is a newly established broker with a fully functioning site that operates very smoothly. The website uses SSL encryption and a two-factor authentication process as a measure of security.

The Broker nor admits or discourages the notion that it is regulated. We find this very odd as the site is very functional and up to date. By not having a regulatory body monitoring them, it raises questions about the legitimacy of the brokerage firm.

The maximum amount of leverage available on the site is 1:500. the minimum deposit amount on the site is $10 which is for the Micro account. The spreads on the site go as low as 0.0 pips. each account type has a certain amount as a limit.

The site uses MetaTrader5 as its primary trading platform. There is no mentioning of the MT4 software which would seem odd if we didn’t already know the fact that the site seems to be unregulated as there is no mentioning of any legitimate regulatory body on the site.

The broker offers four main asset types which can be traded by the consumers of the website. These are Forex pairs, CFDs, Metals, and of course cryptocurrencies. This broker provides 24/5 customer support via mail, phone calls, and a live chat widget available on the bottom right corner of the website.

Licenses and regulations – Is Enclave FX Legit?

Whether EnclaveFx is regulated or not is up to debate. This is a brokerage firm that is registered in the UK, its number of identification is 12414458. However, there is no mentioning of any regulatory authority that would be monitoring the broker’s services and products.

This is a huge disadvantage, and as our review of Enclave FX shows, it might be a scam Forex broker.

Enclave Fx review – Trading Features

Trading features are the most important aspect of any broker firm. One should always take notice of the specific trading tools, promotions, minimum deposits, and even additional features that a broker might possess.

Account types

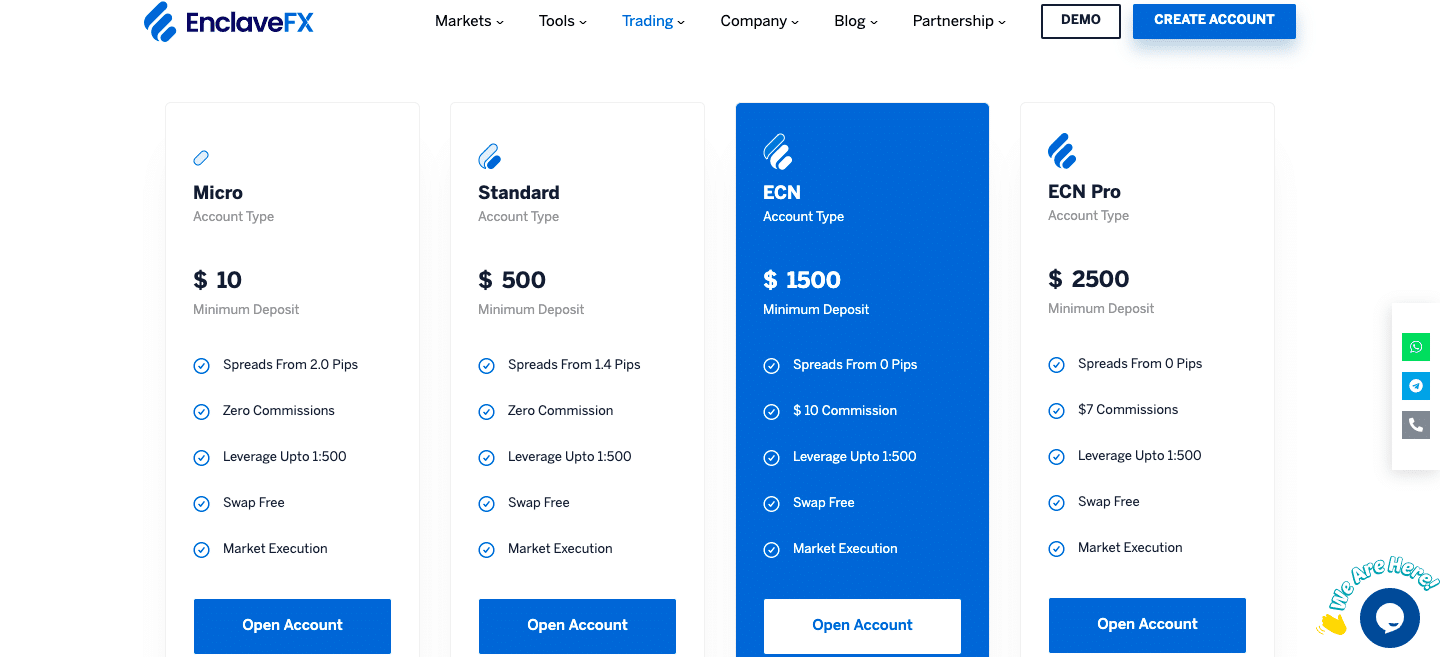

There are several account types available on the site this includes Micro, Standard, ECN, and ECN pro account types. all having their set of features similar and different from one another.

ECN and ECN Pro accoyunts have acommsion fee. other accounts don’t have to pay any commissions as there is a zero commissions policy regarding the Micro and Standard accounts. We have already mentioned the fact that the spreads on the site are in a variable position.

Clearly, the main source of revenue of the broker comes from the spreads alongside the commissions for the high-end exclusive account types. All of the account types are swap-free. one can also endure the thrill of market execution with all of the accounts.

All of the account owners also can take advantage of the demo mode available on the site, which is a great feature to benefit from as a trader can strategize and practice beforehand until they start to trade with their preferred account type in the live mode of the accounts. With the demo mode, one can see the market risk in a very structured environment which can further benefit one’s trading experience in the long run.

Leverage

The maximum leverage ratio the broker can provide one with is 1:500. All types of account owners can benefit from the high leverage. However, for a novice trader, this could be very dangerous. The fact that the site doesn’t have any qualifications explains many aspects of the broker’s features especially the fact that they are able to provide their consumers such a high leverage ratio.

Spreads

This broker has many varieties of spreads. they are in a variable position, which means that they constantly shift and change. This is an important trading tool and for each account type, the spread starts from a different amount.

- The Micro account users get a spread that starts from 2.0 pips

- The spread for standard account starts from 1.4 pips

- The ECN account spreads start from 0.0 pips

- The spreads for the ECN Pro account start from 0.0 pips.

Minimum Deposit

The minimum deposit amount is another feature that brokers use to distinguish their account types. This is the case for EnclaveFX. The lowest minimum requirement for a deposit is $10 and it is for the Micro account type.

- The minimum deposit requirement for a standard account is $500

- The minimum deposit amount for the ECN account is $1,500

- The minimum deposit amount for the ECN Pro account is $2,500

We have already discussed the minimum deposit requirements of the accounts and the general policy of the broker around this topic. However, we have yet to talk about the additional methods of depositing that are not fiat-based.

The minimum amount of BTC that one can deposit is the fiat equivalent of $50. As for the mentioned fiat deposit, the broker encourages its consumer to use local banks or a company called “India Cash”, the minimum deposit amount for these sources is $50 as well. Additionally, these depositing methods don’t have a commission fee according to the broker’s site. The overall execution time varies between 15 minutes to 3 hours.

Bonus

This broker does not have any bonuses or other types of promotional initiatives like a contest or a giveaway. As a newly established firm, we could understand the hesitation which could stem from a lack of experience or c resources. However, we find it hypocritical on the behalf of the broker to not even emphasize the importance of educational material on the site.

There are numerous brokerage organizations and individual brokers who provide various bonus programs, and it is easy to get enticed by their promises. While forex bonuses provide an excellent start to your trading career, you should not overlook the reality that you will eventually need to master the ropes of the trading process.

Final Verdict

All in all, this is not a brokerage firm that can be trusted with your time, recourses, and energy as it is newly established amidst the very chaos of the year 2020. It is unregulated, has high spreads when compared to other newly established brokers and the only thing that could possibly be worthwhile is the leverage ratio however it is not rare to find a more trustworthy firm that is both regulated and also has high leverage for their experienced traders.

As for the reading tools and platform, there is not much to take advantage of in retrospect. They do have MetaTrader5 however they don’t offer any additional trading platform like MT4 or web trader. Some traders prefer web-based software and by not catering to them the broker has isolated itself from a vast majority of traders. There are tools other than the leverage and spreads that are important for the trading process but this broker seems to just have gimmicks instead, their additional tools include an economic calendar, calculator, Forex market hours, and heatmap analysis.

None of the mentioned tools are in any way advantageous. It just a random way to overload the site with visual stimuli. Much like the educational section of the site, they are just for show and can’t offer the consumer any functionality.