Table of content

Just like the Forex market has an economic calendar, which tracks all of the announcements affecting currencies, in the stock market, earnings releases also have a significant impact on the price changes of securities.

So how do earnings releases work? Well, when it comes to the US companies, as well as some European firms, there are 4 earnings announcements during every single calendar year. Each of them covers the quarterly results. After the end of the 4th quarter, companies also release annual reports in addition to their regular quarterly earnings figures.

Before firms publish their reports, analysts prepare their own forecasts. In general, if the actual figures miss those expectations, then the stock price tends to decline. On the other hand, if the earnings exceed forecasts, then the price of security tends to rise.

Obviously, trading earnings announcements are not always so simple. There are indeed many other factors involved which influences the stock prices, such as the current stock valuations, the dividend policy, and the latest news about the company.

In addition to that, it is worth noting that the effect of earnings releases is not strictly limited to short term trading. In fact, the state of company finances can have a sizable impact on the long term stock price performance of the firm.

Finally, it is important to point out that sometimes the latest earnings announcement can create some undervalued opportunities. The fact of the matter is that in some cases, the market might overreact to some piece of bad news, triggering a sale of stock of the company, which in general represents a successful business. Consequently, investors can take advantage of those types of discounts and potentially increase their returns in the process.

Basics of Trading Earnings Reports

When discussing how one can trade earnings announcements, it is essential to make an important distinction. The fact of the matter is that those releases have both short and long term impact on the stock market.

For example, for those who are day trading earnings reports, the main principle here is quite simple. For any company listed on the major stock exchanges, analysts are publishing their earnings forecasts. This represents the amount of earnings and some other figures experts are projecting from the company. Consequently, it is not surprising that in most cases, when the firm’s earnings are lower than those forecasts, the investors are more inclined to sell their shares. As a result, there are more sellers at the market than buyers, depressing the share price.

On the other hand, if the latest company earnings exceed the analysts’ expectations, then the market, in general, tends to favor the stock of this firm. In this scenario, there are more buyers than sellers in the market. The basic economic principle of supply and demand also applies to the stock market. Consequently, the price of the stock rises.

Therefore, those who are day trading or swing trading earnings report can follow a simple method. They can wait until the release of the latest announcement. Once the latest numbers are published, if it is good news for the company and exceeds the analysts’ forecasts, then they can buy the stock. On the other hand, if the opposite is the case, then they can consider selling the security and liquidating their position.

Here it is worth noting that simply comparing current earnings with forecasts might not be enough for those analyses. It might be also helpful to compare the latest quarterly report to that in the same quarter during the previous year.

At this point, some people might ask quite a logical question: why should one compare the latest report to one published a year ago, instead of comparing it to the previous quarterly earnings? Well, here it is important to remember that seasonality can play an important role in the company’s revenues. For example, it is not surprising that most companies that run hotels or airlines have higher revenues during the summer than during winter.

The fact of the matter is that the majority of people like to take their holidays during the summer. Consequently, the sales of those types of firms are higher during the 2nd and 3rd quarter, compared to the 1st and 4th quarter.

Consequently, comparing the 2nd quarterly result to that of the 1st quarter can be very misleading. Most likely the 2nd quarterly report will show higher revenues than the first one. Now, this does not necessarily mean that the firm has made great progress and has massive growth in sales. As mentioned before, most likely there will be some strong seasonality factors at play here.

Therefore, in order to make more accurate comparisons, it might be a much better idea to compare the 2nd quarter result in 2020, to that of 2019. Since it covers the same season, this type of comparison will not be influenced by the seasonal fluctuations.

So if the latest report shows a sizable improvement over the previous year’s results, then it might be a sign to buy the stock. On the other hand, if earnings remain flat or are in a decline, then an investor might consider selling the stock or at least not adding this security to the portfolio.

Earnings Report Trading Strategy for Long Term Investors

When discussing the earnings trading strategy, it is important to remember that not all investors in the stock market are interested in making short term gains. In fact, many market participants, including one of the most famous investors in the world, Warren Buffet, are long term investors.

Instead of making small profits, they prefer to hold their investments for an extended period of time. This enables them to benefit from the regular dividend payments, as well as from the long term appreciation of the stock, which can be more considerable, than short term gains from day trading.

So how can a market participant trade earnings releases if one is a long term investor? Well, here it is worth noting that the main principles here can be slightly more complex than in the previous case and usually requires more analysis.

The first important component of this type of analysis is to construct the long term picture of company earnings. This involves the comparison of the latest report to that of the previous quarters. Then an investor can ask the following questions: are company earnings expanding in the long term? What is the average growth rate of the firm’s profits? Is the company in a position to maintain and grow its dividend payments to shareholders?

So as we can see when it comes to long term analysis, the latest quarterly report is only one piece of information one can use, it is not the only source for analysis. It is just one piece of the puzzle. Therefore, the market participant analyzes several reports in order to get some idea about the long term profitability dynamics of the given company.

It goes without saying that the latest earnings figure is not the only important factor for making investment decisions. In fact, there are several indicators in those reports, which might be important, something we will discuss at length below.

Important Items on Earnings Report

When it comes to trading off earnings reports, it is worth noting that generally, those quarterly publications of different companies tend to be similar and are mostly based on the same principles. The quarterly report usually starts with the title and logo of the firm and is followed by a summary of the most important items from the results. In order to illustrate this better, we can take a look at the fourth quarter report of Coca-Cola Company for 2019:

Firstly, we can see here that the report begins with a couple of sentences which summarizes the financial performance of the firm during this period. In this case, it says that there was a strong growth during the 4th quarter of 2019, as well as for the whole year. In addition to that, the report states that those results have exceeded the guidance, published by the company.

This is followed by a list of some of the important items in terms of the financial performance of the company. It shows that the net revenues have risen by 16% for the last quarter and by 9% for the entire year. In addition to that, the report mentions that the operating income has also risen by 19% during the 4th quarter of 2019 and by 10% for the full year.

As we can also observe from this document, it also shows that the earnings per share indicator of the company has risen to $2.07, which is actually 38% higher than the previous year’s level. Finally, the document also shows that the cash flow from operations for the year has reached $10.5 billion, 37% higher than the previous year.

Those highlights are usually followed by comments written by the Chief Executive Officer (CEO) or Chief Financial Officer (CFO) of the firm. Here they express their opinions about the recent financial performance of the company, as well as the outlook for the future.

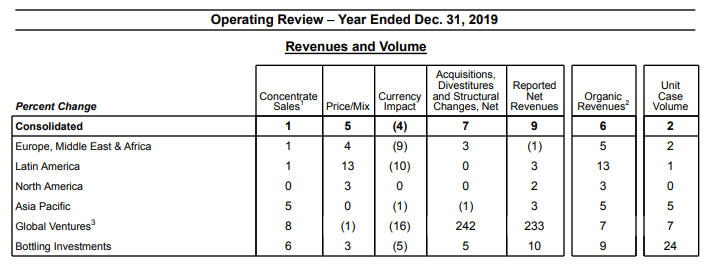

Those comments are typically followed by the breakdown of sales by region or product type. Here we can take a look at these sections from the same report discussed above:

As we can see from this image, this part of the document shows the operating review for the year. This includes revenues and volume figures, which are broken down into several categories. It covers Europe, the Middle East, and Africa in a single category, followed by North America, South America, Asia Pacific regions, global ventures, and bottling investments.

As the report suggests during 2019, in terms of revenue growth, the global ventures have delivered the best result, with the sales in this category rising by 8%. This was followed by bottling investments with a 6% increase and the Asia Pacific region, where revenue has increased by 5%. The consolidated sales growth rate stands at 1%.

Here it is worth noting that in a modern economy the product price usually does not remain flat over years. The fact of the matter is that in general, the prices of goods and services tends to rise due to several factors. An increase in general price levels means that over time the price of raw materials, wages, rents, and utilities tend to rise. Therefore, from time to time companies increase their prices to maintain their profit margins.

It is also worth mentioning that in some instances, companies might decide to reduce the prices of some of their products. This might be caused by a reduction in the prices of raw materials. Alternatively, it might be a part of the promotion with the company trying to attract new customers and increase its market share.

Consequently, quarterly reports do show the average pricing changes by categories. For example, in this document, the Coca-Cola Company has reported that the largest change, in this case, was in Latin America, where the pricing has increased by 13%, while the consolidated price growth stands at 5%.

Impact of Currency Exchange Rates on Financial Reporting

When it comes to earnings report stock trading it is easy to make a mistake of only focusing on headline figures. After all, the general principle here is simple, if the revenues expand at a decent rate, then the company is doing well. On the other hand, if sales are stagnating or falling, it might be a sign that the firm might be facing some financial difficulties down the road.

Unfortunately, this is not as simple as that. Here it is important not to forget that the majority of companies listed on major stock exchanges represent multinational corporations, selling their products and services to dozens of different countries. Consequently, the size of their earnings is bound to be affected by the exchange rate changes. So when it comes to the earning report trading this is something to keep in mind.

Returning to our chart displaying the annual results of the revenues of the Coca-Cola Company, we can see that there is a separate column which shows the currency impact on sales. This is because the reporting currency of this company is the US dollar. However, as we know Coca-Cola Company sells its products across the globe. Consequently, the firm receives revenues in dozens of different currencies.

Therefore, when the US dollar depreciates against its peers, the currency impact tends to be positive. This is because, in those times, revenues received from abroad tend to be worth more in USD terms, than before.

For example, let us suppose that during the previous year, an individual corporation, based in the US reports its earnings in USD. During the previous year in 2019, the firm received €300 million in revenue from the Eurozone countries. Let us further suppose that by the time of preparation of this report the EUR/USD exchange rate stood at 1.10.

This means that, since the reporting currency of the company is USD, it will report that during 2019, it received $330 million in sales from Eurozone countries. Now, what will happen if the underlying sales figures remain flat during the next year, but the EUR/USD exchange rate rises to 1.20?

Well, actually, the company will report that revenue received from Eurozone has risen to $360. So the firm’s sales have risen by 9.1%. This might seem quite an impressive achievement, but in this case, this was not the result of the company’s products becoming more popular. The reason for this expansion in sales is that the USD has depreciated against the Euro. So this is why the sales increased by 9.1% in US dollar terms.

Obviously, sometimes the currency exchange rates can also have a negative effect on company earnings as well. Let us now imagine that instead of EUR/USD rising to 1.20, it fell all the way down to 1.00, in other words, the US dollar has appreciated against the Euro to such an extent that it has reached a parity level with the European currency.

In this case, the company in question will report that the sales in Eurozone countries have dropped to $300 million, compared to $330 million during the previous year. In other words, sales fell by 9.1%. Therefore, without taking into account the currency impact some market participants might conclude that the company is facing serious financial challenges since it lost a significant portion of its revenue. However, the reality of the matter, in this case, is that the company’s sales have declined in USD terms because the US dollar has appreciated against the Euro.

In the case of the Coca-Cola Company earnings report, we can see that the general currency impact on the firm’s earnings was minus 4%. In other words, if the exchange rates remained at exactly the same level as during the previous year, then the company earnings would have been 4% higher than in this report. This was mostly because 2019 was a good year for the US dollar. During this period the US currency has made some notable gains against the majority of other currencies.

Now here it is worth noting that the currency impact was not the same for all the regions and categories. The most negative impact came from the global ventures category, where the negative impact amounted to 16%, followed by sales figures from Latin America, where the effect was at minus 10%.

On the opposite end of the spectrum, in North America, the currency impact is at zero. This means that the currency exchange rate changes in this region did not have any positive or negative impact on company earnings in terms of the reporting currency. This is not very surprising, since the largest portion of revenues from this region came from the USA, in US dollars.

There were also some sales from Canada and Mexico, but it seems the exchange rate change in USD/CAD and USD/MXN pairs were not large enough to have a sizable impact on the company earnings.

So this is something to keep in mind when dealing with earning report day trading as well as when doing the long term investing.

Analyzing Income Statements

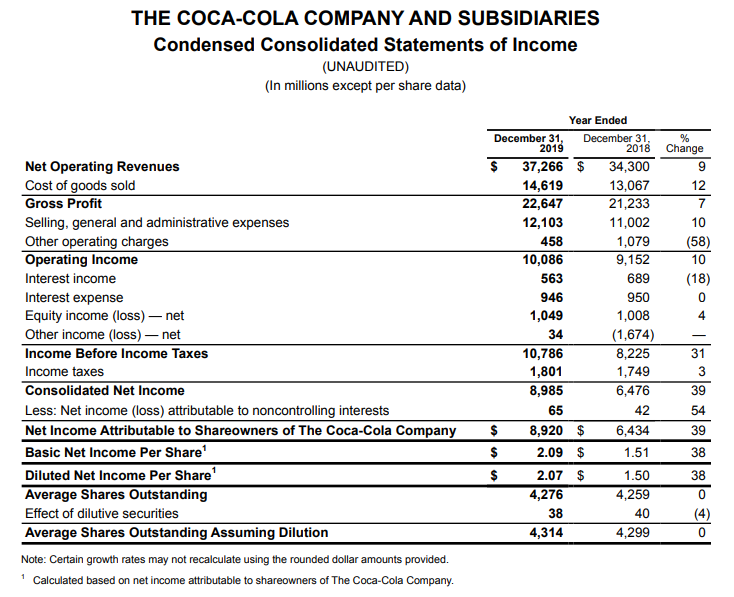

When it comes to trading earnings reports, one item an investor would be dealing with is the income statement. This lists all major income sources as well as expenses for the given company during the specific quarter or the year. In order to get a better idea about those types of statements, let us take a look at the income statement of Coca-Cola Company for 2019:

As we can see from the above statement, the net operating revenues for the year has reached $37,266 million. This was actually 9% higher than the previous year’s figures when this sales indicator stood at $34,300 million.

It goes without saying that just like any other company, this firm also has a number of expenses to cover. Firstly, there is the cost associated with producing those goods, which in 2019 stood at $14,619 million. This includes the cost of necessary ingredients for making Coca-Cola, Fanta, and other drinks produced by the company. It goes without saying that this corporation also spends a considerable amount of money on plastic and glass bottles.

Finally, the cost of production also includes the salaries of those workers and managers who work in factories, which produce those drinks. It is true that some processes are mechanized, however, it still takes a sizable number of workers in order to operate those machines and keep the production process going.

In addition to that we have the general, selling and administrative expenses category, which during the year was at $3,224 million, as well as other operating charges, worth $114 million. Here we are dealing with such expenses as transportation costs. After all, the firm has to take all thousands of prepared bottles from their factories to supermarkets, restaurants, and other selling locations. In addition to that, the firm needs to pay the salaries of marketers, accountants, drivers, and other employees in order to keep the business going.

Other important items to take into account include such items as interest expenses. Now here it is worth noting that many companies also have some interest income as well, which they received from bonds and bank deposits they hold. This is because nearly all major companies have a considerable amount of cash reserves. Therefore, instead of keeping all those amounts in physical cash, they move most of those into treasuries and banks to deposit, so that they can earn some income in the process.

On the other hand, those firms also have some corporate loans, mortgages, and other types of liabilities, which incurs an interest expense. Consequently, one has to take both of those factors into the account, when going through the financial statements of the company.

Another important item here is taxes. Obviously, the tax laws are different in every single country, however, what is certain is that all companies have to pay some taxes to the government of those companies in which they operate. In this report, it turns out that after taking those factors into account, the net income attributable to shareowners of the Coca-Cola Company at $8,920 million, which was 39% higher than during the previous year.

In addition to analyzing income statements, some investors also take a look at the balance sheet of the company. This document lists the assets and liabilities of the company. At the same time, some market participants also take a look at the cash flow statements as well.

So as we can see here there is plenty of material provided with earnings releases for investors to analyze and come up with their own conclusions about the current profitability of the company as well as its future prospects.

Buying Decent Stocks at Discount

When discussing how a trader or an investor can trade an earnings report release, it is important to mention that some experienced investors look at those announcements as opportunities to buy some solid stocks at a discounted price.

So what are the reasons behind this? Well, the answer lies in strategies associated with trading earnings gaps. The fact of the matter is that there are many solid companies listed on the major stock exchanges, which have delivered a decent amount of growth for several years and also returned the money to shareholders.

However, the reality of the matter is that no company can match the analysts’ forecasts 100% of the time. There are many reasons for this. Sometimes, the firm might face some setbacks, when launching new products or when entering into the new market. Or alternatively, the country where the firm operates might be facing a recession, leading to a temporary decline in company sales.

Obviously, this does not mean that the firm has bad management, or it is doomed to fail. It is more likely for the company to recover at some point in the future. However, the market quite often tends to overreact on pieces of bad news. As a result, the share price might fall considerably.

Therefore, what investors can do here is to create a list of companies with solid fundamentals and with a decent track record of returning money to shareholders. Then they can wait for earnings releases and buy those stocks, the price of which has gone down significantly, after those announcements. In this case, the market participants can easily get a 5% to 10% discount on solid stocks.

It is true that using this method only once might not deliver a sizable payoff to investors. However, if the market participants use this technique on a regular basis, then those gains can easily add up to a considerable amount. This has the potential to increase the size of returns substantially.

For example, let us suppose that during a 4 year period the price of the individual stock has risen from $100 to $120. In order words, those investors who owned this stock during this period had managed to gain 20% on the investment. However, as we know the stock market does not move in a straight line. There are always some corrections and pullbacks.

Consequently, if an investor managed to get the stock at $90, during one those times when there was panic selling of the stock, then the overall return would be 33%, instead of 20%. So in this case the size of return would be 13% higher than in the previous example. Therefore, as we can see here, even if an investor manages to get a decent stock at a small discount, it can substantially boost the rate of returns he or she receives in the long term.

Trading Earnings Reports – Key Takeaways

- When it comes to financial reporting, the US companies, as well as a significant portion of the European and Asian firms publish their earnings reports on a quarterly basis. In addition to that, the 4th quarter report is usually accompanied by the annual results as well. Those types of announcements are typically followed by increased volatility in the stock market.

- The short terms trading strategy of the earnings release is quite simple. If the latest numbers are in line with or above the analysts’ expectations, then it is likely that this will attract more buyers in the market and push the stock price higher. At the same time, if the latest figures miss those forecasts, this might encourage more sellers in the market and lead to a decline in the price of the security.

- The analysis of company earnings reports can also be useful for long term investors as well. Here they can look at the dynamics of the profitability of the company, by comparing the recent figures to that of the previous years. This type of research might involve analyzing income statements, as well as balance sheets and cash flow statements. In those types of analysis, it is also important to take the impact of the currency exchange rates on company revenues as well.