Alpari is one of the oldest Forex brokers currently operating in the global markets. Because of this, we need to approach this Alpari review on a completely different level. Things such as trading conditions will be given a lot more attention compared to the regular focus on licenses and registration.

Considering that Alpari has been operating for more than 20 years, it’s not necessary to start researching the Alpari scam possibility, because there is none.

The review will introduce you to the brokerage as an already recognized legitimate company, but with an emphasis on comparison and cost-effectiveness.

20 years of experience – Alpari review

As already mentioned, Alpari has been active in the Forex markets for more than 20 years now, as it was first established in 1998 by a few Russian financial experts.

Nowadays though, the company covers almost all of the world in its market share and services thousands of clients on a daily basis.

The transparency of Alpari is definitely not in question as its founder and CEO have been seen on television and at various other Forex conferences speaking with full disclosure of their identity.

When it comes to the license, Alpari has a confirmed document from the Financial Services Commission of Mauritius. In any other circumstance, we’d have some kind of a suspicion that the Alpari fraud was a possibility for having an offshore license, but considering the markets they are trying to focus on, Mauritius was indeed a great choice to go for.

Don’t forget that this is only for Alpari International, as the broker also has branches in countries like the United Kingdom, where it holds a separate license from the FCA.

This is where we will stop with the discussion about regulation as it is more than enough to convince us about the broker’s legitimacy. Let’s now, discuss the much more important parts of trading conditions and the overall profitability of the brokerage.

The safety and security of Alpari

Alpari is a regulated broker that has been around for more than 20 years they seem very legit and reliable. The broker is authorized and regulated by the Financial Services Commission of Mauritius (FSC). Although this regulator is offshore and not as strict as other reputable ones it still offers a basic safety feeling for investors and Alpari has been on the market for a long time.

The broker offers negative balance protection in case customers abuse 1:3000 leverage and go beyond their trading balance. All client finds are in segregated bank accounts, meaning the broker won’t be able to use client funds.

Alpari Fees and spreads

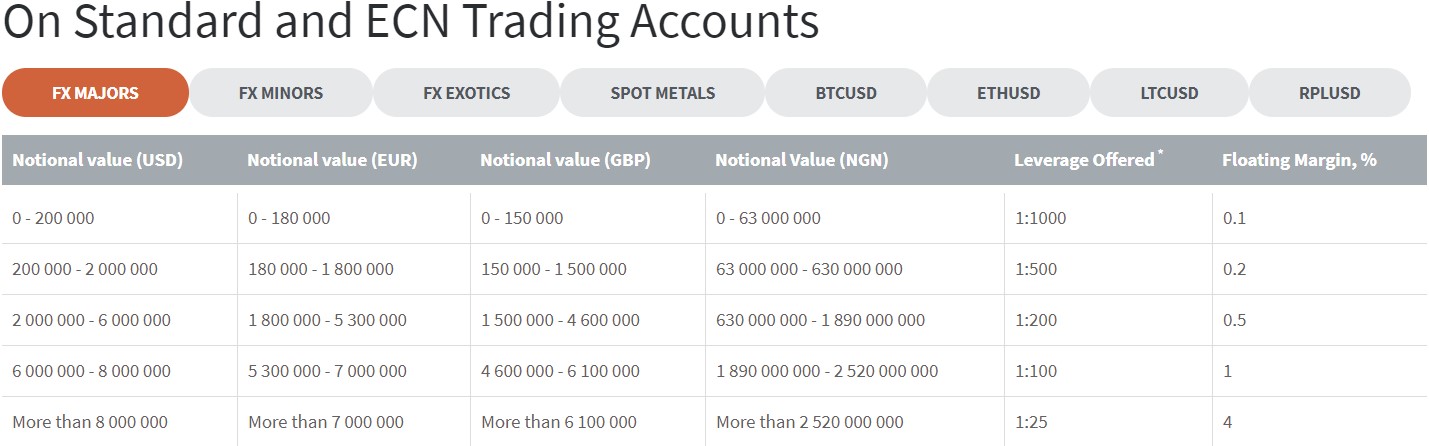

The maximum leverage that Alpari offers its traders is 1:1000, but this is mostly dependent on the type of account one chooses. However, we mention the maximum leverage, therefore there’s no discrimination against the type of account.

In most cases, the leverage varies from 1:1000, 1:500, 1:200, 1:100, and 1:25 respectively to their accounts. The smaller the account (meaning the less experience a trader has) the larger their leverage will be. However, the larger the account (meaning if the trader is a veteran and has substantial capital on the account) the lower it will be.

When it comes to spreads though, Alpari is one of the best choices in terms of profitability on all levels. Simply looking at the broker’s offers, it’s easy to see that they’re trying to focus as much on beginner support as possible, which is why the smallest account has the smallest spread range.

All the accounts have a floating spread ranging from 0.1 pips to 4.0 pips. This is calculated based on the funds invested respectively in the accounts. So, the less you deposit, the smaller your spread will be. It’s a great way to get started with Forex trading and remain profitable as well.

Accounts, deposits, and withdrawals of Alpari

There are four different account types in total with Alpari. The Standard Account, the Micro Account, ECN Account, and the ECN Pro Account.

All of these have corresponding trading conditions as highlighted in previous paragraphs, so it’s easy to determine which ones are for beginners and which ones are not.

Considering that the market standard is to have no more than three different account types, it’s safe to say that Alpari Forex broker has an above-average variety of choices here.

However, when it comes to trading software, there’s only MT4 available with a few hints on WebTrader.

Overall, it still deserves an above-average score in our books.

Deposits & Withdrawals

The leverage and spread conditions aren’t the only things that determine a broker’s cost-effectiveness for both beginner and veteran traders.

In this case, we need to talk about the Alpari withdrawal methods as well as minimum deposits for various tears of traders.

The deposits start as low as $10 and can reach as high as $10,000 depending on which account you choose to go for. Naturally, though, the brokerage makes sure that those who deposit more are given the adequate tools and support from their experts, while smaller deposits are only supplied with limited guidance, but access to educational material.

This is also an advantage as dozens of Forex brokers neglect the importance of supplying educational material to beginners and rather delegate it to already experienced traders who know the markets upside-down.

Withdrawal methods

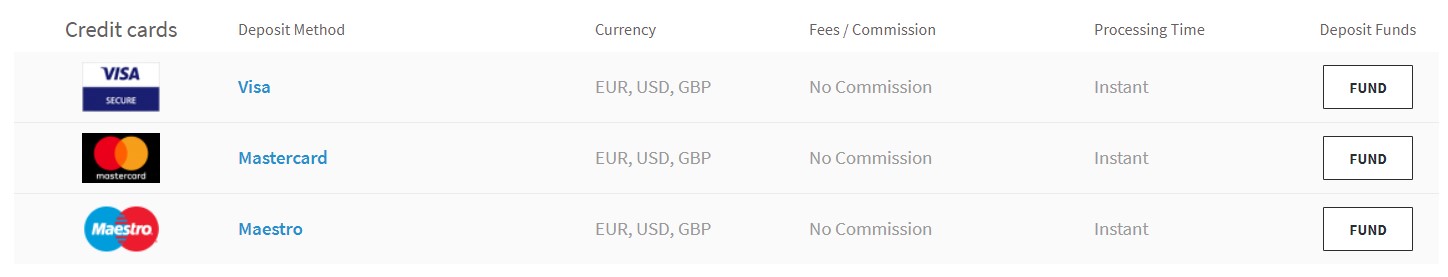

Now, let’s take a look at the methods you can use to withdraw funds from the brokerage. This is one of the most important aspects of the broker as well due to the fact that you’re reaping the rewards of your hard work using the tools that they supply.

The easiness of making withdrawals is usually the main showcase during Forex broker reviews, on how trustworthy the company is. This Alpari review is no different.

According to the withdrawal page on the website, there are a total of 27 different options to take funds out of the brokerage and into your own hands.

These include things such as bank transfers, credit cards, digital wallets, and various other online banking methods. Overall, there’s absolutely no issue in finding the most comfortable option for yourself with Alpari.

Furthermore, the Alpari withdrawals don’t even have fees, meaning that the brokerage pays all of the overheads on the customer’s withdrawal so that you can get your hands on 100% of the profits you’ve made with the company.

Alpari Trading assets and features

From 1400+ tradable instruments, you should be able to find your preferred asset type and instrument. From these assets, there are 46 Forex pairs, 670 share CFDs, 14 indices, 9 commodities, and plenty of other assets. The only downside of the broker is it does offer limited information about their tradable assets but after a little dig, we still were able to find all the details about offered trading assets. You will just have to click on the trading conditions and all available instruments with details as spreads are immediately available to check.

Alpari trading conditions – are they worth it?

The next thing we need to focus on is whether or not it’s worth it to trade with Alpari International. Since we’ve already determined that they are a trustworthy brokerage, we can dedicate all of our efforts to finding out whether or not they can pose as a great alternative to various other Forex brokers on the market.

In order to do this we need to find out about their maximum leverage, the lowest spreads they are ready to offer, and of course, the accessibility of the platform through things such as minimum deposits, bonuses as well as the available software.

The Alpari Forex broker is quite elaborate so we may have to break down the information in small portions.

Customer Support Review of Alpari

Like all well-established brokers, Alpari too, offers all customer support options with an expert team. The live chat is the easiest and fastest way to ask questions and get help from the broker. The customer team is well-trained and responsive and all questions are answered with professional knowledge. It is possible to choose between a variety of live chat options, but for more convenience, live chat is better and faster than support on the Telegram channel.

The support is available 24/5 and there are email, hotline, and online form methods offered in addition to the live chats. All in all, we were very impressed by the support quality of this broker.

Alpari Education

The education structure is very well-devised on Alpari’s website and there are online workshops occurring constantly which is a great opportunity for traders to get into the trading world and become profitable. Other educational include beginners’ guides, strategies, and trading articles and insights. with all the educational materials available on the Alpari it is possible to start from zero and become a hero of FX trading. The broker offers diverse types of educational materials and we hope they continue to offer even more features and resources in the future.

Alpari also offers copy trading capabilities for investors who do not have en tough time staring at the charts all day.

Can Alpari be trusted? Should you consider this broker?

After such an extensive Alpari review we need to break down all of the points made within it and try to combine them in one simple conclusion.

Is Alpari legit? Yes, it most definitely is.

Are they worth it as a company? Yes, the $0 minimum deposit amount is more than achievable by the majority of traders.

Do they have industry-standard conditions? Yes, the 1:3000 leverage and 0.1 pips floating spread are more than enough for even beginners to remain profitable.

Should I start trading with Alpari? Most definitely so, Alpari has shown some of the best conditions we’ve seen in the Forex market. The UK branch may slightly differ from the International one, but that’s due to existing regulations in the European Union. But as for this branch of the brand, the broker is more than worth it.

Is Alpari a good broker

Is Alpari a reliable and legitimate broker?

How can I deposit and withdraw funds with Alpari?