Forex trading is not easy. It is not a secret that two-thirds of the trades will eventually lose their money. Partially, it happens due to the tricky nature of the Forex market as it is extremely volatile and sometimes completely unpredictable. However, mostly, trades lose their financial resources due to a lack of knowledge, expertise, and understanding of significant concepts in trading. One of the crucial concepts in Forex trading is choosing the right Forex broker. The importance of a decent Forex broker cannot be diminished in any financial market or any region in the world.

For that purpose, we provide extensive reviews on both reliable and non-legit brokers in order to supply the necessary information to the traders. Trades can choose to research the brokers themselves, however, it is a highly time-consuming activity that requires a professional attitude and considerable knowledge of in trading general. We present the review of Tickmill Forex broker in this article with a focus on major aspects of the brokerage firm, its background history, regulations, trading assets, and various opportunities for Tickmill customers.

Tickmill brief history

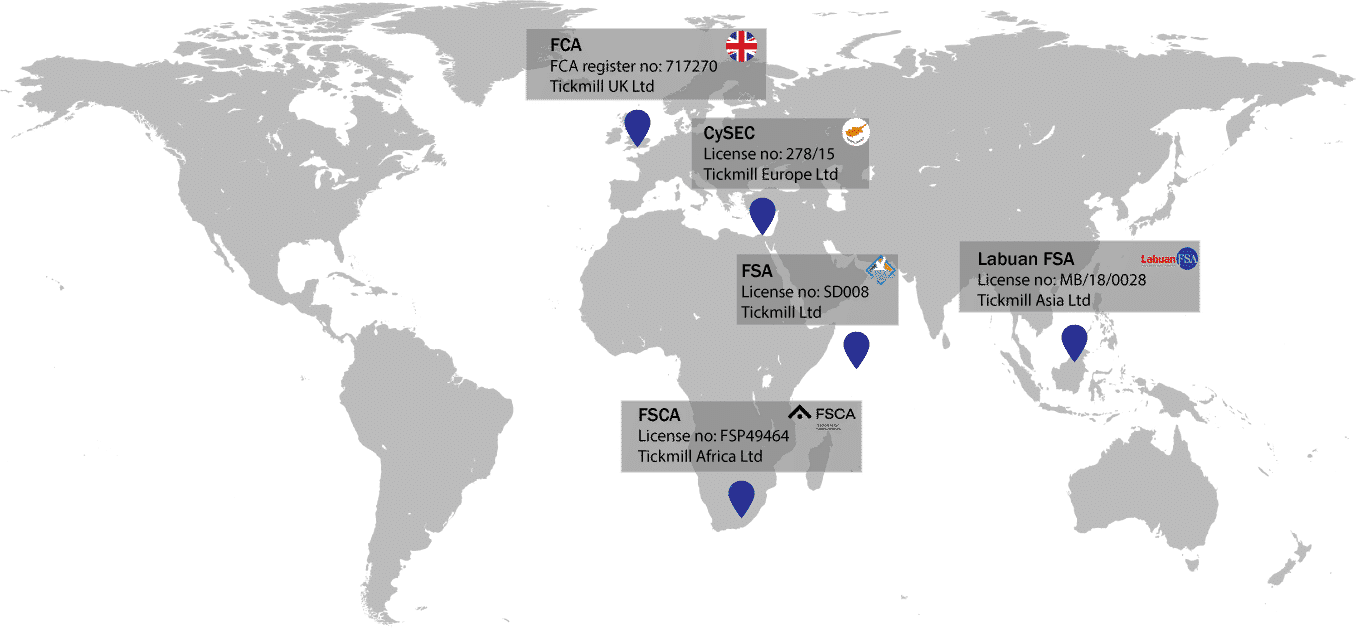

First things first, the brokerage firm has experience of over eight years on the Forex market. Tickmill’s history goes back to 2014 when the company began operating in several regions of the world. There are five branches of the broker operating worldwide united under the international company Tickmill Group. All five branches are regulated within five different jurisdictions with the licenses granted from the corresponding local regulatory authorities. The regulations are the first significant indicators that the broker is indeed legit, which serves as a safety guarantee for the traders.

The safety and security of Tickmill

Usually, when deciding whether to trust the broker or not, we recommend checking the license that the broker holds. Sometimes, brokers will claim that they are regulated and will list several regulatory bodies as their authorization entities. However, when we check within the database of the regulatory bodies, brokers do not appear within the list of regulated Forex brokers. Fortunately, we could identify that Tickmill Forex broker is indeed regulated within five jurisdictions and the broker holds five different licenses to prove its legitimacy:

- Seychelles Financial Services Authority (FSA) authorizes Tickmill Ltd as a Securities Dealer with license number SD 008

- Financial Conduct Authority in the UK (FCA) regulated Tickmill UK Ltd with FCA register number 717270

- Cyprus Securities and Exchange Commission (CySEC) authorizes Tickmill Europe Ltd as a CIF limited company with license number 728/15

- Labuan Financial Services Authority (Labuan FSA) regulates Tickmill Asia Ltd with the license number MB/18/0028

- Financial Sector Conduct Authority in South Africa (FSCA) regulates Tickmill South Africa (Pty) Ltd with the license number FSP 49464

Recognitions

The security of the funds and client data with the broker is not sufficient for deciding to trade with the broker. The regulations do not guarantee the excellence of the brokerage services that the company provides, but it simply safeguards clients from any fraudulent activity initiated by the broker. On the other hand, awards and recognitions serve as an indicator that the broker’s services are indeed high-quality and exceed the market standards. Tickmill Group received various awards and recognitions as an industry leader from some of the most reputable institutions, business magazines, and Forex fairs. In 2021, Tickmill received an award as a #1 Broker for Commissions and Fees from ForexBrokers.com Annual Forex Broker Review. In 2020, the brokerage firm got recognized within five different categories including reliability, education provision, best trading conditions, and experience, as well as the title of the Best Commodities Broker by Rankia Markets Experience Expo. Between 2017 and 2019, the broker received more than 10 industry awards.

Tickmill Fees and spreads

The trading commissions of Tickmill are super low and can compete with any other well-established brokers in the brokerage scene. The broker offers a commission of 4 USD round turn per 1 lot traded on zero spread FX accounts. With the commission this low, any scalping strategy can be implemented properly and profitably. This places huge opportunities in the hands of traders who love quick entry and exit tactics in trading. The main concern in Forex trading is that your broker is licensed, offers low spreads and fees, and allows you to withdraw your funds without difficulties. Tickmill marks all the boxes for being one of the best brokers on the market right now. The only slight disadvantage is their spread on the standard account which starts from 1.6 pips on major pairs and is commission free.

Tickmill Accounts, deposits, and withdrawals

Some of the awards that Tickmill Broker received throughout previous years also include recognition for best trading conditions. The broker offers spreads from 0.0 pips, however not always. There are several account types that provide minimum spreads starting from zero. Furthermore, the maximum leverage that Tickmill traders can get is 1:500, which is flexible enough in our opinion. The broker has one of the fastest execution speeds on the market, as well. The average execution speed of the orders on all account types and for all trading assets is 0.20 seconds.

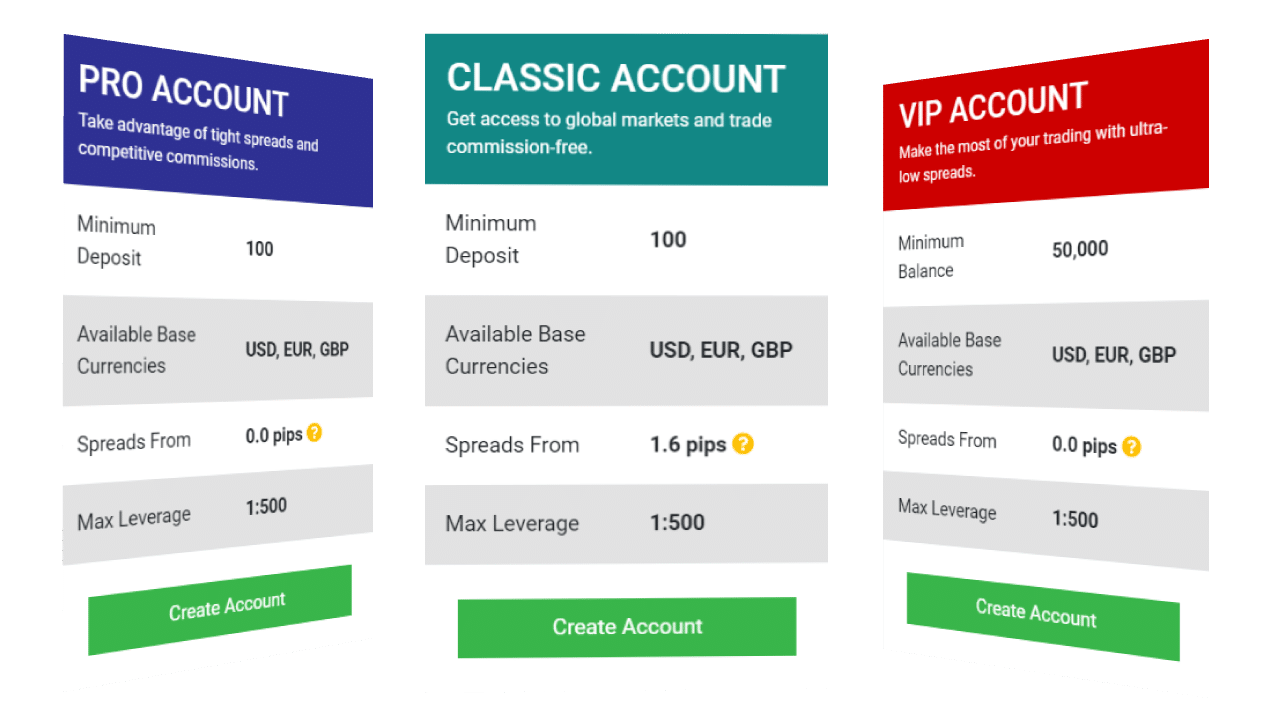

Trading Account Types

The account types at Tickmill Forex broker are very flexible and suit most of the trading styles existing globally. The accounts vary according to deposit and balance requirements, minimum spreads, and conditions. However, all account types come with a maximum leverage allowance of up to 1:500. They also have the fastest execution with an average speed of 0.20 seconds on every trading asset for each account type. Furthermore, all account types allow the option of a swap-free Islamic account. There are in total three account types, and all of them grant freedom in choosing any trading style and strategy customers like. Available base currencies for the account types are GBP, EUR, and USD.

Classic Account – min. deposit of 100 USD, with no min. balance required, spreads from 1.6 pips, no commission;

Pro Account – min. deposit of 100 USD, with no min. balance required spreads from 0 pips, commission – 2 per side per 100,000 traded

VIP Account – no min. deposit, 50,000 USD min. balance required spreads from 0 pips, commission – 1 per side per 100,000 traded

Tickmill’s Opinion is the same as ours. The broker offers WebTrader, which supports MetaTrader 4. In contrast to MetaTrader 4 original software, which requires downloading and installation, WebTrader can be accessed from any browser with ease. There is no actual trade-off for the simplicity of accessibility of the WebTrader. The security of the platform is on a high level, successfully guarding client data and funds. Furthermore, it has exactly the same features as MetaTrader 4.

Tickmill Bonuses

The brokers can provide competitive trading conditions, excellent customer support, and diversified portfolio, and still not stand out in the competitive world of trading. Mainly, it happens when brokers are reluctant to support rewarding campaigns for their customers as it may come at the broker’s expense. However, we cannot ignore the significance of promotional programs for the trading experience, especially for beginner traders who need encouragement more than anyone. That is not the case with Tickmill. The Tickmill rating partially comes from the broker’s extensive promotional portfolio that includes bonuses, contests, rewarding campaigns, and championships.

Tickmill offers a 30 USD welcome bonus that serves as a no-deposit bonus for newly registered traders. The bonus can be claimed immediately after registering and verifying the trader’s identity. There is no further deposit requirement. Tickmill also provides a Trader of the Month contest where every month the most profitable trader will be announced and rewarded with 1000 USD. The winner is decided according to the individual performance of the trader, the total profit generated along with the sum of the deposits he or she made, and the risk management skills.

The unique campaign devised by the broker is the NFP machine campaign which runs every week. The rules are as follows: the broker announces a single trading instrument at the beginning of NFP week and the traders have 30 minutes to guess the price of the instrument. The participant with an exact hit on the price gets rewarded with 500 USD. If there is no perfect hit, then the closest hit author receives 200 USD. Additionally, IB Global Championship held by the broker provides a chance to get a share from the 65,000 USD cash prize pool. Within the contest, Introducing Brokers have to bring new traders to the Tickmill platform. The more their referrals trade, the more points IBs accumulate.

Trading assets and features of Tickmill

Even though Tickmill is mainly a Forex broker, the firm also administers numerous CFD products on its trading platform. The traders can access more than 80 financial instruments within the Tickmill portfolio. The list of trading assets includes Forex, Stock Indices, and Oil, Bonds, and Precious Metals. Obviously, Forex is the dominating market for the broker, as well. All products are provided with 1:500 or 1:100 leverage and spread from zero depending on the account type. Furthermore, there are no limitations to what kind of trading styles or strategies the customers of Tickmill can incorporate. They can go for scalping, heading, EAs, or anything else they enjoy and like.

Within the Forex products portfolio, there are over 60 currency pairs available to trade with Tickmill. The leverage on currency pair trading is 1:500. For Stock Indices and Oil, the leverage can go up to 1:100. Over 15 products are provided within the category of Stock Indices and Oil. In the Precious Metals portfolio, traders can access Gold and Silver crosses with leverage up to 1:500. The four most popular European bonds are presented to the customers in the Bonds trading portfolio. The customers of Tickmill can trade bonds with leverage of 1:100.

Tickmill Customer Support

Multilingual live chat enables customers of the Tickmill broker to connect directly to a broker’s representative and ask any questions or get assistance with any issues that may arise during the trading. Top broker offers one of the top quality customer services and Tickmill’s clients can enjoy the professionalism this broker built over the years. Users can select between more than ten different languages and get answers in their native language. But live chat is not only a support option from Tickmill as the broker supports all other options including email support, online form, hotline, and physical offices globally.

Tickmill Education

Tickmill also shines in educational resources numbers and offers Webinars, Seminars, Ebooks, Video Tutorials,

Infographics, Forex Glossary, Fundamental Analysis, Technical Analysis, Articles, and Market Insights. Video tutorials offer a unique perspective to actually watch how to open positions and how to use trading platforms. Forex trading is mainly based on practical training and video tutorials offer valuable lessons and make trading education more entertaining and interesting. Books and webinars are great to deepen the knowledge of financial markets and Tickmill offers all kinds of educational resources. If other brokers just offer education to appeal to regulators and other legal entities Tickmill takes this seriously and offers beginners real resources to achieve success.

This is not all as Tickmill continues this trend of offering its traders value by offering various useful tools and indicators that can assist traders in increasing their decision-making accuracy and making market research and chart analysis easier. Among the offer tools are Autochartist, Myfxbook Copy Trading, Economic Calendar, Forex Calculators, Tickmill VPS, and many many more tools.

Should you consider Tickmill?

Tickmill is a multi-awarded and multi-regulated Forex broker operating in many regions worldwide. The broker holds licenses from five different regulatory authorities. It offers a diversified trading portfolio including 80 financial instruments in Forex, Stock Indices, Metals, and Bonds. The spreads are as low as 0.0 pips and the leverage is highly competitive at 1:500. Apart from the famous MetaTrader 4 software, the broker supports WebTrader, a user-friendly and easily accessible MT4 web version.

Additionally, Tickmill provides three different trading account types, where traders can choose to operate without commissions and 1.6 pips spread, or with low commission and zero spreads. There are four different promotional campaigns, including a no-deposit bonus, a Trader of the Month contest, Introducing Brokers Global Championship, and a weekly NFP machine campaign. Not to forget about the numerous awards that the broker received, we conclude that Tickmill Forex broker is indeed a highly reliable, transparent, and customer-centric brokerage firm that deserves even more attention than it is getting at this point. The broker is especially attractive for scalpers as its commission are the lowest among zero-spread brokers. This low commission is a result of Tickmill’s large trader base of over a million.

Is Tickmill a good broker?

What are Tickmill's withdrawal fees and processing times?