The foreign exchange market has evolved into a colossal segment within the trading industry, dwarfing all others in terms of sheer magnitude. With a staggering daily traction of nearly 6 trillion US dollars, it stands as a financial behemoth.

Given its scale, this industry attracts a diverse array of players, each with its own offerings and requirements. Traders, for instance, seek to purchase securities at lower prices and sell them at a premium, generating profits along the way. Similarly, service providers, commonly known as brokers, aim to do the same: selling assets at higher prices to clients while acquiring them at lower costs.

This competition of interests is a natural aspect of the market, and there’s nothing inherently wrong with it. However, what is wrong is when brokers try to use deceitful tactics, luring unsuspecting clients into financial manipulations—a trend that has unfortunately gained momentum on the internet.

Fortunately, trustworthy brokerages abound, and with a little research and guidance from reputable reviewing web platforms like Top Forex Brokers, you can clearly see the true nature of a broker. Today, our focus is on Axi, an Australian-born financial brokerage that formerly operated under the name AxiTrader.

Since its inception in Sydney back in 2007, Axi has crafted an excellent track record, and expanded operations internationally, established offices across the globe, and welcomed a substantial number of traders from the UK, Middle East, Europe, Russia, and Eastern Asia into their fold.

Our purpose today is to thoroughly examine Axi, to unravel the factors that make them so enticing to a multitude of traders. By delving deeper into their offerings and dissecting their products, we hope to shed light on what truly sets them apart.

Initial overview

A fair warning before we go further: there aren’t many international FX brokers that we think deserve as much praise as we’re giving Axi in this review.

Let’s start with the service. It can be hard for a business to sustain a high level of service while they’re in the midst of major growth and expansion across the world. It stretches resources and puts pressure on the amount of time you can spend working with each individual customer. But, despite plenty of change over the years, Axi’s services have remained at a very high level.

Part of that seems to stem from a love of efficiency that they appear to bring everywhere they operate – specifically to their website.

Our Axi impressions

When we opened up Axi’s website, we were greeted by a simplistic interface that may not be as pleasant to the art aficionado, but it’ll definitely do the trick for traders. The design doesn’t look too crowded with unnecessary visual effects, only the most important elements are put in there.

This, in turn, improves navigation on the website. We found the website (www.axi.com) to be extremely easy to navigate, no matter what part of the page we went to. Sure the homepage isn’t the most beautiful site in the world, but it loads quickly and it is easy to find your way around, which are the most important details from a functionality perspective. The developers have put together a nice menu that makes finding information super simple.

Putting all their information out there gives a sense that this is a trustworthy and reliable broker. You see all the selling points but also clear displays of the risks of trading which, if you look at it from an Axi opinion, suggests there’s nothing to hide. Honesty is always the best policy – especially when the subject is the financial well-being of a person depositing money with your company – so we’d like to say a good job to Axi on their responsive and easy-to-use website.

Traders can enter the website and just a click away, they can find any kind of information about the broker’s trading terms and conditions, as well as its licensing and other legal implications. Speaking about licenses, let’s list the numerous regulators the Axi is overseen by.

The safety and security of Axi broker

License is one of the surest ways of determining the broker’s credibility. And with Axi, one can be sure that they’re doing the right choice, here’s why:

First off, the broker has a full-on SVGFSA license from St. Vincent and the Grenadines financial regulator. This license is one of the most popular and sturdiest legal pieces in the financial world right now. And even if it were alone on the platform, it would still ensure that there’s no Axi fraud going on.

However, there’s definitely more! Since Axi was based in Australia and has a major headquarters there, it also has legal obligations to the Australian Securities and Investment Commission (ASIC). If this detail needs any explanation, here it is: Australia is one of the most powerful countries in the world. There’s literally no way of scamming clients and getting away with it when the ASIC license is present. On top of that, we also have the FMA license from Lichtenstein, one of the most financially stable European countries.

So, when it comes to licensing and restricting any kind of suspicious activity, the combination of SVGFSA, ASIC, and FMA licenses definitely does the job. The only inconvenience is the regulators listed are limited depending on your jurisdiction and you have to browse each website separately to collect the list of all regulators.

Axi regulation extends to the Middle East (DFSA license), New Zealand (FMA license), and the UK where it operates under the FCA within the strict space they operate for FX brokers. Having multiple licenses is part of the reason AxiTrader has been viewed by traders as being a highly trusted broker.

Fees and Spreads of Axi

Axi does not disappoint in the fees and spreads department as well. The spreads on commission-free accounts start from 0.4 pip which is close to many brokers’ so-called zero-spread accounts. With the spreads this low, you can implement and deploy any trading strategy on the market including the scalping method. While the standard account is commission-free the pro account comes with a $7 round trip (USD) trading commission and even lower spreads from 0.0 pips.

Axi may charge an inactivity fee if an account remains inactive for a specific period. The details of the inactivity fee, such as the duration of inactivity and the amount charged, may vary.

Axi Leverage structure

On Axi, traders can use a 1:500 leverage to increase their initial positioning power by 500 times. This inadvertently means increased profits, but also losses, that’s why the broker allows clients to choose the most suitable leverage ratio. Maximum leverage is limited depending on the trader’s jurisdiction as ASIC and FCA limit it to 1:30. Only international traders can enjoy excessive leverage of 1:500.

Axi Accounts, deposits, and withdrawals

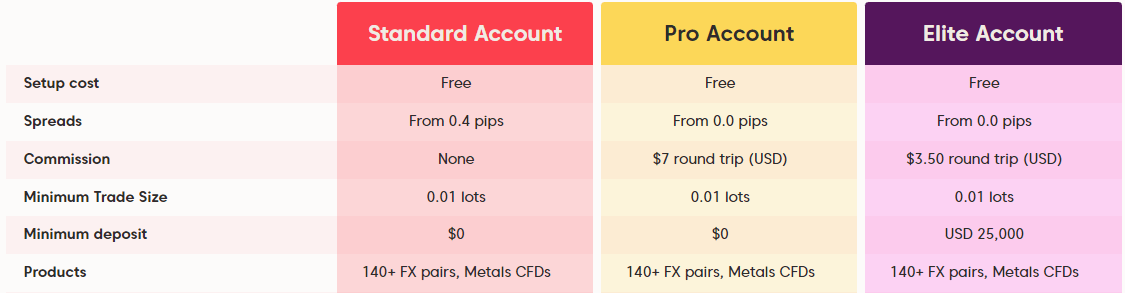

The broker offers three types of accounts to their users: a Standard account, a Pro account, and an Elite account. Each one has certain benefits depending on what a trader wants.

All Standard accounts come with full and free access to the MT4 platform, as well as automated trading, mobile trading, flexible charts and tools for analyzing the market, the full range of markets, and enhanced connectivity. Users with this type of account will have access to 80 currency pairs, no commission trading, as well as no minimum deposit requirements (unless they start working with a promotion).

Those who choose to go the Pro road get access to spreads as low as 0.00, instant execution, no requotes, low commission, ECN style deep liquidity, third-party advisors, low swap rates, high-security settings, strategic flexibility, positive price improvement, lower latency, high-speed trading, as well as free VPS services.

The Elite account is a pro max version of the Pro account as it comes with an even lower commission for zero-spread trading possibilities. The main selling point here is to scalp with the lowest commissions possible. It has a minimum deposit requirement of 25 grand in contrast with the 0 USD initial deposit requirement for other accounts.

While the differences between the three account types might not seem significant, the key is in the detail. For example, you could go for a Standard account so that you pay no commission on trades, or you could choose a Pro account that charges a commission but gets you slightly better spreads – the decision will end up being based on the requirements of the user. Elite accounts will offer even lower spreads for traders with considerable trading capital. And, hey, you could always swap to a different account if you needed to.

Demo Account

The broker outlines a number of general services on the homepage, but one of the most important is the Demo account and there aren’t many brokers offering a demo account this flexible.

The Axi FX brokerage allows new users to access a Demo account, which is filled with virtual funds they can use to practice trading. This allows these users to prepare for live trading through a real-time simulation of the real-world market, without having to risk their own money upfront. Demo users get 30 days to practice trading and there’s no obligation to upgrade to a live account before the person is ready.

Another great detail about the Axi Demo account is that users can access it from their mobile devices. This isn’t something always seen with other brokers and it lets Axi clients learn how to trade more effectively and much faster than those who trade with comparative Demo accounts from some other brokers.

In general, users report their Axi opinions of the Demo account to be extremely positive and full of useful experiences that prepared them for live trading. If more brokers offered a service like this, more people would be able to experience the markets before getting involved in them, making them more proficient at trading and giving them a better chance of earning money.

Axi also has a decent Islamic account with commission-free trading and competitive spreads.

Then there’s trading software. Being on the market for more than 15 years has taught Axi that having a polished trading platform is an essential requirement for any broker. That’s why the Axi MT4 is the main software people can use here. MetaTrader has long been an industry standard and there’s just no way of going wrong with it.

But there are also other pieces of software present here: the broker offers the MT4-based WebTrader, which is a more simplistic and less power-hungry software that runs on any web browser. And there’s also AxiOne and PsyQuation for anyone who prefers these platforms.

Axi deposits and withdrawals

If you’re going to be doing business with a broker, you should know first up, the funding methods. Axi has about ten different ways to deposit money into your trading account, with the current options outlined below:

- Credit Card

- Debit Card

- Neteller

- Skrill/Moneybookers

- Local and International Bank Transfers

- BPAY

- China Union Pay

- Bank Wire

We were quite impressed when we saw an infographic where all the payment methods were listed. Ranging from the most traditional (bank/wire, credit cards) to the most unconventional financial platforms (Neteller, Skrill, Fasapay, etc), the broker has all of it. And what’s more, transactions are commissionless (below $50,000).

With the exception of the bank wire option, all these payment methods are usually completed within 24 hours of initiating the transfer and most incur no fees.

Withdrawals are requested through the broker’s secure client portal, with the withdrawal options being pretty much the same as deposits in terms of method, timeframe, and lack of fees. Best of all, because withdrawals are self-service transactions, you won’t have to jump through any hoops to get your money out.

Trading assets and features of Axi broker

Axi deals with a good number of products and tradable assets within different classes, including:

- Bullion, Metals, and Commodities CFDs

- Gold and Silver CFDs

- Oil CFDs

- Indices CFDs

- Bitcoin CFDs

- Shares CFDs

In the flagship Forex part of their business, users have access to more than 80 currency pairs (major, minor, and exotic) to choose from. Having a large range of assets at your disposal enables a more diverse trading portfolio.

While CFDs can seem unfamiliar and scary to inexperienced users, the fact that the broker does its best to encourage education means that users should get over that hump and become informed quite quickly. And once they’re comfortable there’s a lot to pick from in the CFD field, with the Axi range going from traditional metals (gold, silver) to commodities (oil, gas, coffee) and even Cryptocurrencies – Bitcoin and several other cryptos were introduced in 2018.

Axi Customer Support Review

One of the most important aspects of any broker is their customer support – the first line of defense when people get in touch after something has not gone the way they expected it. While the Axi support team won’t be giving you any market recommendations or providing any hints on trading, they will be able to help you with technical problems, facilitating deposits and withdrawals, and other general issues.

The quality of the customer service boosts the overall Axi rating simply because it’s consistently good – they respond quickly, solve issues, and are unfailingly polite. They run a 24-hour global support network that directs to different offices around the world (the two main centers are Axi AU and Axi UK) and they offer multi-lingual service in more than a dozen languages. Email support is also available, as is an online chat facility through the website.

All customer support methods are online and active on the Axi website. the live chat has an inbuilt assistant helping to find some answers. But there is a button to connect with the support. The support and website are both multilingual which is very helpful for international traders as the company operates in 150+ countries worldwide.

Other methods include an online form and a hotline. If you are lucky to live in one of the cities where the broker is located you can also visit the local office.

Axi Customer Reviews Explained – what do traders have to say?

Although we always appreciate things like a broker holding a number of licenses from trustworthy regulatory bodies, we can’t help but remain distrustful if we can’t find other ways to confirm the company has a good reputation.

We were able to find an Axi wiki, detailing the history of the company and the general reviews provided by the users over the years, which is worth noting because a significant number of those reviews were negative. That said, for any broker that’s been around for more than a decade you‘d expect a good number of bad reviews.

Experience tells us that negative reviews are more often the result of traders making bad decisions during market fluctuations and losing significant amounts of money as a result. And while some understand that losing is a part of trading Forex, others do not. These people tend to go online and complain about the broker, despite the fact that the broker did nothing wrong and money gets lost simply because the trader made a poor decision, or just got unlucky.

It’s not a good feeling to lose money when trading, but the underlying point here is that these reviews are still up which suggests the broker understands that there’s no way to please everyone. It’s better – and easier – to be honest and recognize that when it comes to trading there’ll always be disgruntled clients so there’s little point in trying to cover anything up, especially things that were written years ago and have little relevance to the way the business currently operates.

What is inspiring to see are the thousands of positive Axi reviews online. It takes something a little bit special to encourage a person to put the effort in to actually sit down and write a positive review, which takes effort, so that’s a good endorsement of the business. A lot of the reviews mentioned the lack of the Axi minimum deposit, others talk about the great customer support, and more mention the positive relationship they have dealing with the broker.

Comments like these are why we believe Axi is one of the best brokers currently operating in the industry and one that should be considered by all traders who operate in Australia, the UK, and worldwide.

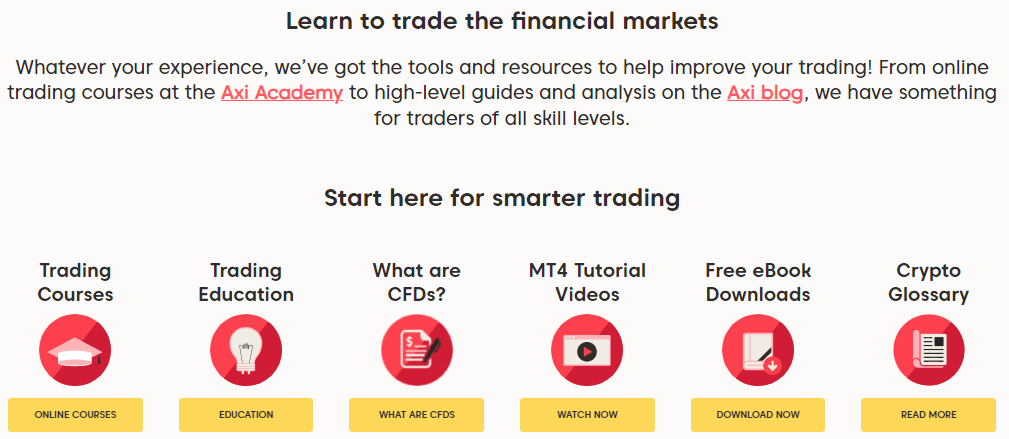

Axi Education

Something unique that Axi seems to be doing is showcasing to the rest of the world what an honest broker looks like.

While they don’t have detailed guides on how to avoid scams, the fact that they have detailed descriptions of their services and actively try to provide potential users with all kinds of information about themselves serves as a great example of what a scam broker would not do and why you should be avoiding any broker that does not freely talk about their services.

This leads to another great service that the broker has to offer: their in-depth educational materials which give users the opportunity to understand the Forex industry at the highest level. They provide video tutorials, in-depth analysis, guides on how to use technical analysis and other kinds of analysis, teach their users how to utilize the platforms that they have provided for them and so much more. The Axi rating is brought sky-high by having such a detailed educational service.

Spending some time with these tutorials is likely to provide most people with enough knowledge to be able to understand the markets better and make better trades, whether they’re entering it for the first or the tenth time.

It’s been said many times before that educated users are likely to make better decisions than those who are entering the market after only getting some trading experience from Demo accounts. But if you combine the two – deeper knowledge and demo account experience – you’re more likely to become better at trading than if you’ve only chalked up one of those experiences.

Autochartist

To help try and bring their traders another edge, the Axi Forex broker provides several complementary add-on tools for the MT4 platform. One of the most popular and effective is Autochartist, a program that permits users to automatically chart the markets and more easily understand the current market trends.

This tool offers automatic intraday market change updates, plus some interesting updates on what the market might be doing within the next couple of hours (sentiment indicator). While not especially easy to use when you first start out, it’s a tool that quickly becomes essential, providing extra information on a market activity that most indicator tools and charting tools aren’t able to provide with the same speed, efficiency, and degree of automation.

Should you consider Axi?

So, what’s the final verdict on the Axi Forex broker? Is this a legitimate broker that lets people trade as they wish, instead of how the broker might prefer them to trade? Yes, it is.

Axi has built a respected reputation over the past decade or more and managed to help many traders achieve their own goals in the Forex trading industry. They have useful services, a lot of added extras, are officially licensed, have plenty of favorable reviews, and give good old-fashioned support.

The bottom line is that Axi is the broker we would recommend to a trader, whether they’re beginners or advanced.

Is Axi a good broker?

What licenses does Axi hold?

What are Axi trading accounts?

What are Axi deposit and withdrawal options?