Table of content

When the Dow Jones Industrial Average index was first published back in the 1880s, it stood near 63, however, after decades of growth, interrupted by several major corrections, by September 2020, the index reached 27,900 level. This means that throughout its existence the DJIA has risen by more than 442 times, which is quite impressive.

After making this realization, it might be difficult to understand why some people still lost money on the stock market on a consistent basis. Well, in the majority of cases, the reason is that they keep making some of the most common stock market mistakes.

The fact of the matter is that some investors do not make any proper due diligence when choosing stocks to invest in. Instead, they follow the herd behavior, choosing securities not according to the merits of the company, but simply following what other market participants are buying.

In addition to that, some investors make a very common mistake of buying overvalued stocks, ignoring the valuation methods in the process. Or alternatively, some income investors are chasing high yields, without making any other considerations.

One of the major errors in terms of risk management is ignoring the Beta indicator, which is one of the most important measures of the volatility of the stock. While some other investors ignore the dividend history of the company, which can easily lead to serious losses.

It is also worth noting that some market participants put all of their savings in the stock market, without maintaining any sort of emergency fund. This is problematic because at some point in the future they might be forced to sell some of their investments in order to cover their day to day emergencies or other expenses.

It is also very common for some investors to sell stocks prematurely, at a loss, due to their emotions, while others do not pay any attention to the commission structure and other conditions of the brokerage company they invest with.

Therefore, in this article, we will discuss those 9 some of the most common mistakes traders make in stock investing. Let us now take a look at those 9 stock market mistakes in greater detail.

Not Making Proper Due Diligence

One of the stock market mistakes to avoid is not making any proper due diligence when purchasing securities. The fact of the matter is that some market participants simply base their decisions on the current market price and the latest stock news.

It goes without saying that this is a very risky practice, which can easily lead to serious losses. It is true that examining annual and quarterly reports of the firm, taking look at valuations and other indicators does take some time. However, it is a necessary and unavoidable process for successful investing.

If for example, the current market price of the stock seems cheap in some cases it might present a good buying opportunity. However, it is worth remembering that this is not always the case. Sometimes, there are good reasons for the stock to be cheaper than in the past. It might happen that the firm is rapidly losing its earnings, or the management is making some serious mistakes. Alternatively, the business might be doing fine, but the firm’s leadership might not be willing to return money to shareholders.

This is exactly why not doing due diligence is one of the biggest stock market mistakes some investors make on a daily basis. The detailed analysis of the latest earnings reports, as well as the observation of the stock indicators, can reveal a lot of important pieces of information regarding the current conditions of the business. Consequently, by conducting proper due diligence the market participant can significantly reduce the possibility of making wrong decisions.

It is also interesting to note that those types of stock market investing mistakes are made not only by individual investors but also by some institutions as well. For example, back in 2008, the Royal Bank of Scotland spent billions of euros in a bid to acquire ABN Amro, a Dutch bank. In fact, they eventually succeeded in this endeavor.

However, what the leadership of the Royal Bank of Scotland failed to do was to conduct thorough due diligence. The official explanation for this was that many major banks have already done their due diligence on this Dutch bank, therefore, there was no need for the RBS staff to go through all of those details once more.

Unsurprisingly, this turned out to be a major mistake. After some months it was relieved that ABN Amro has invested significant amounts of money in subprime mortgage securities. This in turn, resulted in massive losses for the RBS. The British Bank was unable to adequately respond to those financial challenges because they have already spent most of their cash reserves on the ABN Amro purchase.

Consequently, the Royal Bank of Scotland has faced some serious liquidity problems and had to be rescued by the UK government, in exchange for the nationalization of the bank. As a result of this deal, the UK government became an 82% shareholder of RBS. The share price of the bank struggled to recover during the subsequent years and never returned back to 2008 highs.

On the other hand, if the Royal Bank of Scotland has done proper due diligence on ABN Amro, it would have been discovered that the Dutch bank had significant exposure to toxic assets. In this case, the takeover attempt would have been called off. As a result, the RBS would have retained much needed cash reserves worth tens of billions of pounds. This in turn would have given the RBS management the ability to withstand the upcoming financial crisis and preserve the independence of the bank.

Buying Overvalued Stocks

The proper due diligence process does involve the analysis of the financial performance of the firm, as well as that of the future potential of the business. However, even if the stock passes all of those tests successfully, it does not guarantee that it is a great investment.

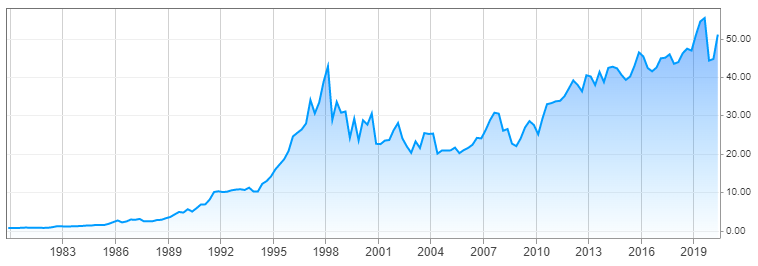

The fact of the matter is that sometimes stock can become extremely overvalued. As a result, it is highly likely that at some point in the future it might face a sharp correction. In order to illustrate this let us take a look at the long term chart of the Coca-Cola Company (KO) stock:

source: cnbc.com

As we can see from the above image, in the long term, this stock has turned out to be a good investment. After all, at the beginning of this chart, it traded below $1 mark, but by September 2020 has reached $51 level. This means that during this period, the stock price has risen by more than 51 times. So how can an investor ever lose money with this security?

Well, if we take a close look at this chart, we can see that there were instances where the shares have faced a major correction. For example, back in 1998, the stock reached an all time high of $42. At this point, the shares became extremely overvalued. As a result of this development, the stock price mostly moved sideways during the following years, before facing a sharp correction during 2001 and 2002. This was followed by a recovery, but it was not until 2015 before the stock managed to return to 1998 highs.

So as we can see here one of the stock market beginner mistakes is to buy overvalued stocks. Those people who have purchased the Coca-Cola Company stock back in 1998, had to wait for more than a decade for them to recover their losses.

Consequently, it is always helpful to take stock valuations seriously. One of the most popular indicators for this purpose is the price to earnings ratio, also known as the P/E ratio. The method of calculation here is quite simple, this indicator divides the current market price of the stock to the earnings per share of the company.

The general rule of thumb here is that if the P/E ratio is above 20, then the stock is considered to be overvalued, while if it is below 15, then the security is deemed to be undervalued. Consequently, if the price to earnings ratio of the stock is between 15 to 20 it is generally considered to be fairly valued.

Obviously, the price to earnings ratio is not the only measure for stock valuations, however, it is very useful to get some idea about whether or not the current stock price offers a good deal to investors.

Herd Behaviour

One of the common stock trading mistakes some investors make is following a herd behavior. The fact of the matter is that many market participants base their decisions on the latest stock news posts or TV commentators.

So if one stock is popular among financial experts or commentators, then they tend to buy it regardless of the financial performance of the company, while also ignoring the stock valuations.

It goes without saying that this can be one of the most common stock trading beginner mistakes. The fact that an individual stock is popular in no way guarantees that it will perform well in the future. Actually, in most cases, quite the opposite is the case. The reality of the matter is that this tends to attract many buyers into the market, making the stock overpriced. Consequently, it is very difficult to find any bargains among those securities.

Alternatively, it might also be the case that the market is pricing in too much good news into the stock. So there might be some unrealistic expectations involved, leading to a bubble. However, as soon as the reality kicks in and the firm in question faces some financial headwinds, the price of the stock comes crashing down.

To illustrate one example of such a scenario, let us take a look at this long term chart of Bank of America (BAC) stock:

source: cnbc.com

As we can see from the above image, the stock had a very strong showing for several decades. In fact, adjusting for stock splits, at the beginning of the 1980s, the shares were trading at $1.65, however, after a consistent rise, it has reached $53 level by 2006. This means that during this period the stock has risen by more than 32 times, which is indeed quite impressive.

At that time, many investors and financial commentators made very bullish comments on banking stocks, expecting a steady rise in the profitability of those institutions, as well as the appreciation of securities tied to those companies. So, those investors who made their decisions based on financial media would likely have also purchased some Bank of America shares.

Things started to change from 2007, as the credit crunch hit the market, the banking stocks began their slide. This trend only accelerated in 2008, especially after the bankruptcy of Lehman Brothers, one of the largest investment banks in the world. The Bank of America shares were no exception to this trend. The stock fell below $7, which means that it lost more than 85% of its value.

It is true that during the subsequent years, the shares recovered and by September 2020, they traded near the $25 mark, but it is still much lower than the 2006 peak.

So as we can see from this example, the herd behavior can be one of the biggest stock mistakes, which can easily lead the market participants to make decisions, which later they might regret due to suffering losses. Consequently, it is always a better idea for investors to do their own analysis of the stock, rather than relying on the financial media to do so.

Chasing High Dividend Yields

It is a well known fact that a significant portion of investors put their savings into the stock market in order to earn some income from their capital. As the majority of the world’s major central banks adopted near-zero interest rate policies, it became nearly impossible to find any decent returns on savings accounts and certificates of deposit (CDs). For example, in the United States, the long term average inflation rate stands near 3%, consequently, earning 0.1% or 0.25% return is not enough to preserve one’s purchasing power.

Consequently, investing in the stock market, especially in dividend-paying stocks became one of the reasonable alternatives to earning near-zero returns. However, one of the common stock investing mistakes is that some investors are simply chasing the highest dividend yields without paying any attention to other stock indicators.

This is not to say that if an individual stock has a high dividend yield it is always a bad idea to invest in that security. It goes without saying that there are several decent stocks with a decent track record of returning money to shareholders, which might offer yields ranging from 3% to 6%.

However, the problem here is the fact that where the high dividend yield of the stock can be misleading, and purchasing those securities might be one of the stock portfolio mistakes investors make. In fact, there can be several scenarios, where this might be the case.

For example, during the 2008 Financial Crisis, the earnings of the majority of companies, listed on the major stock exchanges have dropped significantly. However, not all of them responded with immediate dividend cuts or cancelations. Yet, the poor financial performance of those firms led to a sizable fall in their share prices.

The result of those developments was that the dividend yields of several companies have risen considerably, some of them even surpassing 10%. By the end of 2008, the US Federal Reserve had already dropped its Federal Funds Rate all the way down to 0% to 0.25% range. Consequently, it is not surprising that 10% yields offered by some of those stocks were a very attractive option for many investors.

However, this is indeed one of the rookie stock mistakes some market participants make. The fact that some companies offer high dividend yields does not necessarily mean that it is in any way sustainable in the future. In fact, faced with unprecedented challenges many companies were forced to either cut their payouts or cancel them entirely.

There were also those corporations, which managed to maintain and then even increase their dividend payouts. However, this was achieved not because of high yields, but the reasons here was that those firms had enough profits and cash flow to maintain those payments.

Therefore, it is always helpful for investors to take a look at all important stock indicators, as well as at the state of a company’s financial performance, rather than solely focusing on the dividend yield of the stock. This approach can significantly reduce the risk exposure of an individual and also reduce the amount of potential losses in the process.

Not Paying Attention to Beta Indicator

When it comes to the stock market there is no such thing as the best stock for investing. The fact of the matter is that every investor has its own investment style, which might or not be suited with a particular stock.

For example, there are those investors who prefer more risk-averse investing styles. Therefore, they look for stocks which have relatively less degree of volatility than most other securities. This means that in times of bear market, they are able to hold on to most of their net worth.

On the other hand, some market participants have high risk tolerance. Consequently, they usually prefer to invest in more volatile stocks. One upside to this approach is that in times of a bull market, those investors have an ability to benefit from a larger amount of capital appreciation, compared to some other market participants.

Now one of the mistakes stock traders make is to ignore beta indicators in their analysis. This indicator measures the volatility of the stock. For example, if the security has beta at 1.00, this means that it is exactly as volatile as the broader market. On the other hand, if this indicator is higher than 1.00, then the security is more volatile than the overall market. Consequently, those investors with high risk tolerance looking forward to building a growth portfolio might choose those stocks which have a high beta.

On the other hand, those securities which have a beta indicator below 1.00 might be more suited for risk-averse market participants, who do not like a high degree of volatility.

Consequently, one of the intraday stock market mistakes as well as long term trading errors is ignoring the beta indicator. Without this type of analysis, investors would have no idea about the expected volatility of the stock. This, in turn, makes finding the right stocks which suit the risk tolerance levels of an individual investor an increasingly difficult task.

Having No Emergency Fund

The absence of the emergency fund is yet another one of the mistakes stock investors make in investing. Now, this might be surprising to some people, after all, what does the emergency fund have to do with stock investing? Well, the connection between those two terms might not be so obvious to everyone, however, the link is quite logical.

Firstly, it is important to remember that the main purpose of the emergency fund is to have cash reserves at hand in times of emergencies and economic hardships. So this allows individuals to address such problems as car repairs, job loss, medical expenses, and other important items.

Now the fact of the matter is that if a stock investor does not have an emergency fund, then the market participants will be forced to buy some of the stocks in the portfolio, in order to come up with enough money to cover those expenses. It is true that this is a better option than taking out consumer loans or credit cards to cover those emergencies. However, this still has several downsides.

Firstly, an investor might be forced to sell those stocks at a massive loss, in times of a bear market. So if an individual had an emergency fund then the investor would not have to take the loss. On the other hand, if there are no cash reserves to speak of, then the losses from this untimely sale can be substantial.

There is also the case of the loss of motivation. The fact of the matter is the successful wealth building process does not only depend on the financial factors but also on psychological things as well. So for example, if an individual spends months in saving and investing money and now suddenly is forced to liquidate some of the investments, it is likely that the market participant will lose motivation to continue investing. Many people might just decide to give up.

Consequently, it is very important for investors to have some sort of emergency fund at hand before they start investing their hard earned money. This can help to keep their investments intact even if they face some financial emergency in their lives.

The recommended size of an emergency fund is always the subject of debate among the financial experts. Some of them suggest to have 3 months worth of expenses as a cash reserve, others argue for larger amounts. However, the general idea here is to have just enough money to keep going if an individual faces some unexpected financial problems.

Ignoring Terms and Conditions of Brokerage Company

One of the biggest stock trading mistakes some market participants make is to ignore the terms and conditions of the brokerage company they want to trade with. Here it is worth noting that the brokers do not represent the non-profit charitable organization, they need to earn some revenues and distribute profits.

Consequently, one of the largest sources of income for stock brokers is the commissions they charge to traders for executing trades. Here it is important to point out that there is no such thing as a standardized amount of trading commissions. Every brokerage company has its own policies on the subject. Some of them might have a flat $15 fee for each trade. While some other brokers might reduce the amount of fees if the investor meets certain conditions.

In fact, some brokers in the UK offer their clients the so-called bundle purchasing of stocks. This means that once or twice per week the brokerage company bundles together all buy orders for stocks and purchases them in bulk on behalf of its clients, saving money on commission in the process. Consequently, this allows them to pass on some of those savings to their customers. Therefore, investors can submit their bulk buying orders and purchase those stocks with the commission rate of $5 or even cheaper, instead of paying for the standard rate.

The only downside to this arrangement is that the investor does not control the exact market price at which the securities are purchased. However, for the long term and dividend investors, it is usually of little concern.

In addition to that, it is worth noting that some brokers also charge so-called ‘custody fees’ to their clients. This is generally a quarterly or a monthly fee, which represents a certain percentage of the overall size of the holdings of the customer.

It goes without saying that this type of fee is very unpopular among investors since the more assets one accumulates more one has to pay in form of those fees. One can even argue that this is one form of negative interest rates. Consequently, it is not surprising that many investors give preference to those brokers who do not have those types of custody fees.

Therefore, it is very important for investors to take a look at the commission structure of the brokerage firms, before deciding with whom to invest. This can help them to avoid the type of stock broker mistakes, we discussed earlier. The difference between different firms might seem quite small at the start, but in the long term it can certainly add up to a significant amount.

Selling Stocks Prematurely

One of the mistakes some people make at the stock exchange is to trade based on emotions and sell stocks prematurely, at a loss. The fact of the matter is that some investors purchase securities, but if they decline to a certain extent, they panic and sell it at a loss. This is actually, one of the main reasons why some people consistently lose money in the stock market.

In fact, one of the most successful investors in the world, Warren Buffet mentioned that the stock market was an efficient instrument for distributing money away from inpatient market participants to patient investors. The main idea here is that if an investor has done proper due diligence before the purchase and is confident of the future of the company, one has to give it some time before this investment bears fruit.

It is common for investors to check the stock price of the security which is part of their portfolio once per day or week. However, when the market participants make the mistake is to respond emotionally to this daily volatility. The general market experience shows that the stocks of successful companies tend to rise in the long term, with its investors benefiting from the capital appreciation of the security, as well as potentially from dividend payments.

However, this does not mean that the stock of successfully managed companies will rise every single day. Just like with any other stocks, there will be some pullbacks and corrections down the road. Now, as Warren Buffer and many other experienced investors suggest, the market participants should not panic at those developments and liquidate their holdings. Instead, they should look at this as an opportunity to expand the size of one’s investment portfolio at a discount.

After all, if the company is well managed and delivers value to shareholders, at some point in the future, the bear market will end and it is likely that the stock will eventually erase all of its losses and reach new highs. However, if an investor is impatient and has already sold the stock, then the market participant will be unable to benefit from this type of price appreciation. Consequently, this type of mistake can not only leave investors with financial loss, but it can also lead to many missed opportunities as well.

Ignoring Dividend History

At this point, it is worth noting that one of the stock market forecastings mistakes some income investors to make is to ignore the dividend history of the stock. The fact of the matter is that some market participants only look at the current stock price and dividend amount, without enquiring how much the management has payout out to shareholders in the past.

This can be a major mistake. The reason for this is that if an individual company is currently paying a decent amount of dividend, it does not mean that it has aways done so or will continue doing so in the future.

Ignoring Terms and Conditions of Brokerage Company

One of the biggest stock trading mistakes some market participants make is to ignore the terms and conditions of the brokerage company they want to trade with. Here it is worth noting that the brokers do not represent the non-profit charitable organization, they need to earn some revenues and distribute profits.

Consequently, one of the largest sources of income for stock brokers is the commissions they charge to traders for executing trades. Here it is important to point out that there is no such thing as a standardized amount of trading commissions. Every brokerage company has its own policies on the subject. Some of them might have a flat $15 fee for each trade. While some other brokers might reduce the amount of fees if the investor meets certain conditions.

In fact, some brokers in the UK offer their clients the so-called bundle purchasing of stocks. This means that once or twice per week the brokerage company bundles together all buy orders for stocks and purchases them in bulk on behalf of its clients, saving money on commission in the process. Consequently, this allows them to pass on some of those savings to their customers. Therefore, investors can submit their bulk buying orders and purchase those stocks with the commission rate of $5 or even cheaper, instead of paying for the standard rate.

The only downside to this arrangement is that the investor does not control the exact market price at which the securities are purchased. However, for the long term and dividend investors, it is usually of little concern.

In addition to that, it is worth noting that some brokers also charge so-called ‘custody fees’ to their clients. This is generally a quarterly or a monthly fee, which represents a certain percentage of the overall size of the holdings of the customer.

It goes without saying that this type of fee is very unpopular among investors since the more assets one accumulates more one has to pay in form of those fees. One can even argue that this is one form of negative interest rates. Consequently, it is not surprising that many investors give preference to those brokers who do not have those types of custody fees.

Therefore, it is very important for investors to take a look at the commission structure of the brokerage firms, before deciding with whom to invest. This can help them to avoid the type of stock broker mistakes, we discussed earlier. The difference between different firms might seem quite small at the start, but in the long term it can certainly add up to a significant amount.

Selling Stocks Prematurely

One of the mistakes some people make at the stock exchange is to trade based on emotions and sell stocks prematurely, at a loss. The fact of the matter is that some investors purchase securities, but if they decline to a certain extent, they panic and sell it at a loss. This is actually, one of the main reasons why some people consistently lose money in the stock market.

In fact, one of the most successful investors in the world, Warren Buffet mentioned that the stock market was an efficient instrument for distributing money away from inpatient market participants to patient investors. The main idea here is that if an investor has done proper due diligence before the purchase and is confident of the future of the company, one has to give it some time before this investment bears fruit.

It is common for investors to check the stock price of the security which is part of their portfolio once per day or week. However, when the market participants make the mistake is to respond emotionally to this daily volatility. The general market experience shows that the stocks of successful companies tend to rise in the long term, with its investors benefiting from the capital appreciation of the security, as well as potentially from dividend payments.

However, this does not mean that the stock of successfully managed companies will rise every single day. Just like with any other stocks, there will be some pullbacks and corrections down the road. Now, as Warren Buffer and many other experienced investors suggest, the market participants should not panic at those developments and liquidate their holdings. Instead, they should look at this as an opportunity to expand the size of one’s investment portfolio at a discount.

After all, if the company is well managed and delivers value to shareholders, at some point in the future, the bear market will end and it is likely that the stock will eventually erase all of its losses and reach new highs. However, if an investor is impatient and has already sold the stock, then the market participant will be unable to benefit from this type of price appreciation. Consequently, this type of mistake can not only leave investors with financial loss, but it can also lead to many missed opportunities as well.

Ignoring Dividend History

At this point, it is worth noting that one of the stock market forecastings mistakes some income investors to make is to ignore the dividend history of the stock. The fact of the matter is that some market participants only look at the current stock price and dividend amount, without enquiring how much the management has payout out to shareholders in the past.

This can be a major mistake. The reason for this is that if an individual company is currently paying a decent amount of dividend, it does not mean that it has aways done so or will continue doing so in the future. Therefore, one of the ways how to avoid stock trading mistakes is to check the dividend history of the individual company.

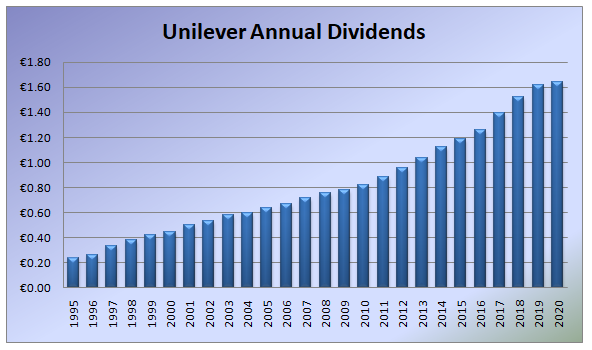

So if an investor wants to build an income portfolio, then then it is a much better idea to look for those stocks which have paid dividends on a consistent basis. In order to illustrate this better let us take a look at this chart, which shows the total annual amount of payouts to shareholders by Unilever PLC:

So as we can see from the above diagram, bak in 1995 the firm has paid dividends, which was the equivalent of €0.235 per share. During the subsequent years, the company has increased its payouts steadily and by 2020, it now pays €1.64 per share in annual dividends to shareholders.

Now, the fact of the matter is that when an individual company has such a strong track record of returning cash to shareholders, it means that it is likely to continue to do so. After all, it is highly unlikely for the management to spoil such a splendid record going back to several decades for no good reasons.

Obviously, this does not represent a 100% guarantee that the firm will always be able to deliver such results to shareholders. After all, corporations are under no legal obligation to always pay dividends. However, in general, companies with solid dividend history are more likely to hold out in times of economic downturns than other firms.

Common Stock Trading Mistakes – Key Takeaways

- Nearly every comprehensive study of the stock market shows that in the long term on average it allows investors to earn returns, which are considerably higher than the inflation rate. However, many investors still lose money in the stock market because of very common mistakes.

- One of the most common mistakes not only individual investors but also institutional investors make is not conducting proper due diligence when choosing companies to invest in. The fact that one particular stock is very popular and is frequently praised in financial media, does not guarantee that it is indeed a good investment. It is far more reliable for investors to go through its financial accounts, as well as stock valuations and other indicators, before making investment decisions.

- Some market participants invest in the stock market, without having any sort of emergency fund in place. This is a major mistake, since if investors face some financial problems, then most likely they will be forced to liquidate some of their investments prematurely and possibly at a loss. Consequently, it is a far better idea to have cash reserves in place to deal with those financial emergencies, so that one does not have to sell his or her investments in order to take care of those types of problems.