Table of content

The leverage is essentially a loan which the brokerage companies provide for traders, which they can use for trading purposes. The actual level of leverage depends on the broker and local government regulations and can vary from 1:1 to as much as 1:1000. Those types of loans can help traders to significantly increase their payouts and earn much higher returns for their investments.

One can argue that Forex is the most highly leveraged market. Obviously, one can use margin trading with stocks, make real estate investments with 5:1 leverage, by making a 20% down payment and borrowing the rest 80%. However, compared to those markets, Forex traders can take on might higher levels of leverage.

Despite some of its obvious upside, some experienced professional traders and financial experts call leverage a double-edged sword. The reasoning behind this is the fact that by taking on those loans, traders are also running a risk for suffering higher losses, compared to what they would lose if they did not use leverage.

Consequently, there are indeed some risk-averse investors and traders who usually do not use broker loans and rather prefer to trade and invest with their own cash. For the majority of Forex traders, this approach might make very little sense. However, if we analyze this question in greater detail, we might see that there are some categories of traders, to whom no leverage trading can have some tangible benefits.

The first possible category for this is traders with very large trading accounts. For example, some traders with $100,000+ accounts might not feel comfortable with trading 50:1 or even 50:1 leverage. The reasoning for this is that nobody is secure from sometimes making mistakes and entering losing trades. So with large capital and high amounts of leverage, any significant loss might take out a significant amount of investment.

On the other hand, no leverage Forex trading could keep those types of losses at a minimum and let traders survive even the most volatile markets.

Another major category of traders who might prefer Forex trading without leverage can be those investors who use carry trades as some sort of component for a retirement portfolio. By using no leverage, they can ensure that the daily income they receive keeps coming in, even the exchange rate of the chosen currency falls.

Benefits of Trading with Leverage

When discussing the topic of trading with and without leverage, it is important to first consider some of its benefits. Considering the fact that the heavy majority of Forex brokers use those types of broker loans on a regular basis, speaks about the fact that it should have at least some number of advantages.

Well, leverage can be helpful in many cases. Firstly it is worth mentioning that on a comparative basis, Forex is relatively less volatile than the stock market. Therefore, to earn some significant returns on a regular basis, traders should trade with large amounts. For example, the standard lot in the Forex is 1 lot, which is the equivalent of 100,000 units of a given currency.

The obvious problem here is the fact that the majority of Forex market participants do not have $100,000 to work with. Actually, if one can accumulate this amount of money, at that stage, many financial experts would advise to diversify to other investments as well, rather than putting all of the eggs into one basket.

However, the existence of leverage gives investors with relatively small amounts of capital the opportunity to join the Forex market and potentially earn some profits in the process. So returning in our example, a trader can start trading with just $5,000, use 20:1 leverage, and trader with $100,000.

So as we can see from this example, the leverage gives traders and investors with small amounts of capital an opportunity to have access to larger sums of money for trading and potentially earn higher payouts in the process.

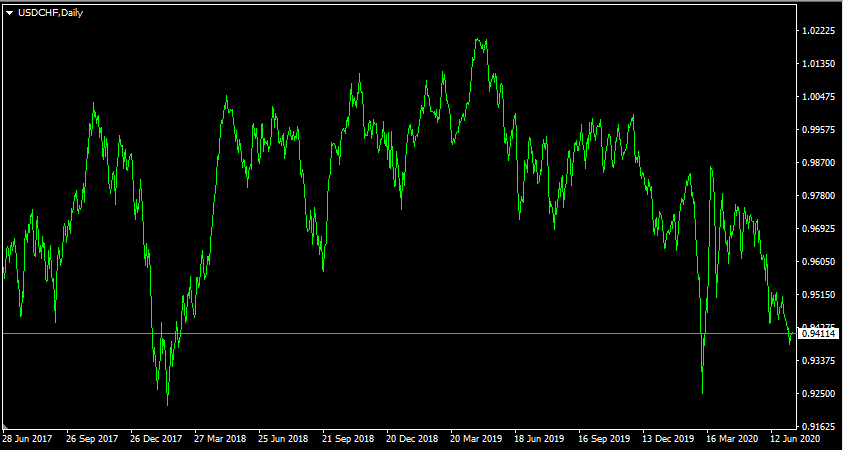

The second benefit to leverage is the fact that it can help traders to earn higher returns even with those currency pairs which have a very low level of volatility. To illustrate this better, let us take a look at this USD/CHF chart:

As we can see from the above diagram, during the last couple of years, the pair has become one of the least volatile currencies in the Forex market. 3 years ago, USD/CHF was trading near 0.9550 level. The pair had its low point in February 2018, when the US dollar dropped down to 0.92 mark.

This was followed by a lengthy period of very slow, but steady USD appreciation. As a result of those developments, the USD/CHF pair has reached 1.02 level by April 2019. After reaching this peak, the US dollar began its slide and by July 2020, traders close to 0.94 level.

So as we can see from this example, the distance between the low and high points during the last 3 years of trading is approximately 1,000 pips, considerably lower than other major currency pairs. So in this case the best realistic expectation for swing and long term traders is to just gain up to 100 pips. Consequently, if a trader opens a long USD/CHF position at 0.9400 level and in one month the pair rises to 0.9500, then this would represent a 1.06% appreciation of the currency.

Therefore, if a trader invests $10,000 in this trade, then the eventual profit, in this case, would be $106. This is nice, but for many traders, such a low return on investment might not be satisfactory for a month’s worth of effort. So if instead, a trader used even a moderate amount of leverage, for example, 20:1, then he or she would be able to open a $200,000 position by investing just $10,000. Therefore, in this case, the profit would be $2,120, instead of just $106, representing 21.2% return on investment.

Downsides of Using Leverage

Now, despite some of the advantages of using leverage, it does not mean that it has no drawbacks. Returning to our earlier example, we should consider the fact that the USD/CHF pair might go the opposite way. Instead of a steady appreciation of the US dollar, by the end of the next month, the American currency might depreciate. So let us suppose that due to those developments the USD/CHF pair drops from 0.94 down to 0.93. This 100 pip fall represents a 1.07% decline in the exchange rate.

So the obvious question here is this: If a trader used 1:20 leverage and invested $10,000 on the long USD/CHF position, then what will be the amount of losses? Well, using 1:20 leverage here means that a trader puts down $10,000 and the broker lends the rest $190,000. So in this case, $190,000 represents the loan investment which has to be returned to the broker, no matter the exchange rate.

Anything above $200,000 is for a trader to keep as a profit. On the flip side of the coin, if the market goes the opposite way, then it is a market participant who has to take a hit from losses, while the broker must still get the money in full.

So in this case, due to this decline in the USD/CHF exchange rate, the value of the trade will drop from $200,000 down to $197,872. After closing the trade, the brokerage company will get its $190,000 back and the trader will be left with the rest $7,872. This means that the market participant lost $2,128.

Let us now consider the other scenario, if a trader invested $10,000 in this position, without using any sort of leverage. In this case, the value of this trade would drop down to $9,894. This means that the total amount of loss in this scenario would be just $106. So as we can see from this example, in the case of losing traders, the actual amount of losses is usually much lower when traders are trading Forex without leverage. So this is why this type of trading might be more appealing for a number of market participants.

Traders with Large Trade Balances

As mentioned earlier, the majority of traders simply can not afford to invest $100,000+ sums into the Forex trading. On the other hand, some market participants have the ability to come up with such a large amount of trading capital. The problem for those traders is the fact that they stand to lose much more money from losing trades, then those with limited amounts of capital.

Therefore, one way those relatively more resourceful traders can protect their trading accounts and reduce their risk exposure in the process is to do currency trading without leverage. For those of them, this trading style can have certain distinct benefits.

Firstly, as we have seen from the earlier example, by trading without leverage Forex traders have the ability to cut down the actual dollar amount of their losses they suffer from losing trades. This is an important advantage because it is much easier to recover from small losses. On the other hand, when a trader losses a significant portion of trading capital, then it is much harder to regain those amounts and turn things around.

Secondly, by avoiding leverage, traders are able to hold positions with currency pairs for an extended period of time without being forced to close trades due to adverse market movements. In some cases, this gives opportunities to traders to recover from some of the losing positions and turn them into winning trades.

Example of EUR/GBP Currency Pair

For the purpose of better understanding those dynamics, let us take a look at this daily EUR/GBP chart:

As the above image demonstrates, after the steady appreciation of the Euro, the pair have reached a high point of 0.93 level by August 2019. This was followed by months of strengthening of the British pound. As a result of this development, the EUR/GBP pair has fallen all the way down to 0.83 level. However, this period of Euro weakness has not persisted for long. Just in a matter of one month, the single currency was trading above the 0.93 level and by July 2020, the pair stabilized around 0.91 mark.

Now let us consider two scenarios with this currency pair. Let us suppose that just before the Euro’s decline a trader opened a long EUR/GBP position with $10,000, using 1:20 leverage when the pair was trading at 0.90 level. As we already know, the Euro temporarily fell to 0.83.

This means that the trader essentially had two options. He or she could close the position at some point and accept some amount of losses. Or alternatively, even before the pair fell to 0.83, the margin call would be triggered and the entire $10,000 investment would be lost.

Next, let us now discuss the second scenario. Just like with the first case, a trader opens a long EUR/GBP position at 0.90. However, the one difference here is the fact that instead of taking on any leverage, the trader invested his or her own $100,000 to fund this trade.

As a result of this setup, when the pair fell down to 0.83, it would reduce the value of the trader’s account from $100,000 to $92,222. However, unlike in the first scenario, here market participant’s trades will not be closed down due to margin calls. Here traders have the ability to analyze the situation, latest economic data, and technical indicators. So if the situation calls for it, the market participant has the option to hold on to the trade.

If this happened, the trader would have benefited from the EUR/GBP’s appreciation from 0.83 to 0.93. At this point, the value of the trader’s account would have reached $103,333. Therefore, at that stage, the trader could close the position and lock in those potential payouts.

One important point to keep in mind here is the fact that during this 6 month period, traders had to cover some rollover expenses. The fact of the matter here is that at that time the European Central Bank held rates at 0%. On the other hand, the Bank of England kept its key interest rate at 0.75%.

Considering the broker commission of 0.1%, the trader had to pay the equivalent of 0.85% annual interest rate on a daily basis, as long as the position was open. For a 6 month period, this expense will be approximately $425. Yet, despite those rollover fees, the trader would still end up with a net profit of $2,908.

Here it is worth noting that trading without leverage does not guarantee that traders will always avoid losses. Long term or day trading without leverage does reduce the risks and gives a greater margin of safety to market participants. However, despite those obvious advantages, there might be several cases when traders might be better off closing losing positions and cutting potential losses, rather than chasing losing traders indefinitely.

Conducting Carry Trades without Using Leverage

As we have discussed above, traders who have a considerable amount of capital can engage in trading and try to earn some returns on the possible appreciation of currencies. However, as we have seen before, there is still a risk that traders might get the trades wrong and lose some money in the process.

Now, the one way traders could reduce their risk further is to engage in carry trades. This involves borrowing money in low-yielding currencies in order to invest in higher-yielding currencies. This allows traders to capitalize on those interest rate differentials and earn daily income from the broker in the process.

One obvious risk with this type of Forex strategy is the fact that the exchange rate of that higher-yielding currency might fall, triggering a margin call and forcing the liquidation of the position. However, when it comes to trading without leverage, there is no such threat. In this case, the trader uses his or her own capital to execute traders. Since the broker did not lend any money to the client, there is no risk of a margin call.

Consequently, traders can keep carry traders open for months or even years, without the fear that the broker would liquidate their trades if the market turns against their positions. As a result, this allows market participants to receive income on a daily basis for an extended period of time.

Example of Carry Trading Without Using Leverage

To illustrate how this process might work, let us take an example from this daily EUR/ZAR chart:

As we can see from the above diagram, the exchange rate between the Euro and South African rand moved sideways and stayed mostly stable from late 2017 until the end of 2019. However, the outbreak of the COVID-19 pandemic led to panic selling for emerging market currencies. As a result of this process, the EUR/ZAR pair has risen from 15.80 to 20.60. Once the panic selling ceased, the South African rand started to recover. By July 2020, the pair trades close to 19.10 level.

From March 2020, all of the world’s major currencies are now yielding 0.25% or lower. Therefore, the opportunities to earn substantial income from those no longer exist. Consequently, nowadays traders looking to earn some daily revenue from carry trades, have to choose between some emerging market currencies. One of those possible options would be to open a short EUR/ZAR position.

For several years now, the European Central Bank (ECB) keeps its key interest rate at 0%. This makes the Euro an attractive funding currency for carry trades. One the other hand, the South African Reserve Bank (SARB) moved its interest rates within a 3.75% to 6.75% range. In order to keep things simple, let us take the midpoint of this range, 5.25% for the purposes of our calculations.

Here it is also important to remember that the brokerage companies do retain some portion of those swap payments as a commission. So if the interest rate differential is 5.25%, the broker might keep 0.1% and pass on the rest 5.15% to traders.

So let us suppose that a trader opens a short EUR/ZAR position with $100,000 without using any leverage. In this case, if he or she keeps the trade open for a year, the total amount of earnings from the rollover will be $5,150. This means that the daily interest payments will be the equivalent of $14.11 or $429.17 per month.

Advantages and Disadvantages of Carry Trading with No Leverage

If a trader used even 1:5 leverage with the position mentioned above, then the position would have been liquidated due to the decline of ZAR. Therefore, the market participant would suffer some serious losses and would not be able to receive daily income. On the other hand, with no leverage, traders are able to retain this position indefinitely, earning some daily payouts in the process.

This can be a very attractive rate of return, especially considering the fact that all major central banks now have adopted near-zero rates. As soon as some years ago, even after the great recession, investors and savers could earn up to 4.75% from the assets, denominated in the Australian dollar. However, after the outbreak of the COVID-19 pandemic the Reserve Bank of Australia has reduced rates to 0.25%.

The Federal Reserve has returned its Federal Funds Rate back to 0% to 0.25% range. At the same time, some central banks went as far as to resort to negative interest rates. For example, the Bank of Japan cut rates to -0.1%, while the Swiss National Bank went even further, taking rates all the way down to -0.75%. In the latter case, savers with larger balances have to pay commercial banks for the privilege of depositing money with them.

As we can see from the above examples, nowadays it is increasingly difficult for investors and savers to earn some decent returns for their capital. After all, they still need to earn at least enough of a return to offset the loss of purchasing power due to inflation.

Considering this environment, one place to earn those decent returns is from carry trades. This might have several advantages over other sources of income. Firstly, in this case, traders receive their interest payments on a daily basis. In contrast, the heavy majority of rental properties pay rents on a monthly basis. At the same time, most dividend-paying stocks pay quarterly dividends.

The second important advantage of carry trading income is the fact that it is quite a liquid instrument. For example, if a property owner needs to get some cash, then the actual process of the sale might take several months. On the other hand, with carry trading, all a trader needs to do is to close the position and withdraw funds to his or her bank account.

Despite all of the advantages, described above, it is worth mentioning that carry trading without the use of leverage still has its own risks and downsides. Firstly, here it is important to keep in mind that unlike with certificates of deposit (CDs) or savings accounts, the principle of investment is not secure.

So if traders invest $100,000 in a short EUR/ZAR position, they will earn daily income, however, the value of this investment will not remain fixed at $100,000. Instead, this will fluctuate according to the exchange rates. This means that if at some point in the future, a trader has to close position and withdraw money, it might happen at a loss.

Trading Forex Without Using Leverage – Key Takeaways

Many experienced professional Forex traders refer to leverage as a ‘double-edged’ sword. This is because while leverage can considerably increase traders’ potential profit, it can also magnify the amount of losses. Therefore, some categories of traders, such as individuals with large $100,000+ trading accounts and some long term carry traders might prefer to trade with their own funds and avoid borrowing money from the brokerage company.

Trading without leverage lets traders with large amounts of capital avoid the margin call due to adverse movements in the market and stay in the trade for an extended period of time. In some cases, this gives traders an opportunity to take advantage of market reversals and turn losing positions into winning trades. At the same time, there are some scenarios where traders might better off by closing losing trades and cutting losses in the process.

One obvious risk traders take when they engage in carry trades with leverage, is the fact that there is always a distinct possibility of the position being liquidated as a result of adverse market movements. Therefore, traders who open carry trades without any use of leverage can maintain their daily income, even in the case of the market going against their positions. However, it is worth noting that the principal of the invested amount will still not be secure and will be subject to daily market fluctuations.