Lirunex Forex broker has been active in the financial industry for several years. The brokerage company sets its vision to adopt technological innovations to attract more customers. With various trading tools, Lirunex is a brand that has a lot of clients. It is available in 7 different countries and won several awards, including the best broker of Malaysia in 2020. However, while the broker might seem decent at first glance, we think that the latter has numerous flaws, which we are going to explore thoroughly in our Lirunex review. The first obvious problem is the fact that the “About Us” section does not function properly. But this is not the only we did not like about Lirunex, let’s dive deep and find out more about the safety, fees, and other important specs about this broker.

The safety and security of Lirunex

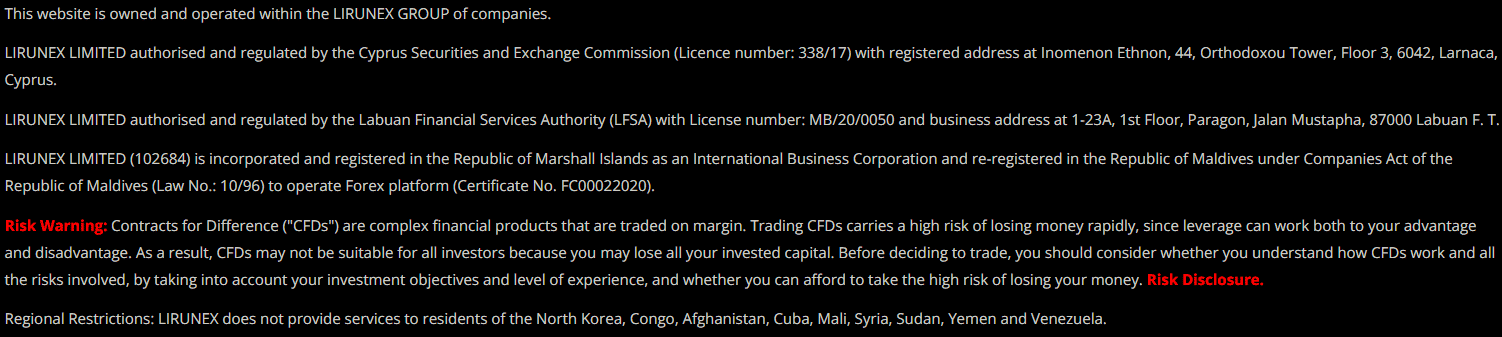

The broker started operating in 2017. Lirunex was regulated by three of the world’s leading financial jurisdictions: CySEC, Labuan Financial Services Authority, and the Republic of Maldives Ministry of Economic Development. Currently, the broker is only re-registered in the Republic of the Maldives under the Companies Act of the Republic of the Maldives (Law No.: 10/96) to operate the Forex platform (Certificate No. FC00022020).

What does this mean? The Lirunex broker lacks proper oversight and there are no direct reputable regulators to ensure client safety and strong work ethics. The company may be ethical and fair, but the absence of any powerful regulator is a strong downside of Lirunex broker, and traders should exercise extra caution when dealing with this broker.

In addition, we could not find information about negative balance protection on the website as well as information about AML policy, which we think makes the broker a little suspicious. Negative balance protection is a necessary tool to make sure clients’ funds are stored safely. Can Lirunex be trusted? Missing vital information such as this truly puts their legitimacy under question.

We should also point out that still having a license is preferable because in case something happens with a customer, there will always be someone to appeal to.

Lirunex Fees and spreads

Lirunex trading fees depend on the type of account you are going to have on the broker’s website. On LX-Prime and LX-Pro, it is 8 and 4 USD per lot, respectively. The spreads on the commission-free account of LX-STANDARD start from 1.5 pips, which is above the industry average of 1 pip. Spreads can be as low as 0 pip, but once again the type of account is important to consider. For Islamic accounts, swap-free trading is provided. There are no deposit fees whatsoever and depending on the withdrawal method you might be charged extra. Your location also plays a role, as some payment methods vary depending on the location. All payment methods of withdrawals and some of the deposit methods are subject to charges, making it expensive to withdraw funds or start trading at Lirunex.

Lirunex Trading Accounts, deposits, and withdrawals

Lirunex Forex broker offers 4 main types of trading accounts that are: LX-Standard, LX-Prime, and LX-Pro. You would need a minimum of $25, $200, and $10,000 to open each type of account respectively. LX-Pro requires quite a large minimum deposit, which may be unsuitable for novice traders. These accounts differ from each other in the number of spreads and lots. We should also point out that the maximum leverage is 1:1000.

In addition to these accounts, users also have the possibility to open a demo account, before they move to real trading. The essence of a demo account is to give a customer virtual funds that he or she will use for simulated trading. In such a way, a trader will acquire the basics of trading that will be used later for real trading. Lirunex provides this possibility to its clients, but all Forex brokers have a free demo account, providing no advantages for the Lirunex demo account.

In addition, there is a swap-free account available, which is also called an Islamic account. For people who follow the Muslim faith, Islamic Standard and Islamic Prime accounts are provided. They are different from each other primarily in spreads and the amount of minimum deposit.

Lirunex Deposits and Withdrawals

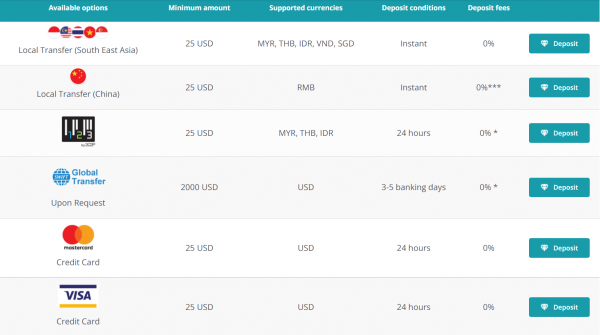

Lirunex broker supports a plethora of payment methods for its customers such as Mastercard, Visa, Tether, PayPal, and Bitpay. The minimum amount you can deposit is $25. USD, AUD, EUR, and JPY are the supported currencies on the website. There are no deposit fees on the majority of payment methods but depending on your location it could vary. Withdrawals are a bit complex – you can check the official info on the website to find out whether you will be charged for withdrawals or not. Normally, deposits are instantaneous, but the same cannot be said about withdrawals. Sometimes it could take up to 7 days before your transaction is fully completed, which is much longer than industry-accepted 2-3 business days.

Lirunex Trading assets and features

Lirunex offers shares, indices, metals, and energies in addition to Forex trading. The broker provides different conditions for these assets and a trader needs to take into account the requirements in order to start trading effectively. Leverage requirements, as well as spreads, could vary depending on the asset type. We should also point out that almost every popular market is available on the broker’s website. Forex trading is without a doubt the most popular activity for traders on Lirunex.

The maximum leverage that you can get from trading assets is 1:1000. It is a large amount, which could be detrimental for traders if they do not know what to do. The higher the leverage is – the risks are higher as well. While talking about trading assets, we should note that the broker offers a welcome bonus to new users so that they can use money further in trading.

Lirunex Trading Platforms

At the present moment, Lirunex FX broker offers MetaTrader 4 platform to traders. It is surprising that MetaTrader 5 is not supported, as the majority of brokers implement this platform on their websites. In addition, no WebTrader is available. MetaTrader 4 in its turn is available on different devices as laptops, mobile, and tablets. MetaTrader 4 is famous for its cutting-edge and user-friendly features. Traders will also be able to access all major trading instruments through the platform, but you need to make sure you have a strong computer to run the program. MetaTrader 4 also has multi-currency and language support for customers. Automated trading alongside expert advisors is also a possibility.

Lirunex Customer Support

Lirunex customer support can be contacted through 3 different ways: live chat, online form, and e-mail. Each of these methods has advantages as well as disadvantages. From a customer’s point of view, it is advised to use a live chat, because the answer will come in a few minutes, while a live form and e-mail could take some time before your request is initialized. The support is provided in several languages, but mostly it is available in English. The website’s main language is also English.

Lirunex Educational Section

On the website of Lirunex, there is no possibility to access the educational section. Users cannot get more knowledge by attending webinars or online courses/tutorials that would enhance the trading process. In addition, there is no blog where weekly news pieces are added by the broker. We think that the absence of such an important feature is a massive disadvantage for the broker. Numerous online brokerage companies try their best to provide customers with as many trading webinar opportunities as possible, but, Lirunex does not have one. Furthermore, even registered users are not able to make use of the following feature as attending different webinars.

Should you consider this broker?

We have finally come to the conclusion of our Lirunex review – can this broker be trusted? From what we have acquired through the help of the official website, the broker is licensed, though it has a lot of flaws, which we think require attention from customers. In addition, there are some questions regarding trading assets that the broker offers. There is no separate educational section where users can get information about different subjects that are pivotal in Forex trading. As a result of our research on Lirunex, we do not recommend users register on the website of Lirunex, as there are more reputable and reliable brokers reviewed on our website that offer better terms and conditions for trading financial markets.

Is Lirunex a reliable broker?

What are the fees and spreads at Lirunex?