Table of content

When looking at Forex economic calendars one thing traders can notice is that the monetary policy meetings and decisions by the US Federal Reserve are usually marked with high expected volatility. This is actually quite accurate in the majority of cases. In fact, during those events, the currency pairs which include USD tend to become much more volatile than before. It is not even very uncommon for the given currency pair to rise or fall by more than 100 pips in response to the latest and decisions coming out from the US Federal Reserve.

Therefore, it will be accurate to conclude that the policies and statements of the US Federal Reserve have a significant impact on the value of the US dollar. One of the most important indicators for predicting the movements of the USD is so-called the federal funds rate.

This represents a specific interest rate, set by the Federal Open Market Committee, also known as the FOMC of the Federal Reserve. This essentially represents the rate at which commercial banks lend each other money overnight.

Now since the federal funds rate essentially represents the rate at which the commercial banks get access to liquidity, it has a significant influence on the banking products. In fact, interest rates on savings accounts, certificates of deposit, also known as CD, credit cards, auto loans and mortgages are all heavily dependent upon the current federal funds rate.

The general rule here is that when the US federal reserve raises its key rate, everything else being equal, it tends to strengthen the US dollar and leads to its appreciation. On the other hand, the USD tends to depreciate in response to the rate cuts. The FOMC is scheduled to meet 8 times per year to consider the latest monetary policy decisions. The committee might decide to raise or reduce the federal funds rate, or alternatively, maintain it unchanged until the next meeting.

It is also worth noting that if the circumstances dictate, the US Federal Reserve can organize an emergency FOMC meeting in order to make timely monetary policy decisions in response to economic crises or other types of unpredictable challenges.

The latest federal funds rate decision is not the only factor influencing the exchange rate movements of the US dollar. Another major factor is the actual FOMC statements as well as comments of the Federal Reserve chairman during the press conferences, which usually takes place once per quarter.

The US federal reserve also has some additional monetary policy tools to influence the economy. Those include the quantitative easing programs, as well as the minimum reserve requirements. The former one involves asset purchases in a bid to inject money into the economy and stimulate the recovery. At the same time, minimum reserve requirements show what percentage of deposits should the banks retain as reserves. Now let us go through each of those factors influencing the US dollar in more detail.

Federal Funds Rate

As mentioned before, one of the strongest drivers of the exchange rates of the US dollar is the federal funds rate. The fact of the matter is that when the US Federal Reserve raises rates this has several important implications.

Firstly, it generally increases interest rates on savings accounts and certificates of deposit. Obviously, higher potential returns give savers a strong incentive to save more money. In addition to that those individuals who have capital in multiple currencies might decide to convert some of their funds into USD in order to take advantage of higher interest rates. It goes without saying that this tends to strengthen the exchange rate of the US dollar against other currencies.

It is also worth noting that higher federal funds rates tend to make USD more attractive for carry traders. Carry trading in general involves borrowing in lower yielding currency in order to buy a higher yielding currency and then receive a daily income from the brokerage company due to the interest rate differentials. So obviously, with higher federal funds rates, traders are more encouraged to open and hold long positions for the US dollar.

In addition to that, it is also helpful to point out that higher federal funds rate discourages traders from holding short positions for USD. This is because, when the interest rate differentials are against the trader’s position, they have to pay a daily interest to the brokerage firm, instead of them receiving any payments from the broker. This might represent a small fee for one or two days. However, over time those small payments can add up to a significant amount. Consequently, traders have a very strong incentive to close short positions for the US dollar.

It goes without saying that the opposite is also true. When the US Federal Reserve lowers its key interest rate, it effectively lowers the returns across the board on savings accounts, certificates of deposit, as well as on carry trades. Consequently, this makes the US dollar much less attractive to savers, traders, and investors, potentially leading to its depreciation.

Influence of Federal Funds Rate on US Dollar Exchange Rates

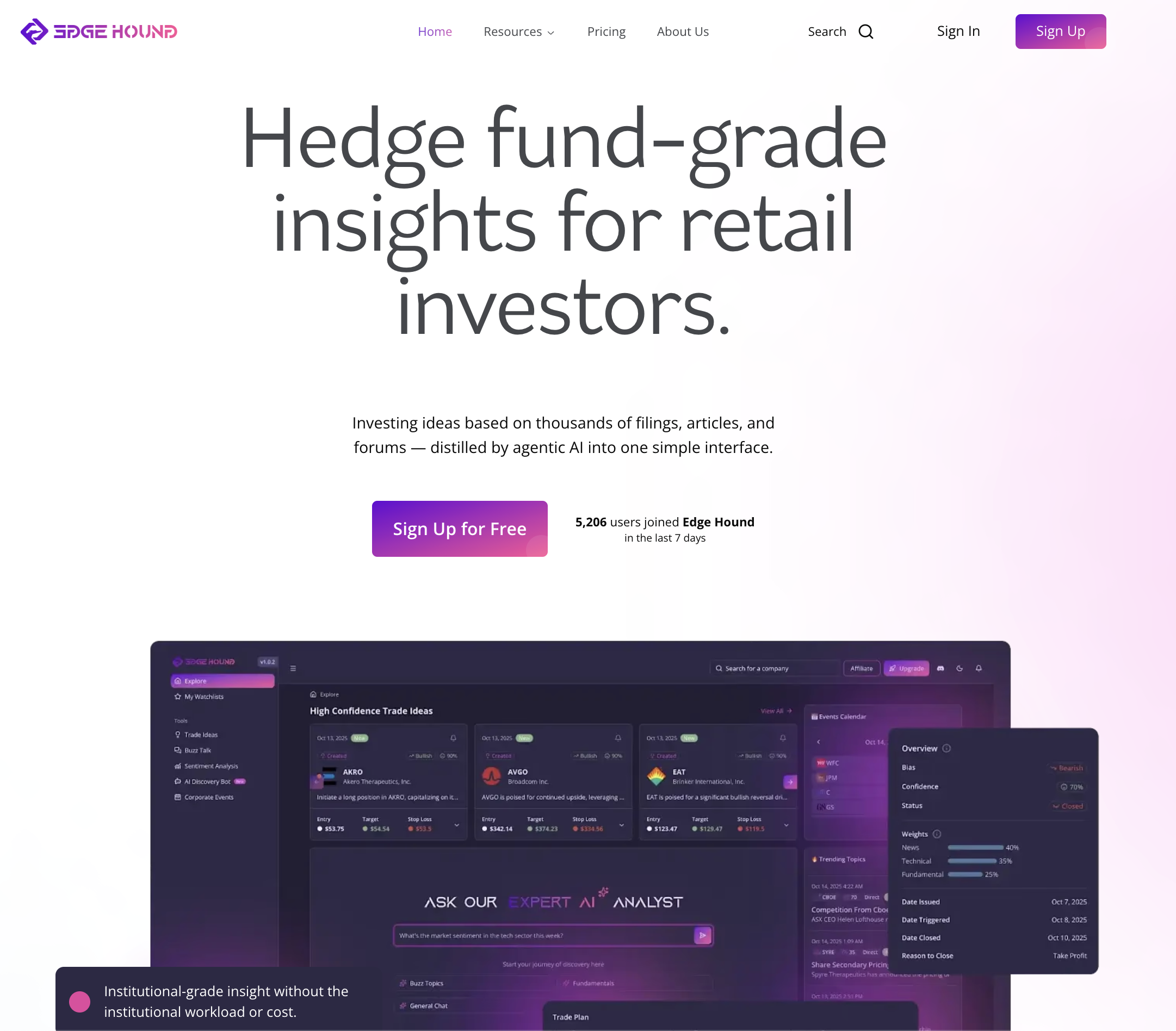

The dynamic described above becomes even more apparent if we look at the past history of the US dollar. In order to illustrate that let us check this weekly EUR/USD chart:

As we can see from the above diagram, back in 2000, the US dollar was at the height of its strength, with EUR/USD mostly trading close to $0.90 level. This is not surprising, since at that time, the US Federal Reserve was holding its federal funds rate at 6.50%, something not seen ever since.

In sharp contrast to those policies, the European Central Bank, also known as ECB, set its key interest rate at 3%, when it began its monetary policy operations back in 1999. During the subsequent years, in response to higher inflation and the weakness of the Euro, it did raise rates to 3.75%, however, it was much lower than rates in the United States.

So the fact of the matter was that savers and investors could earn 2.75% higher rates with savings accounts and CDs, denominated in US dollars, compared to ones denominated in Euros. In addition to that, those traders who opened and kept the short EUR/USD positions have earned some decent payouts in the form of daily swap payments by their brokers.

Quite predictably, this led to the strengthening of the US dollar. After all, why settle for 3.75% returns on Euro savings accounts, when one could earn up to 6.50% with the US dollar deposits? So as we can see the strength of the US dollar has persisted well into the first quarter of 2002.

However, by that time the situation has changed quite dramatically. From January 2001 the US Federal Reserve has started cutting rates repeatedly, eventually cutting them all the way down to 1% by 2003. This was actually an unprecedented move by that time. In fact, during the previous series of rate cuts back during the first half of the 1990s, the lowest federal funds rate was just 3%.

So this time the US policymakers have decided to go for much lower than that. The ECB also followed suit and started cutting rates, but they did it more gradually. So the result of this development was the fact that the Euro had around 0.5% higher interest rate than the US dollar did for some time.

The results were predictable, from the second quarter of 2002, the Euro began its long term appreciation, even surpassing the parity level with the US dollar before the end of the year. This appreciation persisted until the end of 2004, by that time EUR/USD was already trading to $1.35 level.

However, by that time, the situation has improved in favor of the US dollar. The fact of the matter was that the US Federal Reserve has already started raising rates from Summer 2004. By 2005, the repeated rate hikes gave USD a significant advantage over the Euro, since ECB decided to keep rates at 1% until December 2005.

The result of this development was that the US dollar has recovered a significant portion of its recent losses, with EUR/USD dropping all the way down to $1.18 level. Now, this reprieve eventually turned out to be temporary. The US Federal Reserve did raise rates all the way up to 5.25%. However, due to the credit crunch in the housing market, the US policymakers have eventually decided to reverse the policy and start reducing rates.

So as we can see from 2006 until the Summer of 2008 the depreciation of the US dollar continued. In fact, during the middle of 2008, the EUR/USD pair reached an all-time high of $1.59 level.

However, this was followed by the beginning of the 2008 Financial Crisis, which essentially forced all central banks to adopt near-zero policies in response. In fact, the US Federal Reserve kept rates within 0% to 0.25% from 2008 until the end of 2015.

Actually, interestingly enough the ECB was one central bank that tried to avoid this, maintaining rates at least at 1% until the Summer 2012. However, by that time the challenges of the Eurozone Sovereign Debt Crisis became too serious to maintain such rates. So inevitably, the ECB started gradually cutting rates, until reducing them to zero in 2016. The ECB has maintained rates unchanged during the subsequent years.

In contrast to those policies, the US Federal Reserve has gradually started lifting rates from 2015, eventually rising them all the way up to 2.5% by the end of 2018.

It is not surprising that in the long term, this had a positive impact on the US dollar. Despite a considerable amount of fluctuations, the EUR/USD was generally in a long term downward trend, with the pair eventually dropping all the way down to $1.08 level by March 2020.

At that time the central banks across the globe started responding to the economic challenges, brought by the outbreak of the COVID-19 pandemic. As a result, the US Federal Reserve reversed the policy and reduced rates back to 0% to 0.25% range. This created an opportunity for the Euro’s recovery, with EUR/USD pair eventually rising to $1.18 level by the end of September 2020.

FOMC Statements and Press Conferences

As we can see so far, the actual interest rate decisions can have a sizable impact on the USD-based currency pairs. However, here it is worth mentioning that the Forex market always tries to guess future monetary policy decisions before they are actually announced.

Consequently, one of the things traders look at to make those types of predictions is the FOMC statement. Those statements discuss the current economic situation in the United States, as well as explain the latest monetary policy decisions. Even if the Federal Reserve Board decided to keep rates unchanged, they still release the statement.

Therefore, the market participants go through those statements to find some potential clues about the future path of the monetary policy. So they find hints about possible rate hikes down the road, then this is likely to lead to the appreciation of the US dollar. The opposite is also true, if the statement is pessimistic about the US economy and gives some indication of the possible future rate cut, it can easily lead to the depreciation of USD.

In fact, the official FOMC statements are not the only things traders and investors are looking for. There are also press conferences held once per quarter. The format of those events is quite simple. It begins with the statement of the chairmen of the US Federal Reserve. Once this part is concluded, then the journalists attending the event have an opportunity to ask some questions.

It is not surprising that during those events the USD becomes more volatile and even some of the most cautious statements of the Federal Reserve chairman can have a significant impact on the Forex market.

In addition to that, the Federal Reserve also publishes the FOMC projections about the future inflation and economic growth rates, as well as projections of FOMC members of the future federal funds rates. It goes without saying that, if those forecasts are positive about the US economy, or alternatively if the FOMC members foresee a possible rate hike, it can certainly benefit the USD.

In fact, there have been many cases when the market reaction to the interest rate announcements was quite unpredictable. For example, there were occasions, when the US Federal Reserve announced a rate hike, but the US dollar remained flat or even lost some ground against other currencies. Obviously, theoretically speaking, the USD should have made some notable gains in response to this decision, however, it did not happen.

This is actually when the old market saying: ‘buy the rumor, sell the fact’ comes into play. As mentioned before, traders are always trying to predict the future policy rates. So what happens very often is that the actual rate hike or rate cut is already priced into the market by the time the actual announcement comes out.

This does not mean that the actual interest rate announcement has no impact on the market exchange rate. They still have a significant long term influence on currencies. In addition to that it is helpful to point out that if the central bank makes an unexpected decision, then this can easily lead to large volatility in the market.

Quantitative Easing as a Way Out of the Liquidity Trap

When it comes to monetary policy, the main principle here seems quite simple: If the inflation rate is above the target and the economy is strong, then the central bank responds by rising rates to restrain the CPI. On the other hand, if there is an economic downturn, or the inflation rate is well below the target, then the central bank cuts the interest rates.

However, the 2008 Financial Crisis has exposed a serious problem, faced by the policymakers. The fact of the matter is that as many central banks reduced rates to near-zero levels when the economy did not recover in a timely manner, they could not reduce rates beyond zero.

Well, in theory, they can adopt the negative interest rates, just like in the case of the Bank of Japan and the National Bank of Switzerland. However, the obvious problem here is that the central bank can not simply enforce negative rates on commercial banks, consumers, and businesses.

This is because it is highly unlikely that banks would ever agree to pay their clients for borrowing money. The main point for issuing loans to customers is to earn some income in the form of the interest payments. Obviously, if the bank reverses that and starts paying interest to borrowers, it will wipe out one of the largest sources of income those financial institutions have and instead turn it into the expense. It goes without saying that this policy can easily lead to the insolvency of several banks and consequently to a new financial crisis.

In addition to that it is also worth noting that if banks started charging depositors for savings accounts, it can give a strong incentive to clients to simply withdraw their funds from their accounts. This potentially can create significant liquidity problems for those financial institutions, which also has the potential to lead any country to an economic crisis.

Faced with this reality, the US Federal Reserve instead adopted quantitative easing policies. This involves the purchase of US government bonds, as well as the mortgage-backed securities. The rationale behind this policy is that this process will inject a significant amount of money into the economy, which can support the recovery.

So in this case the US Federal Reserve became the largest buyer of the treasuries in the bond market. It is not surprising that the increased demand led to the decline in the US bond yields. In addition to that, quantitative easing also leads to a large expansion of the money supply. Consequently, everything else being equal, the net result of those two factors is the depreciation of the US dollar.

Now, the quantitative easing programs, at least in theory are not permanent. At some point, once the economy recovers, the US Federal Reserve is supposed to reduce the amount of monthly purchases gradually, until it is down to zero.

At this point what happens is that quantitative easing slowly turned into quantitative tightening. Why is this the case? Well, the fact of the matter is that every single bond and mortgage-backed security has its own term. So once this term expires, the investor will get the principal back. In this case, the US Federal Reserve acts as an investor in the bond market.

Consequently, once the bond matures, the US government pays the invested amount back to the US Federal Reserve. So what happens here is that the money is effectively taken out of circulation. This has an opposite effect on the economy compared to quantitative easing and therefore, leads to an appreciation of the US dollar.

The actual market data generally tends to support this argument. Returning back to our EUR/USD weekly chart, we can see that the US dollar already started making some significant gains against the Euro, from Summer 2014. Yet, as mentioned before, the first actual rate hike only came in December 2015.

So the obvious question here is: why did the US dollar start appreciating against other major currencies at least 18 months before the first rate hike came out? Well, the fact of the matter is that by 2014 the US Federal Reserve was already reducing the size of monthly asset purchases. Some financial commentators and professional Forex traders called this process ‘tapering’.

Eventually, there came a point when the US policymakers have terminated the program and even slowly started winding down the balance sheet of the US Federal Reserve. This was one of the most important contributing factors for the strength of the US dollar during this period. So as we can see from this example, the qualitative easing policies can also play a decisive role in the exchange rate developments for a given currency.

Minimum Reserve Requirements

The monetary policy decisions, FOMC statements, and quantitative easing are not the only tools under the disposal of the US Federal Reserves. The minimum reserve requirements are yet another tool central banks can use to achieve their goals.

So how can we define this term? Well, the fact of the matter is that the modern economy is built on so-called ‘fractional reserve banking’. This means that when clients deposit money at the bank, the financial institutions do not store all of those funds in their vaults. Instead, they retain some portion of those deposits, and they lend it out the rest.

The reason for this is the fact that banks have to pay depositors some interest on their savings accounts and on certificates of deposit. So if they hold all of their deposited amounts at vaults, then banks have to pay depositors from other sources of income. However, what they can do here is to lend those deposits out at higher interest rates. For example, if the bank pays 3% on savings accounts, they can lend it for 6% and keep the 3% interest rate differential for themselves.

Obviously, the money earned from this 3% interest rate differential will not entirely be converted into the profit. Here there are several factors to account for. Firstly, it is important to remember that banks do have their own operating expenses to pay for. This includes the salaries of employees, utility bills, cost of equipment, rents, and other types of expenses.

In addition to that, it is also worth keeping in mind that bankers should also have to account for bad loans. The reality of the matter is that not all borrowers will repay the money on time along with interest payments. Generally speaking, the majority of borrowers are likely to make their payments on time. However, there is always some percentage of people who are very often late on their payments or default on those loans entirely.

Obviously, banks do have an option to go to court to recover the funds owed. For example, in the case of a mortgage, the financial institution can sell the home, which was used as collateral. There are also thousands of court cases involving unpaid credit card debt.

However, it is worth remembering that those cases might take months or even years to be fully resolved. In addition to that banks usually do not turn to court if the amount owed is small. For example, it is highly unlikely for the financial institution to spend thousands of dollars in legal fees just to recover the unpaid $300 credit card debt.

However, despite all of those arguments, some central banks around the globe do impose minimum reserve requirements on banks. This is expressed as a percentage of deposits the bank has to retain as a reserve. So basically this represents the portion of the total amount of deposits, which the bank is not allowed to lend out.

During March 2020, in response to the economic downturn caused by the outbreak of the COVID-19 pandemic, the US Federal Reserve announced that it was reducing the minimum reserve requirement to zero. Before this point the reserve requirements ranged from 3% to 10%, depending on the total amount of deposits under the bank’s disposal.

Generally speaking, reducing the minimum reserve requirement does have an effect of stimulating the economy. This is because this decision essentially frees up more money for the banks to lend out. As a result, this is likely to increase the number of loans issued by the financial institutions.

However, this does not mean that reducing reserve requirement is always a positive development for the currency in question. This is because it does have both positive and negative implications for the currency. On the positive side, since the banks can lend out large portions of deposits, they can earn a higher income and offer higher interest rates for depositors.

However, on the other hand, this increases risks in the banking sector considerably. This is because if for whatever reason a significant number of depositors decide to withdraw money from bank accounts, then this can bring the solvency of those financial institutions under question. They can surely borrow money from some other commercial banks or even from the US Federal Reserve, however, it is important to keep in mind that no bank has an unlimited borrowing power.

Appreciation of USD against Emerging Market Currencies

At this stage, some people might ask a very logical question: since the interest rates in the US have been so low during the last decade, then how it happened that the USD still gained some ground against many emerging market currencies?

So if the interest rate was the only decisive factor in determining the exchange rates, then by now the Turkish lira should have made some massive gains against the US dollar. So was this the case? Well, in order to answer this question, let us take a look at this daily USD/TRY chart:

As we can see from this diagram, at the beginning of 2018, the US dollar was trading close to 3.75 level against the Turkish lira. Since March 2018, the Turkish currency began its steady depreciation, with the USD/TRY pair going as high as 6.90 level by August of the same year.

This was followed by a sharp correction, with the Turkish lira regaining some of its losses and the USD/TRY pair dropping down to 5.15 level by November 2018. However, this type of recovery was short-lived. From 2019, the USD/TRY resumed its upward trend and reached new highs. By October 2020, one US dollar was already worth 7.90 Turkish liras. It clearly seems that the 10.25% interest rate, set by the Turkish central bank is not enough to put an end to the lira’s depreciation. So, the fact of the matter is that during the last 3 years the USD/TRY exchange rate has risen by more than 90%.

There are actually two reasons behind those surprising developments. Firstly, the average inflation rates in Turkey are above well above 10%, when the US long term inflation stands at 3%. This means that the US dollar is much better to store of value than the Turkish lira. In addition to that, the US dollar is still the world’s top reserve currency, so it is still in high demand among savers and investors.

Influence of the US Federal Reserve on the USD – Key Takeaways

- One of the most important indicators which have a significant impact on the value of the US dollar is the federal funds rate, set by the US Federal Reserve. This essentially represents an interest rate at which commercial banks lend money to each other overnight. The federal funds rate has a significant influence on the savings accounts, certificates of deposit, mortgages, consumer loans, and other banking products.

- Everything else being equal, when the US Federal funds rate rises, it generally tends to strengthen the US dollar. This is because this increases returns on savings accounts, certificates of deposit, and carry traders. Consequently, in this case, the USD becomes more attractive for savers, traders, and investors. The opposite is also true, when the US Federal reserve cuts rate, it is likely to lead to the depreciation of the US dollar against other currencies.

- The US Federal reserve has other monetary policy tools such as quantitative easing and minimum reserve requirements. The former involves the purchase of government bonds and mortgage-backed securities in order to stimulate the economy. The minimum reserve requirements specify the percentage of deposits banks have to retain as reserves. So they are not able to lend that portion of deposits to their customers. In March 2020, the US Federal Reserve reduced reserve requirements to zero.