Table of content

It goes without saying that one of the most essential elements of successful investing is to build a profitable stock portfolio. However, here it is also worth noting that there is no single universally accepted method to go about it, which can always guarantee success. Instead, investors have different investment strategies and goals.

The fact of the matter is that some of them are aiming to build a decent income portfolio. This category generally includes investments in those stocks which pay dividends on a consistent basis.

On the other hand, there are market participants who are aiming at creating a high growth stock portfolio. This type of investing aims at achieving the highest possible returns, instead of focusing on maximizing income.

For this strategy to succeed it is important for investors to pick stocks in a way to maximize the long term growth of the portfolio. Consequently, the first logical step in this direction is to find and then compile the list of undervalued stocks. This can include the securities which have their price to earnings ratio, also known as the P/E ratio, at 15 or below. However, in some cases, it might also be worthwhile to buy stocks which have their P/E ratios within the 15 to 20 range.

When choosing stocks for the best growth stock portfolio, it is important to check the historical share price performance of those companies. After all, if the security performed very poorly in the past, it is unlikely for it to do much better in the future.

The proper due diligence process also involves checking the financial performance of the company during the recent years as well as analyzing the latest quarterly reports. This involves going through the latest revenue figures, earnings dynamics, earnings per share, also known as EPS, as well as other indicators.

Another important factor to look at when investing in growth stocks is the policies of the individual companies regarding the share buybacks. If the given firm spends a considerable amount of money for this purpose, it can be beneficial for the long term stock price performance.

Finally, it is worth noting that building a growth portfolio does not in any way exclude the dividend stocks. In fact, investors always have an option to reinvest those payouts and buy more shares, which can be a valuable tool to increase one’s overall return in the stock market. Now let us go through those methods in more detail.

Picking Undervalued Stocks

It goes without saying that one of the most important ways of building a profitable portfolio is to find undervalued stocks. Those types of securities are generally defined as the ones the current market price of which is below its fair value.

Now, there are obviously dozens of different methods for measuring stock values. One of the simplest techniques to do so is to calculate the price to earnings ratio. The P/E ratio divides the current market price of the stock on the earnings per share indicator. The EPS in turn is calculated by dividing the total amount of the firm’s annual earnings on the number of outstanding shares.

For example, during the middle of September 2020, the Microsoft stock trades near $204 level. At the same time, the EPS of the company is at $5.76. Consequently, the price to earnings ratio of the firm is at 204 / 5.76, which is at 35.42.

When it comes to those types of stock valuations, the general rule of thumb is that if the price to earnings ratio of the individual security is above 20, then the stock is considered to be overvalued. Higher the P/E ratio, the more overpriced the security becomes. For example, if the price to earnings ratio of the stock is at 21, then one might suggest that it trades just slightly above its fair value. On the other hand, if the security has its P/E ratio at 100, then this might be an important indicator that the stock is extremely overvalued.

Therefore, when building a growth portfolio, the stock price can be a significant factor in the decision making process. Here investors need to find those stocks which are considered to be undervalued. In terms of price to earnings ratio, the stock is generally deemed to be underpriced in its P/E ratio is at 15 or lower.

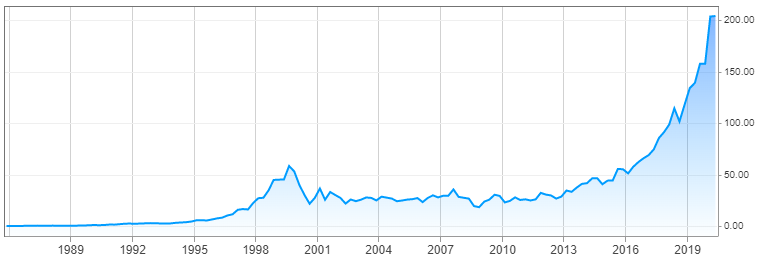

The reasons for this approach is the fact that undervalued stocks generally tend to perform better in the long term since they have more room for growth. In order to illustrate one example for this, let us take a look at this long term chart, showing the price movements of the Microsoft stock:

source: cnbc.com

As we can see from the above diagram, during 1986, the stock was considerably undervalued and was only worth just 10 cents per share. During the subsequent years, the stock had a very strong showing, making some massive gains in the process. By 1999, the security had reached a peak near the $58 level. This means that adjusting for the stock splits, the Microsoft shares have risen by 580 times, an epic achievement for any security.

However, at this point, it is not surprising that the stock has become considerably overvalued. As a result, the shares have faced a sharp correction during the late 2000 and then stayed mostly flat for several years. In fact by 2008, at the height of the financial crisis, the stock was once more back to the undervalued levels, trading at $18 by the end of the year.

Those people who have taken advantage of this undervalued opportunity have not regretted their decision, as the stock has risen considerably after 2009, eventually going all the way up to $204 by September 2020. This means that those investors who purchased the stock at $18 and held it until 2020, their net worth in this investment would have increased by 11.3 times.

Yet, as we can see from the current valuations, the price to earnings ratio of the Microsoft stock is now above 35. This suggests that the relentless rise of the stock has eventually led to its considerable overvaluation. Therefore at the current price, this security at the moment might not be the best addition to a growth stock index portfolio.

It is also worth mentioning here that the above arguments do not mean that the growth investors should strictly limit their investments at those stocks which have a P/E ratio at 15 or lower. In fact, according to the general rule, if the security has the price to earnings ratio within 15 to 20 range, it is considered to be fairly valued.

Now, the fact of the matter is that sometimes there is a strong bull market, with the stock prices becoming much more expensive than before. This is also fueled by the near-zero interest rate policy of the US Federal Reserve, as well as other major central banks in the world.

The reasons for this are quite simple. Many people simply do not find 0.1% or 0.25% savings accounts and certificates of deposit (CDs) very attractive options for investing. This is not surprising, considering that the average long term US inflation rate is 3%. Therefore, if they invest their funds at such a low rate, they would be losing money in real terms. So they turn to other investments, where they can find higher rates of return. So one of the places where they can potentially find decent returns is the stock market.

Therefore, if the market participants can achieve the average annual return of 9%, it will be 3 times higher than the average inflation rate, which can be quite impressive. Consequently, in times of low interest rates, a significant amount of capital tends to leave the bank deposits and moves on to the stock market.

So, it is not surprising that sometimes, this process makes it very difficult to find stocks which have their P/E ratios at 15 or lower. Consequently, in those cases, it might be a good idea for investors to invest in fairly valued stocks as well, meaning the ones with P/E ratios within the 15 to 20 range.

Historical Performance of Individual Stock

Finding the undervalued stocks can be considered one of the best growth investing tips. However, this does not mean that the market participants should only focus on the current price of the security, ignoring all other factors. In fact, one of the most important things one should consider here is the past historical performance of the stock.

The reality of the matter is that if the stock has not shown the potential for growth in the past, it is not highly likely for it to do so in the future. So even if the current share price is cheap, it might not be a good idea to buy the stock, if it had consistently performed poorly in the past.

In order to illustrate one example of such a scenario, let us take a look at this chart, which shows the price movements of Norwegian Air stock:

source: cnbc.com

As we can see from this diagram, by the end of 2015 one stock of the firm was worth 200 Norwegian Krone (NOK). During early Spring 2016, the stock has made some notable gains and reached 211 kr level. However, this turned out to be a high watermark. During the next three years, the security has declined steadily, eventually dropping all the way down to 98 kr by the Spring 2018.

There was a short-lived rally during April, however, after several months of consolidation, the downward trend resumed. At the beginning of 2020, the stock was already down to 42 kr level. The outbreak of the COVID-19 pandemic has only accelerated this decline, with the stock trading just at 1kr mark by September 2020.

It goes without saying that as a result of the virus outbreak, the stocks of many airline companies have suffered significantly. However, in the case of Norwegian Air, we can see that it has already lost more than 3/4 of its value, even before there was the outbreak of COVID-19. Consequently, this points to the fact that the stock has already been in a terminal decline for several years now. Therefore, investing in this company, might not be the most reliable way of building a stock portfolio, capable of delivering a decent amount of capital appreciation.

After reaching those extremely low levels, the stock might have some rebound, however, in order for it to achieve a sustainable recovery, the firm must be able to restore its profitability, something which is far from guaranteed, considering the current state of affairs.

Obviously, in the stock market, there is no such thing as the security which constantly makes gains, without facing any correction. However, what an investor should look here is the stock which has demonstrated its long term growth potential. One example of this would be the McDonald’s stock, the chart of which is displayed below:

source: cnbc.com

As we can observe from the above image, adjusting for stock splits, back in 1980, the shares were trading near the $1 mark. During the 1980s and 1990s, the stock has made some consistent gains, eventually rising all the way up to $45 by 1999. However, despite this impressive run, the stock faced a major correction for the next 3 years, dropping all the way down to $14.

Regardless of this major setback the shares began to recover from 2003 and began yet another long term upward trend. By September 2020, the stock already trades near $218 level. It is true that at this point the stock has already reached overvalued levels, since its price to earnings ratio is already well above 34. However, if the stock were to face some major correction and become more reasonably priced, then it might be a decent addition to any growth orientated portfolio.

Analyzing Financial Performance of Company

It is nice to find the stock which is currently reasonably priced and has a decent track record of the long term appreciation. However, the reality of the matter is that past performance can not guarantee that shares will always deliver a decent capital growth to investors.

This always depends on the financial performance of the company. It is not surprising that one of the growth investing tips experts give us is to find firms with improving profitability. One of the most obvious ways to determine this is to take a look at the company profits. This represents the amount left from revenues, after covering wages, rents, cost of raw materials, and other operating expenses, as well as taxes.

Here it is worth noting that when it comes to measuring the profitability of the firm, many investors give preference to the earnings per share indicator. This indicator is calculated by dividing the total earnings of the firm on the number of outstanding shares. This means that if the EPS of the individual stock is rising consistently, then it shows that the firm is improving its profitability. Consequently, this can eventually translate into higher stock prices and dividend payments.

In addition to those measures, experienced investors also take a look at the latest sales figures for the firm. The majority of quarterly and annual reports also break down those revenue numbers by regions and product types. This allows the market participants to get some idea about the latest sales dynamics of the company.

The professional investors also take a look at the overall size of a firm’s liabilities as well as the amount the company spends on servicing those debts. This is because if the organization takes on too much debt, then the management will be forced to spend a significant portion of the revenue on repayments, as well as on the interest. This can potentially bring the future solvency of the company under question. Therefore, it is very important for the management to keep its debt levels under control.

Another important to analyze, when one wants to build a profitable portfolio is the liquidity position of the firm. The reality of the matter is that the company might be profitable, but if it does not have enough cash reserves to address its problems, then this can put the solvency of the firm under risk. Therefore, it is essential for the firm to have enough liquidity to address all of the potential financial problems it might face.

Share BuyBacks

The share buybacks, also known as the stock repurchases are operations when the firm’s management buys back the company shares and withdraws them from the market. This process has several important implications.

Firstly, the most obvious effect of those operations is that it reduces the overall number of outstanding shares. Here it is worth remembering that the basic economic law of supply and demand does also apply to the stock market. Consequently, if the amount of supply, in this case, the overall number of shares decreases, this can certainly put an upward pressure on the stock price.

At this point, it is important to note that the expanding profitability of the firm is not the only thing which can increase the earnings per share indicator. Here it is worth remembering that the EPS is calculated by dividing the total amount of company earnings on the number of shares. Consequently, if the latter one decreases, this will push EPS higher. This means that after the stock buybacks each share of the company becomes more valuable since now it represents a larger portion of the firm’s earnings.

The share buybacks also send a strong signal that the management of the company is committed to building the shareholder value. This, in turn, tends to improve the level of confidence investors have in the firm and consequently, leads to increase in the share price.

Finally, it is helpful to point out that share buybacks allow firms to increase their dividends at a faster rate. The fact of the matter is that when the company repurchases its shares, it does not have to pay any dividends for those. Consequently, this frees up a considerable amount of money in dividend payments. Therefore, the management will have a choice whether to increase those payouts at a higher rate or buy back more shares. In each of those cases, the company shareholders do receive some tangible financial benefits.

This is why it is very useful to find the stocks of those firms, who authorize the stock buybacks on a consistent basis. Obviously, this does not give investors a 100% guarantee that the stock price will deliver substantial growth. However, this does make the future price growth more likely., due to increasing investor confidence, as well as due to expanding earnings per share indicator.

Potential for Dividend Reinvestments

There are indeed many growth stocks, with very decent financial indicators with no dividend payments. In fact, some companies have adopted the policy of reinvesting all of their profits, instead of paying payouts to shareholders. One obvious example of this is Berkshire Hathaway, the firm run by Warren Buffet, one of the most successful investors in the world.

Now, the line of reasoning behind this policy is that by reinvesting all of its profits, those firms should be able to achieve a faster rate of earnings growth, and consequently, its shareholders can benefit from a sizable amount of capital appreciation.

However, growth investing can not be limited to those stocks. In fact, there were many stocks which paid dividends on a consistent basis and delivered an impressive rate of capital growth in the process.

Now, one of the upsides of including those types of stocks in the growth portfolio is the fact that here investors get an opportunity to reinvest all of their dividends, instead of spending those payouts. By doing so, investors can substantially increase their annual rate of return on those investments. Here investors benefit from not only the share price appreciation but also from the fact that over time they increase the overall number of shares they hold in their possession.

In fact, many corporations that have paid dividends for several decades, also tend to raise their payouts over time. Consequently, investors can create a dividend growth stock portfolio with those. This means that due to the increasing amount of dividends, the market participants can purchase larger amounts of shares.

Basic Principles of Growth Investing – Key Takeaways

- There are several different types of methods when it comes to building a portfolio with stock investments. Some investors prefer to invest for income, while others more focus on achieving the long term growth. In the latter case, market participants are looking for those stocks with higher growth potential in order to maximize the capital appreciation.

- One of the most important principles for growth investing is to find stocks which are undervalued. According to the general rule, if the price to earnings ratio, also known as the P/E ratio is 15 or lower, then the security is considered to be undervalued. If this indicator is within 15 to 20 range, it is deemed to be fairly valued. On the other hand, if the P/E of the stock is above 20, then this can be a sign that it is overpriced.

- When choosing stocks for growth investing, in addition to the P/E ratio investors should consider several factors. This includes the presence or absence of stock repurchase programs, dividend reinvestment options, and earnings per share, also known as the EPS indicator of the company. Experience investors also analyze the past stock price charts when making the investment decisions.