*Trading is risky.

Most of the time, people find themselves lost when they try to search for a Forex broker with whom they can open an account with. This is because there is an immense number of brokers out there. People generally lack the knowledge to know what to check and the presence of rogue brokers makes it tough. In our Capital.com review, we are going to look into the main features of the brokerage firm which should help you determine whether its legit or not.

Capital.com Forex broker

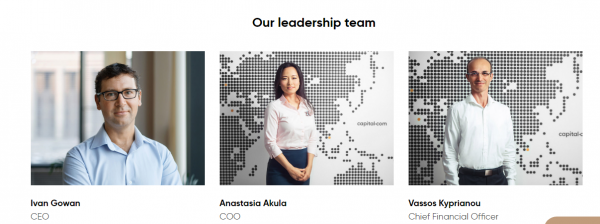

Capital.com Forex broker is owned by a Cyprus based Financial Investment Firm called Capital Com Investment Limited. Capital.com was founded in 2016 and it has over the time acquired more than 300,000 clients located in 51 different countries. The firm operates a 24-hour support team which serves in 13 different languages.

Capital Com Investments Limited which owns the brokerage firm holds a trading license with CySEC and the number is 319/17. It also holds a business registration number HE 354252. As a CySEC licensed broker, Capital.com maintains clients’ accounts separately from those of the firm. In case a broker collapses, CySEC observes MiFID rules which state that each and every client can get a refund of up to 20,000 Euros. The security afforded by CySEC encourages traders to seek CySEC-registered Forex brokers.

Capital.com scam claims are few if any. This is probably because the firm strives to follow the ESMA regulations which were introduced in August 2018. The new European Securities Markets Authority rules say that leverage for major currency pairs cannot go beyond 1:30. Minor currencies and major Indices can only go up to 1:20. Cryptocurrencies, which Capital.com also offers, enjoy a leverage of only 1:2.

How is trading at Capital.com?

In our Capital.com review, we browsed the firm’s website and the trading platform seems smooth and well organized. On this platform, you will find Investmate which is a web-based trading platform. This platform is supposed to be used instead of the globally recognized MT4. If you prefer to trade on-the-go, there are Mobile Apps which work well with both Android and iOS Smartphones.

When you decide to open an account with Capital.com forex broker, you will have access to over 700 assets. Whether you prefer to deal in metals, commodities, cryptos, Forex or Indices, you will find your trading instrument here. A standard account stands to enjoy tight spreads of up to 0.6. Even though the broker says that there is no commission charged on trades, we cannot confirm this as there is demo account to help us with this.

The account to open with Capital.com

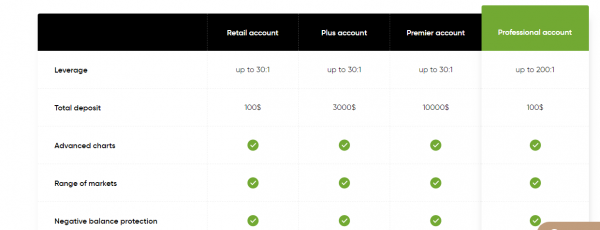

A trader gets the option to open any one of the four different accounts which Capital.com has to offer. The common and entry account is the Retail Account which requires a minimum initial deposit of $100. The features that come with this account include negative balance protection and an access to advanced charts. You can try the Plus Account which requires a deposit of $3,000. Features such as a dedicated platform walkthrough and custom analytics are found here. There is the Premier Account which can only be funded with an initial amount of $10,000.

As you may already have read in some of the Capital.com reviews, the broker offers a Professional Account. This account is designed to suit the requirements set by ESMA whereby those persons who have enough experience and expertise in FX trading can open this account. This account requires a minimum initial deposit of $100. However, the leverage is 1:200 for currency and 1:5 for crypto. These features make the Professional account the most attractive to the professional traders.

Is Capital.com legit?

There are several features on Capital.com platform which will undoubtedly lure traders. Among the leading positive features include the licensing details of the firm. It is regulated by CySEC, one of the most respected financial regulators. As part of taking social responsibility and also in observance of ESMA regulations, the broker indicates on its website that around 77% of its clients lose money while trading.

As stated earlier in this Capital.com Forex broker review, the minimum deposit is $100. This is a reasonable amount even though there are credible brokers out there that ask for much less. The other positive feature is that the broker has offers its clients a professional account in accordance with the ESMA ESMA regulations.

Some of the Capital.com opinions out there state that the broker is a market maker. After browsing the firm’s website and observing the pips, we concur that the broker seems to be a market maker. Even though the broker does not offer a demo account, it seems to be a fairly good and well-regulated firm where you can try your hand in Forex trading.

*Trading is risky.