Table of content

There are indeed many investors who wonder how interest rates affect stock prices. After all the obvious question is: how could a stock market be completely indifferent to the latest monetary policy changes?

Well, actually, many financial experts, as well as commentators believe that there is a significant degree of negative correlation between the interest rates and the stock market. This means that when the central bank raises the interest rates, equity prices tend to decline. At the same time, when policymakers cut rates, it generally tends to have a positive impact on the stock market.

There are indeed several fundamental reasons behind this type of relationship between those two categories. The fact of the matter is that when a given central bank raises the rates, it tends to make the credit more expensive. This means that firms have to spend larger portions of their revenue on servicing their debts. Consequently, this generally tends to decrease its overall profitability.

In addition to that in a high interest rate environment, the instances of the capital leaving the stock market become more frequent. This is because when rates are high, the bank deposit products such as savings accounts and certificates of deposit (CDs) tend to offer attractive rates of return to investors. Consequently, many people in those times prefer to invest in such fixed income securities. As a result, this tends to have a negative effect on the stock market.

It is also worth noting that not all stocks are correlated with interest rates with the same degree. The fact of the matter is that in general, everything else being equal, banks tend to benefit from rate hikes since this enables them to increase their profit margins. In addition to that, the degree of negative correlation between interest rates and dividend-paying stocks might be stronger than other securities. The reasoning behind this is the fact that those two tend to compete for the capital of income investors.

Effects of Interest Rates on Corporate Finance

When discussing what the interest rates impact on the stock market it is worth remembering that the majority of companies which are included in the major stock market indices have a considerable amount of debts, worth several billions of dollars. Firms usually borrow money to expand their businesses, by hiring new personnel, buying new equipment, or by opening new locations.

In some instances, the management of the company might decide to borrow funds in order to tackle some financial challenges, faced by the company. Regardless of the reasoning behind those borrowings, there are essentially two ways companies can raise capital. They can go to commercial banks for liquidity. In this case, the current central bank interest rate will have a considerable impact on the rate, which the company has to pay for those loans.

The reason for this is the fact that many commercial banks themselves are borrowing a significant amount of money from central banks in order to meet their liquidity needs and regulations. This means that if the Federal Funds Rate stands at 3%, then commercial banks will usually not lend their clients at a loss at 2%.

What happens instead is that we have so-called the ‘Prime Rate’. Since the 1990s the Prime Rate is exactly 3% higher than the Federal Funds Rate. This means that as the current Federal Funds rate stands near 0.25%, the current Prime Rate is at 3.25%. The Price Rate is essentially an interest rate at which commercial banks lend money to their prime customers. That 3% difference is meant to cover the costs of operating the bank, such as salaries, taxes, rents, equipment, utilities, and other expenses.

This means that if the US Federal Reserve decided at some point into the future to raise its key rate to 0.50%, then the commercial banks will adjust their Prime Rate to 3.50%. So as we can see here, the central bank interest rates are directly tied to the rates at which individuals and companies can borrow money.

Consequently, when a central bank raises interest rates, it makes borrowing more expensive for corporations, so they have to spend more money on servicing their debts. Now if the overall size of liabilities of the firm is rather small, then the latest interest rate changes might have very little impact on the financial performance of the company.

However, the reality of the matter is that the heavy majority of those firms, listening on major stock market indices have a large amount of liabilities, usually amounting to billions of dollars. Therefore, even a 25 basis point rate hike can have a sizable impact on the financial performance of those companies, increasing their interest expenditure by millions of dollars. Consequently, it is not surprising that this usually has a negative effect on future company earnings.

At the same time, the interest rate effect on the stock market is that when the central bank cuts rates even by small amounts, many companies are able to save millions of dollars on interest expenses. Therefore, this has a positive impact on the future earnings of the firm.

The second common way companies raise capital is by issuing corporate bonds. The exact amount of interest rate is typically determined by investors on the auction. However, the outcomes of those auctions are also usually tied to the central bank interest rates. For example, if the Federal Funds rate is at 5%, then it is highly unlikely that investors will settle for just 3%.

So as we can see here, the interest rates affect not only the loan rates of commercial banks but also on the bond rates as well. Consequently, the latest central bank interest rate decisions can have a sizable impact on the stock market.

Competition of Investor Capital

When talking about how interest rates affect the stock market, it is worth noting that there are also other reasons why those two have such a negative correlation with each other. The fact of the matter is that both the capital markets and the stock market are essentially competing for investor capital.

The reality of the matter is that investors are always looking for a decent return for their capital. After all, it is their hard-earned money, something they have worked for and saved up for the future. Consequently, high interest rates affect the stock market in a distinctly negative way.

The reason for this is that when rates are high, investors always have an option to earn decent returns on their investments without having to risk the principle. For example, during 2000, the Federal Funds Rate stood at 6.50%. This means that at that time the market participants had an opportunity to earn a 6.50% return on some savings accounts and certificates of deposit (CDs).

So the obvious conclusion for some investors is as follows: Why would I risk the principle of my investment on the stock market, when I can earn 6.50% with my principal secured on fixed income securities? So this question is quite logical and makes a lot of sense.

As a result, many stocks reached their peak by 1998, simply moving sideways during the subsequent years. This was followed by the bear market since 2001, leading to a major correction.

We had the opposite scenario from 2009 until 2020. In response to the enormous challenges brought by the 2008 Financial Crisis, the US Federal Reserve has reduced its Federal Funds Rate to 0% to 0.25% range. It goes without saying that 0.25% is not an attractive rate of return for any investment.

This is especially true, considering that the long term averages US inflation rate is near 3%. So obviously, many people were not willing to lose 2.75% annually on real terms. In fact, with some major banks, the rates on deposits were even lower. There were plenty of cases with those institutions offering 0.1% or 0.05% returns to their clients. In other words, by their interest rate policy, the commercial banks were signaling to depositors that they had enough money and did not really need their capital.

Consequently, this gave investors a strong incentive to take their capital out of savings accounts and CDs and move it to the stock market or the real estate. In fact, for many market participants, the dividend stocks represent some sort of viable alternative to CDs. During this period, there were some decent stocks with a dividend yield ranging from 3% to 6%. Therefore, this allowed the market participants to get some decent return on their investment and preserve the purchasing power in the process.

So if anybody is wondering whether the interest rate affects the stock market, they can just take a look at the performance of the major indices in the aftermath of the 2008 Financial Crisis and compare it to the Federal Funds Rate. The connection between these two factors is quite clear. Obviously, there were indeed other factors involved in the process. However, the near-zero interest rates have been one of the strongest forces fuelling the growth in the stock market during this period.

Real Life Examples of Negative Correlation

At this point, some people might wonder whether there is any actual evidence to support the theory described above. Well, in order to judge the accuracy of those theories, let us analyze some charts.

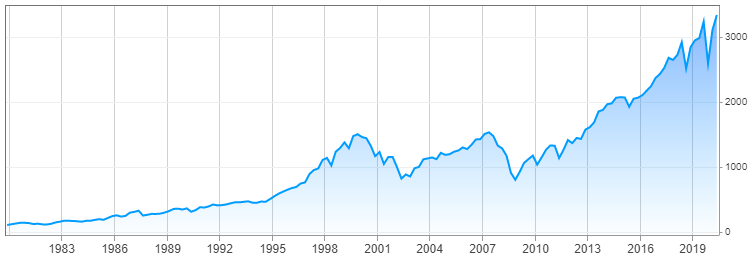

Firstly, let us take a look at the most famous stock market index, the Dow Jones Industrial Average, which includes the top 30 US companies listed on the New York stock exchange:

source: cnbc.com

As we can see from the above chart, the US stock market has made some dramatic gains during the 1980s, as well as in the 1990s. In fact, Dow Jones has already surpassed the 10,000 mark by 1998. This was quite surprising, because it was not long ago, back in 1995, when the index first surpassed the 5,000 mark. So this meant that on average, the stock prices have doubled just in the 3 year period. During the same period the US Federal Reserve, faced with rising inflation, by 2000 has raised the interest rates to 6.50%.

Now as we can see from the above image, after this development the stock market stagnated for some time until facing a major correction during 2001 and 2002. However, here it is worth remembering that the US Federal Reserve has responded by cutting the rates dramatically, eventually reducing them all the way down to 1%.

As discussed before, what happens when interest rates fall, especially when it is at 1% is that investors and savers start to look for alternatives to savings accounts and CDs. One of the options is indeed to invest in the stock market. Therefore, as we can see from 2003 the Dow Jones Industrial Average has begun to recover, eventually reaching new highs by 2007.

During the same period, the US policymakers started gradually raising interest rates, eventually increasing it to 5.25%. However, this adjustment was relatively short-lived. As the US housing bubble burst and the world faced the financial crisis, the US Federal Reserve has reduced rates all the way down to 0% to 0.25% range.

It goes without saying the US stock market faced some major losses during the 2008 Financial Crisis. However, the near-zero interest rate policy had given people a strong incentive to move their capital away from savings accounts and other fixed income instruments. One of the beneficiaries of this policy was the stock market, which began to recover. In fact, by 2013 the Dow Jones Industrial Average index has already surpassed 15,000, eventually even reaching 25,000 by 2019.

Here it is worth mentioning that the Dow Jones Industrial Average is not the only index which is affected by the rising or falling interest rates. Here we can take a look at the chart displaying the S&P 500 index:

source: cnbc.com

As we can see on the above diagram, the patterns here are very similar to the first chart. There was a peak in the stock price during 1998 and 1998, as well as in 2007. Those periods were followed by some major corrections. Here we can also notice that three was a long bull market beginning in the aftermath of the 2008 great recession, due to near-zero interest rate policies of the US Federal Reserve.

Exceptions to General Rule

So far as we discussed how interest rates affect stock prices, the general rule seems to be that those two indicators tend to have a strong negative correlation. However, when it comes to interest rates and their effect on stocks, it is important to note that there are some exceptions to this general rule.

The fact of the matter is that the rising interest rates do not have a negative impact on all companies listed on the stock exchanges. For example, the commercial banks, as well as the credit card companies stand to benefit from rising rates, since this can translate into the higher interest earnings for those firms.

At this point, some people might argue that in times of high interest rates, commercial banks have to pay higher rates for borrowing money from central banks. Actually, this is true, however, it is important to recognize that those financial institutions do not get all of their liquidity from central banks.

In fact, there are several other sources of capital. Firstly, there are customer deposits. Now, the rates on those fixed income instruments generally tend to move with interest rates. However, there is no law or rule which says that the interest rates of savings accounts and certificates of deposit (CDs) have to be exactly the same as with the central bank.

What many commercial banks and credit card companies do in this situation is to raise rates on their deposits more slowly compared to central bank rates. As a result, this situation allows those firms to increase their interest margins and boost their earnings in the process.

This seems quite logical. After all, in high interest rate environments banks have more room to maneuver and increase their profit margin, than compared to in times when rates are suppressed to near-zero levels.

So one thing to remember about how interest rates affect the stock market is the fact that unlike with other stocks, the securities of banking and credit card companies generally tend to benefit from higher rates. This is something to keep in mind when investing in those types of stocks.

Interest Rates and Bond Market

So far we have discussed the relationship between the interest rates and the stock market, however, it is worth noting that stocks are not the only securities influenced by the monetary policy decisions. As a matter of fact, it can have a sizable impact on the bond market as well.

Now, the general consensus among the financial experts and experienced investors is that just like with the stock market, the bond market is negatively correlated with the bond market. One thing how interest rates work is that the rising rates tend to have a negative effect on bond prices.

So what is the reason behind this? Well, in order to respond to this question, we need to take a look at how government bonds work in general. The general principle here is that the government gets to determine the term, as well as the coupon rate payable to the bond. However, it is important to note that the effective yields on the securities are determined by the auction.

If there is a high demand for bonds, then this tends to push the prices of those securities higher, reducing the yield in the process. On the other hand, if there is relatively less demand for bonds, then investors will demand higher yields and the value of those securities will fall.

For example, let us suppose that the government issues a bond with a nominal value of $1,000 with a coupon rate of 3%. This means that the government will pay a $30 in total annual interest to the owner of the bond, until its maturity.

So if this bond is in high demand and the market value of this security rises to $1,200, then the effective yield on the security will be 30 / 1,200, which is 2.5%. On the other hand, if there is little demand for this bond and its price falls to $900, then the yield will rise to 3.3%.

For the purpose of illustration, we can take a look at his long term chart, which shows the yield movements of 10 year US treasury bonds:

source: cnbc.com

As we can observe from this image, the yields on those types of bonds are indeed in a long term decline. This is a positive development for the bond prices since it shows that the demand for those securities has increased and consequently, their prices have risen as well.

Now, the dynamics here are quite similar to the relationship between interest rates and the stock market. There are indeed several reasons for this. The fact of the matter is that if the central bank has a high interest rate, then it is far more likely that bond investors will demand higher yields from the government. This tends to raise bond yields and consequently, reduce the market prices of bond securities.

However, nowadays we are dealing with the opposite type of scenario. As the US Federal Reserve restored the policy of near-zero rates, this increased demand for US bonds. This is because people are buying those securities in order to receive a higher rate of return, compared to the savings accounts. At the same time, considering the fact that banks pay very little for deposits, the bond investors are not in a position to demand higher returns from the US government.

Therefore, it is not surprising that in 2020, the US government bonds are in high demand, the market prices of those securities increases, and the yields fall. So as we can see, when it comes to the bond market, the dynamics here are generally similar to

effect of Interest rates on the stock market

It is also important to point out that although the US reserve has a healthy degree of influence on the bond market, it can not always change yields as the board members might wish. The reality of the matter is that those are the bond investors who eventually determine the interest rates. So if it happens that bond investors demand high interest rates from the US government, the Federal Reserve can not just suppress those yields easily without any economic repercussions.

In fact, back in 1993, as the Clinton administration took power, one of the problems faced by the government was the fact that bond yields were rising consistently, eventually surpassing the 7% mark.

At that time the chairman of the Federal Reserve, Alan Greenspan, advised the president and Congress to reduce the budget deficit. So he did not try to intervene on a massive scale and suppress those yields artificially. At that time the Clinton administration, as well as congress decided to take his advice and during the subsequent years have reduced the deficit on a consistent basis.

In fact, the Clinton administration went even further, with the US running a budget surplus in 1998, the first time in several decades. As a result, the bond investors have regained confidence and yields fell considerably.

Effects of Interest Rates on Stock Market – Key Takeaways

- Interest rates affect stocks in a way which forms the negative correlation between them. This means that when rates rise, it has a negative effect on stocks. On the other hand, falling rates tend to boost the stock market. This adverse relationship is not a new phenomenon, in fact, the study of charts shows that the negative correlations between interest rates and stocks go back to several decades.

- There are essentially two main reasons for the negative correlation between stocks and interest rates. Firstly, it is important to point out that when the central bank raises the rates, it makes borrowing more expensive for households and corporations. Consequently, businesses have to spend more money on servicing their debts. In addition to that, high interest rates tend to attract some of the investor capital to fixed income investments, away from the stock market.

- Just like with any other rule, there are some exceptions here as well. The fact of the matter is that stocks of commercial banks and credit card companies generally tend to benefit from higher interest rates. The reason for this is the fact that this gives them an ability to increase their interest rate margins and consequently, boost their profitability in the process.