Table of content

Forex arbitrage is a very low-risk trading method, which aims to exploit the inefficiencies in the market, by buying and selling currency pairs simultaneously. Here it is worth mentioning that there is not just one universally accepted type of arbitrage trading. Instead, there are several arbitrage strategies available to Forex traders.

The Forex triangular arbitrage strategy focuses on capitalizing on market inefficiency between three currency pairs. On the other hand, Forex swap arbitrage aims to take advantage of interest rate differentials. Forex latency arbitrage relies on delayed broker quotes to find some lucrative trading opportunities.

Finally, the Forex statistical arbitrage is a longer term strategy which focuses on purchasing undervalued currencies, in order to profit from their future appreciation. When it comes to this term, there is no one definition of currency undervaluation. Therefore traders use different indicators for currency valuations.

Each of those strategies mentioned above does have its own advantages and drawbacks. However, here it is worth noting that although arbitrage methods are very low-risk methods, they still do not represent risk-free options for traders. So there can be instances where traders could lose money even with Forex arbitrage strategies.

Understanding Forex Arbitrage

Despite the perceptions of many traders, modern markets are not always 100% efficient. In fact, sometimes those inefficiencies do create some profitable opportunities for market participants. The one obvious Forex arbitrage example would be so-called triangular arbitrage.

This method involves three different currency pairs, composed of 3 currencies. For example, let us suppose that a trader decides to open positions with the British pound, the Australian dollar, and the US dollar with the initial capital of $10,000. Let us further suppose that the current exchange rates are as follows: GBP/USD at 1.25, AUD/USD at 0.70, and GBP/AUD 1.80.

At first, a trader begins by selling $10,000 and buying £8,000. Then in the second stage, the market participant sells £8,000 for A$14,400. Finally, the trader sells A$14,400 and purchases $10,080. This means that at this stage a market participant holds a long GBP/USD, short GBP/AUD, and AUD/USD positions.

However, no matter where the market moves, as we can notice the trader has already locked in $80 payout. So as we can see in this case those three currency pairs were inefficiently priced by the market, which allowed for this sort of triangular arbitrage.

Nowadays, those sorts of opportunities still appear in the market. However, those occurrences are usually quite short-lived, because traders are usually very quick to respond to those situations and take advantage of it until the proper balance is restored. Therefore, in some cases, the triangular arbitrage opportunity may only last for minutes or even seconds.

This is why some Forex news websites and brokerage companies provide traders with a Forex arbitrage calculator, where they are able to quickly detect such opportunities and calculate their potential profits in the process. Therefore, those interested in this type of trading do not need to install any Forex arbitrage software in order to benefit from those possibilities. Instead, they can do all the necessary calculations by visiting brokerage or Forex news websites.

Finally, when discussing the triangular Forex arbitrage strategy, it is worth noting that despite the low risk attached to this method, it is not entirely a risk-free option. The problem here is that this approach involves opening 3 positions simultaneously, which still takes some seconds. Therefore in such a short period of time, the market exchange rates might change considerably and the profitable opportunity might disappear. As a result, traders might end up with a net loss.

The second possible problem is the fact that obviously there are spreads involved with Forex trading, so potential payout from this type of Forex arbitration might be entirely consumed by those types of fees.

Finally, one more thing to consider with this type of trading is the fact that traders need to close all 3 positions before the end of the trading day. The reasoning behind this is that if they keep those trades open for several days, they will face rollover charges, which can potentially offset any gains they made by arbitration.

Forex Swap Arbitrage

When it comes to using Forex arbitrage, those techniques are not confined to triangular Forex arbitrage. In fact, there are at least 3 other methods, which aim to take advantage of market inefficiencies. Next on our list comes Forex swap arbitrage.

This might sound like rather a complicated concept, however, the basic idea behind this is very simple. In the modern economy, the key interest rates are set by the central banks. Those types of decisions are dependent on the latest Consumer Price Index (CPI) releases as well as other indicators that measure the economic performance of a given country.

Therefore there is a great deal of diversity across the world when it comes to interest rates of currencies. On the one extreme, we have the Swiss National Bank, which now holds interest rates at -0.75%. On the other side of the spectrum, there is the Turkish central bank, which keeps rates at 8.25%. Therefore, interest costs, associated with borrowing money in Swiss francs will be entirely different from taking out loans in Turkish liras.

This divergence creates opportunities for traders. So some market participants prefer to borrow from low-yielding currencies in order to buy high-yielding currencies. As a result, the brokerage company pays a trader a daily interest on the interest rate differential, as long as the market participant keeps the position open. This method is also known as the carry trade.

Examples of Swap Arbitration

This strategy has been very popular in the trader community for many years. For example, from 2000 until 2008 traders opened long AUD/JPY positions and kept it open for a considerable amount of time. By that Bank of Japan kept rates from 0% to 0.5% when during the same period the Reserve Bank of Australia maintained its cash within 4.25% to 7.25%. So essentially carry traders could have earned from 4% to 7% annual return by carry trades.

Now obviously 4% to 7% return might be a very attractive return on savings accounts or on Certificates of Deposit (CDs). However, considering the risk associated with Forex trading, this might not be a very lucrative rate of return. Yet, here we are forgetting the fact that on this market traders can also use some leverage. For example, if traders used 5:1 leverage, the annual returns mentioned above, would increase to 20% to 35% range. In the case of 1:10 leverage, the potential returns would range from 40% to 70%.

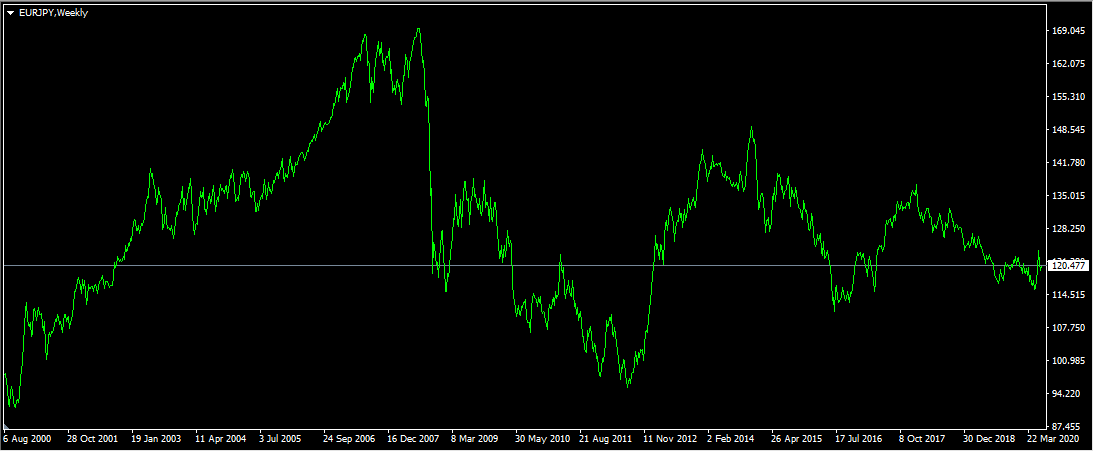

Obviously, this tendency also had a major impact on the exchange rates of the Australian dollar and the Japanese yen. In order to illustrate this better, let us take a look at this weekly AUD/JPY.

As we can see from the above diagram, during late 2000, AUD/JPY was trading close to 56 level. The weakness of the Australian dollar has persisted until September 2001. However, after this period the AUD started to make some steady notable gains over the course of the next several years. This appreciation reached its highest point in July 2007, when AUD/JPY reached 107 level. For the next 12 months, the pair experienced a significant amount of fluctuation but still was confined to the tight range.

However, from July 2008, as the Reserve Bank of Australia started cutting its rates, the pair dropped sharply. Just in a matter of 3 months, the pair collapsed to 58 level. This means that all of the gains the Australian dollar made during the last 7 years were essentially wiped out during one single quarter.

As the Reserve Bank of Australia started raising rates again, the AUD/JPY pair recovered and eventually rose above the 103 mark by April 2013. However, this upswing turned out to be very short-lived. Following RBA’s consistent rate cuts, the Australian dollar settled into the long term downtrend, nowadays trading just below 75 level.

So what do those developments tell us about the Forex swap arbitrage strategy? Well, here we can make several observations:

- Unlike with the triangular arbitrage, the interest swap arbitrage opportunity can remain open for an extended period of time, in some cases even several years. Therefore, this makes it easy for traders to detect such possibilities and potentially earn some payouts as well.

- The first problem associated with this type of arbitration is the fact that there is always an interest rate risk involved in this process. For example, if the inflation rate in the given economy falls much lower than the intended target, then it is highly likely that policymakers will respond by cutting rates. This will obviously reduce the profitability of swap arbitrage currency trading.

- There is also an interest rate risk associated with the funding currency. If the central bank which issues that currency decides to raise rates due to rising inflation or any other factor, this can also reduce the interest rate differential between two currencies in carry trading.

- Finally, as the above example has demonstrated, there is a considerable exchange rate risk. If the market rate drops significantly, it can not only offset all of the gains from carry trades, but also even force the liquidation of the entire position. This can inflict some serious losses on the trader’s account.

Therefore, swap arbitrage can be a potentially very profitable strategy for Forex traders. However, it does have its own risks, which should not be ignored by market participants.

Use of Forex Latency Arbitrage

Forex latency arbitrage is a relatively little known term among the majority of traders. This approach relies on the fact that some brokers adjust their spreads some seconds later than some of their peers. So if a trader can manage to gain access to faster quotes, then he or she might be able to know exchange rates 5 to 15 seconds before some brokers adjust their spreads.

To illustrate this scenario better, let us take a look at this 1-minute EUR/USD candlestick chart:

As we can see from this image, we have a long red line at the beginning of the diagram. This denotes the fact that within a one minute timeframe, the Euro fell from $1.1272 to $1.1264 level. So a trader could potentially have taken advantage of a relatively low-quality broker and sold EUR/USD at $1.1272. Then once the broker adjusted spreads, he or she could close the position at the $1.1264 level and gained 8 pips in the process. So this process in some ways can be seen as an automated Forex arbitrage.

It goes without saying that this strategy is not so simple to implement. In order to successfully use this method, traders need to find a very quick quoting service for exchange rates and also identify a relatively low-quality broker, which is usually late at adjusting for changes in the market price. So essentially here we are dealing with a low-risk scalping method. One can even call this approach a Forex broker arbitrage.

However, the fact that the latency arbitrage is a low-risk method, it does not imply that it can always guarantee no-loss trading for market participants. This strategy certainly has its own disadvantages. Firstly, the fact of the matter is that spreads can take out some or all of the gains made from the use of this method. Here it is important to keep in mind that the actual size of spreads is not fixed with the heavy majority of brokers. In times of the high amount of volatility, they do widen, making it even more difficult to earn profits from the latency arbitrage strategy.

The second obvious problem with this type of approach is the fact that there is no guarantee that a given broker will always be late in adjusting its spreads. In the era of major competitions, many brokers constantly try to improve the quality of their service. Therefore, one simply can not rule out the scenario, where a trader might try to use those methods, but would no longer be able to do this, because a given broker has improved its efficiency and adjusts its spreads much quicker than before.

How does Forex arbitrage work with Statistical Method?

Finally, after going through several arbitrage methods, we have a statistical arbitrage strategy. This involves the identification of currencies that trade significantly above or below the fair value. After conducting this type of analysis, a trader buys undervalued currencies and sells the overvalued ones. This strategy relies upon the assumption that at some stage, the market will eventually address and correct the imbalance and give traders the opportunity to earn some decent payouts in the process.

Here for the sake of accuracy, it is worth mentioning that there is no one universally accepted definition of ‘fair value’ or ‘currency undervaluation’. In fact, there are dozens of technical and fundamental indicators that traders can use as a measuring rod for this purpose.

One of the simplest methods to achieve this might be the use of moving averages. Many traders use a 20-day moving average as a short term indicator, while also utilizing a 50-day moving average as a medium-term measure. Finally, many traders also make use of the 200-day moving average as a long term indicator.

Therefore, one very simple way to use this type of arbitration method is to simply buy currency pairs that trade above its moving averages and sell the ones which trade above it.

This approach can work for some traders, however, there are also other methods of currency valuations. One of the most popular of those is the Purchasing Power Parity (PPP) indicator. PPP represents the exchange rates at which the average prices of goods and services in two countries can be equalized. The reasoning behind this theory is that when one nation’s products are much cheaper than others, it increases the demand for its exports and this eventually pushes the exchange rate much higher until it reaches the PPP level.

Example of Using Statistical Arbitrage Strategy

So how can traders use this arbitration method in practice? To make things simpler, let us use the example of EUR/SEK and take a look at this daily chart:

As we can see from the chart above, 3 years ago the pair was trading close to 9.60 level. At the time the latest reports coming from the British magazine Economist suggested that the Swedish Krona was approximately 30% overvalued.

The uptrend for the EUR/SEK pair began in October 2017 and lasted until the middle of March 2020. During this period the pair has risen from 9.50 to 11.20. This represents approximately 16.7% appreciation of the single currency. After this impressive run, the exchange rate moderated and by July 2020, settled around 10.45 level.

So back in 2017 a trader, using the statistical arbitrage strategy, would have analyzed several currencies and opened a long EUR/SEK position, because of the relative undervaluation of the single currency and considerably overvaluation of the Swedish Krona. As a result of this trade, he or she would have benefited from capital appreciation and earned some decent payouts in the process.

However, this example does not imply that the statistical arbitration can by any means always guarantee success. So the obvious question at this stage is: what are the risks with this approach? Well, firstly it is worth mentioning that the currencies can stay at undervalued levels for several months or even in some cases, several years as well.

The currency might be undervalued by PPP or any other economic measure. However, factors such as low-interest rates, political instability, low Gross Domestic Product (GDP) growth rate, or even persistently high inflation rates. Therefore traders always need to take those factors into the account when making trading decisions.

The second potential risk with this type of approach is the rollover factor. As mentioned, a trader does receive a daily interest if he or she buys a higher-yielding currency and sells the lower-yielding currency. However, we can easily imagine the scenario where the PPP, moving averages, or other types of evaluation might be telling traders to do the opposite.

So if a trader buys a currency with a low interest rate and sells a higher-yielding currency, then his or her account will be charged with daily interest payments. As mentioned above, Forex statistical arbitrage is a long term strategy. So most likely, traders using this approach have to keep the positions open for several weeks or even months. It goes without saying that during such a large period of time the rollover expenses will start to add up. Eventually, those types of payments might be all of the potential gains traders make from this strategy.

This can get even worse for traders if the undervalued currency does not appreciate for several months. In this case, traders will be left with a considerable amount of interest expenses with no payouts to offset those costs.

One obvious way to sidestep this problem is to find swap-free accounts. Fortunately, nowadays there are many brokerage companies, which offer accounts to their clients, which are specifically designed for this purpose. Brokers can make up for those losses by offering wider spreads, charging a flat fee per trader, and not paying any rollover to clients, when the interest rate differentials are in their client’s favor.

So as we can see statistical arbitrage strategies can be a useful long term approach to trading. However, just like with every other strategy we have discussed, this method also has its own risks and disadvantages.

Forex Arbitrage Explained – Key Takeaways

- Forex arbitrage strategies are low-risk trading methods, which aim to take advantage of inefficiencies in the market, by simultaneously buying and selling currency pairs. The is no one universal method of Forex arbitrage strategy. Instead, it includes a number of methods. The list of those includes triangular, swap, latency, and statistical arbitrage strategies. Each of them has their upsides and disadvantages, however, it is worth noting that none of them should be considered as a risk-free strategy.

- One of the simplest forms of Forex arbitration involves the use of a triangular arbitrage strategy. It involves opening positions with 3 currency pairs, composed of 3 currencies when they are priced inefficiently. Luckily, for traders, many financial news websites as well as that of brokerage companies have Forex Arbitrage Calculator available. This lets traders to quickly and effectively detect triangular arbitrage opportunities, without spending a great deal of time on manual calculations.

- The principals of interest swap Forex arbitrage is essentially the same as that of carry trading. Traders using these methods try to take advantage of interest rate differentials between different currencies. They achieve this by borrowing money in low yielding currencies in order to buy high-yielding currencies. As a result of this transaction, they can earn daily interest from brokers. So it can be a useful strategy for creating a daily income stream for traders. However, despite all of its upsides, it does have interest rates and exchange rates risks associated with this type of trading strategy.