Table of content

Many experienced professional traders advise beginners to focus on just focusing on several major currency pairs. The reasoning behind this is the fact that this allows traders to become familiar with the characteristics of a number of currencies and gather more experience trading those pairs.

There are also many experienced traders who prefer to limit their trading to only major currencies. The reasoning behind this is the fact that those currencies tend to be relatively less volatile than emerging market currencies and in general are usually more predictable.

Despite those arguments, many professional traders do include exotic currency pairs into their portfolios. The reason for this is that they have several unique characteristics. Firstly, many of them have much higher-yields, then major currencies. This tendency makes them very attractive for carry traders.

Trading the exotic currency pairs also tends to stay undervalued for extended periods of time. This allows traders to open currency positions at reasonable prices and therefore can be well-positioned to benefit from the potential appreciation of those securities.

Finally, exotic currency pairs tend to be more volatile, then major currencies. This gives traders opportunities to earn higher payouts in a relatively shorter amount of time.

Despite those advantages mentioned above, on the flip side of the coin, those characteristics of trading the exotic currency also create some risks for traders. For example, higher volatility of those currencies is like a double-edged sword, because while increasing the potential gains for the trader, it can also magnify the possible losses for market participants.

The frequent undervaluation of those currencies does represent some better buying opportunities. However, because of this tendency, sometimes those securities have a hard time making gains against major currencies and stay undervalued for extended periods of time.

Finally, it is true that higher interest rates create some nice opportunities for carry trades. Yet, central banks of those currencies tend to change interest rates very frequently and with large amounts of basis point changes. Therefore, there are always those carry trades that might become less profitable due to massive interest rate cuts.

Consequently, it can be very helpful for traders to keep in mind those special characteristics of trading exotic currency pairs and applying those in the Forex market.

In Search of Undervalued Currencies

Just like in the stock market, many traders are constantly in search of undervalued assets. The reasoning behind this is the fact that by identifying those currencies, they can buy them cheaply and then sell them at a considerable profit, once the market addresses this sort of imbalance and currency appreciates.

Obviously, from time to time, we can also see the cases of undervaluation with several major currencies. Yet the market typically tends to address those sooner or later and the opportunity disappears. Also, it is important to mention that in most cases the degree of undervaluation usually ranges from 5% to 25%. So more extreme cases here are quite a rate, so it is difficult to find more lucrative opportunities and to capitalize on those.

One the other hand, it is worth noting that there are always many undervalued currencies. Very often their undervaluation reaches 40% or even 60%. This allows traders to take positions with those currencies at very cheap prices. Once the market stabilizes and the respective economies of those currencies return to a decent level of economic growth, then traders can benefit from rising interest rates and potentially, the considerable appreciation of the currency in question.

At this stage, the obvious question is: how do we measure which currencies are undervalued and which ones are overpriced? There are obviously dozens of different indicators for currency valuations.

In order to keep things simple, let us use the Purchasing Power Parity indicator for analyzing our examples. It is relatively easy to understand. It measures the exchange rate at which the average price of goods and services can be equalized between the two given countries. The logic of this theory is that when the average price of products are cheaper in one nation, it leads to a higher demand for their goods and services. This in terms puts upward pressure on the currency in question.

There is no one universally-accepted version of the PPP indicator is measured by several organizations, including the Organization for Economic Cooperation and Development (OECD) and the British financial journal the ‘Economist’.

To illustrate how this works, let us take an example from this daily USD/CZK chart:

As we can see from the chart above, 4 years ago the pair was trading close to the 24.20 level. During the subsequent months of trading, the US dollar has made some notable gains, with USD/CZK eventually reaching a peak of 26.90 by December 2016.

At this point, according to the ‘Economist’, the PPP level for the currency pair was at 14.88 level. This means that by December 2016, the currency of the Czech republic was undervalued by approximately 44.7% against the US dollar.

As we can observe from our diagram, due to this high degree of undervaluation, since the beginning of 2017, the Czech koruna has made some steady gains against the US dollar. The lengthy downward trend of USD/CZK has lasted for 14 months. As a result of this development, the pair dropped all the way down to 20.10 level by February 2018, getting much closer to the Purchasing Power Parity level than before.

After several months of steady depreciation, the US dollar started to recover, with USD/CZK appreciating and then settling for mostly 22 to 23 range. However, the pair has broken out of this range during Spring 2020. The catalyst for this move was the outbreak of the COVID-19 pandemic and the March 2020 stock market crash led to a flight to safety in the Forex market. This process had a massive selloff of emerging market currencies, leading to a considerable amount of depreciation.

This development also had a major impact on the USD/CZK pair, as a result of which it has risen all the way up to 25.90 level. However, once more the extreme undervaluation of Koruna did not persist for a long time. From May 2020, the USD/CZK has already started it’s a slide and by July 2020 the pair trades close to 23.20 level.

So as we can see from this example, the Purchasing Power Parity indicator acts as a power of gravity for the currency pairs. Therefore if the exchange rate diverges considerably from this level, in many cases at some stage the market addresses this imbalance, and the undervalued currency makes some significant gains.

Reasons for Extended Periods of Undervaluation

However, despite those examples, for the sake of accuracy, it is important to state that those expectations of appreciation of exotic currencies might not materialize for years. The fact that by Purchasing Power Parity or some other valuation indicator, the currency trades below its fair value does not necessarily mean that the Forex market will correct this imbalance in a short period of time. Sometimes those emerging market currencies can stay undervalued for long periods of time.

The possible reasons behind this can be indeed several. Here it is important to understand that everything else being equal, the world’s major currencies are perceived as more stable currencies, due to factors such as the strength of their economies and low average inflation rates. On the other hand, the exotic currencies typically have higher average inflation rates and they still represent developing economies.

Another possible cause of this tendency is the fact that some of the emerging market currencies have a history of long term depreciation against the major currencies. Therefore, many market participants just assume those trends to continue. It is also important to note here that the credit rating of some of those countries is lower, then developed nations, therefore, many market participants consider their bonds and currencies to be more risky.

Finally, many economists point out that because many developing countries have lower GDP per capita than developed countries, it is only natural that the average prices of goods and services will be lower in comparison. Actually, in response to this criticism, the British journal Economist has already added an additional measure of PPP, which adjusts this measure to differences in GDP per capita levels.

Returning to our example of USD/CZK, as mentioned before, the Economist’s raw Big Mac Index shows the fair value to be just below 15. However, the GDP-adjusted index shows the PPP level at 21.43, which is much closer to the current exchange rate. Therefore, as we can see from this example, in many cases taking the differences in GDP per capita into account might bring PPP closer to market exchange rates.

So, it is important to note here that those arguments do not imply that Purchasing Power Parity and other currency valuations are totally useless. In fact, as mentioned before, traders can improve the accuracy of their currency valuations by using those PPP measures, which are adjusted for GDP per capita indicator.

Carry Trading Strategy For Exotic Currencies

One very important reason why one might decide to trade exotic pairs is the fact that the majority of emerging market currencies have higher yields than major currencies. This became especially apparent after March 2020. In response to the economic downturn, caused by the outbreak of the COVID-19 pandemic, the world’s major central banks, including the Bank of England, the US Federal Reserve, the Reserve Bank of Australia have reduced their key interest rates to 0.25% or lower.

In fact, the interest rates in Japan and Switzerland are already in negative territory. The Bank of Japan has already reduced rates to -0.1%, while the Swiss National Bank holds rates at -0.75%.

So at this stage, if one can find a brokerage company with competitive rates, it might be possible to earn up to 0.25% annually with a long AUD/JPY position, but this is not a very attractive rate of return for many trades. In fact, even despite the near-zero interest rate policies, one can still find certificates of deposit (CDs), which pay considerably higher returns than 0.25, and here investors do not have to risk the principal of their investment.

Therefore, nowadays, when it comes to carry trading, there are no longer any lucrative opportunities among major currencies. It is true that at some point in the future, most likely at least of those central banks might start raising rates and normalization of the policy. However, it goes without saying that this process will be gradual. Therefore, it might take at least a couple of years before traders and investors will be able to earn some decent returns from carry trades and savings accounts of those currencies.

Consequently, in this environment, the only way to earn some decent returns on carry trades is by trading the exotic pairs. Despite the recent economic disruptions, caused by the outbreak of the pandemic, there are still several central banks, which still maintain relatively high interest rates.

For example, as of July 2020, the Russian ruble yields 4.50%, the South African rand – 3.75%, Turkish lira – 8.25%, Mexican peso – 5.00, and Indian Rupee – 4.00%. So the lists of exotic currency pairs, which can be utilized for carry trades would include short positions on EUR/RUB, USD/RUB, EUR/ZAR, USD/, and others.

So for example, let us suppose that after some analysis traders decide to open the short EUR/RUB position with 1 standard lot. The latter measure is the equivalent of 100,000 units of the currency. The European Central Bank still keeps its own key interest rate at 0% for more than 4 years now. On the other hand, the Bank of Russia holds rates at 4.50%.

So the interest rate differential between those two currencies is 4.50%. However, here it is important to keep in mind that even the most competitive brokerage companies keep some percentage of the difference as a commission. So if a broker keeps 0.1%, then the trader will receive a rollover, which is the equivalent of a 4.4% annual return.

So if traders invest $100,000 in this trade, then they will receive $4,400 annually. This means that their daily rollover income will be the equivalent of $12.05. This means that the average monthly earnings will be just below $367.

Now, earning 4.4% in times of near-zero interest rates by trading an exotic currency pair, might be an acceptable return on investment for some market participants. However, it can get even better than that. If traders use leverage, then those annual returns might be even higher.

Returning to our earlier example, if traders invested $100,000 in opening the short EUR/RUB position with 10:1 leverage, then they will be able to open trade with 10 lots. Therefore, their annual earnings from rollover will amount to $44,000. Here the daily swap rate will be at $120.50. Consequently, the annual rate of return on investment will be 44%, which can be indeed very attractive for many traders.

So as we can see from this example, by trading in exotic currency pairs, traders can find potentially lucrative carry trade opportunities, even when the world’s all major central banks are still keeping their key interest rates at or below 0.25%.

Risks of Using Exotic FX Currency Pairs for Carry Trades

Despite all of the advantages of trading the exotics for carry trading purposes, it is vital to mention that it is not a risk-free strategy. Here it is important not to forget that unlike with certificates of deposit or government bonds, the principal of the investment is not secure. The value of the invested amount is constantly subject to daily market fluctuations. This risk is even greater with leveraged trades.

The reason behind this is the fact that with 1:10 leverage, if the currency exchange market moves against the trader’s position by 10% or more, then the entire trade will be liquidated and the market participant will lose his or her entire investment. On the other hand, if a trader uses no leverage, then there will be no margin calls to worry about. However, the principal of investment still remains under risk.

So this is why it is important to conduct a thorough technical and fundamental analysis, even when engaging in such a long term Forex strategy as carry trade.

Higher Volatility of Widely Traded Exotic Currencies

Another very important characteristic of trading the exotics is the fact that those currencies typically tend to be more volatile than major currency pairs. In order to illustrate this dynamic better, let us compare two charts. Firstly, we have a daily EUR/USD diagram, showing the price action of the most traded currency pair in the world:

As we can see from the above chart, 3 years ago, the Euro was trading close to $1.14 level. After months of a considerable fluctuation, the single currency has made some steady gains and by February 2018, even reached $1.25 level. After this development, the exchange rate stabilized and moved sideways until April 2018. However, this was followed by a long term appreciation of the US dollar.

For more than the next 2 years, the EUR/USD exchange rate fell steadily, going all the way down to near $1.06 level during the March 2020 stock market crash. However, after reaching this bottom, the single currency recovered and during the following months appreciated considerably against the US dollar. By July 2020 the pair has already reached $1.14.

So as we can see from this example, despite 3 years of trading, the EUR/USD came full circle, eventually returning back to 2017 levels. The largest move the pair made was when it dropped from $1.25 to $1.06, which is the equivalent of 15.2% depreciation.

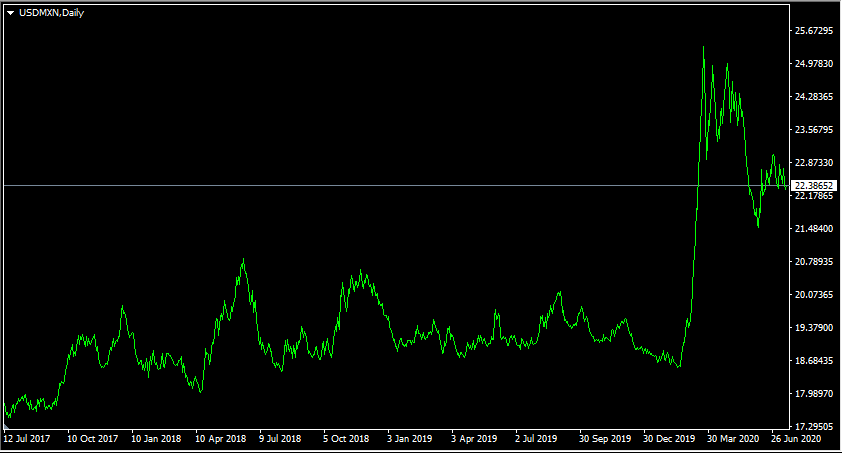

Now let us compare this to the daily USD/MXN chart:

As we can observe from this diagram, 3 years ago, the US dollar was trading at 17.60 level. During the subsequent months, the US currency strengthened, by June 2018 had reached a 20.85 level. However, after reaching this point, the exchange rate stabilized and moved sideways for several months. The situation changed radically with the outbreak of the COVID-19 pandemic.

The panic selling during the March 2020 stock market crash led to a flight to safety in the Forex market as well. As a result of this development, the US dollar has made some massive gains, with USD/MXN reaching the 25.40 level. However, those extreme overvaluations did not last for long. During the subsequent, Mexican peso started to regain some of its recent losses. By July 2020, the pair stabilized around 22.40 level.

So as we can see from this particular example, despite the fact that both of those currency pairs contain the US dollar, the USD/MXN is much more volatile than the EUR/USD. In fact, from July 2017 until March 2020, the US dollar has appreciated by 44.3% against the Mexican peso. Those types of moves are very rare when it comes to the major currency pairs.

The upside to this reality is the fact that this allows market participants to potentially earn higher returns by trading in exotic currency pairs, rather than just trading majors.

However, it is very important to mention that on the flip side of the coin, the higher volatility of even some of the most widely traded exotic currencies, makes them much riskier. Therefore, traders need to make use of the stop-loss and trailing stop orders in order to protect themselves from suffering large amounts of losses.

We can further observe that in times of crisis and economic uncertainty, the majority of emerging market currencies tend to depreciate rapidly against the major currencies. The reason behind this is the fact that in economically challenging times people want to store their wealth in a liquid and more stable currency. Once the situation stabilizes and most of the world return to economic growth, emerging market currencies tend to regain some of those losses.

Trading Exotic Currency Pairs – Key Takeaways

- Exotic currencies have several distinct characteristics, which makes them different from the major currencies. Some traders prefer to trade exotic currencies because they might stay undervalued for extended periods of time. This allows market participants to purchase them at very reasonable prices and potentially make some considerable gains from their potential appreciation. However, the fact that the given currency is undervalued does not necessarily guarantee that it will rise significantly in the foreseeable future, it might take a while before the market addresses those imbalances.

- Many carry traders prefer to trade exotic currency pairs because in emerging markets one can still find some high-yielding currencies. This enables market participants to earn rollover income on a daily basis. Carry trading is usually a long term Forex strategy, which can help traders to earn some decent returns on their investments. However, it is worth noting that it is not a risk-free strategy. The fact of the matter is that the principal of the investment is still subject to daily market fluctuations.

- Exotic currency pairs typically tend to be considerably more volatile than major currency pairs. This enables traders to earn potentially higher returns by trading those types of securities. However, due to their high degree of volatility, they are also considered to be more risky. It is also important to note, that in times of economic downturn and uncertainty, people tend to exchange exotic currencies for major currencies. This leads to a depreciation of emerging market currencies and it might take a while before they could recover from those losses.