Table of content

According to the Wall Street Journal, the US prime rate is the base rate on corporate loans, published by at least 70% of the 10 largest banks in the United States. Generally speaking, as the name suggests, the prime rate also represents the interest rates at which the majority of US banks are lending money to their prime individual and institutional clients.

This generally includes bank customers with high credit ratings. The logic behind this is that those types of individuals and corporations are unlikely to simply default on their debts and consequently, banks do not take on much risk when lending them money. Therefore, there is no need to add risk premiums to the interest rates those financial institutions charge on those types of loans. As a result, prime clients can borrow money at the bank at cheaper rates than other regular clients.

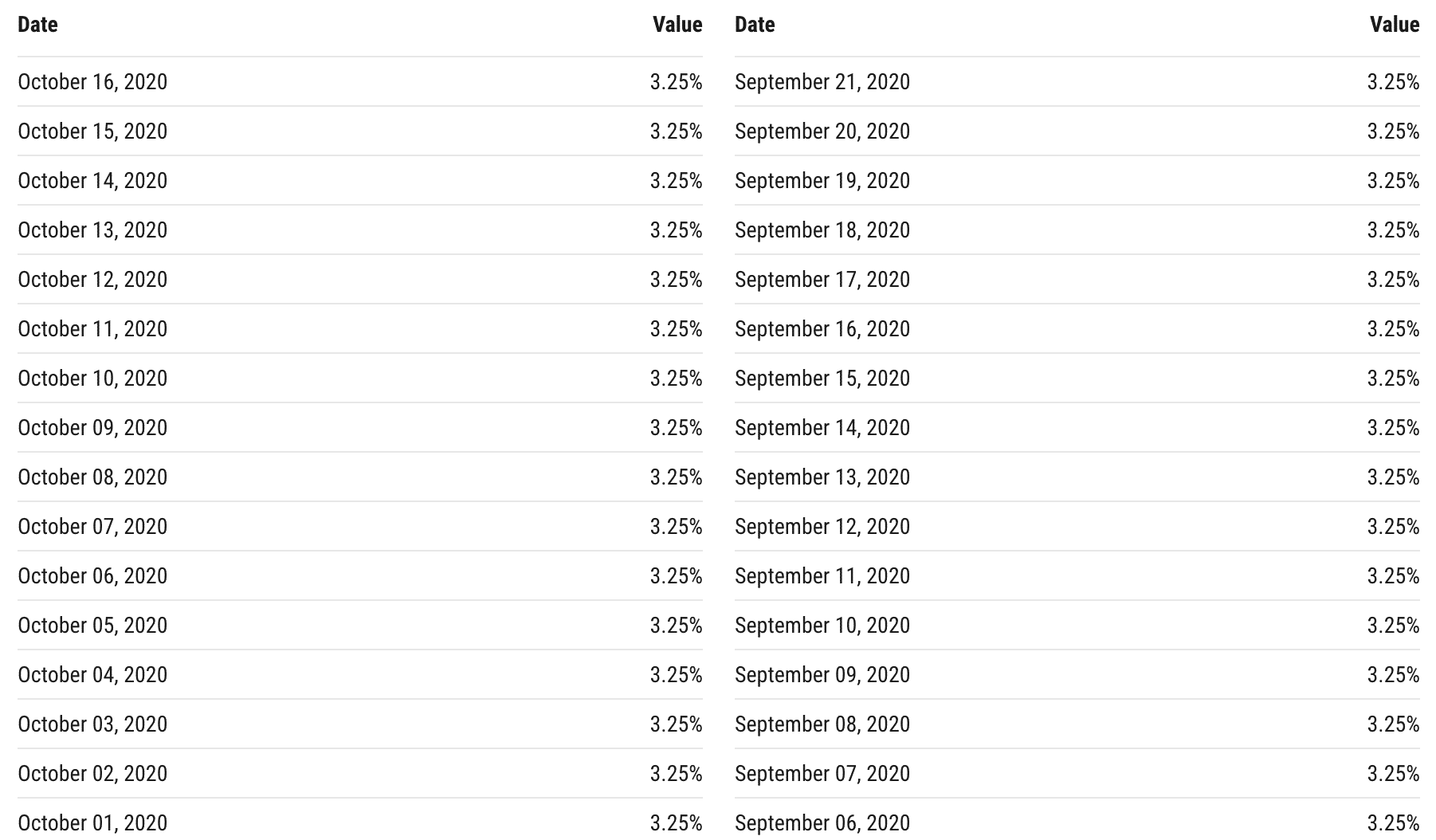

The prime rate is published by the Wall Street Journal on a daily basis. One thing to remember here is that the prime rate is 300 basis points higher than the Federal funds rate. So for example, in September and October 2020, the Federal funds rate was within the 0% to 0.25% range, while the prime rate was at 3.25%. So what happens here is that banks take the upper limit on the Federal funds rate and add it 3%.

Here are the US Prime rates for October 2020 (the time of writing this article):

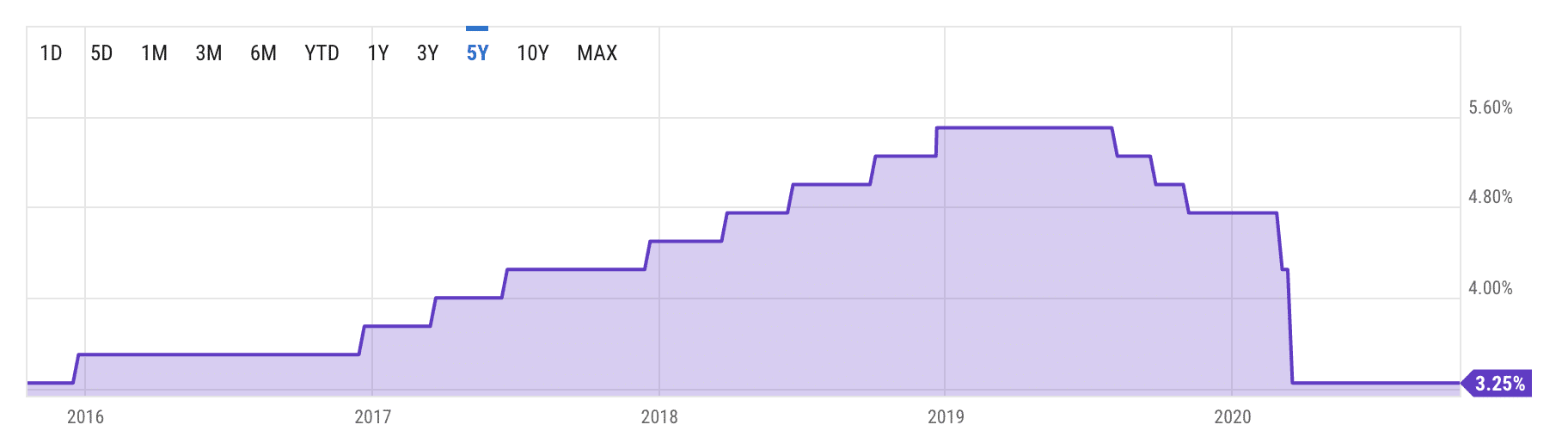

And below is the chart that shows the US Prime rates change over the course of the last 5 years.

It goes without saying that the prime rate does have a sizable influence on the exchange rate as well. The higher prime rates generally tend to support the exchange rate of the US dollar.

In addition to that, it is worth noting that the spread between the central bank rate and the prime rate is higher in the US than in the majority of developed countries, including Japan and Canada. Everything else being equal, this tends to be a positive factor for the strength of the US dollar.

Specifics of the US Prime Rate Formula

As mentioned before, the basic formula for the prime rate is quite simple. One can calculate it by adding the upper range of the Federal funds rate 3%. At this stage, some people might ask two very logical questions:

- Why do banks take the upper range of the Federal funds rate?

- Why do banks in the United States add 3% to the central bank rate?

So why do not banks take the midpoint or lower bound of the Federal funds rate, when setting the prime rate?

Well, here it is worth remembering that by September 2020, the Federal Funds rate stood at 0% to 0.25%. So the midpoint of this range is 3.125%. Obviously, it is technically possible to use this number as an anchor for setting rates. However, it is much simpler to use 3.25% as a reference. After all, the prime rate is used for setting rates for dozens of loan and deposit products.

Consequently, from the practical point of view, it is much simpler to take the upper range of the federal fund rate and use 325 basis points as a reference, rather than use 312.5 basis points for the same purpose.

Now at this point, some people might argue that the commercial banks have an option to use a lower bound of the Federal funds rate, in this case, 0% to set the prime rate. In this case, if we add 300 basis points to 0% we will end up with 3%, a nice round number for reference, and use.

However, here it is important to point out that in the case of the Federal funds rate standing within 0% to 0.25% range. This means that commercial banks can not simply borrow money from the central bank and from each other at exactly 0%. More likely it will be somewhere in the middle of this range, but in some cases, it might be even at 0.25%. If the commercial banks set their prime rate at 3%, then the effective spread here will be 275 basis points, instead of 300 basis points.

It goes without saying that banks have no intention to lose some of their spread because of those types of miscalculations. So one obvious way to make sure that it does not happen is to simply take the upper range of Federal funds rate and add it 3%.

Why do the US commercial banks add 3% to the Federal funds rate?

Well, actually there are at least three distinct reasons for this.

Firstly, it is important to understand that banks, just like any other businesses do have their operations. Obviously, they have to pay salaries of its regular employees, managers, and executives. They also have to pay for rents, utilities, equipment, and other types of expenses. So if they set the loans at the same rates as the US Federal funds rate, then they will not have enough money to pay for those expenditures.

In addition to that, banks are not non-profit organizations. They do pay dividends to shareholders, as well as retain some of their profits as cash reserves. In fact, some banks also use some of their cash for stock buybacks. Consequently, they do have to earn some profits in order to do those things.

The third reason for this is the fact that when banks lend money to their prime clients, they want to make sure that they are not losing purchasing power due to inflation. Here it is worth remembering that the long term average inflation in the United States stands near 3%. So if those commercial banks started lending money to their clients at 1%, then on average they would be losing 2% in terms of the purchasing power.

So, by setting the prime rate 3% higher than the Federal funds rate, the commercial banks can make sure that their loans are well-positioned to maintain their buying power after factoring in the inflation.

How does Prime Rate Affect Loans and Deposits?

In order to understand how a prime rate can influence the currency, firstly, it is important to analyze how it affects the overall economy. The first thing to mention about this is that when it comes to individual customers, the mortgage rates for borrowers with high credit ratings are typically very close to prime rates.

This is because of two reasons:

The mortgage represents a type of secured loan

This means that if the customer defaults, the bank can sell the property to recover the lost funds. It goes without saying that this reduces the risk exposure of the financial institution. In addition to that since the bank is dealing with customers with a high credit rating, generally speaking, they are unlikely to face a significant number of defaults under the normal economic circumstances.

So this is why the mortgage rates for prime clients can be very close or even identical to the prime rate. When it comes to the car loans and consumer loans, the rates are higher, since those are considered to be more risky products. So banks do generally add risk premiums on those. However, they still use the prime rate as a reference point to set those rates. It is not surprising that credit cards usually have the highest interest rates, however, they are also influenced by the prime rates, just like all other loan products.

%I didn’t see the second reason to wrap it into a heading%

Now, one thing to realize here is that the loan products are not the only ones that are affected by the latest prime rate changes. In fact, many savings accounts and certificates of deposit are also tied to this indicator. For obvious reasons, the interest rates on those generally tend to be lower than the prime rate. Yet, sometimes one can find 5-year CDs or other types of investment products that might be able to match the current prime rate, depending on the financial institution in question.

Influence of Prime Rate on Currencies

After those considerations, it seems quite logical that everything else being equal, the higher prime rates make the currency in question more attractive for traders and investors. This is because it allows traders to earn higher returns from carry trading. At the same time, investors can earn more money on certificates of deposit, bonds, and other fixed income securities. In fact, many companies are also using the prime rate as a reference point to set coupon rates on their corporate bonds.

Example of EUR/USD Exchange Rates

Therefore, it is not surprising that the higher prime rates tend to strengthen the currency in question against its peers. In order to illustrate one example of this, let us take a look at this daily EUR/USD chart:

As we can see from the above diagram, in early 2018, the Euro has risen against the US dollar, reaching a multi-year high of $1.25. However, during the subsequent two years, EUR/USD settled for a long term downward trend. As a result of this development, the US dollar has made some notable gains against the Euro, with the EUR/USD pair falling from $1.25 to $1.06 level by March 2020.

Now, one of the main drivers behind this trend was the rising interest rates in the United States. In fact, from late 2008 until December 2015, the Federal funds rate stood changed between 0% to 0.25% range.

This means that throughout this period, the prime rate in the United States was at 3.25%. However, from December 2015, the US Federal Reserve started increasing rates. As a result, the commercial banks responded by increasing their own prime rates as well. In fact, by December 2018, the US prime rate has reached 5.50%, a level not seen in a decade.

Consequently, this has made the US dollar quite attractive to traders and investors, resulting in the appreciation of the USD against some of its peers. However, here it is worth noting that this policy has not persisted indefinitely. The fact of the matter is that the US Federal Reserve already started cutting rates during the 3rd quarter of 2019, followed by even larger reductions in March 2020, in response to the outbreak of the COVID-19 pandemic. As a result of this development, the prime rate was back at 3.25%.

As we can see from the EUR/USD chart, the market reaction was immediate. The Euro started to recover some of its losses and by the end of September 2020 has reached $1.17 level.

So as we can see from this example, the higher prime rates generally tend to strengthen the US dollar, while lower prime rates make the USD much weaker. It goes without saying that there are many other factors which influence the exchange rates. However, the interest rates are one of the strongest forces which can have a sizable impact on the Forex market.

Example of GBP/USD Exchange Rates

Here it is important to point out that the EUR/USD pair was not the only pair which was influenced by the interest rates in the United States. In order to illustrate another example of this, let us take a look at the GBP/USD chart:

As we can see from the above image, at the beginning of 2018, the pound was trading near $1.35 level against the US dollar. During the following months, the British currency has made some notable gains, eventually even rising above $1.43 level.

However, from April 2018, there was a major reversal. The GBP/USD pair began its long term downward trend. In fact, the strength of the US dollar has reached such an extent that by March 2020, the value of pound sterling has even fallen below $1.15.

There are indeed several reasons for this development. Firstly, as mentioned before, we know that this was a period of rate hikes coming out of the US Federal Reserve, lifting the federal funds rate up to 2.5% by December 2018. In sharp contrast to this policy, the Bank of England has only authorized two 25 basis point rate hikes, lifting the key interest rate to 0.75%.

So as we can see here, when it came to the interest rate differentials, the US dollar had a clear advantage during this period. Now, this downward trend was also accelerated by the outbreak of the COVID-19 pandemic. As a result of the March 2020 stock market crash as well as due to an economic downturn, many investors started liquidating their assets and transferred those funds to the USD-denominated assets, leading to the appreciation of the US currency in the process.

However, it is also worth noting that at that point the US dollar has already lost the interest rate advantage we mentioned before. In response to the economic downturn, the US Federal Reserve has cut its rates to near-zero levels. At the same time, the Bank of England reduced its own key interest rate to 0.1%. So at this point, the interest rates in the United States and the United Kingdom were close to each other.

As a result, GBP/USD ended its long term downward trend and the British currency began to recover, eventually rising above the psychologically important $1.30 level by October 2020.

So once more, we can see from this example that the US interest rates have a decisive impact on the exchange rates of USD-based currency pairs.

Differences in Prime Rate Formula Calculation

So far we have discussed the fact that the US commercial banks usually set their prime rates 3% higher than the US Federal funds rate, set by the US Federal Reserve. However, here it is worth noting that this is not the case in all other countries.

For example, in Canada, the current prime rate is at 2.45%. This is because banks there set their prime rates 2.2% above the Bank of Canada’s rate. So as we can see from this example, the spread the Canadian banks use is lower than the spreads used by US commercial banks.

We can also take a look at the case of Japan. According to the latest data, published by the Wall Street Journal, by September 2020 the prime lending rate for commercial banks in Japan stands at 1.48%. Now, here it is worth remembering that the Bank of Japan has its key interest rate at -0.1%. So this means that the spread of the Japanese commercial banks is near 1.6%.

Those types of differentials between interest rate spreads do have several implications. Firstly, it is worth mentioning that lower spreads are beneficial to customers. This allows consumers to borrow money at a cheaper rate. This tends to boost economic activity in the given country.

Now, generally speaking, anything which promotes better economic growth tends to strengthen the currency exchange rate. However, for the sake of accuracy, it is important to point out that this is not necessarily the case with the prime rates. The fact of the matter is that banks simply can not pay higher interest rates on savings than they charge on their loans. If they do so, they would face some serious losses.

So when spreads are small and the prime rate is very low, the banks then have to offer very low interest rates to savers and investors. This makes the currency in question less attractive to market participants, having a negative impact on the exchange rates.

On the other hand, when the size of spreads is higher, then the commercial banks have more room to offer higher rates to the depositors. As a result, those currencies tend to be more attractive to investors and Forex traders.

So for example, if the prime rate in Japan is at 1.5%, the Japanese banks might not be able to pay to its depositors more than 0.5%, since they also have to cover their operating expenses. On the other hand, in the case of the United States, where the prime rate is at 3.25%, the commercial banks might be able to pay their depositors 1% or even slightly higher without having to take any losses. Consequently, everything else being equal, this state of affairs makes the US dollar more attractive currency for investing, than the Japanese yen.

Prime Rates in Other Countries

At this point, some people might wonder what are the prime rates in the Eurozone countries as well as in other nations. Well, here it is worth noting that there is no single prime rate in the Eurozone, which is accepted and used by all of the members of the block. This is because there is still a significant amount of divergence in terms of the economic growth and development between the different member states.

The general trend here is that the prime rates in countries like Germany and France are close to 1.5%. However, in countries like Ireland, Greece, and Cyprus the prime rates are considerably higher, close to 3% to 5%. So what is the reason behind this difference?

Well, the main reason behind this is the fact that those countries have not yet fully recovered from the Eurozone debt crisis. Consequently, the default rates on those nations are relatively higher than in German and France. Consequently, banks in those countries generally face more risk when lending money to customers. So in order to compensate for those potential losses, those financial institutions charge higher interest rates to their clients.

Moving on to the emerging markets, here it is worth noting that the prime rates are here even higher than that of Greece, Cyprus, and Ireland. There are actually several reasons for this. Firstly, it is helpful to remember that in developing countries, the unemployment rates are still high, with average incomes much lower than in developing countries. As a result, the default rates are considerably higher in those nations and as a result, banks face more risk. This is why they have to charge higher interest rates to clients in order to compensate for possible losses from those defaults.

However, this is not the only reason why prime rates are higher in developing countries. Here it is useful to remember that many emerging market currencies have considerably higher inflation rates than major currencies. For example, when the US has an average inflation rate of 3%, in some emerging countries this indicator might be at 6% or even higher.

This has two major consequences. The reality of the matter is that due to higher average inflation rates, the central banks in those countries are typically keeping their rates at high levels. This is because if they attempted to adopt near-zero policies of the world’s major central banks, then it is highly likely that the annual CPI rate will likely get out of control. So obviously, the policymakers at those institutions do not want this to happen.

In addition to that, even if one day all central banks in the developing world have set their interest rates to zero, the commercial banks in those nations might still be reluctant to reduce their rates to 3% or lower.

In order to explain the reasons behind this, let us take an example:

Let us suppose that the average inflation rate in a given country is 6% and the bank decides to give $10,000 to an individual at a 3% interest rate for a year. After 12 months the client repays the full amount with the additional $300 in the form of interest payments.

So the bank has lent $10,000 and received back $10,300. This means that in nominal terms the financial institution has made a $300 profit. However, here it is important to remember that the 6% inflation rate means that $10,000 will have the same buying power as $9,434 did a year ago. Even if we factor in the interest earnings of the bank, $10,300 today will have the same purchasing power as $9,717 during the previous year.

Therefore, as we can see from this example, in real terms, the bank has lost $283 in constant dollars, which is the equivalent of 2.83% of the entire amount. It goes without saying that the commercial banks are not really interested in losing the purchasing power of their money due to low interest rates. Consequently, they do offer relatively higher interest rates to their customers, sometimes even higher than 10%, in order to cover the source of funds, absorb losses from bad loans, as well as to pay for their operating expenses.

Now, the one objection here might be that generally, banks use depositors’ money for making loans, so they can simply pass on the loss of the purchasing power to their depositors. Here it is worth noting that considering the near-zero rate policies of the world’s major central banks, it is true that the majority of savers are losing their purchasing power.

However, here it is useful to remember that not all the capital which the bank lends to its customers, comes from the deposits. Indeed a significant portion of it can come from the investor’s capital. In addition to that, it is worth noting that all banks have their own mandatory cash reserves. Consequently, the banks have to make sure that they protect the purchasing power of those types of assets.

Imperfections of the Prime Rate

Despite all of its uses, the prime rate alone can not guarantee a 100% success rate to the market participants. It goes without saying that the relative nominal interest rates do play a major role in the exchange rate dynamics. However, there are many more factors at play in the Forex market than just the prime rate.

As mentioned before that many countries in the emerging markets have high prime rates. So if this was the only decisive factor, then those currencies should have appreciated considerably against the major currencies. For example, by the end of September 2020, the Turkish Central bank maintained its key policy rate at 10.25%, which was obviously a considerably higher level than the US Federal Funds rate, as well as the US prime rate. Despite this reality, the USD/TRY pair has risen by more than 90% since January 2018.

This might be surprising for some market participants, but there are several reasons why this is the case. Firstly, it is important to point out that the average inflation rates in Turkey are much higher than in the US. In fact, most of the time during the last couple of decades it was above 10%. Consequently, those depositors who are earning 10.25% interest in lira savings accounts are still losing money in terms of purchasing power. Consequently, in terms of maintaining the buying power of savings, it is better to invest in currencies which have higher real interest rates, instead of nominal rates.

Obviously, the list of additional factors influencing the Forex market does not end with the real interest rates. Such economic indicators as the relative GDP growth rates, the unemployment rate, the consumer confidence data, and other important measures all have some notable impact on the exchange rates.

Major points to remember about US Prime Rates

Here are the three main things we want you to learn from this article:

The US Prime rate definition

The US prime rate represents the base interest rate at which the American commercial banks are lending money to their prime individual and institutional clients. The general rule for the US prime rate is that it is 300 basis points higher than the upper range of the US Federal funds rate.

Difference between US prime rate and Federal funds rate

The difference between the US prime rate and the Federal funds rate represents the spread the American commercial banks apply to the interest rates. This is because those banks need to cover their regular operating expenses, as salaries for employees, rents, utilities, and equipment. In addition to that, many commercial banks also pay dividends to their shareholders on a regular basis.

Prime rates in other countries

The relationship between the prime rate and the central bank rate differs from country to country. For example, in Canada, the prime rate is 2.2% higher than the key central bank rate. However, the general rule here is that when prime rates are high, it tends to make the currency in question more attractive to depositors, traders, and investors.

At least something trading related

info is missing

At least something trading related 2

info is missing