Forex is a complex world, and finding a reliable Forex broker is one crucial step to getting started. If you are wondering which broker to select, here is our reviews platform where you can find objective reviews. In today’s review, we will briefly go through the Markets.com broker’s regulations, fees, accounts, assets, support, and education. Read and discover whether you want to trust them with your money.

The safety and security of Markets.com

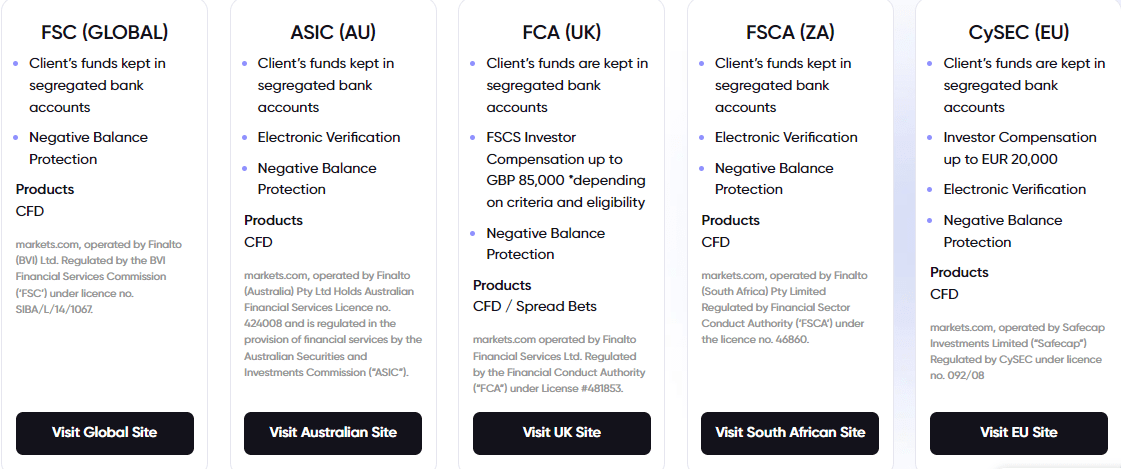

Without further due let’s list all the regulators who are overseeing the Markets.com fair activities

The broker is very well regulated and depending on your location will show the specific regulator. But we contacted support and got a link to see the list of regulators. Here are all regulators overseeing the broker

- B.V.I Financial Services Commission (FSC)

- Australian Securities and Investments Commission (ASIC)

- The UK’s Financial Conduct Authority (FCA)

- South African Financial Services Conducts Authority (FSCA)

- Cyprus Securities and Exchange Commission (CySEC)

All accounts are protected with negative balance protection to avoid clients going into minus. The broker is part of the investor compensation fund in case of insolvency and protects client funds with segregated accounts.

With these many regulators Markets.com is not a scam for sure, but how well do its services hold up against competitors?

Markets.com Fees and Spreads

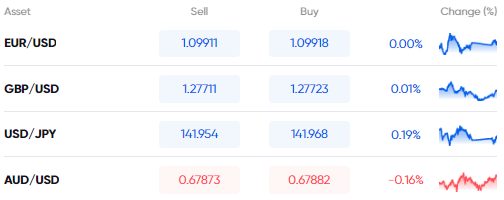

Markets.com mentions low spreads and shows numbers on its website, meaning the broker is not hiding anything.

The spreads on major pairs starting from EURUSD are from 0.8 pips. We could not define exactly on which account the broker offer this spread. Since Markets.com has several accounts we assume this spread is on their Basic accounts. GBPUSD comes with a 1.2 pips spread which is very good for this pair. Markets.com has spreads near to the industry average of 1 pip which is super attractive. Unfortunately, we were unable to find exactly what are commissions for zero-spread accounts.

Tesla’s stock spread starts from 1.6 USD per share, and Amazon 0.76 USD per share. You will cost around 75.12 USD spread to buy BTCUSD pair, while ETH has spread from 3.5 USD per ETH.

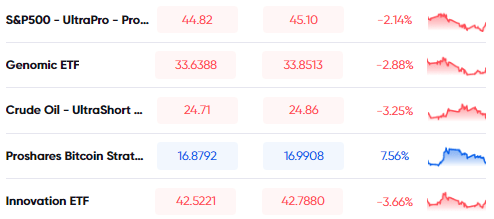

Spreads on S&P 500 ETF Trust start around 2.62 USD per unit.

The leverage is 1:300 but it depends on the jurisdiction and can be 1:30 for FCA, and CySEC regions.

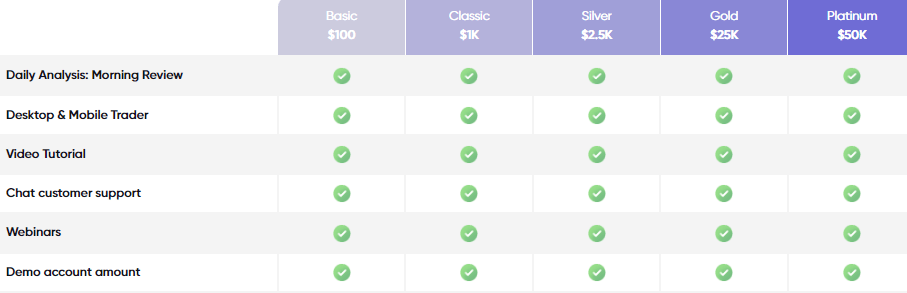

Accounts, deposits, and withdrawals at Markets.com

Markets.com offers five different trading accounts, which have different initial deposit requirements, and offer similar trading conditions. The spreads are lower for Gold and Platinum accounts. Basic accounts have just a 100 USD initial deposit requirement. The broker supports all account holders 24/5 and offers webinars, and account managers. It is a very good sign that the broker does not differentiate much between different accounts and only spreads and commissions are different. Since the broker explicitly indicates that it lowers spreads on gold and platinum accounts, we assume the spreads start from 0.8 pips on all other accounts and are commission-free.

Markets.com offers Senior Account Manager communication to their classic and upper-tier accounts. Silver, Gold, and Platinum accounts are eligible for wire transfer fee reimbursement.

Deposits and Withdrawals

Markets.com accepts the following payment methods

- Visa/ MasterCard debit and credit cards

- Wire transfers

- Skrill

- Ozow

The broker does not charge fees for popular methods, but the wire transfers will be charged by the payment providers which is normal.

Markets.com Trading assets and features

Traders can choose between diverse trading assets including Forex pairs, cryptos, ETFs, shares CFDs, commodities, indices, bonds, and IPOs. Initial public offerings, or IPOs, are a closely watched market where investors try to find the next big stock. Imagine if you could buy Tesla, or Amazon for a few dollars to sell them for over 100 USD per share. IPOs offer this opportunity to Markets.com investors but will require experience and advanced market research skills. Markets.com specifically offers three ways of trading IPO stocks:

- CFDs on newly listed shares

- Grey markets to trade CFDs on companies pre IPO

- The Renaissance Capital IPO ETF

IPOs, while offering get-rich-quick opportunities are relatively riskier business, as their price can rise and fall at extreme speeds.

ETFs or Exchange Traded Funds create a single asset that combines the benefits of funds and stocks. It makes it possible to trade several stocks under one instrument effectively speculating on the whole sector of the market. Some of the Markets.com ETFs include FTGC, INVESCO, DELLTECH, and MCKESSON.

Customer Support Review of Markets.com

We had several questions regarding regulations and other important matters for Markets.com support, and they were excellent. The response speed was a few seconds on the live chat and answers were fast, polite, and professional. The live chat is available 24/5 and the broker does an excellent job of answering all inquiries on time.

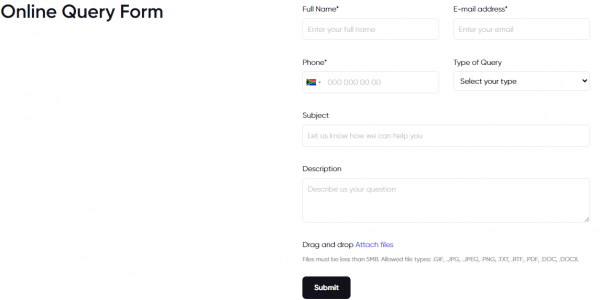

Markets.com support consists of several popular methods including email Support, Phone support, live chat, and an online form. Both the support and the website are multilingual.

Markets.com Education – What can you learn?

The broker’s educational resources include trading basics, a glossary, webinars, a trader’s clinic, and an education centre. Trading Basics offers basic explanations for the most basic Forex and CFDs trading concepts, by offering brief texts for each topic. Education Centre consists of more wholesome courses including Trading 101, How to Guides, and Trading Definitions.

Trader’s Clinic is the most intriguing of the bunch as it offers entertaining podcasts with experts and pro traders sharing their experiences and discussing important trading matters. While Trader’s Clinic is focused on combining entertainment with trading, webinars are a more serious way of learning how to trade from scratch.

Markets.com final verdict – Should you consider them?

From what we’ve gathered so far, Markets.com is not a scam and offers decent trading services. Educational resources are abundant and support is super fast and reliable. Spreads are below the industry average and the initial deposit requirement will not require from you more than 100 USD to get started.

While there are better brokers out there Markets.com is still a decent brokerage firm with several reputable regulators.

Is Markets.com regulated?

What are the spreads and fees?

What types of accounts are available?