AlphaTick Broker review — Safety, assets, support, and many more!

AlphaTick is a Forex broker that operates in multiple jurisdictions under AlphaTick LLC and AlphaTick (Pty) Ltd (for South Africa). Launched in 2023, it offers speculative trading services with a focus on accessibility, but has several issues when it comes to transparency.

In this brief review of AlphaTick, we will evaluate the broker’s safety, account types, funding methods, profit withdrawals, spreads, leverage, support, and more.

The Safety and Security of AlphaTick

The broker is solely regulated by South Africa’s FSCA, or the Financial Sector Conduct Authority. AlphaTick is also presented with several other entities that are registered in Cyprus and Saint Lucia.

Alpha Tick keeps the client funds in segregated bank accounts, meaning the broker’s operational funds are kept in separate accounts from client money.

All retail trading accounts are protected with negative balance protection, preventing traders from going beyond their account balance, and all balance is reset to zero if traders go into negative.

AlphaTick Fees and Spreads

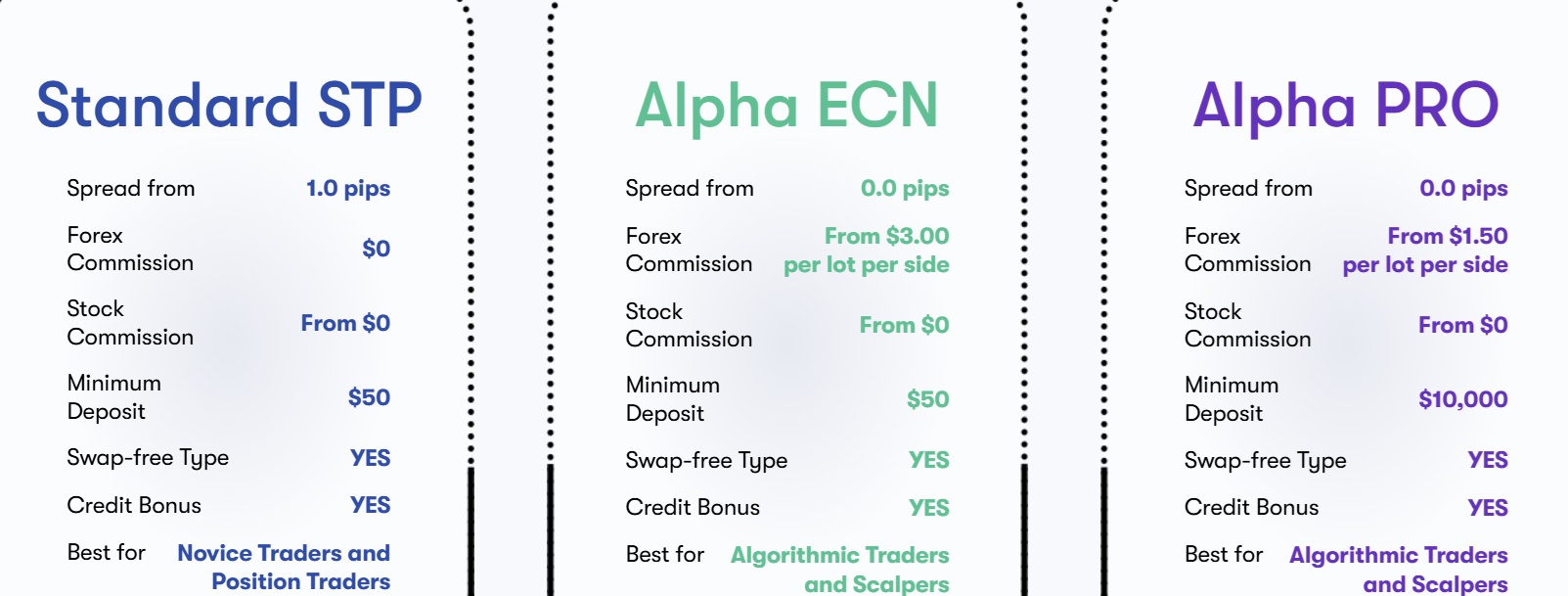

Spreads and commissions define how attractive brokers are. AlphaTick has several accounts, and spreads and fees are different. The standard account comes with 1 pip spread and fee-free trading, which is competitive. The ECN accounts offer 0 pips trading spreads but charge commissions, which are also very competitive. The ECN charges 6 USD round-trip, and the Pro account charges 3 USD round-trip. This is very competitive. Both deposits and withdrawals are also fee-free. However, there is a catch: the broker does not provide details about profit withdrawal processing times, which is a red flag.

AlphaTick Accounts, Deposits, and Withdrawals

AlphaTick accounts are three: Alpha STP, Alpha Pro, and Alpha ECN. These accounts offer attractive trading conditions, and we are going to briefly analyze each of them.

AlphaTick Standard STP Account

The STP trading account is a standard trading account that charges spreads but has zero commissions. The spreads are 1 pip, and the minimum deposit is just 50 USD, which is fairly competitive. The maximum leverage is 1:500, which is plenty. The minimum lot size is also low at 0.01 lots, enabling traders to control their position sizing fully.

AlphaTick Alpha ECN Account

The ECN accounts enable fast order execution and offer 0 pips spreads, but have a commission of 6 USD per lot round trip (3 USD per side). The minimum lot size is 0.01 lots, and the minimum deposit is also 50 USD, which is very competitive. Maximum lot size is capped at 500:1 as well.

AlphaTick Alpha Alpha Pro Account

This account is an upgraded version of the standard ECN, offering the same 0-pip spreads but with even lower commissions. The leverage is 1:500, commissions are $1.50 per lot per side (a $3 round trip), and the minimum lot size is also 0.01 lots. However, the minimum deposit is 10,000 USD, which is high and makes this account a VIP account.

AlphaTick Deposits and Withdrawals

AlphaTick accepts various payment methods, including international wire transfers, bank cards (Visa and MasterCard), broker-to-broker transfers, and a selection of cryptocurrencies such as BTC and ETH. Deposits are processed instantly and are fee-free. The broker does not charge fees for withdrawals either, but fails to provide details about processing times, which is always a bad sign when dealing with new brokers.

AlphaTick Trading Platforms, Assets, and Features

Trading platforms enable traders to analyze and access markets. AlphaTick does not provide advanced trading platforms, which is a major drawback. This trading platform offers basic features but lacks advanced features, which is a downside. Unlike MT4 and MT5, it does not support custom indicators and expert advisors, and the built-in tools are also very limited in variety. Mobile trading is not available properly, which is also a major drawback of this broker.

AlphaTick Assets

Alpha Tick trading assets lack crypto pairs, which is a downside. The broker offers access to foreign exchange currencies, indexes, stocks, and even ETFs. The lack of digital currencies is a serious drawback and makes the broker very unattractive in the sector. Despite these disadvantages, the spreads as well as the commissions are very competitive, and traders can start trading with a small budget of 50 dollars.

AlphaTick Extra Features

Extra features are not a strong side of the Alpha Tick broker. There are several features that lack diversity and flexibility. There are two bonus promotions offered only: a 50% deposit bonus and a 100% cash rebate. There are no other extras offered, which is a downside for sure.

AlphaTick Customer Support Review

Customer support channels of Alpha Tick include email and live chat only. The absence of a phone support mode is a great disadvantage as traders can not call and resolve issues. The live chat, on the other hand, offers timely assistance and quick contact with support personnel. The broker is also multilingual, offering both its website and support in many languages.

AlphaTick Education

Educational resources are pretty limited at AlphaTick broker. There is only market analysis and market news offered. This is not enough to learn trading, and the broker is not designed for beginners in mind. With the resources offered, traders can only get insights about market whereabouts and use them in their trading, which makes AlphaTick more suited for experienced traders overall.

Should you consider AlphaTick?

AlphaTick offers competitive fees, low entry barriers, and high leverage, but lacks advanced platforms, full transparency, and crypto assets. It is much better suited to experienced traders, but is still a risky broker due to the reasons mentioned above.

FAQ on AlphaTick

Is AlphaTick a scam broker?

While there is no direct evidence of AlphaTick being a scam, its limited regulation and lack of transparency in some areas are serious drawbacks.

Is AlphaTick a cheap broker?

Yes. It offers low spreads and commission-free trading for small accounts, and minimum deposit requirements are also low.

What is the AlphaTick minimum deposit?

The minimum deposit at AlphaTick is 50 USD for standard and ECN accounts, and starts from 10,000 USD for the pro accounts.