Table of content

Every individual who has some basic understanding of banking knows how term deposits and certificates of deposit work. The principle is very simple, a client deposits a lump sum of money at the bank for a specific term, generally ranging from 3 months to 5 years. In exchange for lending money to the bank in this way, the client receives a predetermined amount of interest on the deposit. Once the term of deposit or CD expires, the client receives the principal back along with the interest payment.

Now, what happens with the ordinary term deposit or CD is that the client chooses the currency in which the account is opened and receives all interest payments in that currency. In order words, the daily fluctuations of the currency exchange rates have no effect on the amount of return the client receives in exchange for depositing funds with the bank.

However, interestingly enough there are some commercial banks that offer deposit accounts which are directly linked to the Forex market. One such type of product is the dual currency deposit. The main principle here is simple. The bank clients choose the currency in which they deposit money at the financial institution. In addition to that, they also get to choose the alternative currency in which they want to receive their principal and interest if the exchange rates are favorable. In fact, some banks call this the convertible term deposit.

This allows the market participants to benefit from the potential appreciation of the base currency and earn higher returns, compared to regular deposit accounts. In addition to that, some commercial banks also offer triple currency deposits. In this case, besides base currency, the client chooses two alternative currencies in which they agree to receive their principal if the exchange rates are favorable.

Dual and triple currency deposits are closely tied to the Forex market and are quite similar to trading. However, it is important to point out that there are some distinct differences between them.

On the positive side, with dual currency deposits, the market participants do not have to pay any rollover charges for holding positions for extended periods of time. Another major advantage of this product is that the principal of the investment is secure. So in the worst case scenario, the trader will receive its money back with a small interest.

On the other hand, it is worth mentioning that people can not use leverage with dual currency deposits. At the same time, these types of products are usually 3 months as a minimum investment period. So it goes without saying that dual currency deposits are generally designed for long term traders and investors. Consequently, it might not be so appealing for scalpers and day traders.

Now let us go through these types of trading instruments and their specific characteristics in more detail.

How do Dual Currency Deposits Work?

The basics of dual currency deposits are quite simple. Firstly, the market participants have to choose the so-called base currency, in which they deposit money. In addition to that, they also get to choose the alternative currency, in which they wish to receive their principal and interest if the exchange rates end up favorable for the client.

To simplify the explanation, let us take an example. Let us suppose that some traders decided to take advantage of dual currency deposits. They have chosen the US dollar as the base currency and the British pound as an alternative currency. The interest rate on the deposit is just 1% annually.

So, this can have two outcomes. If the USD depreciates against GBP, then there is no need to convert the US dollars into pounds at a loss. Consequently, once the term expires these clients will receive their money back in USD, alongside with 1% annual interest, as agreed before.

To illustrate this better, let us take a look at this daily GBP/USD chart:

As we can see from the above diagram, back at the beginning of October 2017, at market rates one pound was worth approximately $1.32. So let us suppose that each trader has invested $10,000 in this deposit for 3 months. This means that at the time of opening deposit, at current market rates, the invested sum was the equivalent to £7,576, if we round it to the nearest pound.

Now, as we can see from the chart, during the next three months, the British currency made some steady against the dollar, eventually rising to $1.36 level. This means that the $10,000 initial deposit, now became an equivalent of £7,353. Obviously, clients are not interested in losing £223, so one the term expires their deposit will not be converted to GBP, instead, they will receive it back in US dollars, $10,000 plus $25 in interest.

Let us now suppose that at the beginning of April 2018, these traders decided to try again, investing $10,000 in USD and once again choosing GBP as an alternative currency. By that time, the GBP/USD pair has risen all the way up to $1.40. Consequently, that $10,000 investment will be the equivalent of £7,143. Let us further assume that instead of 3 months, the term was set at 2 years, with a 1% interest rate.

As the above chart demonstrates, after reaching multi-year highs during early 2018, the British currency has started a steady depreciation, eventually dropping all the way down to $1.24 level by early April 2020.

Therefore, once the term expires, these clients can receive their $10,000 back, alongside with $200 interest. Or alternatively, they can get £8,065 back plus £161 in interest payments. Let us now remember that these traders have invested the sum, which was the equivalent of £7,143. Consequently, if they receive back £8,065 plus £161, this would represent a 15.2% return on the investment. Therefore, the deposit will be converted from USD to GBP, with the market participants earning a decent rate of return in the process.

It goes without saying this represents an attractive rate of return for the market participants. On an annual basis, this is approximately the equivalent of 7.5%, which is quite impressive, especially at current near-zero interest rates.

Basics of Triple Currency Deposits

Now, one of the criticisms some people might make against the dual currency deposit is that if the base currency depreciates, then the investors and traders will not receive any significant amount of return. Since there are only two currencies involved, the chances of earning a sizable amount of money from currency appreciation are near 50%.

Obviously, this is why the market participants have to choose carefully their base currency, by conducting a thorough analysis of fundamental and technical indicators. However, in order to address the above mentioned criticism, some commercial banks simply came up with so-called triple currency deposits.

The mechanics with this banking product is very similar to the dual currency deposit. The only difference here is that in this case there are actually 3 currencies involved in the deposit. This theoretically increases the chances of success for the market participant considerably. This is because if the base currency appreciates against both or at least one of the alternative currencies, the trader will receive some payouts.

For example, let us suppose that traders have chosen the Euro as a base currency with the triple currency deposit. The term is 3 months and the two alternative currencies are the US dollar and the British pound. This can have four potential outcomes:

Firstly, let us begin with the worst case scenario. Let us suppose that the Euro has depreciated against both USD and GBP. So if EUR/USD falls by 3% and EUR/GBP declines by 2%, then in order for traders to avoid any loss of capital, they will receive the principal of their investment back in Euro. There might be small interest paid alongside the principal depending on the agreement. However, in terms of capital appreciation, the traders have not earned anything. Yet, on the bright side, they did retain their capital.

Let us now move on to the second scenario, where the Euro loses ground against the US dollar but makes gains against GBP. So if the EUR/USD falls by 4% and EUR/GBP rises by 3%, then the invested amount will be converted from EUR to GBP. In this case, the market participants will receive a 3% return due to capital appreciation.

In the case of the third scenario, the Euro appreciates against the US dollar and depreciates against the British pound. So if the EUR/USD rises by 5% and EUR/GBP declines by 1%, then the invested amount will be converted from EUR to USD. As a result, traders will earn a 5% return due to capital appreciation.

Finally, we have the best case scenario, where the single currency appreciates both against the British pound and the US dollar. In this case, the amount will be converted into the currency against which the Euro makes the most gains. For example, if EUR/USD rises by 6% and EUR/GBP climb by 4%, then the invested capital will be converted from EUR to USD. The result of this will be that the trades will make a 6% return due to capital appreciation.

So as we can see here, the triple currency deposit represents some sort of upgraded version of the dual currency deposit. It improves the chances of the market participants to earn payouts due to capital appreciation and allows them to choose 3 currencies.

Benefits of Dual and Triple Currency Deposits

So why would someone consider investing in these kinds of deposits? Well, the fact of the matter is that currency deposits do have their own distinct advantages. Firstly, it is worth noting that the most important advantage of these trading instruments is that the principal of the investor is fully secure.

This means that if the market participants get their analysis wrong, they might not receive any profits, but at the same time, they will retain their principle. Consequently, this limits the potential downside of trading currencies.

Therefore, those people who are interested in trading Forex, but still feel uncomfortable with opening trading accounts, might consider opening dual or triple currency deposits instead. This can help them to limit their risk exposure considerably, while also giving them a chance to earn some decent payouts from currency movements.

Another major benefit of dual and triple currency deposit accounts is that the market participants do not have to pay any rollover charges. This means that whether they open those accounts for 3 months or 2 years, they do not have to pay any swap payments. This is a significant benefit for long term traders. The fact of the matter is that the swap charges due to interest rate differentials do significantly limit the trader’s ability to hold the long term positions with some currencies. On the other hand, with currency deposits, they can do so without having to worry about any additional charges.

Finally, those types of deposits allow the market participants to earn considerably higher returns on their investments, compared to savings accounts, certificates of deposit, and even government bonds. In fact, there is no limit on the rate of return they can earn with those accounts since it is entirely dependent on the exchange rate movements in the market.

It goes without saying that before 2008 it was perfectly possible for the market participants to earn up to 5% interest on ordinary savings accounts and certificates of deposits. This was because at that time the key interest rates of the US Federal Reserve, the Bank of England, the Reserve Bank of Australia, and other central banks were at 5% or higher.

However, the situation has changed considerably after the 2008 Financial Crisis. Faced with collapsing demand in the economy and the threat of deflation, policymakers in those central banks have responded by cutting their rates dramatically reducing them to near-zero levels.

There was a temporary recovery with interest rates, as the US Federal Reserve and some other central banks raised rates since December 2015. However, this rate hike cycle was cut short by the outbreak of the COVID-19 pandemic. Faced with an economic downturn, the policymakers in the United States, the United Kingdom, Australia, New Zealand, and other countries have cut rates to 0.25% or lower.

Consequently, bank deposits and CDs simply became very unprofitable. In fact, in real terms, depositors are losing their purchasing power since the interest rates there are considerably lower than the average inflation rates.

Obviously, one reasonable alternative to losing purchasing power is to invest in the real estate or the stock market. However, some people still shy away from making those types of investments. It is true that in the long term historically those assets have proven to be a decent hedge against inflation.

Yet, the fact of the matter is that the principle of the investment in those cases is not secure. For example, during the March 2020 stock market crash, many investors have lost a significant portion of their net worth due to a collapse in the stock prices.

Therefore, dual and triple currency deposits are attractive to investors and traders in a sense that it guarantees the safety of the principle and still allows the market participants to earn a decent amount of return on their deposits.

Downsides of Currency Deposit Accounts

Just like with any other type of investment and trading vehicle, the currency deposits also have their own downsides as well. Firstly, it is helpful to keep in mind that there are no leveraged positions available with currency deposits. The clients can only invest their own money with those deposits.

Now, this might not be any problem for those investors and traders, who are always using their own money to invest. After all, this style of investing is considerably less risky than leveraged traders. However, this does mean that currency deposits might not be for those people who like to use leverage on a regular basis.

It is not for no reason that many financial experts and professional traders are saying that leverage is a double-edged sword. On the positive side, it allows the market participants to earn high rates of return in a relatively short period of time. On the other hand, it also increases trader’s risk exposure considerably, where without proper risk management strategies, traders might lose a significant portion of their trading capital.

Consequently, this is mostly a matter of personal preference. Generally speaking, scalpers and day traders tend to use a considerable amount of leverage. However, there are people who are not full-time traders and only aim to earn some decent amount of returns on their savings, so they might not use leverage. For the latter category, the currency deposits might be a reasonable solution for their concerns.

It is also helpful to point out that with currency deposits the choice of currencies is rather limited. Generally, speaking commercial banks only offer the choice of major currencies. In addition to that if the bank is based in the emerging markets, then it might also offer access to the local currency. Consequently, the choice here might be limited to 3 to 9 currencies. Therefore, those traders who like to trade exotic currencies, might not find currency deposit accounts that useful. This is in sharp contrast to Forex brokerage companies, which offer access to dozens of exotic currency pairs.

How People Can Succeed with Dual or Triple Currency Deposits?

So far as we have discussed the dual or triple currency deposits are most suited for long term traders, who are looking for the security of the invested principal and also want to earn some money on currency movements in the market.

However, at this stage, the obvious question is: how traders and investors can succeed with those investments? How can they earn decent returns with those deposits? Well, there are several components for successful investing in dual and triple currency deposits.

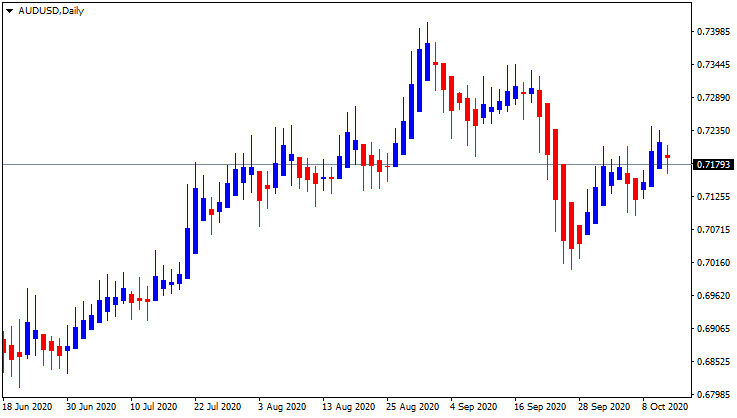

Firstly, it is important to mention that some people usually take a look at the latest trends in the Forex market, in order to determine which currency has a momentum. For example, let us suppose that an individual investor is considering the AUD/USD pair. In order to conduct basic technical analysis, let us take a look at this daily AUD/USD Heiken Ashi chart:

As we can see from the above diagram, back in June 2020, the pair was trading close to $0.68 level. During the subsequent months, the Australian dollar has made some notable gains, eventually rising all the way up to $0.74 level by the end of August 2020.

This was followed by a major correction during the next month, with the Australian dollar dropping down to 0.70 mark. However, as we can see here, the psychologically important 0.70 level provided vital support for the pair. Consequently, from the beginning of October, the AUD/USD once more started rising, eventually surpassing the $0.71 level.

So from this chart, we can conclude that the Australian dollar is so far in a solid upward trend. Consequently, it might be a good idea to choose AUD as a base currency and USD as one of the alternative currencies, in order for traders to positions themselves in a way to benefit from the potential appreciation of the Australian dollar.

In addition to that one of the most obvious stepping stones for succeeding with those types of deposits is to choose the right base currency. Here it is worth remembering that for the market participants to earn payouts they have to choose a strong currency which will make some gains against the chosen alternative currencies.

In order to do so, the market participants can take a look at several important indicators. Firstly, it is important to analyze the relative real interest rates between different currencies. The calculation process here is quite simple: one has to subtract the current inflation rate from the key central bank interest rate. It is also worth noting that some analysts are taking the long term average inflation rates for calculations since sometimes CPI can be very volatile.

So for example, if the central bank interest rate is at 3% and the inflation rate stands at 2%, then the real interest rate for the currency in question is 1%. Obviously, sometimes real interest rates can go negative as well, which became especially common in the aftermath of the 2008 Financial Crisis.

The main principle here is quite simple: currencies with the highest real interest rates have natural advantages over the ones with lower real interest rates. This is because the former ones are much better at retaining their purchasing power than in the latter case.

Obviously, real interest rates are not the only important factor when choosing the strongest currency. One has to take a look at the current economic indicators, such as the gross domestic product, also known as the GDP growth rate, as well as the unemployment rate and the consumer price index, also known as the CPI rate. The general principle here is that everything else being equal, the strength of the economy leads to an appreciation of the currency.

It is also worth noting that the market participants can use the purchasing power parity or PPP indicator for currency valuations. The PPP indicator essentially represents the exchange rate at which the average prices of goods and services will be equalized between the two given countries.

Consequently, if the given currency trades below the PPP levels, then it means that it is undervalued. This makes the products of the country cheaper compared to the rest of the world and makes them more attractive for international importers. As a result, the undervalued currencies tend to appreciate until they reach PPP equilibrium.

On the other hand, at any point in time, there are also currencies that are trading above the PPP level. Consequently, they are considered to be overvalued and are likely to experience some depreciation.

Therefore, when choosing the base currency, it might be helpful to choose the one from some of the most undervalued currencies, so that it is likely to benefit from a likely appreciation in the future.

In the case of choosing alternative currencies, the rules are essentially reversed. Obviously, it is important to choose stable currencies for those, since there is a distinct possibility that the market participants will receive their principal back in one of those currencies.

However, at the same time, what the market participants are looking for here is the overvalued currency, which has the potential for a significant depreciation in the foreseeable future. In addition to that, it might be also worth choosing the currency which has lower real interest rates, which can be yet another driving force for the potential depreciation against other currencies.

Finally, it is important for the market participants to also keep track of the inflation rates and make sure that they earn enough return to offset any losses in terms of the purchasing power due to an increase in the price levels.

Investing in Dual and Triple Currency Deposits – Key Takeaways

- Dual currency deposits allow the market participants to choose the base currency to make the initial deposit, as well as the alternative currency. If the base currency appreciates during the investment term, then the investor will receive funds in the alternative currency, benefiting from capital appreciation.

- Triple currency deposits are similar to dual currency deposits, however, the main difference is that here clients are allowed to choose two alternative currencies, instead of just one. This means that if the base currency appreciates against both or even one of the alternative currencies, then the market participants can benefit from capital appreciation.

- Dual and triple currency deposits do have some significant differences compared to Forex trading accounts. With those types of deposits, the principal of the invested amount is secure at all times. In addition to that, investors do not have to worry about the potential rollover charges for taking the long term positions in the market. On the other hand, those types of currency deposits do not allow market participants to use leverage.