Online trading can be so frustrating in many cases, in particular when searching for the right trading assistant to lead the way and provide a good service. Brokerage companies abound in the industry, that’s why finding the right ones and avoiding scammers is so tricky. Today we’re going to take a look at one of those companies and ask the age-old question “Can-AM Broker be trusted?” or is it just another blatant attempt to scam people?

The AM Broker opinion – basic overview

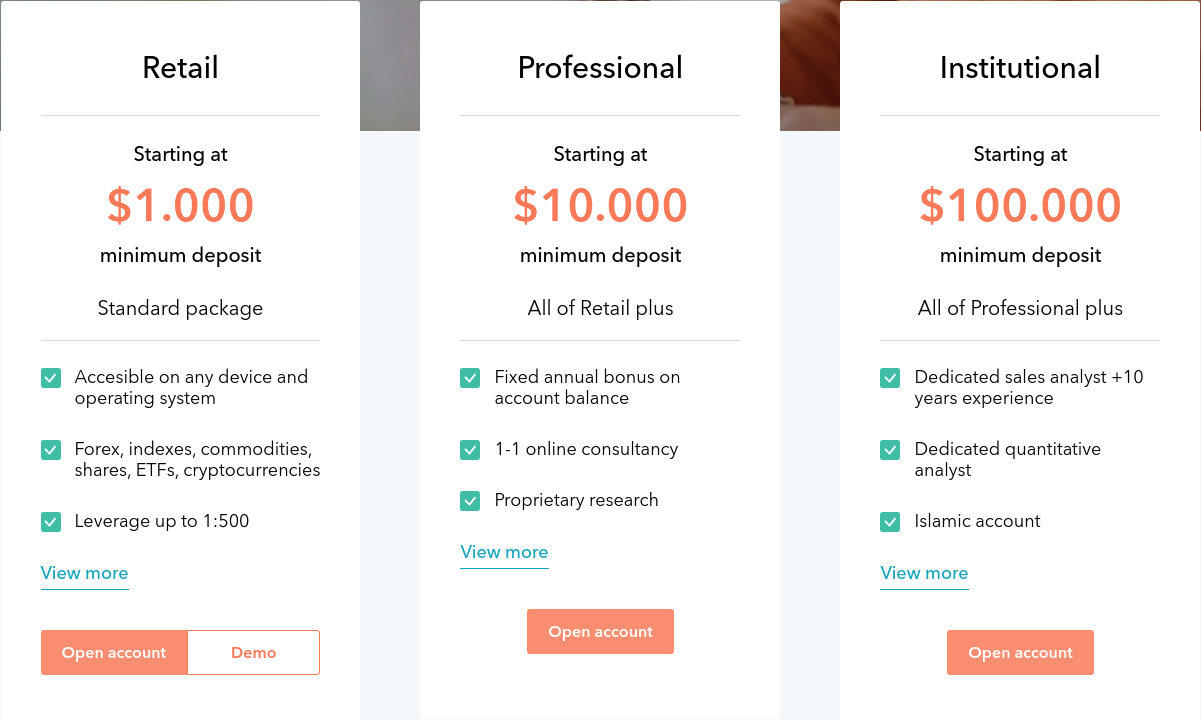

To better determine its credibility, we need to take a look at what the company offers to its future customers. Taking a quick tour of their website gives us an overall idea of what the AM Broker has in store. The minimum deposit requirement for the standard account type is $1,000, which is quite a big number given that the company has only been on the market for about a year. But more about that is below.

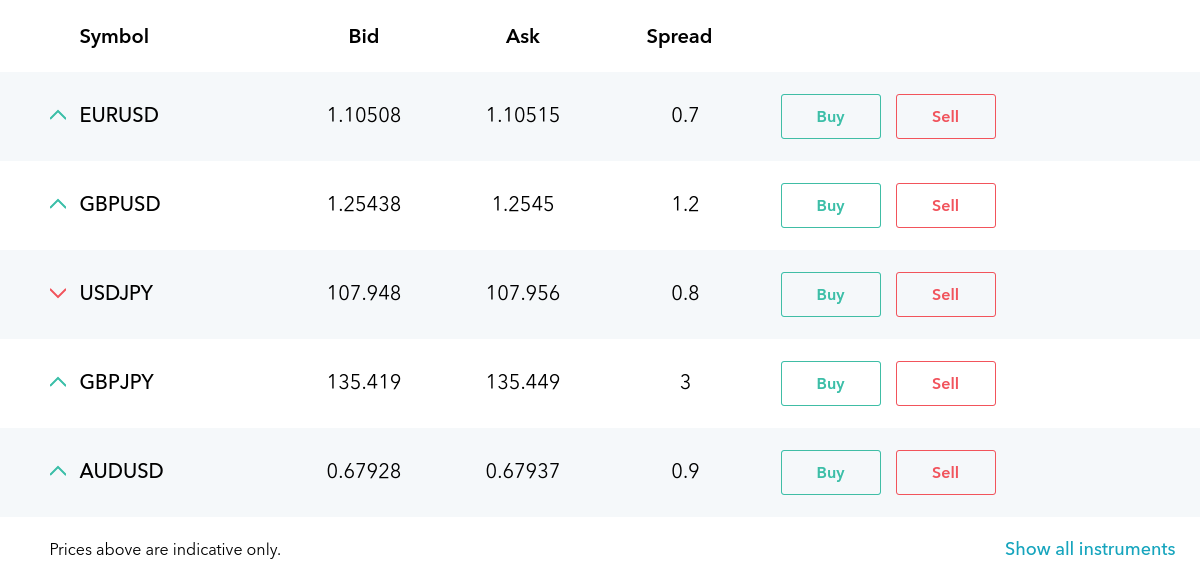

As for the other offers, the average spread varies between 0.6 to 0.9 pips; the maximum leverage goes up to 1:500, and the bonus at a deposit is 25%. These are some impressive numbers, but sometimes the numbers on paper can be deceiving. We’ll find that out soon.

The software that they’re using for trading is the up-to-date MetaTrader 4 and Web Trading, which provide a seamless trading experience.

As the licensing goes, the AM Broker is registered at the Financial Services Authority of Saint Vincent and the Grenadines. This is not the same as being regulated, anyone can register at SVG, but being held is totally different matter. We will discuss this below in more detail.

The safety and security of SVGFSA registration – what does it mean?

At the very bottom of the first page, it says that the company has been registered by the Financial Services Authority of Saint Vincent and the Grenadines.

If you have the tiniest knowledge of Economics or trading, you should know that companies opt for small distant countries in order to hide their earnings and suspicious activities. St. Vincent and the Grenadines is definitely that kind of country. Claiming that the company has been registered by the country’s Financial Services Authority might say something on paper, but in reality, it only adds to our suspicions about the AM Broker’s legitimacy.

The company is not regulated by any authority, the fact they are registered there does not provide any safety or security features like it would be if the broker were regulated. When a broker is regulated they have to adhere to the rules and guidelines of the regulatory body. In this case, anyone can register there and without regulation, there is no guarantee that funds are safe or the broker is legitimate. It has to be said that, even regulated brokers mess up sometimes or turn out scams.

AM Broker Fees and spreads

The same goes for spreads; 0.6-0.9 pips is a really good rate, but you need to know that the unofficial companies, that offer some kind of exchange operations are trying to minimize the difference between buying currency/commodity and selling it. This way customers opt for their service. Not much info is given on fees and charges matter on the broker’s website. There is only a general intro to what the Forex market is when you click on the Forex market to see their offered instruments list. All in all, not offering critical info to your customers indicates suspicious activities or a low level of professionalism and experience from the broker’s side. There was a page where you could see spreads, but recently the broker seems to have removed this information from their website. When we re-review old reviews of the broker to refresh them we usually see one of two things: either the broker went extinct and no longer provides services, or the broker has significant noticeable improvements. In the AM Broker’s case, the opposite is the case. Which only indicates more suspicious activities and lowers the trustworthiness of the broker.

Accounts, deposits, and withdrawals at AM Broker

As mentioned above, the broker offers some impressive trading conditions, which would trick any newcomer in the field. Let’s find out what these numbers actually mean.

As we know, the standard account requires a minimum deposit of $1,000. Considering the industry-average requirement, which is somewhere around $250, $1,000 is too high a price. But for a company that doesn’t have much credibility, is registered somewhere deep in the Caribbean islands, and plus, doesn’t provide service to the citizens of the developed countries, it becomes suspicious: they have to offset their high risk-factor with high requirements in order to gain lucrative revenues. They could be legitimate, but the high initial deposit requirement is suspicious for newly established brokers.

Now let’s discuss the maximum leverage, which is 1:500. Again, when you’ve just established a brokerage company and don’t have much to your name, you need to find a way to attract customers. By boosting the leverage possibilities, the customers get more incentive to choose the given broker and for this case, the AM Broker fraud appears less likely. But the truth is, the broker simply flashes big numbers to attract your attention and doesn’t care much about their actual reputation.

AM Broker review – website and user experience

Now let’s head over to their website and see how it compares to the industry standards. Right off the bat, we can notice how fluent and simple the website looks. The first page contains some basic information about brokers’ offers, as well as trading tutorials and forex analytics. The website is divided into 5 departments, combining Trading, Resources, Promotions, Partners, and About pages, which is neat.

The broker also has some modern trading platforms, such as MetaTrader 5 and Web Trading. It also lets you trade on iOS/Android platforms, which is convenient. But is AM broker legit because of this? Well, not necessarily.

You have to keep in mind that creating a simplistic and at the same time comprehensive website doesn’t take much knowledge. There are plenty of online platforms that help you design and construct your own website. A well-designed website cannot change the fact that there are serious suspicions about the broker’s credibility.

The website is not informative and provides even fewer details about offered services than before, indicating that this broker has not to be trusted.

There is no info about deposit or withdrawal methods or fees.

AM Broker Trading assets and features

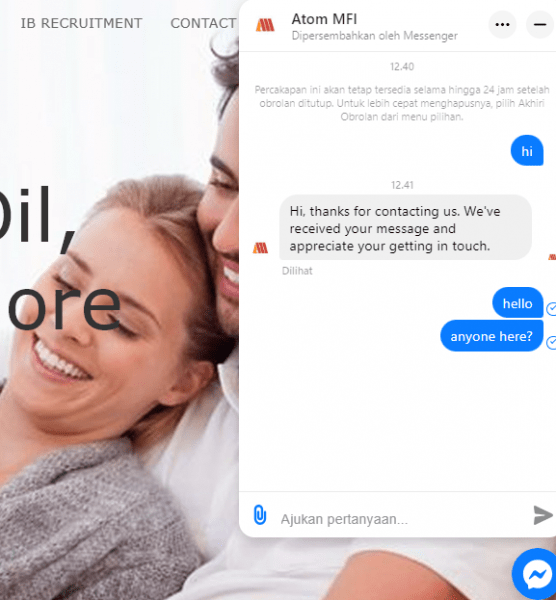

We could only see the list of asset classes offered by the broker. The list of offered asset types includes Forex pairs, Stock CFDs, crypto CFDs, metals, indices, and commodities. There are only a general overview and explanation of these markets and no detailed info on what the broker has to offer. Live chat did not give us answers either.

Customer Support Review of AM Broker

The support includes the live chat which is good. But the issue here is the live chat is in an Indonesian language and seems like it was made in a hurry and needs some adjustments. When the language is set to English the live chat is in Indonesian. We tried to contact the live chat to ask questions and find out more details about their assets, fees, and other important matters but no one answered.

Education of AM Broker

There are no educational resources other than small descriptions of each asset class offered by the broker which is not sufficient enough to be considered as educational resources. As for trading and market research tools, the broker claims there MT4 comes with numerous preinstalled indicators. But the website is so scarce of information and resources that these sections need serious attention. All in all, the website is very poorly implemented and provides no information whatsoever.

Should you trade with AM Broker?

What do we conclude in this AM Broker review? With the flashy numbers, a well-groomed website, and the suspicious regulatory claims we wouldn’t advise you to have any financial connection with this broker. At first, you may be overwhelmed by the lucrative leverages and bonus rates, or lower spreads, but you have to know: that’s what the scammers do. They trick people with their lure and entangle them into their Ponzi schemes.

Is AM Broker trustworthy?

What is the minimum deposit requirement for AM Broker?

Does AM Broker provide reliable customer support and educational resources?