Table of content

It goes without saying that Warren Buffet is one of the most famous and successful investors in the world. He not only managed to accumulate billions of dollars in net worth but also built Berkshire Hathaway, a successful investing company, the stock price of which has risen dramatically over the years.

Therefore, it is not surprising that many investors and other market participants want to get some insight into Warren Buffett’s investing strategy. The first thing to mention about Warren Buffett’s investment style is that if anybody listens to his interviews and conferences at the annual general meetings of Berkshire Hathaway, the first impression one will get is that Buffet is a long term investor.

The fact of the matter is that Berkshire Hathaway’s employees are not day traders. Therefore, if somebody interested in learning about scalping or day trading, then Warren Buffett’s strategy on investing might not be the best source of information on that subject.

Instead, Berkshire Hathaway chooses companies with significant long term potential and holds those investments for an extended period of time. The second major aspect of Warren Buffett’s investment strategy is his preference for dividend investing. In fact, the majority of the investment portfolio of Berkshire Hathaway consists of stocks of those firms, who have paid and increased dividends consistently over several years.

It is also worth noting that Buffet does not ignore the current pricing and valuations of individual stocks either. It is one thing to find decent dividend-paying stocks with significant growth potential. However, he also looks for securities that are at least reasonably priced if not undervalued.

In addition to that Buffet only invests in those businesses, which he understands and the products and services of which will be in high demand in the future. Consequently, he stays away from those stocks which might be currently very popular, but the business model of which is difficult to understand.

Also, Warren Buffett’s stock investment strategy does involve the element of currency diversification. By not limiting all of his investments to the USA and investing globally, his firm holds its assets and receives dividend income from several countries in different currencies. This means that the investment portfolio of Berkshire Hathaway is well-positioned to withstand the depreciation of possible depreciation of the US dollar, Euro, or any other major reserve currency.

Finally, Warren Buffet puts an emphasis on having a healthy amount of cash reserves at all times. For him, it is like an insurance policy against uncertainty and financial risks. Let us now go through each of the principles mentioned above in more detail.

Long Term Investment Style

When discussing how to Invest like Warren Buffett first thing to note is that we are dealing with a classic long term investing strategy. Buffet himself has made the following analogy during several of his interviews: If an individual decides to buy farmland, after making this purchase, one will not start checking the weather forecasts on a daily basis. Or alternatively, decide to sell this asset just because there was bad weather for several days.

Instead what happens is that the new owner of the farmland will wait until the harvest time to receive the income from this business and hold this asset for an extended period of time. According to Buffet, the same goes for stock market investing. The main idea here is that if an investor is convinced about the future potential of the business, it is better to give an investment some time, for it to bear fruit and deliver results.

As Buffet himself mentioned, the stock market is an efficient mechanism for distributing the wealth from impatient market participants to patient investors. Therefore, according to him, patience is key for long term success in investing. As he suggested during his interviews and conferences, in the short term the market is highly unpredictable. However, the stock of a successful business will rise considerably in the long term.

In fact, the Warren Buffett stock strategy goes even further. According to him, if the stock price of a successful company goes down after making the initial investment, this is not bad news at all. In fact, this represents an opportunity for investors to purchase those stocks at cheaper prices.

This means that there is no such thing as Warren Buffett’s trading strategy for the short term. Instead, he invests with large timeframes in mind, typically extending to at least several years.

In fact, Buffet himself vowed several times not to ever sell his share in the Coca-Cola Company. However, this does not mean that Berkshire Hathaway holds all of its shares indefinitely. There were several cases when the firm has sold some of its investments with some major gains after several years have passed from the original investment. In addition to that, there were some instances where Buffet decided to liquidate some of the investments at a loss, in order to limit further losses in the future.

Dividend Investing

Another major component of Warren Buffett’s investing principles is dividend investing. The fact of the matter is that when choosing stocks, he usually gives preference to the shares of those companies which have paid and raised dividends to their shareholders over extended periods of time.

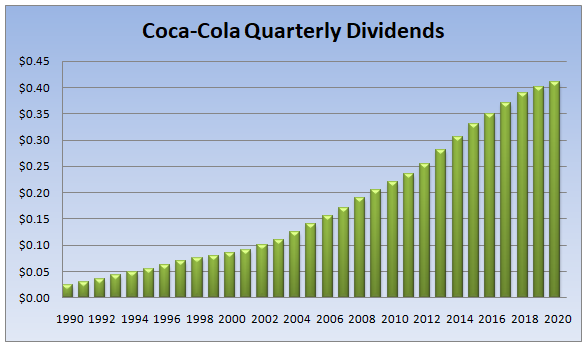

In fact, one of his favorite investments, the Coca-Cola stock, has paid increasing payouts to shareholders for several decades now. In order to get a better understanding of this example, let us take a look at this chart, which shows the dividend history of this firm for the last 30 years:

As we can see from the above diagram, adjusting for the stock splits, the firm has paid a 2.5 cent per share quarterly dividend back in 1990. During the subsequent years and even decades, the company has raised its dividend consistently.

In fact, the management of the firm was even able to increase payouts during the 2008 Financial Crisis, regardless of all of the economic challenges associated with this period. As of 2020, the stock pays a 41 cent per share quarterly dividend to its shareholders. This means that the 30-year average dividend growth rate of the stock is well above 9%, which is 3 times higher than the long term historical average inflation rate in the United States.

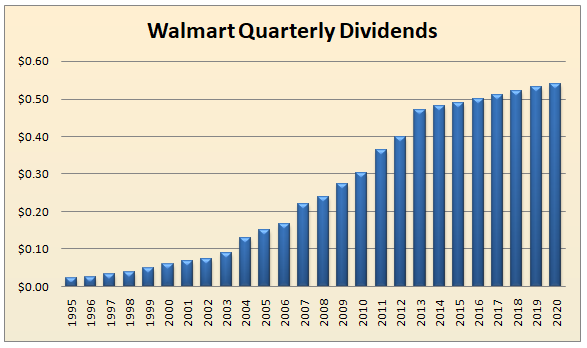

Obviously, the Coca-Cola company is not the only dividend-paying stock, Buffet held with his investment portfolio. Another interesting example here is the Walmart stock, which he held for more than 12 years. In order to get a better understanding of the performance of this company, let us take a look at its dividend history below:

As we can see from the above diagram, adjusting for the stock splits, the firm paid a 2.5 cent per share quarterly dividend to investors. During the next 25 years, the company has managed to raise its payouts consistently and by 2020, the firm now pays a quarterly dividend of 54 cents per share.

There are indeed several reasons why Buffet might be preferring dividend-paying stocks. Firstly, it is worth noting that an unsuccessful company with incompetent management might still be able to pay some dividends for a year or two. However, it is not very realistic to sustain those payments for decades, if they are not supported by the strong performance of the underlying business.

Therefore, when a company pays dividends on a consistent basis for 10 years or more, it is an important sign of the stability and strength of the business. It shows to market participants that the firm’s management takes shareholder’s interests seriously and also has the potential to retain and even increase its profitability.

An additional benefit to investing in those stocks is the fact that their consistent dividend payments tend to discourage the short-sellers. This is because, if the market participant opens a short position on a stock during the payment date, then one has to pay the equivalent of the dividend as well. This generally tends to have a positive impact on the share price of the individual stock.

Buying Reasonably Priced Stocks

Another important component of Warren Buffett’s investment strategies is to look for reasonably priced stocks. According to his philosophy, it is important to find good businesses with significant growth potential. However, it is equally important to purchase shares at reasonable prices. To illustrate this argument better, let us take a look at this long term Coca-Cola Company stock price chart:

source: cnbc.com

As we can see from the above diagram, the stock has experienced a significant capital appreciation over the last four decades. In fact, adjusting for stock splits, back in the 1980s, there was a time when the stock traded below the $1 mark. However, during the 1980s and most of the 1990s, the Coca-Cola Company shares have made some impressive gains. In fact, by 1998, the stock price already reached the $42 mark.

However, at this point, the shares became extremely overvalued and during the subsequent years have faced a major correction. In fact, it took more than 15 years, before the stock was able to return to $42 level and break above those historic peak levels.

So in this case, Warren Buffet has benefited from a significant capital appreciation, since he purchased the stock several decades ago when it was still reasonably priced. However, those investors who disregarded the stock valuation rules and purchased the stock at 1998 highs, they would have suffered some serious capital losses. If they held onto that investment for several years, they would have recovered their net worth, but it is clear that many investors did not. Consequently, it is very important to purchase those stocks which are still reasonably priced.

In addition to that Buffet also looks for undervalued stocks. It is true that there are not a large number of choices of undervalued securities in economically booming times. However, in times of recession, there are indeed more opportunities. In fact, one of Warren Buffett’s bear market maneuvers was to purchase high quality dividend-paying stocks at depressed prices, at the high of recession.

When nearly everybody was panicking and liquidating their investments, Buffet instead made some major purchases. As a result, when the stock market recovered, Berkshire Hathaway benefited from a significant capital appreciation. In addition to that, this investment firm also benefited from the high dividend yields Buffet locked in during the recession.

In fact, one of the famous pieces of advice Buffet has given to investors, goes as follows: become fearful when everyone is greedy and become greedy when everyone is fearful. This perfectly describes one of the main Warren Buffett Principles for investing. This means that investors should not shy away from making contrarian decisions, even during times of economic uncertainty.

This also warns market participants against the herd mentality, the fact that nearly everyone buys some stocks, it does not mean that it is a good investment. In reality, it is highly likely that this has made those securities quite overpriced and it might be a better idea to look for investment opportunities elsewhere.

At the same time, when everyone is panicking during the bear market, the share prices are typically depressed, giving investors an opportunity to purchase high quality stocks at a sizable discount.

Buying Businesses One Can Understand

Another way how Warren Buffett chooses his stocks is that he only invests in those companies, the business models of which he can understand. For example, when it comes to the Coca-Cola Company, it is clear that the firm produces beverages that are in high demand and there are millions of people across the globe who consume it on a regular basis. In the case of the American Express Company, its credit cards are very popular among consumers and are used by a significant portion of the population.

So as we can see from those examples, most items on the Berkshire Hathaway portfolio consists of stocks, the business model of which is quite easy to understand, even for those individuals who do not have a great deal of knowledge and experience in investing. On the other hand, Buffet made it very clear that he is not interested in investing in those companies, the business models of which he could not understand.

One example he brings up in several of his interviews is the case of the Dot-com bubble. This mostly involved the stocks of technology companies. In fact, from 1995 until 2000, the Nasdaq index has risen by a massive 400%. As Buffet mentions by that time some stocks had their P/E ratio above 100, which was an obvious sign of overvaluation. However, many investors still kept buying those securities, due to their popularity at that time.

During this period, Berkshire Hathaway had stayed away from those investments. This was because Buffet could not justify paying so much for those technology stocks. In addition to that he saw no prospect of those stocks achieving the degree of spectacular success, some other investors were expecting. Finally, it is worth noting that just like it is today, the heavy majority of technology stocks paid no dividends to shareholders.

This decision turned out to be correct. In fact, the technology stocks already began their decline before the end of 2000, with Nasdaq eventually dropping by 78% from its peak by 2002. It goes without saying that many investors and mutual funds suffered heavy financial losses as a result of this development. However, Berkshire Hathaway has avoided those mistakes and instead invested in those stocks which did not experience this type of bubble.

Currency Diversification

For the sake of accuracy, it is worth noting that there is no such thing as Warren Buffett Forex strategy. He typically does not talk much about currency hedging in his interviews and press conferences. However, what he does is that he invests internationally, not limiting his investments strictly to the USA.

Now, the dollar has gone through several long term cycles. It did benefit from a solid upward trend from 1995 until 2001. This was followed by a sizable decline from 2002 until 2011. After that, we have seen a resurgence of the US dollar, the trend which is arguably still in force.

So the fact of the matter is that any US-based investor, as well as all international investors whose assets are denominated in USD, are facing the risk of dollar depreciation. Obviously, if they invest in times of long term USD appreciation, they will benefit from those trends. However, if they do so during one of those bearish cycles for the US currency, then they stand to lose some of their purchasing power.

However, Warren Buffett’s strategy for picking stocks addresses the currency exchange rate risk from two angles. Firstly, he invests in those US companies that have a strong global presence. This means that those firms receive a significant portion of their income from abroad in dozens of different currencies.

This means that even in case of a sizable USD depreciation, they are in a position to increase their dividend at a faster rate during those periods, in order to offset potential losses to investors. An important point here is that they can do so without running into the financial problems since those companies receive their income in multiple foreign currencies, so in this scenario, they tend to benefit from the appreciation of those.

This creates a very nice balance between the financial interests of the firm and the interests of its shareholders. What the companies can do and indeed many of them did in the past, they can raise their dividends at a relatively slower rate in times of strong US dollar and increase payouts at a faster pace in times of USD weakness. This can ensure that the purchasing power of investors will be protected regardless of the latest Forex market developments.

Another way how Warren Buffett selects stocks is that he diversifies his investments internationally. It goes without saying that there are many decent dividend-paying stocks outside the US. Consequently, Berkshire Hathaway does invest in some of those. As a result, the firms received some dividends not only in US dollars but also in Euros, Pounds, and several other currencies.

This is very helpful for hedging the currency risk. It means that even if the US dollar enters a long term bear market, the firm will be able to offset some of those losses from the strength of other currencies since they also receive some of their income in those as well. In addition to that Berkshire Hathaway is well-positioned to benefit from the capital appreciation due to the long term stock price increases of those foreign companies.

So as we can see from this example, Warren Buffett’s strategy does not include some techniques for Forex trading. He instead hedges the currency risk by investing in multinational companies and also some dividend-paying foreign stocks. In those two ways, he is able to reduce those currency risks substantially.

Maintaining Cash Reserves

One of the important investing principles of Warren Buffet is to maintain a reasonable amount of cash reserves at all times. As mentioned in some of his interviews, Berkshire Hathaway maintains up to $10 billion in cash reserves. As Buffet pointed out he does not like to have more reserves than he has to, but on the other hand, he does not want to run into liquidity problems either.

Now, there are several distinct benefits to this approach. Firstly, it is important to recognize that from time to time, every business does face some financial challenges. This might happen as a result of some specific problems associated with that business or as a result of the economic downturn. One of the reasons for the bankruptcy of many companies during the 2008 Financial Crisis was the fact that they did not have enough reserves to face those challenges at that time.

For example, as one of the traders at Lehman Brothers, mentioned in his interview with the BBC, in 2008 the average leverage ratio of the firm has reached 1:42. This means that for $1 dollar Lehman Brothers owned, they borrowed $42. In comparison, most of its competitors limited their leverage ratio within the 1:20 to 1:35 range.

As a result, as Lehman Brothers faced some serious financial challenges in 2008, the firm did not have enough reserves at hand to tackle those problems and avert bankruptcy.

Therefore, the fact that Berkshire Hathaway holds several billions of dollars in cash reserves, puts the firm in a strong position to deal with financial problems in times of economic downturn.

Now at this point, some people might argue that the company always has an option to borrow money from financial institutions. Consequently, what they can do is to invest most of their cash reserves and increase their borrowings in times of economic downturn.

Here it is worth noting that there are two problems with this line of reasoning. Firstly, it is important to remember that there is no guarantee that the banks will always be willing to lend money to corporations, especially in times of economic crisis. Or alternatively, the financial institution might be willing to lend some money to the firm, but the amount might not be enough to address the financial problems of the company.

In addition to that, even if the bank lends all the money the organization needed, now the firm has to make interest and principal repayments on a monthly basis. It goes without saying that, this can put an additional burden on the company, which already struggles through financial challenges.

Consequently, it is a much better option to build a sizable emergency fund, so that the company can address its financial problems in a timely manner without incurring any interest expenses. This is actually a good method not only for corporate financial management but also for personal finance as well. After all, having a considerable amount of reserve does make life much easier, especially during economically challenging times.

In addition to those considerations, by having the cash reserve of $10 billion, Berkshire Hathaway is also in a good position to take advantage of good undervalued buying opportunities. It goes without saying that from time to time due to several reasons, there are some decent undervalued stocks on the market. So what Berkshire Hathaway can do is to tap into those opportunities, buy some of those assets, and then during the subsequent months increase its size of reserves back into previous levels.

So as we can see here there are indeed many ways how a company can benefit from having sizable cash reserves, something not all the firms do.

Investment Principles from Warren Buffett – Key Takeaways

- Warren Buffet is a long term investor. His firm, Berkshire Hathaway is not involved in day trading. Instead, he identifies companies with long term growth potential and invests in them for several years. Therefore, he is not concerned about the daily volatility of the market. This allowed Buffet to benefit from the long term capital appreciation of his investments.

- Warren Buffet is a classic dividend investor. The majority of stocks in his portfolio have a solid history of dividend payments going back to several years, some of them even decades. This allows him to have a steady income from dozens of different stocks and also benefit from the potential payout increases from those companies.

- In several of his interviews and annual general meeting conferences, Warren Buffet emphasized the importance of having enough cash reserves at hand. As he stated, he does not like to hold more cash reserves than necessary, but he does not want his company to run into liquidity problems in the future. This is meant to ensure the solvency of the firm at all times, even during the economic downturn.