AssetsFX is part of a group of STP brokers. They claim to offer low commissions and fees, ultra-low spreads, and fast execution. But if you’ve been involved in Forex trading, you should be aware that appearances are often deceiving. That’s why our review of AssetsFX aims to provide you with a comprehensive understanding of this trading provider. We’ve thoroughly analyzed all their services and trading conditions, and by reading this review, you’ll gain access to the essential facts and relevant information about AssetsFX.

AssetsFX – Brief Company Intro

As we all know, trading with unregulated brokers bears an enormous amount of risk, and not many investors are willing to deposit their money with one of those companies. Well, AssetsFX is not a regulated broker, which means that there is a high chance of AssetsFX scams being at play here. This is why we do not recommend trading with this broker. AssetsFX is owned and operated by Oy Nettico Ltd, and its headquarters are located in Espoo, Finland.

The Safety and Security of AssetsFX

As we mentioned, AssetsFX is not regulated and it does not hold any licenses. This itself is a huge red flag, as no supervisory authorities are overseeing the fairness of the broker’s activities. We do not recommend trading with unregulated brokers in general and AssetsFX is not an exception. No regulations mean we can not confirm if the broker is using segregated accounts and other means of security and safety for their client funds.

AssetsFX Fees and Spreads

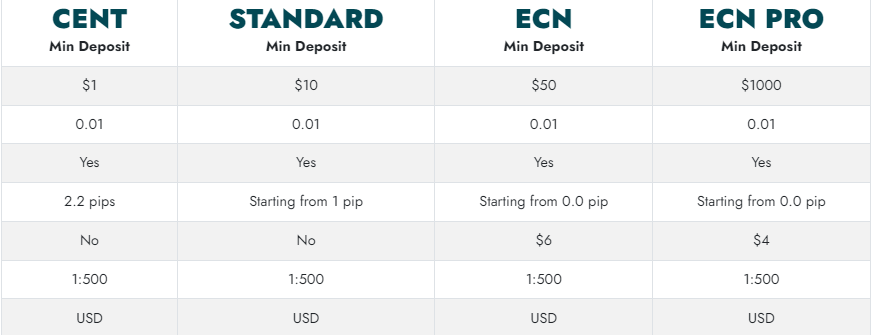

Spreads are 2.2 pips on the cent accounts and 1 pip on the standard accounts. While the 2.2 pips is a huge spread the 1 pip margin is very sufficient for day trading and swing trading. Broker also offers an option for 0 spread accounts which is great news for scalpers. The commission for 0 spread accounts is 6 USD and 4 USD round turn per lot traded. In the spreads and commissions department, AssetsFX offers conditions well within the industry average.

AssetsFX Accounts, Deposits, and Withdrawals

AssetsFX offers four account types which are targeted at traders of all kinds with diverse budgets. AssetsFX’s Cent, Standard, ECN, and Pro accounts offer dynamic minimum deposits of just 1 USD. Cent account has a 1 USD minimum deposit requirement, has spread from 2.2 pips, no commission, leverage up to 1:500, and instant execution speeds. The standard account comes with a 10 USD minimum deposit, 1 pip spread, and leverage up to 1:500. ECN account has spreads from 0 pips, a minimum deposit of 50 USD, leverage of 1:500, and a commission of 6 USD round turn. ECN Pro account is targeted for traders with trading capital of 1000 USD and more. The spreads are from 0 pips, the commission is 4 USD round turn, and leverage is capped at 1:500.

Deposits and Withdrawals

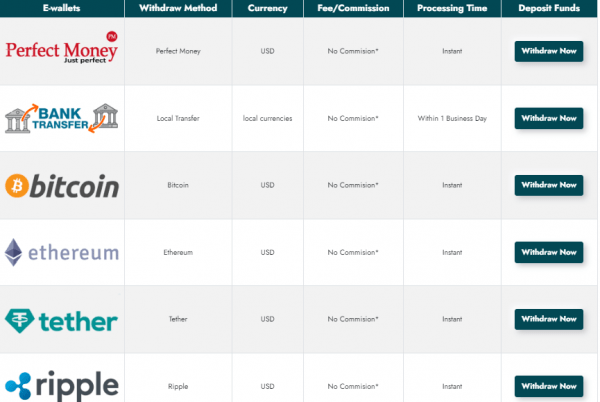

The minimum amount traders need to deposit when starting their relations with AssetsFX is $1, and in most AssetsFX opinions this seems reasonable and in agreement with the amount that most other companies are asking. AssetsFX offers wire transfers and cryptos as the main options for funding.

VISA and MasterCard are not available, and the same applies to Neteller and Skrill. The lack of bank cards and e-wallets is another red flag as the company only accepts cryptos and wire transfers.

AssetsFX Trading Assets and Features

From 31 Forex pairs the presence of USD to Chinese Yuan seems very peculiar as the Chinese currency is known to be fixed and not floating. This means you can not speculate on its changes as the central banks decide the currency rates. Anyways, the other 30 pairs would be enough to trade in theory. But since the broker is unregulated and only accepts cryptos as payments we do not recommend trading with them. From other asset types, there are only 7 commodities of metals and oil provided. It is interesting how the broker accepts cryptos for payments but does not provide them for trading. Another potential red flag here.

AssetsFX – how to start trading

In case you still want to proceed with your idea of investing with this broker, you will have to register and open up an account. Besides a demo account, which is highly helpful in some cases, traders can choose between several categories of live accounts.

AssetsFX – Trading Platforms

Unregulated brokers are sometimes offering honest and fair services but this is rare in the Forex world, and that is why you should be cautious when investing with an AssetsFX broker as well. The broker offers MetaTrader 4 and MetaTrader 5 as trading platforms. These platforms in themselves are very advanced and fully customizable meaning traders can adjust everything. AssetsFX only incorporated the standard set of features into the portal, such as Expert Advisors, trading signals, and “Myfxbook” as an auto-trading solution.

Bonuses and rewards

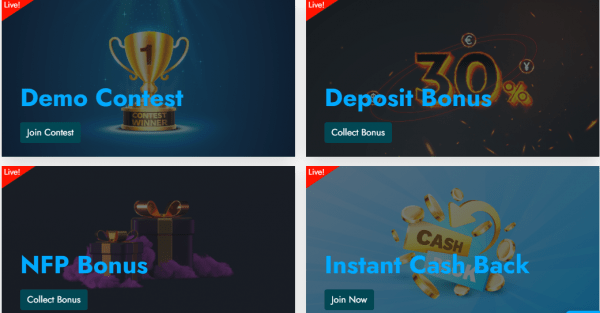

Various gifts and promotions are a common occurrence in the Forex market, and broker houses are sometimes very generous in their offerings. AssetsFX has multiple bonus programs to attract traders. Deposit bonuses, instant cash back, and NFP bonuses will provide traders with extra cash for trading.

Customer support service

The website of AssetsFX Forex Broker is only available in English, which is very few if you want to develop a global presence. Similarly, this company does not provide a broad network of localized support centers, and clients can reach their staff via phone or contact form on the site. There was added A live chat to connect with the broker’s representatives directly. The lack of other options is another drawback in the overall quality of AssetsFX, and we believe that our readers will only experience a lot of headaches and frustrations if they sign up and register with this particular broker. Support is provided 24/7 which is very good, but the lack of regulations and languages makes it difficult for global traders to get support.

AssetsFX Education

There are no educational materials. The same is true for market research tools. The broker only offers free VPS services as a promotion which is not enough. The lack of educational resources and tools will make it difficult for traders to control every aspect of trading from one platform.

Should you consider AssetsFX?

If you have read our entire AssetsFX FX broker review, you could see that a lot of things are “off” with this broker, which is why we urge all of our readers to look elsewhere for a reliable and trustworthy trading provider. We all want to invest our funds in a safe and protected environment, and unregulated Forex brokers are certainly not something that instills a lot of confidence. Lack of license, payment options, and trading assets all add up to our negative conclusion about AssetsFX. If the broker acquires any license and adds credible payment methods then we could recommend it.

Is AssetsFX a regulated and reliable broker?

What deposit and withdrawal options does AssetsFX offer?

Does AssetsFX provide educational resources and market research tools?